Europe Laboratory Developed Tests Market Share, Size, Trends, Industry Analysis Report

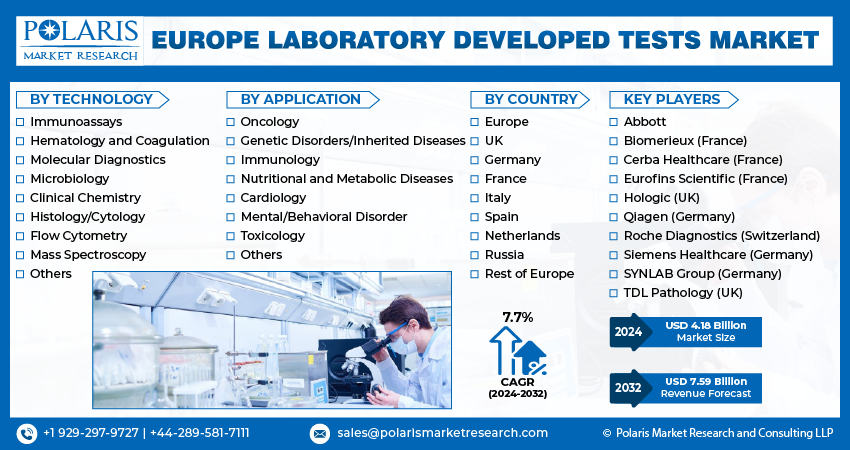

By Technology (Immunoassays, Hematology and Coagulation, Molecular Diagnostics, and Others); By Application; By Country; Segment Forecast, 2024 - 2032

- Published Date:Apr-2024

- Pages: 116

- Format: PDF

- Report ID: PM4804

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

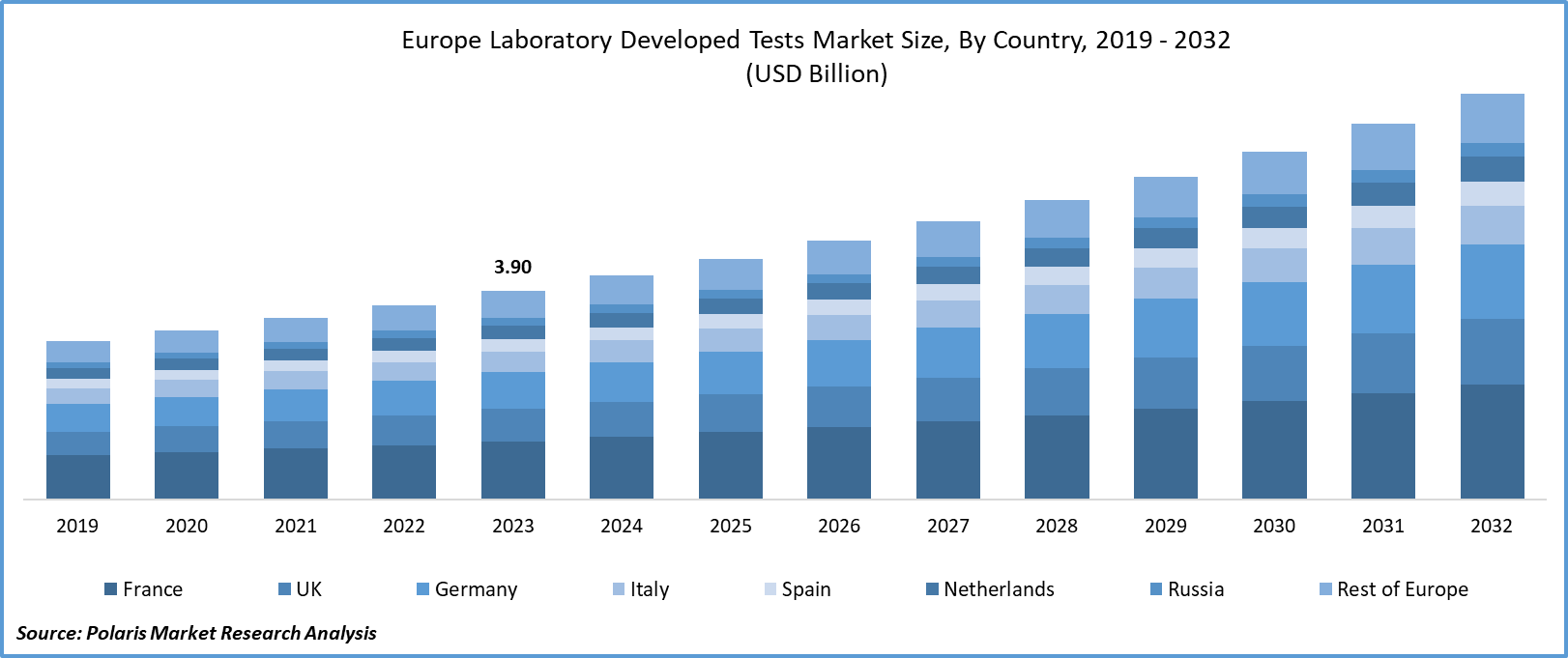

The europe laboratory developed tests market size was valued at USD 3.90 billion in 2023. The market is anticipated to grow from USD 4.18 billion in 2024 to USD 7.59 billion by 2032, exhibiting the CAGR of 7.7% during the forecast period.

Market Overview

The surging demand for personalized medicine, increased prevalence of cancer across the region, and significant availability of laboratory-developed tests at very low prices as compared to registered and licensed vitro diagnostic tests are key factors propelling the global market growth. The continuous advancements in laboratory diagnostic technologies, including molecular diagnostics, immunoassays, and next-generation sequencing with improved accuracy and efficiency, are further likely to contribute to the market’s growth.

- For instance, according to a report by Macmillan Cancer Support, it is estimated that there are over 3 million people currently living with cancer in the UK, and every 90 seconds, someone is diagnosed with cancer in the UK. Each year, more than 167,000 people die due to cancer, with an average of 460 deaths every day.

To Understand More About this Research:Request a Free Sample Report

Furthermore, there have been significant technological advances that have revolutionized modern laboratory medicines and tests. The noteworthy innovations in the field of laboratory automation, nuclear magnetic resonance spectroscopy, mass spectrometry, genomics, and electronic tools, coupled with their growing applications of such technologies, have contributed to improved patient outcomes as well as narrowing of the clinical laboratory interface.

Growth Factors

Demand for personalized medicine and advances in molecular diagnostics to drive market growth

The rapid increase in the demand for personalized medicine is resulting in a greater need for innovative diagnostic tools, including laboratory-developed tests that provide precision information regarding an individual patient's health status and enable tailored treatment approaches. Also, the ongoing advances in molecular diagnostic techniques that are leading to enhanced sensitivity and specificity of tests while enabling the detection and analysis of genetic markers or biomarkers will further boost the market's growth.

For instance, in September 2023, the FDA introduced a pilot program mainly for the oncologic drugs used with the in-vitro diagnostic tests. This program is specially developed to address concerns with laboratory-developed tests that are not FDA-approved.

Prevalence of chronic diseases and aging population to spur market growth

The rising incidences of several types of chronic disorders, including cancer, diabetes, heart diseases, and cardiovascular disorders that require regular diagnostic testing, are driving the market for laboratory-developed tests. Additionally, Europe has a significantly large aging population who are more likely and susceptible to various age-related diseases; thereby, the need for effective diagnostic tests for early detection and treatment of health conditions is growing at a rapid pace.

For instance, according to a report by the British Heart Foundation, more than 7.6 million people are suffering from heart or circulatory diseases in the UK, including 4 million men and 3.6 million women. Every year, over 170,000 people die from heart and circulatory disease.

Regulatory challenges and high costs of developed laboratory developed tests to restrain growth

Stringent regulatory requirements and challenges associated with these tests, as well as the high initial investment required for the development of such tests, especially for small laboratories, are key factors restraining the global market's growth.

Report Segmentation

The market is primarily segmented based on technology, application, and country.

|

By Technology |

By Application |

By Country |

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Technology Insights

Molecular diagnostics segment accounted for the largest market share in 2023

The molecular diagnostics segment accounted for the largest market share. This segment’s dominance is attributed to the widespread adoption of molecular diagnosis for the detection of various inherited and genetic diseases and several viral and bacterial diseases. As people across the region become more aware of the importance of early diagnosis of such diseases, the demand for effective molecular diagnostics solutions is growing rapidly.

The immunoassays segment is expected to register the highest growth rate. This growth is attributable to the increased prevalence of various chronic and infectious diseases such as cancer, heart disease, and cardiovascular diseases, as these diseases fuel the demand for immunoassay-based tests for early detection of diseases and help the patient to be aware of their condition. For instance, according to a report by the European Commission in October 2023, the number of new cancer cases rose by around 2.3 percent in 2022 to reach 2.74 million as compared to 2020. Breast cancer is the most diagnosed cancer in the region, with over 380,000 cases accounting for 13.8 percent of all cases.

By Application Insights

Oncology segment held the majority market share in 2023

The oncology segment held the majority share. This dominance is due to growing applications of laboratory-developed tests in oncology and advances in precision medicine that lead to tailored treatment based on individual patient characteristics. Additionally, rising awareness about cancer symptoms, the importance of early detection or diagnosis, and the growing government focus on cancer treatment programs further boost the demand for oncology laboratory-developed tests.

The nutritional and metabolic diseases segment will grow at the fastest pace. Segment’s growth is fueled by a rapid increase in the prevalence of nutritional and metabolic diseases, including obesity and diabetes, as a result of the changing lifestyles and dietary habits of consumers in the region. For instance, according to a report by the International Diabetes Federation, currently, more than 33 million people in the European Union are suffering from diabetes, and the number is projected to reach around 38 million by 2030.

Regional Insights

France dominated the regional market in 2023

France dominated the regional market with a noteworthy share. This dominance is accelerated by a significant increase in the incidences of non-communicable diseases that create a substantial need for early disease detection facilities and tests to manage the growing prevalence, propelling the demand for laboratory-developed tests. Also, the growing aging population of France is resulting in increased demand for advanced healthcare services, including laboratory-developed tests, because they are widely used in the diagnosis of several age-related disorders. For instance, according to our findings, more than 26 percent of the total population of France is aged 60 years or above, and it is estimated that the aging population will be around 1 in every three by 2040.

The UK is expected to grow at the highest growth rate during the forecast period, on account of increased focus on personalized healthcare solutions offering tailored diagnostic options to patients and growing research & development activities in the field of laboratory-developed tests to introduce more effective tests into the market.

Key Market Players & Competitive Insights

New tests developments and strategic collaborations to drive competition

The Europe laboratory developed tests market is highly fragmented in nature with several global players presence. Key players are competing on various factors such as the development of novel and high-quality tests, regulatory compliance, personalized testing solutions, and offering cost-effective tests. Also, companies are focusing on collaboration with other companies and research institutions to expand their product portfolio and market presence.

Some of the major players operating in the global market include:

- Abbott

- Biomerieux (France)

- Cerba Healthcare (France)

- Eurofins Scientific (France)

- Hologic (UK)

- Qiagen (Germany)

- Roche Diagnostics (Switzerland)

- Siemens Healthcare (Germany)

- SYNLAB Group (Germany)

- TDL Pathology (UK)

Recent Developments in the Industry

- In October 2023, PathAI Diagnostics introduced the world’s 1st AI-assisted laboratory-developed test, which was developed for histologic scoring and staging of metabolic dysfunction-associated liver disease. The newly developed tool uses an AI algorithm, which is proven to reduce the inter & intra-operator variability in the CRN scoring.

Report Coverage

The Europe laboratory developed tests market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, technology, application, and their futuristic growth opportunities.

Europe Laboratory Developed Tests Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 4.18 billion |

|

Revenue forecast in 2032 |

USD 7.59 billion |

|

CAGR |

7.7% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The Europe laboratory developed tests market size is expected to reach USD 7.59 billion by 2032

Key players in the market are Abbott, Roche Diagnostics, Eurofins Scientific, Siemens Healthcare

Europe laboratory developed tests market exhibiting the CAGR of 7.7% during the forecast period.

The Europe Laboratory Developed Tests Market report covering key segments are technology, application, and country.