Empty Capsules Market Size, Share, Trends, Industry Analysis Report

By Type, End Use (Pharmaceuticals, Nutraceuticals, Cosmetic, Research Laboratories), By Functionality, By Application, and By Region -Market Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 112

- Format: PDF

- Report ID: PM2403

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

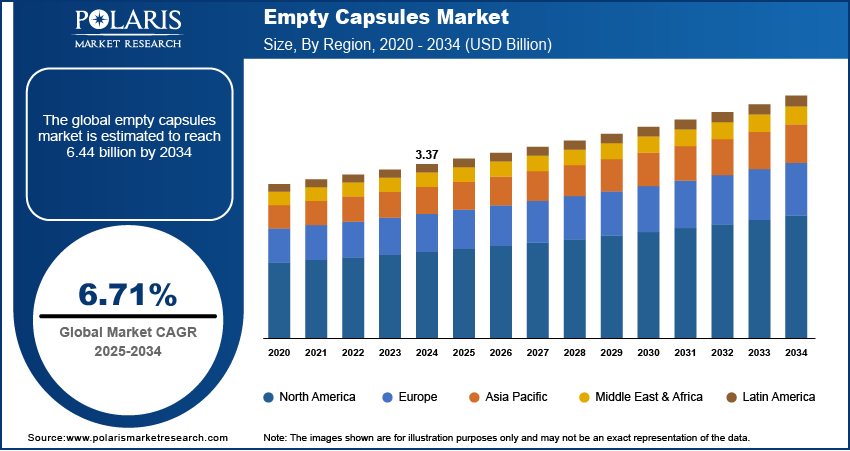

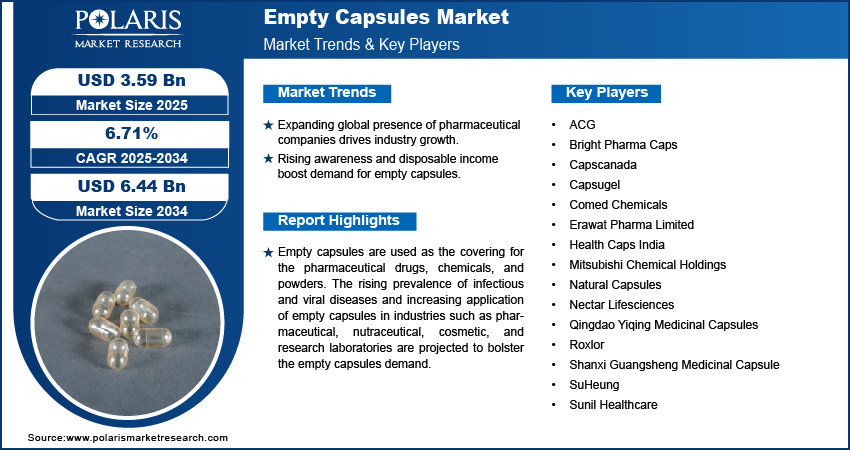

The global empty capsules market size was valued at USD 3.37 billion in 2024. The market is projected to grow at a CAGR of 6.71% during 2025 to 2034. Key factors driving demand for empty capsules include the rising prevalence of chronic diseases, growing aging population, and expanding nutraceutical and dietary supplement.

Key Insights

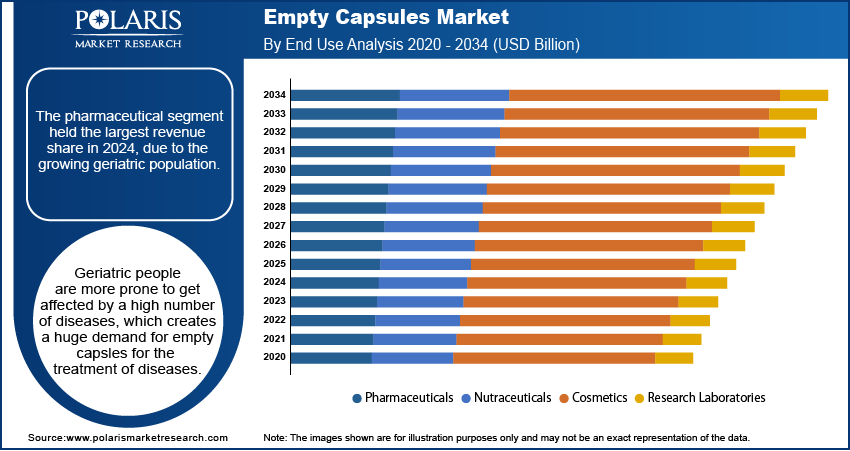

- The pharmaceutical segment accounted for a major revenue share in 2024 due to the growing geriatric population.

- The cosmetic segment is anticipated to grow at a rapid CAGR in the coming years. This is due to the changing lifestyles and rising disposable income.

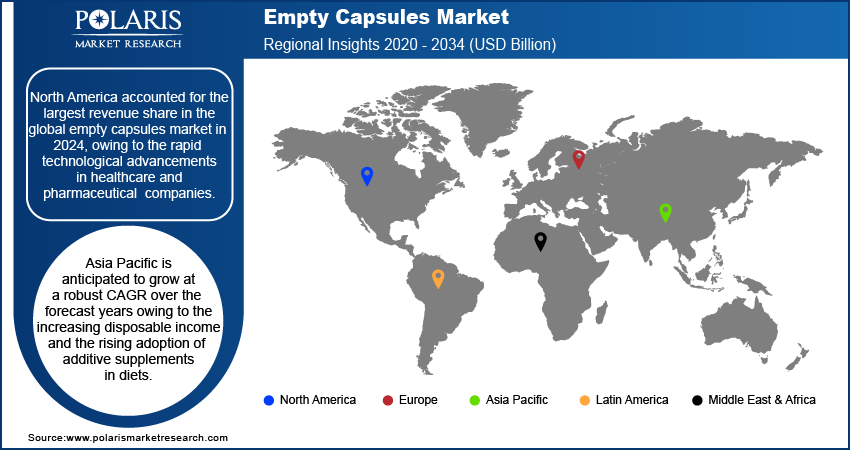

- North America accounted for the largest revenue share in the global empty capsules market in 2024, owing to the rapid technological advancements in healthcare and pharmaceutical companies.

- Asia Pacific is anticipated to grow at a robust CAGR over the forecast years owing to the increasing disposable income and the rising adoption of additive supplements in diets.

Industry Dynamics

- The rising penetration of pharmaceutical companies across the world fuels the industry growth.

- The growing public awareness, rising disposable income, and development of the pharmaceutical and healthcare sector are also anticipated to increase demand for empty capsules.

- The rising investments by the government in healthcare are creating a lucrative market opportunity.

- Rising prices and lower availability of raw materials may hamper the market growth.

Market Statistics

- 2024 Market Size: USD 3.37 Billion

- 2034 Projected Market Size: USD 6.44 Billion

- CAGR (2025-2034): 6.71%

- North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

Empty capsules are used as the covering for the pharmaceutical drugs, chemicals, and powders. The rising prevalence of infectious and viral diseases and increasing application of empty capsules in industries such as pharmaceutical, nutraceutical, cosmetic, and research laboratories are projected to bolster the empty capsules demand. Moreover, the rising number of research & development activities towards the improvement of pharmaceutical industries and increasing government and public spending on healthcare propelled the empty capsules market growth in forthcoming years. The growing public awareness of personal care, coupled with the development of the pharmaceutical industries, contributed to the market growth across the globe.

The outbreak of the COVID-19 has proved to be a supportive factor toward the growth of the industry. During this period, various pharmaceutical companies have highly invested in the production and supply of vaccines, medication, nutraceuticals, etc., which fueled the growth of the empty capsules industry. Additionally, there were many patients that have risen rapidly all over the world, creating a huge requirement for the empty capsules industry. Consequentially, the covid -19 has exhibited a positive influence on the market growth and is likely to lead the market growth in the approaching years.

Industry Dynamics

Market Drivers

The rising penetration of pharmaceutical companies across the world fuels the industry growth. The rising investments in the healthcare sector provided lucrative growth for the empty capsules market across the globe. American Medical Association stated that health spending in the U.S. increased by 7.5% in 2023. Additionally, growing public awareness, rising disposable income, and development of the pharmaceutical and healthcare sector are attributed to industry growth. Bureau of Economic Analysis stated that the disposable personal income in the US increased +0.6% in April 2025 from March 2025. The high younger population especially in countries like India coupled with growing focus on supplementary diets is also leading to an increase in market revenue.

Report Segmentation

The market is primarily segmented on the basis of type, functionality, application, end use, and region.

|

By Type |

By Functionality |

By Application |

By End Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Insight by End Use

The pharmaceutical segment held the largest revenue share in 2024, due to the growing geriatric population. Geriatric people are more prone to get affected by a high number of diseases, which creates a huge demand for empty capsles for the treatment of diseases. For instance, according to the World Health Organization (WHO), the population aged 60 years and above will increase from 605 million in 2000 to 2 billion in 2050. The growing healthcare sector across the globe alos contributed to the segment dominance. Moreover, the rising pentration of pharmaceutical companies worldwide, particualry in countries such as India, China, and Brzail led the growth in 2024. The growing incidence of infectious diseases also led the dominance of the segment by encouraging pharmaceutical companies in to invest in empty capsles for the development of novel medicine.

The cosmetics segment is anticipated to exhibit the highest CAGR in the forecast years. This is attributed to the changing lifestyles and rising disposable income, which is leading the population towards the adoption of skincare products. The increasing spending on beauty products and cosmetics is another major factor propelling the segment expansion. The growth of e-commerce platform and presence of high young population in emerging countries such as India is driving the segment growth. Younger population in countries like India are ordering cosemetic products and capsules extensively from various e-commerce platforms, which is creating the need for empty capsules. Moreover, the rise in women employment rate across the globe is propelling the segment growth.

Geographic Overview

North America accounted for the largest revenue share in the global empty capsules market in 2024. The rapid technological advancements by pharmaceutical companies and increasing government investments in public health care are the major factors that surged the empty pills demand in the region. For instance, according to Health Affairs, in 2021, U.S government spending has increased to 9.7 percent and reach USD 4.1 trillion in 2020, an increase of around 4.3 percent rise from 2019. Moreover, the government of the U.S. are focused on the improvement of healthcare infrastructure, minimizing the spread of diseases, and spreading awareness of public health, which proplled the regional dominance. Additionally, the presence of major companies in the region drove the growth of the empty capsules market.

The Asia Pacific market is anticipated to exhibit the highest CAGR over the forecast period. This is owing to the increasing disposable income and rising adoption of additive supplements in diets. The increasing working population is further leading to the demand for empty capsules as working people are more conscious of skincare which propels them to purchase skincare products, including creams, lotions, and capsules. The expansion of e-commerce platforms in the region and high young population in countries like India is leading to an increase in market revenue.

Competitive Insight

Some of the major players operating in the global market include ACG, Bright Pharma Caps, Capscanada, Capsugel, Comed Chemicals, Erawat Pharma Limited, Health Caps India, Mitsubishi Chemical Holdings, Natural Capsules, Nectar Lifesciences, Qingdao Yiqing Medicinal Capsules, Roxlor, Shanxi Guangsheng Medicinal Capsule, SuHeung, and Sunil Healthcare

Empty Capsules Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.37 Billion |

| Market size value in 2025 | USD 3.59 Billion |

|

Revenue forecast in 2034 |

USD 6.44 Billion |

|

CAGR |

6.71% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Regional scope |

|

|

Key companies |

ACG, Bright Pharma Caps, Capscanada, Capsugel, Comed Chemicals, Erawat Pharma Limited, Health Caps India, Mitsubishi Chemical Holdings, Natural Capsules, Nectar Lifesciences, Qingdao Yiqing Medicinal Capsules, Roxlor, Shanxi Guangsheng Medicinal Capsule, SuHeung, and Sunil Healthcare |

FAQ's

• The global market size was valued at USD 3.37 billion in 2024 and is projected to grow to USD 6.44 billion by 2034.

• The global market is projected to register a CAGR of 6.71% during the forecast period.

• North America dominated the market in 2024.

• A few of the key players in the market include ACG, Bright Pharma Caps, Capscanada, Capsugel, Comed Chemicals, Erawat Pharma Limited, Health Caps India, Mitsubishi Chemical Holdings, Natural Capsules, Nectar Lifesciences, Qingdao Yiqing Medicinal Capsules, Roxlor, Shanxi Guangsheng Medicinal Capsule, SuHeung, and Sunil Healthcare.

• The pharmaceutical segment dominated the market revenue share in 2024.