Energy Management Systems Market Share, Size, Trends, Industry Analysis Report

By System (Home Energy Management Systems, Industrial Energy Management Systems); By Component; By Deployment; By Region; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 117

- Format: PDF

- Report ID: PM2734

- Base Year: 2024

- Historical Data: 2020-2023

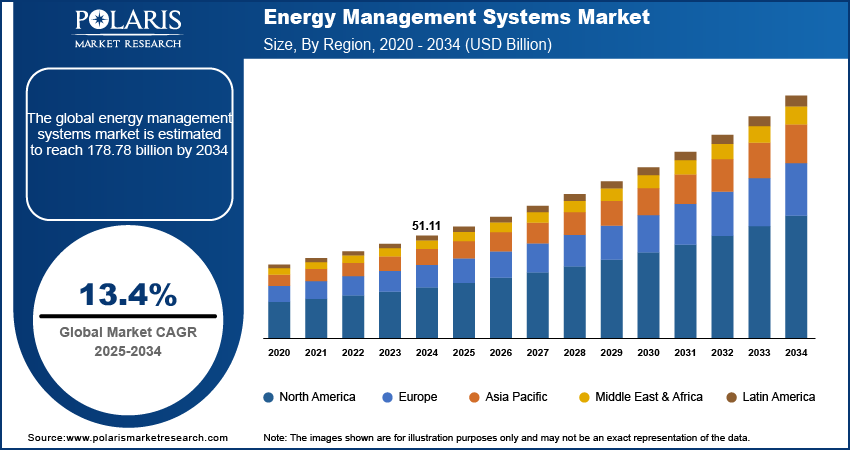

The global energy management systems market was valued at USD 51.11 billion in 2024 and is expected to grow at a CAGR of 13.4% during the forecast period. Key factors driving the market includes price escalation and fluctuations in energy consumption, grid and meter smart installation, growing demand for energy management systems, and transformation of different industrial and commercial operations.

Key Insights

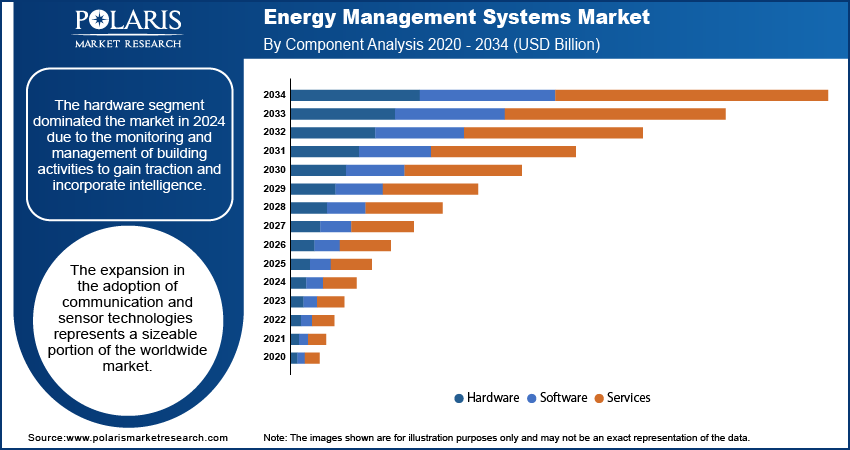

- In 2024, the hardware segment dominated the market. This is due to the monitoring and management of building activities to incorporate intelligence.

- The cloud segment accounted for the largest share of the market in 2024, driven by the need to decrease carbon emissions and lower costs.

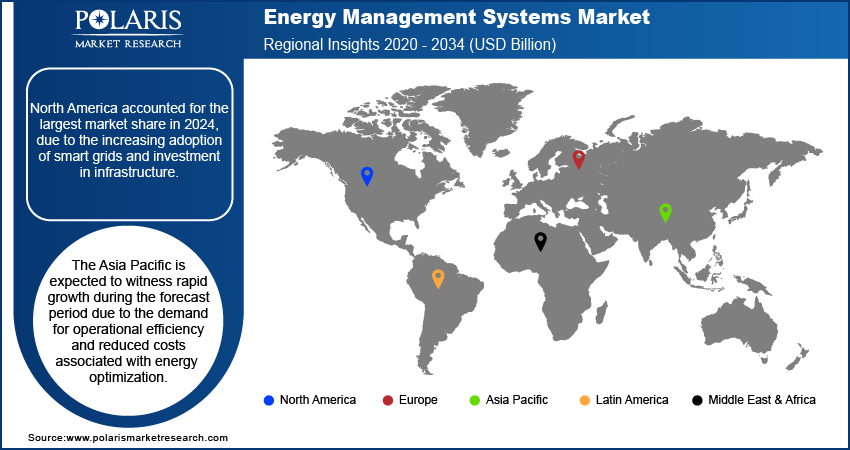

- North America accounted for the largest market share in 2024, due to the increasing adoption of smart grids and investment in infrastructure.

- The Asia Pacific is expected to witness rapid growth during the forecast period due to the demand for operational efficiency and reduced costs associated with energy optimization.

Industry Dynamics

- The digitalization of energy management with connecting devices across a network boosts the overall energy efficiency, market demand, and enables communication with smart grids.

- The high cost and complexity create challenges for a refined energy management system, as it requires the installation of new sensors and the replacement of old ones.

- A rise in energy prices creates an opportunity as EMS provides data and automation needed to reduce consumption and costs.

- The installation of smart grids and meters provides the necessary energy data and network to control EMS, which is required to analyze consumption, and also contributes to growth opportunities.

Market Statistics

- 2024 Market Size: USD 51.11 billion

- 2034 Projected Market Size: USD 178.78 billion

- CAGR (2025-2034): 13.4%

- Largest market in 2024: North America

To Understand More About this Research: Request a Free Sample Report

AI Impact on Energy Management Systems Market

- Historical and real-time data analysis allows utilities and businesses to optimize revenue generation and purchasing capacity.

- Reduction of wastage and operational costs is expected to be achieved through automatic adjustment of energy use in buildings and factories for greater efficiency.

- Prediction of failures before they occur to prevent costly downtime and safety is expected to be achieved through monitoring grids and health of equipment’s.

- Integrating renewable sources and management of grid load to prevent outage is expected to be balanced by supply of energy and demand in real-time.

Electric utility grids employ the energy management system (EMS) to track, examine, and improve the performance of the electric transmission system. It refers to a wider range of energy network applications and specific ones like scheduling and generation control. The system was developed using a real-time data operating system to increase power efficiency. It is extensively utilized in the energy, telecom, and IT sectors, among other industries.

The transformation of different industrial and commercial operations, as well as energy management, has been greatly aided by digitalization. The importance of this tendency toward modernizing energy models is rising along with its greater efficiency. The ability to link and coordinate all of the network's equipment and devices, thanks to the digitization of energy management procedures, results in a larger efficiency gain. Buildings' digital connection may allow for communication with smart power networks.

Globally, there is a growing demand for energy management systems. Many small and medium-sized businesses are still ignorant of the benefits of energy management, though. This aspect is impeding the expansion of the market as a whole. Large businesses are adopting cutting-edge EMS due to their sophisticated infrastructure. However, the adoption across small and medium-sized enterprises is restricted by expensive setup and implementation expenses.

Industry Dynamics

Growth Drivers

Global concern has grown about the steadily declining energy intensity of traditional fuels, such as coal. Worldwide, governments have committed resources to create a fair, secure, and sustainable energy system. Additionally, the rapid industrialization, which causes an increase in energy consumption, drives governments in many nations to establish effective energy management systems. Regular changes in energy price inflation and supplier rivalry are pressuring governments to boost their investments in renewable energy.

Improved efficiencies through the aggressive support of smart infrastructure initiatives, which involve upgrading the energy and utility sectors also contrubites to the expansion opportunities. The rise in investments for smart projects, such as smart buildings and smart farms, generate a substantial need for refined energy management. The implementation of smart grids and smart meters is expanding, which contributes to the growth opprtunities.

The adoption of smart grids is boosted. This is due to the decreased costs, enhanced cost-effectiveness, and fraud detection, among others. Utility bill optimization is another one of these features. Furthermore, data collection, analysis, and insight-gathering tools are integrated into smart grids and meters, enabling the extraction of valuable information. Thus, technologically upgraded smart grids and smart energy meters are expected to aid market development.

Report Segmentation

The market is primarily segmented based on system, component, deployment, and region.

|

By System |

By Component |

By Deployment |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Segmental Insights

Component Analysis

The hardware segment dominated the market in 2024 due to the monitoring and management of building activities to gain traction and incorporate intelligence. The expansion in the adoption of communication and sensor technologies represents a sizeable portion of the worldwide market. Smart sensors, meters, and controllers are essential for the collection of data on energy consumption, temperature, and failures. The software would have nothing to analyze without the presence of these devices. The demand for these components has boosted as businesses aim to digitalize their operations.

Moreover, wired sensor networks are expanding their market presence as they are more dependable, have longer service lives, and are less susceptible to interference and disturbances.

Deployment Analysis

The cloud segment accounted for the largest share of the market in 2024. This is due to the need to decrease carbon emissions and lower costs, which is expected to drive a large portion of the worldwide market growth. Systems for cloud computing have increased flexibility for businesses to analyze, monitor, and evaluate data remotely. End customers are expected to express a need for cloud-based EMS for real-time energy visibility.

Cloud-based energy management solutions have gained popularity, enabling end-users to control and monitor energy habits utilizing IIoT devices. Thus, the cloud is expected to gain global popularity as cutting-edge technology and the Internet of Things play a crucial part in reducing energy consumption.

Regional Analysis

North America Energy Management Systems Market Insights

North America accounted for the largest market share in 2024, due to the increasing adoption of smart grids and investment in infrastructure. The U.S. and Canada are expected to offer opportunities for generating money. According to the IEA, investments in energy grids are expected to increase by 10% in 2021, with the U.S. as one of the primary countries investing in infrastructure. Furthermore, the need for smart energy has boosted throughout the area. This has encouraged the stakeholders to invest money in EMS. The building, residential, and commercial sectors are expected to show the strongest demand for IoT-based solutions. The increase in energy usage for space heating and cooling is primarily responsible for the trajectory of development. For instance, the U.S. Energy Information Administration referenced the Annual Energy Outlook 2022 in June 2022 to claim that heating and cooling accounted for about 50% of the energy consumed in U.S. buildings in 2021. It is also projected that power providers and business and industrial organizations focus on clean energy technology and connectivity to reduce carbon emissions and access the global market.

Asia Pacific Energy Management Systems Market Assessment

Asia Pacific is expected to witness the fastest growth during the forecast period due to the rapid expansion of industries and the economy. Countries such as China and India are expected to create demand for operational efficiency and reduce costs associated with the optimization of energy in intensive manufacturing activities. The acceleration of this trend with large-scale urbanization and smart infrastructure integrates advanced energy management solutions. Regulatory policies and regulations for carbon management have also encouraged the industries to adopt these systems. Moreover, the rise in energy costs is expected to push organizations to invest more in EMS technologies for sustainability and to maintain their market position.

Competitive Insight

Some of the major players operating in the global market include Schneider Electric SE; Honeywell International Inc.; Siemens AG; Johnson Controls, Inc.; C3.ai, Inc.; GridPoint, General Electric; ABB; International Business Machines Corporation; Cisco Systems, Inc.

Recent Developments

September 2024: Larsen & Toubro’s Power Transmission & Distribution (PT&D) business has received the mandate to develop and implement Energy Management Systems. This order is provided for digitally based intelligent projects being executed by L&T DES globally.

June 2024: ABB launched ABB Ability OPTIMAX 6.4, to provide coordinated control of multiple industrial assets and processes, for improved energy efficiency, and to reduce emissions and support decarbonization.

December 2021: General Electric acquired Opus One Solutions Energy Corporation, a software company that aids in the optimization of energy operations and planning. This agreement will help General Electric organize, improve, and trade distributed and renewable energy resources to allow a modern system.

Energy Management Systems Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 51.11 billion |

| Market size value in 2025 | USD 57.76 billion |

|

Revenue forecast in 2034 |

USD 178.78 billion |

|

CAGR |

13.4% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

System, Component, Deployment, Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Schneider Electric SE; Honeywell International Inc.; Siemens AG; Johnson Controls, Inc.; C3.ai, Inc.; GridPoint, General Electric; ABB; International Business Machines Corporation; Cisco Systems, Inc. |

FAQ's

• The global market size was valued at USD 51.11 billion in 2024 and is projected to grow to USD 178.78 billion by 2034.

• The global market is projected to register a CAGR of 13.4% during the forecast period.

• North America dominated the global market share in 2024.

• A few key players are Schneider Electric SE; Honeywell International Inc.; Siemens AG; Johnson Controls, Inc.; C3.ai, Inc.; GridPoint, General Electric; ABB; International Business Machines Corporation; and Cisco Systems, Inc.

• In 2024, the hardware segment dominated the market.

• The cloud segment accounted for the largest share of the market in 2024.