Event Management Software Market Size, Share, Trends, Industry Analysis Report

By Component (Software, Services), By Deployment Mode, By Organization Size, By End Use, and By Region -Market Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 116

- Format: PDF

- Report ID: PM2425

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

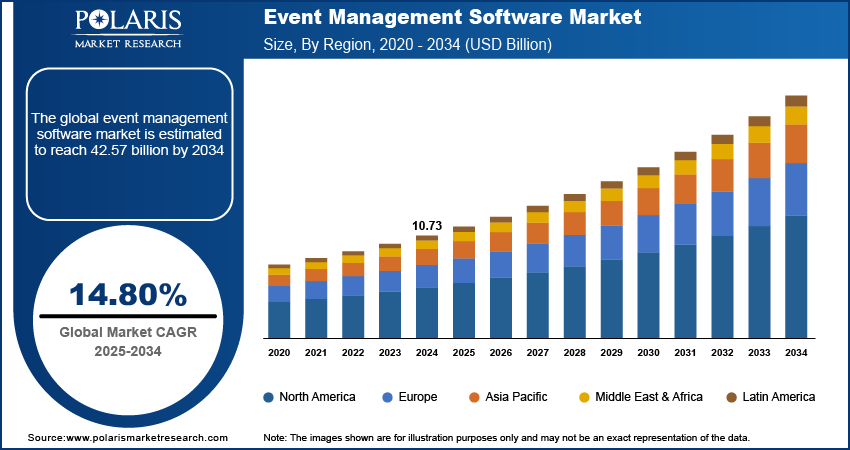

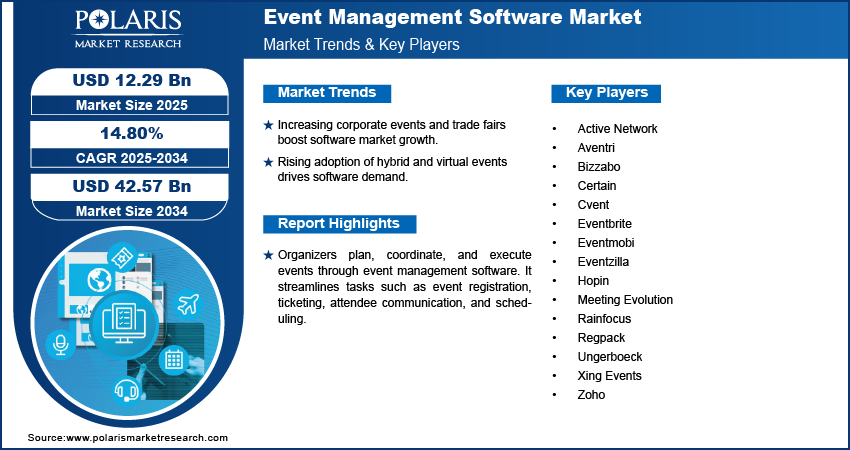

The global event management software market size was valued at USD 10.73 billion in 2024. The market is projected to grow at a CAGR of 14.80% during 2025 to 2034. Key factors driving demand for event management software include the rising popularity of hybrid and virtual events and the growth in corporate events, product launches, trade fairs, and cultural festivals.

Key Insights

- The organizers & planners segment held the largest revenue share in 2024 and is expected to lead the market in the forecast years. This growth is attributed to the event management software's ability to streamline tasks, enhance organization, and boost efficiency.

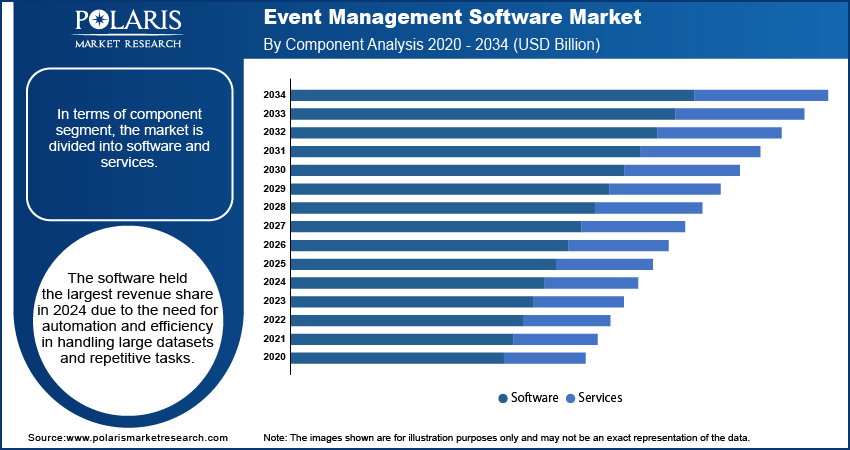

- The software segment dominated the global market share in 2024. This is due to the need for automation and efficiency in handling large datasets and repetitive tasks.

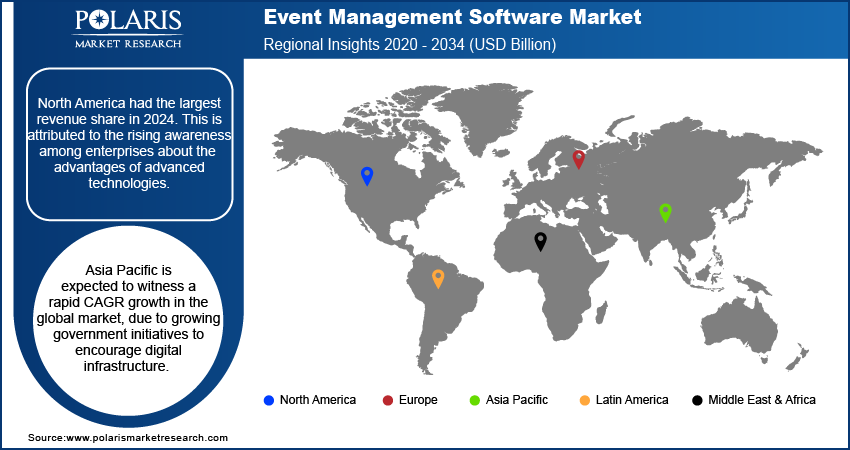

- North America had the largest revenue share in 2024. This is attributed to the rising awareness among enterprises about the advantages of advanced technologies.

- Asia Pacific is expected to witness a rapid CAGR growth in the global market, due to growing government initiatives to encourage digital infrastructure.

Industry Dynamics

- The global event management software market is fueled by a growth in corporate events, product launches, and trade fairs.

- The rising popularity of hybrid and virtual events across countries such as China, Japan, and India is also anticipated to increase demand for event management software.

- Integration of AI into event management software is creating a lucrative market opportunity.

- High cost of this software is projected to hamper the market growth.

Market Statistics

- 2024 Market Size: USD 10.73 Billion

- 2034 Projected Market Size: USD 42.57 Billion

- CAGR (2025-2034): 14.80%

- North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

AI Impact on Event Management Software Market

- AI helps in tasks such as registrations, invoicing, and follow-ups.

- AI enhances event personalization by analyzing attendee preferences.

- AI improves attendee support and engagement by providing instant and personalized assistance.

Organizers plan, coordinate, and execute events through event management software. It streamlines tasks such as event registration, ticketing, attendee communication, and scheduling. The software provides tools for managing venues, speakers, sponsors, and vendors. Event management software improves organization and reduces manual work. This software also enhances the experience for participants. The software further supports various event types. This includes conferences, trade shows, virtual events, and social gatherings.

The rising popularity of gamification acoss the globe is propelling the market growth. Gamification is drving organizers to organize gaming events where number of gamers come and perform their task. This is increasing the deamnd for evenet management software as it allows organizers to achieve goals while also creating a fun-filled memorable experience for all attendees. The increasing meetups of social media influencers in emerging economies such as India, Brazil, and Vietnam is also propelling the demand for evenet management software.

Industry Dynamics

Growth Drivers

The growth of corporate events across the globe is increasing the adoption of evenet management software. This software in corporate events streamline the planning and execution process. It is also used for managing registrations, scheduling sessions, coordinating speakers, and assigning tasks to team members. The growing number of corporate offices around the world is also driving the demand for evenet management software. Moreover, the growing popularity of virtual events by key government and non-government bodies across the globe is also leading to an increase in market revenue. Evenet management software allow organizers to create branded virtual stages with high-definition streaming and interactive features such as live chats, Q&A, polls, and breakout rooms.

Report Segmentation

The market is primarily segmented based on component, deployment mode, organization size, end use, and region.

|

By Component |

By Deployment Mode |

By Organization Size |

By End Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Insight by Component

In terms of component segment, the market is divided into software and services. The software held the largest revenue share in 2024 due to the need for automation and efficiency in handling large datasets and repetitive tasks. Software further helps in improving the attendee engagement and provide real-time data analytics, which increased its adoption among event organizers & planners. Software also provided better budget control and enhanced collaboration. This propelled corporate offices, governments, and organizers & planners to use vent management software.

Insight by End Use

Based on the end use segment, the organizers & planners segment accounted for a major revenue share in 2024 and is expected to be the most significant revenue contributor during the forecast period. Organizers and planners use event management software to streamline tasks, enhance organization, and boost efficiency. This software helps organizers & planners in creating effective invitations, handling registrations, organizing housing, and viewing real-time reports, which contributed to the segment's dominance. Event management software reduces errors and ultimately leads to more successful and engaging events, which encouraged organizers & planners to adopt this software.

Geographic Overview

North America accounted for the largest market share in 2024. This is attributed to the rising awareness among enterprises about the advantages of advanced technologies and software such as event management software. The growing demand for better and more efficient management in corporate offices in the region has resulted in high demand for event management software. Moreover, the presence of high number of corporate offices and government body headquarters in the region contributed to the market dominance in North America.

Which Country Dominated the North America Event Management Software Market in 2024?

The U.S. held the largest share of the North America industry in 2024. Many corporate, government, educational organizations and third-party event planners adopt EMS to handle registration, attendee management, analytics, and hybrid/virtual events. There is a rapid rise in hybrid and virtual events. It propels the demand for systems that can handle online and offline components for streaming, networking, and analytics. Cloud-based deployment is growing due to its flexibility, scalability, and remote access. The U.S. has the presence of many key players. Many large organizations in the U.S. run large-scale conferences/trade shows. It helps fuel EMS adoption and investments. The following table comprises key players in the U.S.

|

Vendor |

Headquarters (USA) |

Key Strengths |

|

Cvent, Inc. |

Tysons, Virginia |

Full-lifecycle event management platform that offers venue sourcing, mobile apps, registrations, and analytics |

|

Eventbrite, Inc. |

San Francisco, California |

Used globally for ticketing and registration; efficient for public events |

|

Bizzabo, Inc. |

New York, New York |

Emphasis on event marketing and hybrid/virtual workflows |

|

Aventri, Inc. |

Norwalk, Connecticut |

Cloud-based SaaS platform for event planning and management, especially corporate/large-scale events |

|

ACTIVE Network, LLC |

Dallas, Texas |

Participant-/activity-management oriented; significant in event management software |

The market in the Asia Pacific is expected to witness a high CAGR in the global market in the coming years. Government initiatives to encourage digital infrastructure are driving the region's acceptance of management services. For instance, in August 2021, the Government of India announced the Digital India initiative to guarantee that all federal programs are available to all citizens electronically. Additionally, the region has a diversified customer base for many industries, necessitating brand promotional activities to reach potential customers, contributing to market growth.

Competitive Insight

Some of the major players operating in the global market include Active Network, Aventri, Bizzabo, Certain, Cvent, Eventbrite, Eventmobi, Eventzilla, Hopin, Meeting Evolution, Rainfocus, Regpack, Ungerboeck, Xing Events, and Zoho.

Event Management Software Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 10.73 Billion |

| Market size value in 2025 | USD 12.29 Billion |

|

Revenue forecast in 2034 |

USD 42.57 Billion |

|

CAGR |

14.80% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Regional scope |

|

|

Key companies |

Active Network, Aventri, Bizzabo, Certain, Cvent, Eventbrite, Eventmobi, Eventzilla, Hopin, Meeting Evolution, Rainfocus, Regpack, Ungerboeck, Xing Events, and Zoho |

FAQ's

• The global market size was valued at USD 10.73 billion in 2024 and is projected to grow to USD 42.57 billion by 2034.

• The global market is projected to register a CAGR of 14.80% during the forecast period.

• North America dominated the market in 2024.

• A few of the key players in the market include Active Network, Aventri, Bizzabo, Certain, Cvent, Eventbrite, Eventmobi, Eventzilla, Hopin, Meeting Evolution, Rainfocus, Regpack, Ungerboeck, Xing Events, and Zoho.

• The organizers & planners segment dominated the market revenue share in 2024.