Ethyleneamines Market Share, Size, Trends, Industry Analysis Report

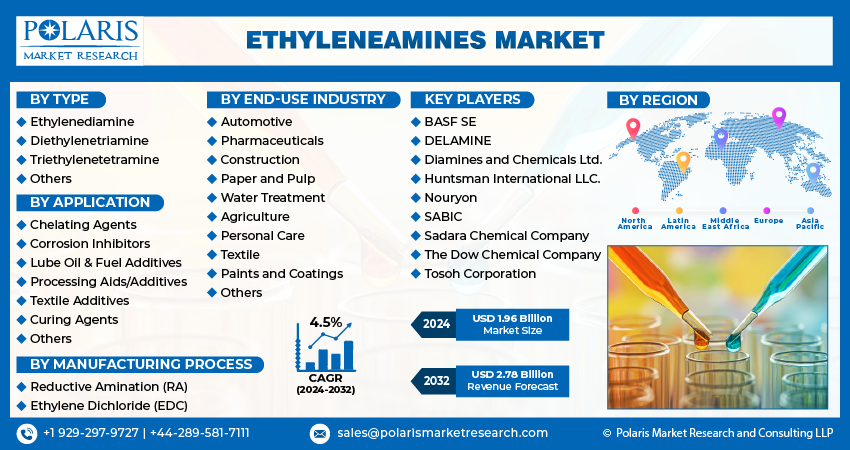

By Type (Ethylenediamine, Diethylenetriamine, Triethylenetetramine, and Others); By Manufacturing Process; By Application; By End-use Industry; By Region; Segment Forecast, 2024- 2032

- Published Date:Jun-2024

- Pages: 117

- Format: PDF

- Report ID: PM4931

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

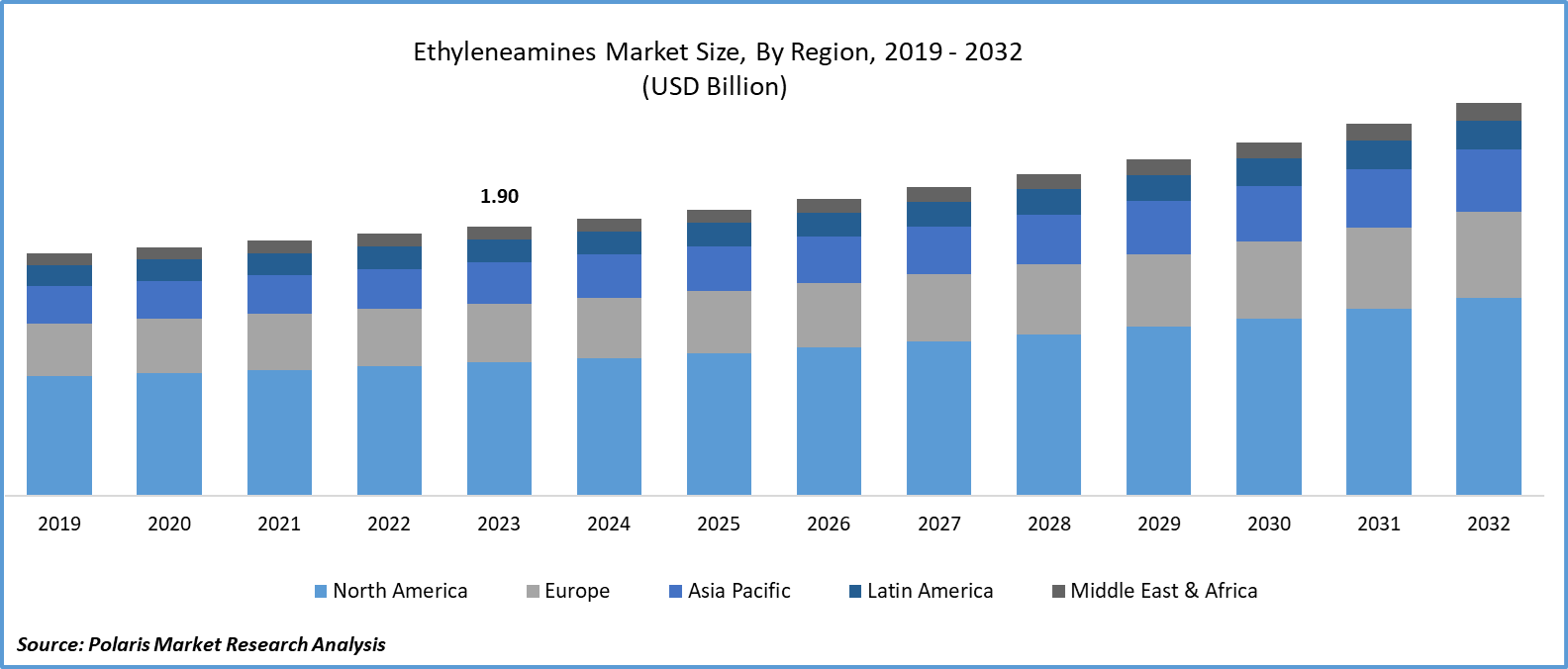

EthyleneAmines market size was valued at USD 1.90 billion in 2023. The market is anticipated to grow from USD 1.96 billion in 2024 to USD 2.78 billion by 2032, exhibiting the CAGR of 4.5% during the forecast period.

Market Overview

Growth in the manufacturing of fuel additives coupled with its increasing product launches is one of the important factors driving the demand for ethyleneamines. Moreover, the growing need to control mildew, scabs, rusts, and blights on fruits, vegetables, potatoes, and cotton is increasing the industry demand for fungicides. As ethyleneamines are used in the synthesis process of fungicides, their adoption will also rise during the market forecast.

To Understand More About this Research:Request a Free Sample Report

- For instance, according to the data by Eurostat, in 2021, out of the total volumes of pesticides sold in the European Union, around 44.0% of the share was accounted for by fungicides and bactericides.

The growing need for raw materials for the production of various pharmaceutical products is driving the ethyleneamines market growth. Moreover, surging need for electronic and automotive products will increase the industry demand for epoxy curing agents, thereby fueling the market growth. Furthermore, the increasing use of ethylenediamine (EDA) and diethylenetriamine (DETA) for the production of chelating agents and rising demand for chelating agents from the pulp and paper industry is expected to contribute to the market growth during the market forecast.

Growth Factors

Increasing demand for ethyleneamines from automotive and personal care industries to propel the market growth

Ethyleneamines are majorly used in the production of fuel additives that control deposits in the fuel system of motor vehicles. Factors such as the increasing production of automobiles and a spike in the consumption of fuels are contributing to the industry growth of the ethyleneamines market. For instance, according to the recent statistics published by the International Organization of Motor Vehicle Manufacturers, in 2022, China produced around 27.0 million vehicles, with an increase of 3.0% compared to 2021. With the increasing production of vehicles, the fuel consumption has also increased. Moreover, the growing production of home and personal care products such as laundry detergents, shower gel, and shampoo are expected to increase the demand for ethyleneamines in the projected years.

Rising agricultural activities and the growth of the pulp and paper industry will support the ethyleneamines market expansion

The necessity to manage blights, rusts, scabs, and mildew on fruits, vegetables, potatoes, and cotton is increasing the demand for fungicides. Increasing use of ethyleneamines as an intermediate in the production of fungicides will contribute to the market growth in the coming years. Moreover, the growing demand for photographic paper and filter paper coupled with the growing production of paper will increase the need for ethyleneamines thereby spurring the market growth. For instance, according to the statistics by the Indian Paper Manufacturers Association (IPMA), in 2022-23, the production of the pulp and paper industry in India was 4,824 thousand tonnes. Such high production volume will fuel the ethyleneamines market growth in the upcoming years.

Restraining Factors

Serious health hazards of ethyleneamines hinder the market growth

Working with ethyleneamines primarily presents the risks of corrosive action on skin and eyes. Moreover, ocular contact with ethyleneamines can cause irreparable damage and blindness of eyes. Furthermore, dermal exposure to ethyleneamines can lead to severe skin burns and allergic skin reactions. Additionally, inhalation exposure to ethyleneamines can cause painful irritations to the eyes, nose, throat, and lungs. Such serious health hazards caused by exposure to ethyleneamines will negatively impact the ethyleneamines market growth during the forecast timeframe.

Report Segmentation

The market is primarily segmented based on type, manufacturing process, application, and end-use industry, and region.

|

By Type |

By Manufacturing Process |

By Application |

By End-use Industry |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Type Insights

Ethylenediamine segment accounted for the largest market share in 2023

The ethylenediamine segment accounted for the largest market share in 2023. The increasing popularity of ethylenediamine, owing to its wide range of applications, contributes to segmental growth. For instance, ethylenediamine is used in the production of surface-active agents, chelating agents, resins, corrosion inhibitors, resins, adhesives, chemicals for rubber, and oil additives. Moreover, its use in the production of tetra acetyl ethylenediamine is also driving segmental growth. Furthermore, the high dependence of the pharmaceutical industry on ethylenediamine as an ingredient is expected to fuel segmental growth, thereby fostering the ethyleneamines market growth.

By Manufacturing Process Insights

The ethylene dichloride (EDC) segment held a major market share

The ethylene dichloride (EDC) segment held a major market share in 2023. The EDC process produces ethyleneamines by the reaction of ethylene dichloride and ammonia. The ability of this process to produce the entire range of ethyleneamines is one of the major factors contributing to the segmental share. Moreover, numerous industry players in the market produce their ethyleneamines by EDC process, which ultimately contributes to the segmental share.

By Application Insights

Lube oil & fuel additives segment is projected to hold significant market share during the forecast period

The lube oil and fuel additives segment is projected to hold a significant market share during the forecast period. The segmental growth is majorly attributed to the increasing fuel and lubricant consumption and rising need for ethyleneamines in fuel additives. For instance, according to the data by the Petroleum Planning & Analysis Cell, in December 2023, the consumption of lubricants and greases increased to 329,000 metric tonnes, compared to 317,000 metric tonnes in November 2023. Moreover, the necessity to regulate deposits in motor vehicles' fuel systems will significantly contribute to the segment expansion.

By End-use Industry Insights

The agriculture segment is expected to emerge as the most opportunistic end-use industry

The agriculture segment is expected to provide a significant growth opportunity for the market growth in the coming years. The production of numerous crop protection goods involves the usage of ethyleneamines. Factors such as the continuous expansion of the agriculture industry and the increasing product launches for crop protection will significantly contribute to segmental growth during the forecast period. For instance, in January 2024, ADAMA announced the introduction of five new cereal fungicide products in Europe to combat the most important diseases affecting farmer yields during the reproductive phases of the crop.

Regional Insights

Asia Pacific region dominated the global market

In 2023, Asia Pacific dominated the global market share of ethyleneamines, also expected to expand at the highest CAGR during the forecast period. The numerous manufacturing hubs have made this region a center for ethyleneamines industrial applications. Moreover, the strong industry growth performance by automotive industry in China, India, and Japan in terms of vehicle production and fuel consumption is propelling the market growth.

Growing trend in use of multi-functional additives in the fuels, and the rising interest in cleaner and more efficient products are expected to increase the demand for fuel additives thereby, spurring the market growth. For instance, in August, 2022, BASF started production of fuel performance additives located at Pudong, China. Moreover, BASF also produces ethylene-amines at its BASF-Sinopec joint venture production site at China.

Furthermore, the increasing need for crop protection coupled with the rising launches of fungicides will prove beneficial for the ethyleneamines market growth. For instance, in October 2022, Insecticides (India), unveiled a fungicide named Stunner to fight mainly Downy Mildew disease in grapes. Thus, the increasing utilization of ethyleneamines for fungicide production, coupled with the presence of local production plants, will contribute to market growth throughout the forecast period.

Key Market Players & Competitive Insights

High production capacities for ethyleneamines are assisting the companies to stay ahead of the competition

The ethyleneamines market is highly consolidated in nature owing to the dominance of several companies. The strong position of these companies in the market is owing to factors including high annual capacity for the production of ethyleneamines and the presence of a number of production facilities across the world. For instance, Arabian Amines (a 50%-owned joint venture of Huntsman International) operates an ethylene amines plant in Saudi Arabia which has an annual capacity of around 70 Mn pounds.

Some of the major players operating in the global market include:

- BASF SE (Germany)

- DELAMINE (Netherlands)

- Diamines and Chemicals Ltd. (India)

- Huntsman International LLC. (U.S.)

- Nouryon (Netherlands)

- SABIC (Saudi Arabia)

- Sadara Chemical Company (Saudi Arabia)

- The Dow Chemical Company (U.S.)

- Tosoh Corporation (Japan)

Recent Developments in the Industry

- In November 2023, BASF & SINOPEC completed the inauguration of the expanded downstream chemical plants at the Verbund site. The company planned to expand the production of ethyleneamines (EEAs), ethanolamines (EOAs) and several other products by significantly reducing the carbon emission.

Report Coverage

The ethyleneamines market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and industry trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The market report provides a detailed analysis of the market size while focusing on various industry trends such as competitive analysis, type, manufacturing process, application, end-use industry, and their futuristic growth opportunities.

Ethyleneamines Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1.96 billion |

|

Revenue forecast in 2032 |

USD 2.78 billion |

|

CAGR |

4.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The key companies in Ethyleneamines Market are BASF SE, Huntsman International LLC., Nouryon.

Ethylene Amines market exhibiting the CAGR of 4.5% during the forecast period.

Ethyleneamines Market report covering key segments are type, manufacturing process, application, and end-use industry, and region.

The key driving factors in Ethyleneamines Market are Rising agricultural activities and the growth of the pulp and paper industry will support the ethyleneamines market expansion

Ethyleneamines Market Size Worth $ 2.78 Billion By 2032.