Electrotechnical Paper Market Share, Size, Trends, Industry Analysis Report

By Product (Press Paper, Diamond Dotted Press Paper, Press Paper with Polyester Film, Crepe Paper, and Aluminum Crepe Paper); By Application; By Sales Channel; By Region; Segment Forecast, 2023- 2032

- Published Date:Jun-2023

- Pages: 114

- Format: PDF

- Report ID: PM3428

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

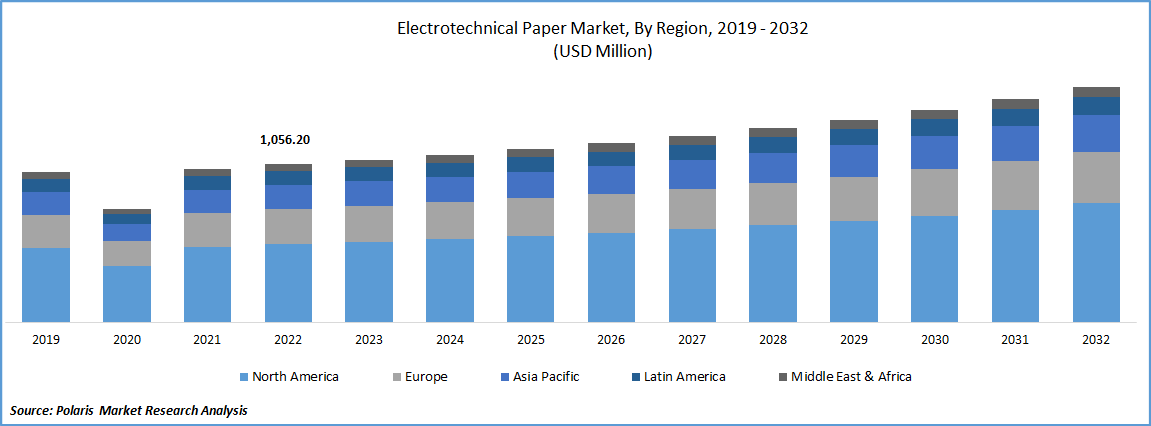

The global electrotechnical paper market was valued at USD 1,056.20 Million in 2022 and is expected to grow at a CAGR of 4.19% during the forecast period. The rapid increase in the prevalence of integrating the product in the cables & transformers around the world and growing production of diamond dotted press paper along with the growing need to replace the aging and inadequate infrastructure to catch up the continuously rising electricity demand and consumption, are driving the demand and growth of the market. In addition, the extensive rise in the export activities of the product from European Union countries, as the region has high concentration of major insulation companies with strong distribution network with focus on making long-term relationships with their customers, is also likely to contribute significantly towards the growth of the market.

To Understand More About this Research: Request a Free Sample Report

For instance, in September 2021, Ahlstrom, a global leading electrotechnical insulation paper manufacturer, announced the acquisition of Kammerer’s electrotechnical paper business, that will help the company to expand its paper offering in the area of semiconductor papers used in various special applications like high-performing power and transformers.

Moreover, the demand for environmentally friendly products that has been resulting in development of biodegradable electrotechnical paper, which can be recycled or composted after use and are made from natural materials such as wood pulp or cotton fibers, and does not contain any harmful chemicals. Additionally, the flexible electrotechnical paper has been developed that can be used in applications where traditional rigid materials are not suitable, as the paper can be easily folded, bent, or stretched without losing its properties.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the electrotechnical paper market. The rapid spread of the deadly coronavirus across the globe has led to decreased demand for the product across various industries due to economic slowdown and less demand for several types of electrical equipment. It has caused delays in infrastructure projects including new plants construction, transmission lines, and substations because of the lockdown measures during the pandemic.

Industry Dynamics

Growth Drivers

The rising demand for electric vehicles and the growing number of hybrid cars have increased the demand for electrotechnical paper, as the product is being widely used in the production of insulation materials for the automotive industry coupled with the surging investments in infrastructure projects such as the construction of new power plants, transmission lines, and substations around the world, are among the primary factors boosting the growth of the market. Furthermore, there has been a emerging trend of using advanced technologies like nanotechnology that has led to the development of nanocellulose-based electrotechnical paper with improved electrical and mechanical properties as well as coating technology, which has enabled the production with enhanced properties such as thermal stability, mechanical strength, and dielectric strength, which in turn, has influencing the electrotechnical paper market growth.

Report Segmentation

The market is primarily segmented based on product, application, sales channel, and region.

|

By Product |

By Application |

By Sales Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Press paper segment accounted for largest market share in 2022

The press paper segment accounted for major global market share in 2022, and is likely to continue its market position over the projected period. The growth of the segment market can be largely attributed to the increasing demand for electricity, which fuels the need for more electrical infrastructure and equipment including transformers and capacitors, that widely utilize press paper as insulation. Moreover, there is an emerging trend and prevalence to modernize and upgrade electrical grids to improve efficiency and reliability, which includes replacing old insulation materials with newer and more advanced press paper products, thereby driving the segment market.

The crepe paper segment is expected to grow at significant growth rate over the next coming years, which is mainly driven by increasing investments in renewable energy and constant shift towards renewable energy sources such as wind and solar power and widespread adoption of the product as an essential component.

Cables segment held the significant market revenue share in 2022

The cable segment held the significant market share in terms of revenue in 2022, mainly due to continuous advancements in cable technology such as the development of high voltage and fiber optic cables coupled with the rising government regulations related to energy efficiency, safety, and environmental protection. The significant rise in the construction of new buildings, roads, and other infrastructure projects requires cables across both developed and developing economies for variety of purposes including lighting, communication, and power distribution, are further likely to have positive impact on the segment market growth.

The motors segment is likely to register steady growth rate during the anticipated period, which is highly attributable to increasing adoption and popularity of electric vehicles globally, that led to higher demand for product as electric vehicles use electric motors that require electrotechnical paper for their production. For instance, according to our findings, the total EV sales across the globe were over 10.2 million units in 2022, with an increase of over 65% as compared to sales of previous year. And, the EV sales are estimated to reach around 17 million units by the end of 2023.

Aftermarket segment is expected to witness highest growth in 2022

The aftermarket segment is expected to grow at a healthy CAGR over the forecasted period, on account of growing digitalization a surge in the popularity and penetration for e-commerce websites offering electrotechnical paper in the recent years. Additionally, with the growing use of various electrotechnical equipment such as transformers, motors, and generators increase, the need for replacement parts also increases, that drives the demand for aftermarket electrotechnical paper products such as insulation materials, conductors, and semiconductors across the globe.

Asia Pacific region dominated the global market in 2022

The Asia Pacific region dominated the global market with substantial market share in 2022, and is expected to maintain its dominance throughout the forecast period. The APAC region has been experiencing rapid industrialization and urbanization, which has led to an increase in the demand for electricity coupled with the growing investments in the power sector to meet the rising demand for electricity mainly in emerging economies like China and India. For instance, according to the India Brand Equity Foundation, the government has announced the issuance of sovereign green bonds including the grid-scale battery systems, and the government allocated around USD 2.47 billion for a PLI scheme to boost the manufacturing of high-efficiency solar modules across the country.

The North America region is expected to exhibit to significant growth rate over the coming years, owing to the growing transition towards renewable energy sources such as wind and solar power has increased the demand for electrotechnical papers used in power transmission and distribution. Government regulations such as the National Electrical Code in the US, which mandates the use of certain types of insulation materials, also drive the demand for electrotechnical paper in the region.

Competitive Insight

Some of the major players operating in the global market include ABB Power Grids, Nordic Paper, Delfort Group, Cottrell Paper Company, Tokushu Paper MFG, Paramount Tube, Hitachi ABB Power, 3M Company, Weidmann Electrical Technology, Vo Roll Holding, Ahlstrom-Munksjo, DuPont, Kammerer Paper, Aurora Technologies, Varflex Corporation, Wicor Holding, and Fibertek

Recent Developments

- In May 2022, Ahlstrom-Munksjo, introduced PurposeSeal heat seal technology, specially designed to ensure the quality & protection for numerous end-use packaging solutions, and it further enhance sustainable benefits when applied to the cristal transparent packaging papers.

- For instance, in May 2022, Voith Paper, announced the launch of its sustainability program called “Papermaking for Life” invested around EUR 100 Mn euros each year to achieve the sustainable & efficient paper production. The company is also researching new disruptive technologies for new and innovative papermaking process which reduce the consumption of fresh water in production by 90%.

Electrotechnical Paper Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 1,056.20 million |

|

Revenue forecast in 2032 |

USD 1,567.73 million |

|

CAGR |

4.19% from 2023– 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023– 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Product, By Application, By Sales Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

ABB Power Grids, Nordic Paper Holding AB, Delfort Group AG, Cottrell Paper Company, Tokushu Paper MFG, Paramount Tube, Hitachi ABB Power, 3M Company, Weidmann Electrical Technology AG, Vo Roll Holding AG, Ahlstrom-Munksjo Oyj, DuPont de Nemours Inc., Kammerer Paper GmbH, Aurora Technologies, Varflex Corporation, Wicor Holding, and Fibertek Inc. |

FAQ's

The electrotechnical paper market report covering key segments are product, application, sales channel, and region.

Electrotechnical Paper Market Size Worth $1,567.73 Million by 2032.

The global electrotechnical paper market is expected to grow at a CAGR of 4.19% during the forecast period.

Asia Pacific is leading the global market.

key driving factors in electrotechnical paper market are rising demand for electric vehicles and the growing number of hybrid cars.