Europe Ostomy Care and Accessories Market Size, Share, Trends, Industry Analysis Report

By Product (Bags, Accessories), By Application, By End Use, By Country – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 128

- Format: PDF

- Report ID: PM6299

- Base Year: 2024

- Historical Data: 2020-2023

Overview

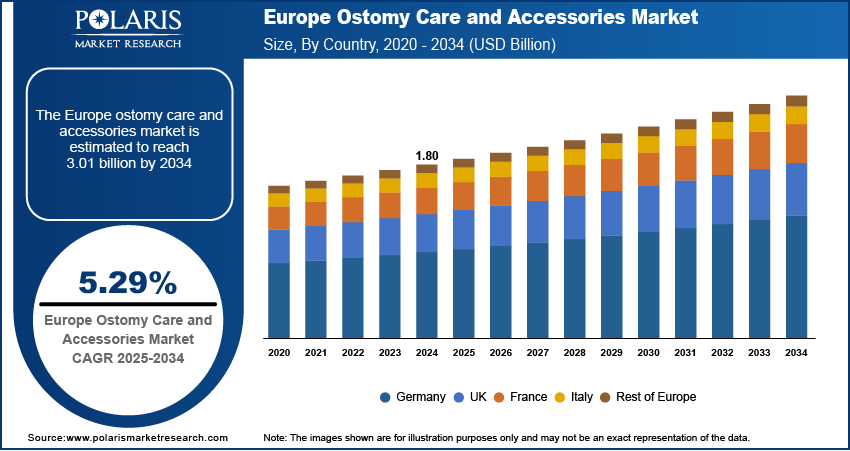

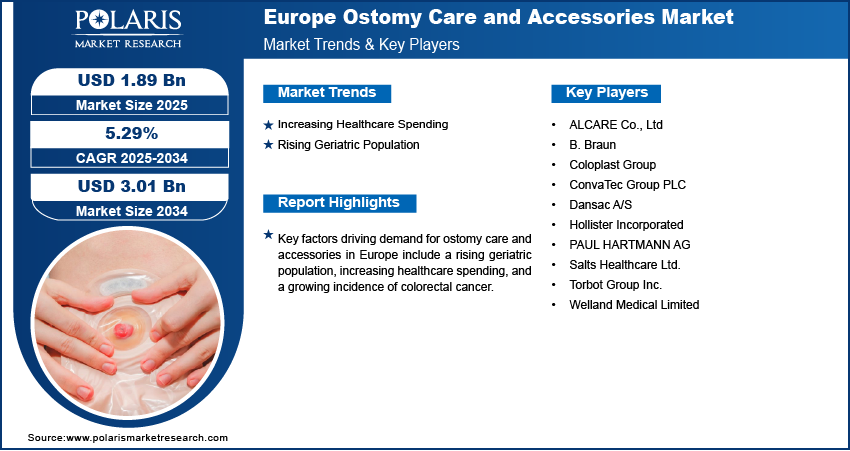

The Europe ostomy care and accessories market size was valued at USD 1.80 billion in 2024, growing at a CAGR of 5.29% from 2025 to 2034. Key factors driving demand for ostomy care and accessories in Europe include a rising geriatric population, increasing healthcare spending, and a growing incidence of colorectal cancer.

Key Insights

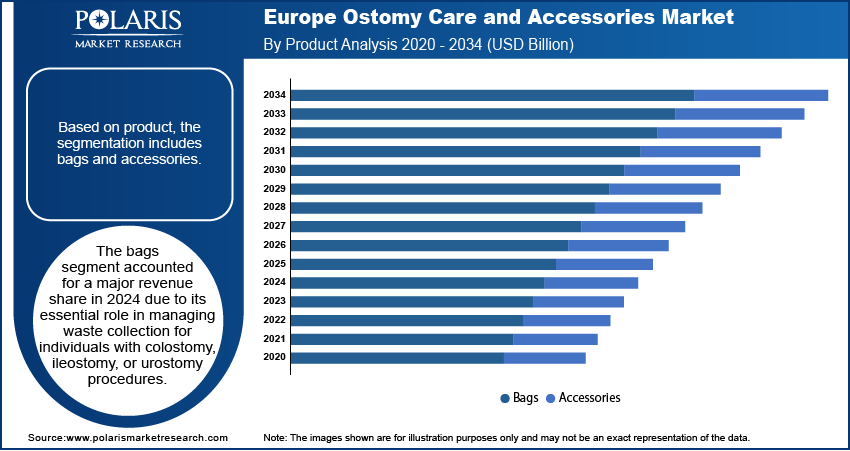

- The bags segment accounted for a major revenue share in 2024 due to the rising number of colostomy, ileostomy, or urostomy procedures.

- The colostomy segment dominated the revenue share in 2024 due to the high incidence of colorectal cancer and diverticulitis.

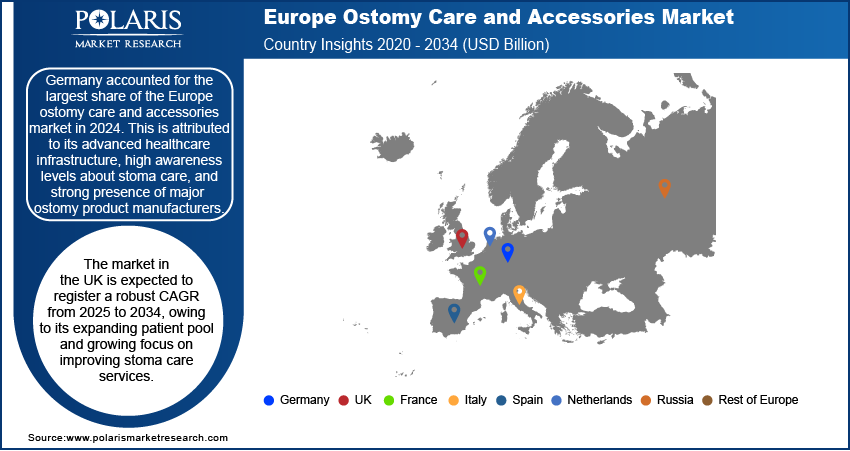

- Germany accounted for the largest share of the Europe ostomy care and accessories market in 2024, owing to high awareness levels about stoma care.

- The market in the UK is expected to register a robust CAGR from 2025 to 2034, owing to a growing focus on improving stoma care services.

Industry Dynamics

- The increasing healthcare spending is fueling the demand for ostomy care and accessories by allocating more funds to advanced medical treatments, including ostomy surgeries.

- The rising geriatric population is driving the Europe ostomy care and accessories market growth as older adults face higher risks of age-related conditions, such as colorectal cancer, which often require ostomy surgeries and accessories.

- Expanding focus on the home healthcare setting is creating a lucrative market opportunity.

- Skin irritation around the stoma hinders the Europe ostomy care and accessories market growth.

Artificial Intelligence (AI) Impact on Europe Ostomy Care and Accessories Market

- AI is transforming Europe's ostomy care market by enhancing product innovation, personalization, and efficiency.

- Smart ostomy devices with AI-powered sensors monitor stoma health, detect leaks, and alert users in real-time, improving patient comfort.

- AI-driven analytics help manufacturers optimize supply chains and predict demand, ensuring better product availability.

- Telemedicine platforms using AI provide remote consultations, expanding access to care, especially in rural areas.

Market Statistics

- 2024 Market Size: USD 1.80 Billion

- 2034 Projected Market Size: USD 3.01 Billion

- CAGR (2025–2034): 5.29%

Ostomy care and accessories refer to medical products used by individuals who have undergone ostomy surgery, creating an opening (stoma) to divert bodily waste. These include ostomy pouches, skin barriers, medical adhesives, and cleansing wipes, which help maintain hygiene, prevent leakage, and enhance comfort for ostomy patients.

The Europe ostomy care and accessories market provides advanced products and solutions to meet the needs of patients across various countries. Rising awareness about stoma care, an aging population, and increased incidences of colorectal cancer drive demand. Europe’s healthcare infrastructure and reimbursement policies support product adoption, while manufacturers focus on innovations such as skin-friendly adhesives and discreet pouch designs to improve patient confidence and quality of life.

The Europe ostomy care and accessories market demand is driven by the increasing incidence of colorectal cancer. According to the European Cancer Information System (ECIS), in Europe, there were an estimated 361,986 new cases of colorectal cancer in 2022, and it is the second leading cause of death in Europe. This growing patient population is driving demand for specialized accessories such as adhesive removers, belts, and deodorants to improve comfort and hygiene. Manufacturers and healthcare providers in the region are also expanding their offerings to meet the needs of these patients, boosting the overall market for ostomy care products.

Drivers & Opportunities

Increasing Healthcare Spending: Governments of Europe are allocating more funds to advanced medical treatments, including ostomy surgeries, for conditions like colorectal cancer, IBD, and trauma, leading to market growth. According to the UK Census Data 2021, total healthcare expenditure increased by 5.6% in nominal terms in 2023. Rising healthcare budgets are also expanding insurance coverage, making ostomy supplies more affordable for patients. Additionally, increasing spending is supporting research and innovation, leading to the development of more comfortable and efficient ostomy accessories, further stimulating demand.

Rising Geriatric Population: Older adults face higher risks of age-related conditions such as colorectal cancer, inflammatory bowel disease, and urinary incontinence, which often require ostomy surgeries and accessories. Additionally, caregivers and healthcare providers seek advanced, user-friendly ostomy accessories to improve comfort and independence for aging patients. On January 1, 2024, the EU population was estimated at 449.3 million people, and more than one-fifth (21.6%) of it was aged 65 years and over. Therefore, this demographic shift is expanding the market, driving innovation and accessibility in ostomy care solutions tailored to the needs of seniors.

Segmental Insights

Product Analysis

Based on product, the segmentation includes bags and accessories. The bags segment accounted for a major revenue share in 2024 due to its essential role in managing waste collection for individuals with colostomy, ileostomy, or urostomy procedures. The growing prevalence of colorectal cancer, inflammatory bowel diseases, and bladder disorders boosted the demand for ostomy bags. Patients preferred advanced pouching systems with improved odor control, skin-friendly adhesives, and discreet designs, which enhanced comfort and confidence in daily activities. The rising geriatric population in Europe, combined with increased awareness and availability of high-quality ostomy products through hospitals, retail pharmacies, and online platforms, further fueled segment growth.

The accessories segment is projected to grow at a robust pace in the coming years, owing to rising focus on improving peristomal skin health and ensuring leak prevention. Products such as skin barriers, sealing rings, deodorants, and adhesive removers are gaining popularity as they extend pouch wear time, reduce skin irritation, and improve overall patient comfort. Growing awareness campaigns by healthcare providers and patient support organizations are encouraging ostomates to use accessories for better stoma care outcomes. Technological innovations in skin protection and the increasing adoption of personalized stoma care solutions are projected to continue to drive strong demand for accessories across the region.

Application Analysis

In terms of application, the segmentation includes colostomy, ileostomy, and urostomy. The colostomy segment dominated the revenue share in 2024 due to the high incidence of colorectal cancer, diverticulitis, and other bowel disorders requiring surgical intervention. The increasing geriatric population, which faces a higher risk of colorectal conditions, further accelerated the demand for colostomy procedures and related care products. Patients preferred advanced colostomy pouches with odor control, flexible designs, and skin-friendly adhesives, which improved comfort and mobility. Widespread availability of these products in hospitals, homecare settings, and pharmacies, combined with strong support from healthcare professionals for post-surgical care, strengthened the segment’s dominant position.

End Use Analysis

In terms of end use, the segmentation includes home care settings, hospitals, and others. The home care settings held the largest revenue share in 2024 due to more patients choosing to manage their stoma care in the comfort of their own homes. The growing elderly population, who often prefer at-home recovery and long-term care, contributed to the demand. Increased reimbursement coverage for ostomy products, the convenience of doorstep delivery through online and retail channels, and advancements in discreet, comfortable pouch designs further strengthened the segment’s dominance.

The hospital segment is projected to grow at a rapid pace in the coming years, owing to the rising number of ostomy surgeries driven by colorectal cancer, bladder cancer, and inflammatory bowel diseases. Hospitals provide immediate post-operative care, stoma education, and customized product recommendations, which encourage patients to adopt high-quality ostomy solutions from the start of their recovery. The growing emphasis on infection control and the availability of specialized wound and ostomy care nurses in hospitals are projected to continue to boost product adoption in the segment.

Country Analysis

The Germany ostomy care and accessories market accounted for the largest Europe ostomy care and accessories market share in 2024. This is attributed to its advanced healthcare infrastructure, high awareness levels about stoma care, and strong presence of major ostomy product manufacturers. The country reported a significant number of colorectal cancer and inflammatory bowel disease cases, which increased the demand for colostomy, ileostomy, and urostomy solutions. Established reimbursement policies, a strong distribution network, and the availability of specialized stoma care nurses further boosted product adoption. German consumers increasingly opted for technologically advanced pouches and accessories that enhanced comfort, skin protection, and discretion, contributing to the country’s dominant position.

The market in the UK is expected to register a robust CAGR from 2025 to 2034, owing to its expanding patient pool and growing focus on improving stoma care services. The National Health Service (NHS) plays a crucial role in providing accessible ostomy supplies, training programs, and post-surgical care support. Rising public awareness, a higher rate of early diagnosis of colorectal conditions, and an emphasis on patient-centered care are fueling the demand for innovative and customized ostomy solutions. The UK’s strong network of stoma care nurses and increasing adoption of e-commerce platforms for product procurement are projected to continue to drive market growth.

Key Players & Competitive Analysis

The European ostomy care and accessories market is highly competitive, with key players such as Coloplast Group, ConvaTec Group PLC, and Hollister Incorporated dominating the sector due to their extensive product portfolios and strong brand recognition. These companies focus on innovation, offering advanced skin-friendly adhesives, odor-control technologies, and discreet designs to enhance patient comfort. B. Braun and PAUL HARTMANN AG also hold significant shares, leveraging their expertise in medical supplies and wound care to provide reliable ostomy solutions. Meanwhile, niche players such as Dansac A/S, Salts Healthcare Ltd., and Welland Medical Limited specialize in customizable and patient-centric products. ALCARE Co., Ltd and Torbot Group Inc. cater to specific needs with high-quality accessories. The market is further driven by increasing awareness of ostomy care, rising prevalence of colorectal cancers, and government healthcare initiatives. Competition intensifies as companies invest in R&D, sustainability, and digital health tools to differentiate themselves in this growing industry.

A few major companies operating in the Europe ostomy care and accessories industry include ALCARE Co., Ltd; B. Braun; Coloplast Group; ConvaTec Group PLC; Dansac A/S; Hollister Incorporated; PAUL HARTMANN AG; Salts Healthcare Ltd.; Torbot Group Inc.; and Welland Medical Limited.

Key Players

- ALCARE Co., Ltd

- B. Braun

- Coloplast Group

- ConvaTec Group PLC

- Dansac A/S

- Hollister Incorporated

- PAUL HARTMANN AG

- Salts Healthcare Ltd.

- Torbot Group Inc.

- Welland Medical Limited

Europe Ostomy Care and Accessories Industry Developments

In September 2024, Convatec acquired Livramedom, a home care service provider based in France, to expand its presence in Europe in the direct-to-consumer market.

In February 2024, Convatec, a major medical products and technologies company, announced the launch of Esteem Body with Leak Defense in Italy, for ostomy care.

Europe Ostomy Care and Accessories Market Segmentation

By Product Outlook (Revenue, USD Billion, Volume Unit, 2020–2034)

- Bags

- One Piece

- Two Piece

- Accessories

- Seals/Barrier Rings

- Pouch Cover

- Pouch Closures

- Stoma Caps/Hat

- Others

By Application Outlook (Revenue, USD Billion, Volume Unit, 2020–2034)

- Colostomy

- Ileostomy

- Urostomy

By End Use Outlook (Revenue, USD Billion, Volume Unit, 2020–2034)

- Home Care Settings

- Hospitals

- Others

By Country Outlook (Revenue, USD Billion, Volume Kiloton, 2020–2034)

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

Europe Ostomy Care and Accessories Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.80 Billion |

|

Market Size in 2025 |

USD 1.89 Billion |

|

Revenue Forecast by 2034 |

USD 3.01 Billion |

|

CAGR |

5.29% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, Volume in Units, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 1.80 billion in 2024 and is projected to grow to USD 3.01 billion by 2034.

The market is projected to register a CAGR of 5.29% during the forecast period.

Germany dominated the market in 2024

A few of the key players in the market are ALCARE Co., Ltd; B. Braun; Coloplast Group; ConvaTec Group PLC; Dansac A/S; Hollister Incorporated; PAUL HARTMANN AG; Salts Healthcare Ltd.; Torbot Group Inc.; and Welland Medical Limited.

The bags segment dominated the market revenue share in 2024.

The hospital segment is projected to witness the fastest growth during the forecast period.