Infrastructure Asset Management Market Share, Size, Trends, Industry Analysis Report

By Application, By Component, By Service (Strategic, Operational, Tactical), By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Feb-2024

- Pages: 120

- Format: pdf

- Report ID: PM4240

- Base Year: 2023

- Historical Data: 2020 – 2022

Report Outlook

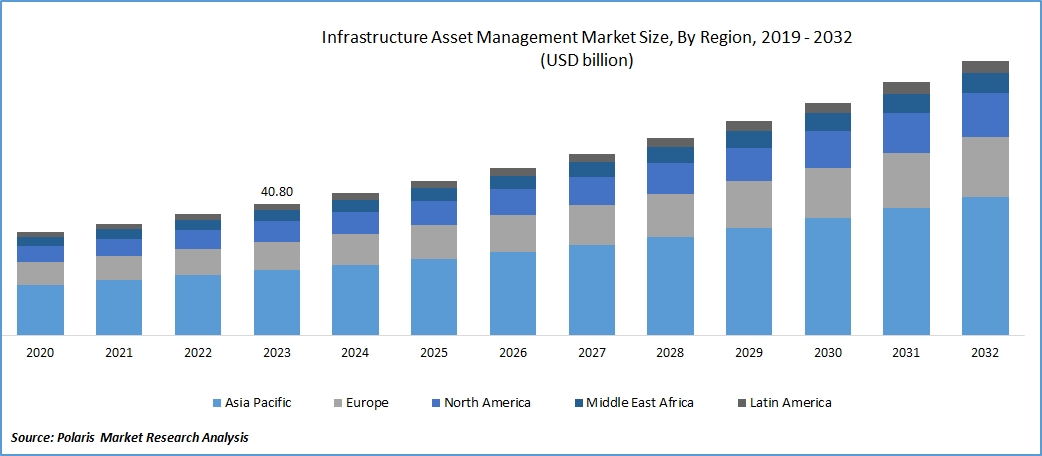

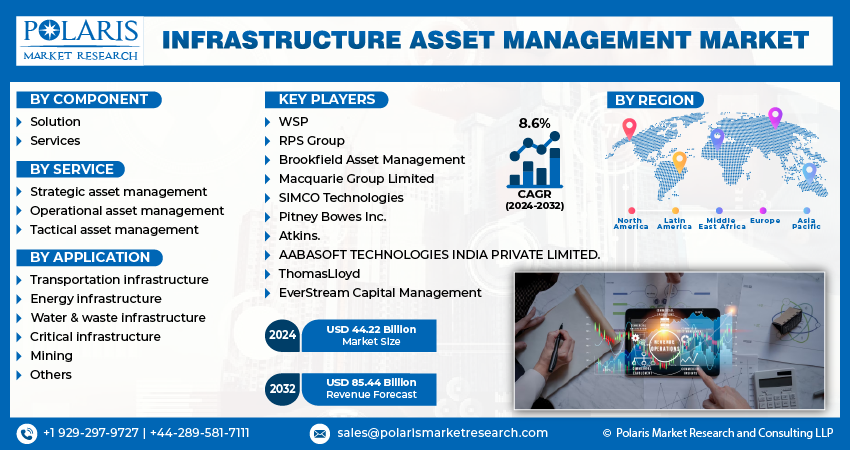

The global infrastructure asset management market was valued at USD 40.80 billion in 2023 and is expected to grow at a CAGR of 8.6% during the forecast period.

The market has experienced significant expansion due to the swift uptake of infrastructure asset management (IAM) services, aimed at minimizing infrastructure procurement and maintenance expenses. The emergence of advanced wireless technologies like High-Speed Downlink Packet Access (HSDPA) is anticipated to facilitate the adoption of cutting-edge technologies such as Artificial Intelligence (AI) & the Internet of Things (IoT). These advancements are set to further propel market growth.

To Understand More About this Research, Request a Free Sample Report

IAM allows companies to effectively monitor, maintain, and optimize their assets, ensuring that they are utilized to their fullest potential. By implementing IAM strategies, businesses can enhance the quality of their operations, improve asset efficiency, and reduce downtime. This, in turn, leads to increased productivity and operational excellence.

Moreover, IAM solutions facilitate data-driven decision-making, enabling companies to identify underperforming assets, schedule timely maintenance, and make informed strategic choices. By aligning asset management processes with organizational goals, IAM contributes to overall quality improvements within the company's operations. As businesses recognize the importance of maximizing their assets' value, the adoption of IAM solutions becomes integral to achieving higher quality standards and increased productivity, thereby driving market growth.

Industries of this nature require substantial capital because frequent modifications or upgrades to old designs are not feasible. Consequently, these sectors utilize Infrastructure Asset Management (IAM) solutions to optimize the use of existing facilities efficiently. IAM solutions also ensure superior maintenance after deployment. For instance, a study by the U.S. Department of Energy revealed that almost 75% of transmission lines and transformers are very old. In Europe, governments encounter issues concerning water and wastewater infrastructure. Leakage in distribution systems results in the wastage of over three billion liters of water in the European region.

The research study provides a comprehensive analysis of the industry, assessing the market on the basis of various segments and sub-segments. It sheds light on the competitive landscape and introduces Infrastructure Asset Management Market key players from the perspective of market share, concentration ratio, etc. The study is a vital resource for understanding the growth drivers, opportunities, and challenges in the industry.

Growth Drivers

Government Initiatives

Government initiatives present promising prospects for emerging economies in the near term. Substantial investments made by companies in the expansion of solar energy infrastructure further contribute to the growth of the infrastructure sector. Additionally, increasing awareness about energy conservation results in a high adoption rate of Infrastructure Asset Management (IAM) solutions for energy-related infrastructure. Furthermore, governments worldwide are heavily investing in the establishment of Smart Cities and emphasizing enhanced safety measures in publicly-owned buildings.

Companies in the industry is employing a dual-track approach known as the Design-Build & Build-Operate-Transfer strategy. Local startups handle the design & construction aspects, while large corporations specialize in providing operation and maintenance software. The market is primarily driven by the risks related to aging infrastructure. Industries like manufacturing and oil & gas utilities rely on assets such as land, buildings, and machinery to ensure their long-term operational efficiency.

Report Segmentation

The market is primarily segmented based on component, service, application, and region.

|

By Component |

By Service |

By Application |

By Region |

|

|

|

|

To Understand More About this Research, Speak to Analyst

By Component Analysis

Services segment garnered the largest share

Services segment dominated the market. Services are cost-effective since support and maintenance are encompassed within the service package. Companies within the services sector prioritize offering training opportunities tailored to the IAM system's workforce.

Solution segment will grow at significant pace. Infrastructure asset management solutions are increasingly sought after due to their systematic and integrated approaches for managing diverse infrastructure in sectors like energy, water, and waste. Customization is a key feature offered by IAM solutions, contributing to their popularity.

By Services Analysis

Operation asset management segment accounted for the largest market share in 2022

Operation asset management segment accounted for the largest market share. This growth is primarily driven by the extensive utilization of operational asset management in the energy sector. Evolving trends in the energy industry are prompting companies to seek ways to reduce energy costs, thus fueling the expansion of this segment.

Strategic asset management segment will exhibit robust growth rate. This is primarily due to the increasing adoption of planning, design, development, and maintenance of infrastructure. The growing acceptance of risk assessment within Strategic Asset Management (SAM) services is expected to be a driving factor for this growth.

By Application Analysis

Transportation segment accounted for the largest market share in 2022

Transportation segment accounted for the largest market share. Government based investments in improving transportation infrastructure play a pivotal role. These investments aim to enhance transportation activities for the citizens, ensuring smoother, more efficient, and accessible transportation options. Also, the integration of the location-based services in the transportation systems is a significant driver. By incorporating technologies that rely on location data, transportation services can offer real-time information, optimized routes, and improved overall user experience.

Energy infrastructure segment will exhibit robust growth rate. This growth is driven by the increasing adoption of energy applications, especially in the context of emerging trends like SMART cities. Many countries are now embracing the concept of SMART cities, wherein Infrastructure Asset Management (IAM) services play a crucial role in the development and management of energy infrastructure.

Currently, government initiatives that align with the availability of funds from investors for SMART city projects are creating significant opportunities in the market. These initiatives involve strategic planning and deployment of IAM services to optimize the management of energy resources within these SMART city projects. As governments invest in these initiatives and attract funding, the demand for IAM services in the energy sector experiences a notable surge. This trend is expected to continue, driving the growth of the energy infrastructure segment in the forecast period.

Regional Insights

North America accounted for the largest share of global market in 2022

North America emerged as the largest region. This was driven by the growing necessity to enhance asset utilization while simultaneously reducing operational costs. Additionally, factors like aging infrastructure and a surge in private sector investments and public-private partnerships (PPPs) in infrastructure projects are contributing to the market's expansion in the region.

Asia Pacific will grow at the substantial pace. The region has seen increased investment in infrastructure, offering new opportunities for market participants. For instance, in India, the government's ambitious plan to develop over 100 smart cities by 2020, supported by efficient telecommunications infrastructure, has been conducive to market growth. However, the progress of this mission was hindered by the pandemic, causing delays. As of March 2023, a report from The Parliamentary Standing Committee indicates that out of 7,821 projects, more than 68% have been completed.

Key Market Players & Competitive Insights

The swift implementation of Infrastructure Asset Management (IAM) services leads to reduced procurement and maintenance expenses for infrastructure. Additionally, IAM services provide security solutions for various facilities, including airports, government buildings, and sports complexes.

Some of the major players operating in the global market include:

- WSP

- RPS Group

- Brookfield Asset Management

- Macquarie Group Limited

- SIMCO Technologies

- Pitney Bowes Inc.

- Atkins.

- AABASOFT TECHNOLOGIES INDIA PRIVATE LIMITED.

- ThomasLloyd

- EverStream Capital Management

Recent Developments

- In June 2023, Macquarie Asset Management (MAM) & Coastal Waste & Recycling (Coastal) have successfully finalized the recapitalization process for Coastal. Consequently, MAM, via one of its funds, has become the principal owner of Coastal.

- In April 2023, Siemens Digital Industries Software and IBM have recently extended their enduring partnership. Their collaboration revolves around developing a unified software solution that merges their individual offerings in systems engineering, service lifecycle management, and asset management.

- In September 2022, WSP has revealed the acquisition of John Wood. This strategic initiative allowed them to leverage their strengths, offering clients a broader array of high-quality multidisciplinary services. Through this collaboration, WSP and John Wood Group can provide clients with innovative solutions and increased value.

- In March 2022, Aptean, has introduced Aptean EAM, a cutting-edge cloud-based Enterprise Asset Management (EAM) software tailored for manufacturing and other businesses that depend on complex equipment for their production processes.

Infrastructure Asset Management Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 44.22 billion |

|

Revenue forecast in 2032 |

USD 85.44 billion |

|

CAGR |

8.6% from 2023 – 2032 |

|

Base year |

2023 |

|

Historical data |

2020 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments covered |

By component, By services, By application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Get in Touch Whenever You Need Us

In today’s hyper-connected world, running a business around the clock is no longer an option. And at Polaris Market Research, we get that. Our sales & analyst team is available 24x5 to assist you. Get all your queries and questions answered about the Infrastructure Asset Management Market report with a phone call or email, as and when needed.

Browse Our Top Selling Reports

Live Commerce Platforms Market Size, Share 2024 Research Report

Peptide and Oligonucleotide CDMO Market Size, Share 2024 Research Report

Energy Engineering Service Outsourcing (ESO) Market Size, Share 2024 Research Report

FAQ's

The global infrastructure asset management market size is expected to reach USD 85.44 billion by 2032

WSP,RPS Group,Brookfield Asset Management are the top market players in the market.

North America region contribute notably towards the global Infrastructure Asset Management Market.

expected to grow at a CAGR of 8.6% during the forecast period.

component, service, application, and region are the key segments in the Infrastructure Asset Management Market.