Solar Power Meter Market Size, Share, Trends, & Industry Analysis Report

By Integration Type (On-grid, Off-grid, and Handheld), By Product, By Measurement, By Technology, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 125

- Format: PDF

- Report ID: PM5788

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

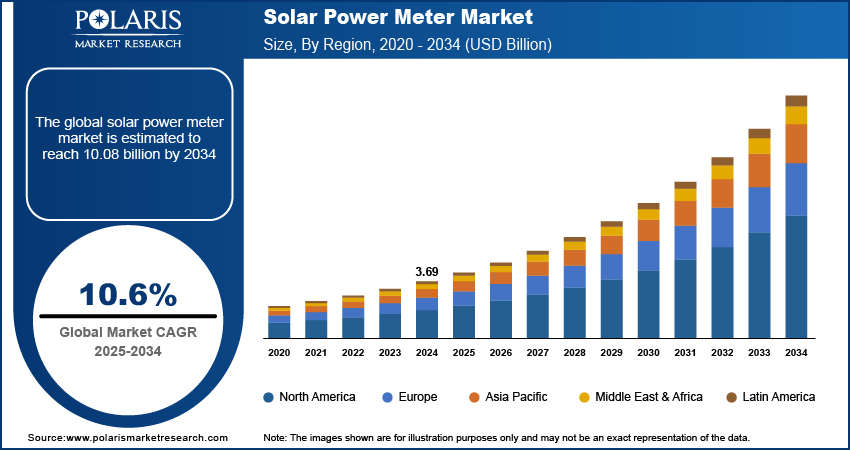

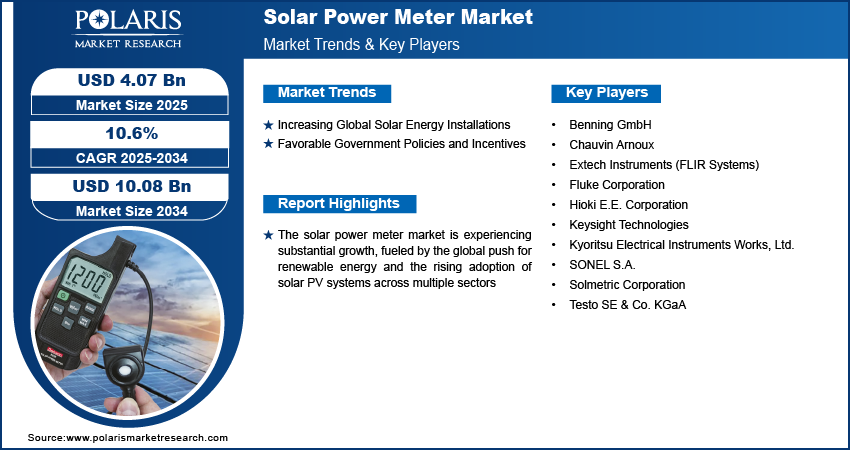

The global solar power meter market was valued at USD 3.69 billion in 2024 and is anticipated to register a CAGR of 10.6% from 2025 to 2034. The growing global adoption of solar energy systems across residential, commercial, and industrial sectors is a key driving factor for solar power meters. Increasing awareness about energy efficiency and the benefits of monitoring solar power generation significantly boosts their demand.

A solar power meter is a device used to measure the intensity of solar radiation, often expressed in watts per square meter (W/m²), and to assess the performance of solar energy systems. These meters are essential for anyone working with solar panels, from installers and technicians to researchers and homeowners, as they help ensure optimal system efficiency and energy output.

One major growth factor is the increasing global adoption of solar energy systems across residential, commercial, and industrial sectors. As more homes and businesses install solar panels to lower electricity bills and adopt clean energy, the demand for accurate instruments to monitor and optimize these installations naturally increases. Another significant driver is the rising focus on energy efficiency and the awareness among consumers and businesses about the benefits of tracking solar power generation. This push for smarter energy management systems further fuels the need for accurate metering solutions.

Many governments worldwide offer subsidies, tax credits, and other financial benefits to encourage the installation of solar power systems. For instance, the Government of India launched initiatives to provide solar power to 10 million homes by 2026–2027 through substantial subsidies and easy financing. This initiative is expected to boost solar panel installations and recycling, increasing the demand for monitoring system performance and ensuring compliance with these programs.

Industry Dynamics

Increasing Global Solar Energy Installations

The widespread adoption of solar energy systems across various sectors is a primary factor fueling the demand for solar power meters. As more homes, businesses, and industrial facilities integrate solar photovoltaic (PV) technology, accurate measurement and monitoring tools are essential. These meters help verify system performance, optimize energy output, and ensure installations operate efficiently.

According to a report by the International Energy Agency (IEA), solar PV generation increased by 320 TWh (up 25%) in 2023, reaching over 1600 TWh. This made it the largest absolute generation growth among all renewable technologies in 2023. This substantial increase in deployed solar capacity directly drives the demand for managing and maintaining these expanding energy infrastructures, propelling the requirement for solar power meters.

Favorable Government Policies and Incentives

Supportive government policies and various incentives designed to promote renewable energy are significantly contributing to the growth. These policies often include subsidies, tax credits, and financial schemes that make solar installations more affordable and attractive for consumers and businesses. As a result, the number of new solar projects increases, boosting the requirement for monitoring equipment such as solar power meters. According to the report by the Press Information Bureau, India recorded a significant annual capacity addition of 29.52 GW in renewable energy in fiscal year 2024-2025, bringing the total installed renewable energy capacity to 220.10 GW. Solar energy contributed the most to this expansion, with 23.83 GW.

This growth, largely fueled by government support for renewable energy, directly increases the demand for the meters required to assess the efficiency and output of these new installations.

Segmental Insights

Integration Type Analysis

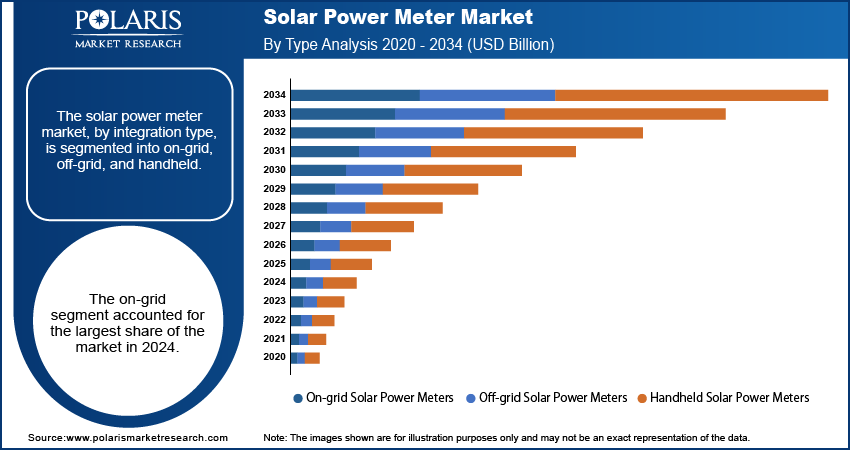

The on-grid solar power meters segment held a market share of approximately 66% in 2024. This dominance is attributed to the widespread global deployment of grid-connected solar PV systems, especially in developed economies where substantial investments have been made in integrating renewable energy into existing power grids. Many countries have policies and programs, such as net metering, that encourage homeowners and businesses to connect their solar installations to the main grid, allowing them to send excess electricity back to the utility.

The off-grid solar power meters segment is anticipated to register the highest growth rate during the forecast period. This accelerated growth can be attributed to increasing efforts to provide electricity to remote and underserved areas that lack access to a reliable central grid. Standalone solar systems, often paired with battery storage, offer a vital solution for energy independence and resilience in these regions. For example, the World Bank's "Off-Grid Solar Market Trends Report 2022" highlights the growing adoption of off-grid solar solutions for rural electrification and productive uses in developing countries.

Product Analysis

The net meters segment held the largest share of more than 28% in 2024. This dominance is primarily driven by the widespread adoption of net metering policies in governments and utility companies globally. Net metering allows solar energy system owners to receive credits for the excess electricity they feed into the grid, effectively reducing their electricity bills. This mechanism makes solar installations more financially attractive, and net meters are essential for accurately tracking both imported and exported electricity, ensuring fair billing and compensation.

The bi-directional meter segment is anticipated to register the highest growth rate in 2024. This is due to the increasing complexity of modern electricity grids and the growing number of "prosumers" who produce and consume electricity. Bi-directional meters are designed to measure electricity flow in both directions, making them crucial for managing distributed energy resources such as rooftop solar. As more smart grid initiatives are launched and the need for granular data on energy flow increases for grid stability and demand-side management, the adoption of bi-directional meters is rapidly expanding.

Measurement Analysis

The current measurement segment accounted for the largest share in terms of revenue in 2024, due to its importance in assessing a solar energy system's basic operation and health. Current measurement allows for immediate verification of whether solar panels produce an electrical current and helps detect common issues such as shading, panel degradation, or connection problems affecting energy flow. Its simplicity and direct relevance to system diagnostics make it a widely adopted and essential measurement for installation and routine checks.

The power measurement segment holds the highest growth rate during the forecast period. This rise is driven by the increasing demand for comprehensive energy analytics and the need to understand solar installations' actual energy output and efficiency. Power measurement, which combines current and voltage readings, provides detailed insights into system performance. For instance, detailed power output data is crucial for calculating a system's performance ratio and identifying potential losses, as highlighted by Hukseflux's insights on solar power monitoring.

Technology Insights

The digital technology segment held the largest share in terms of revenue in 2024. This dominance is attributed to the inherent advantages of digital meters, such as higher accuracy, the ability to store data, and easy integration with smart grid systems. Digital meters can provide real-time readings, offer remote monitoring capabilities, and facilitate detailed data analysis, which is crucial for optimizing solar panel performance and managing energy consumption effectively. The transition from traditional analog meters toward these advanced digital solutions aligns with the broader digitalization trends in the energy sector.

The digital technology segment is expected to exhibit the highest CAGR during the forecast period. This rapid growth is driven by continuous technological advancements, increasing investments in smart grid infrastructure, and the rising demand for sophisticated energy management solutions. Digital meters, particularly smart meters, enable features such as demand forecasting and automated billing, enhancing operational efficiency for utilities and consumers. As solar installations become more widespread and complex, the need for precise, data-rich monitoring tools becomes paramount, further accelerating the adoption of digital meters.

End Use Analysis

The residential segment holds the largest revenue share in 2024. The segment dominance is largely attributed to the widespread adoption of rooftop solar PV systems by homeowners. Driven by desires to reduce electricity expenses, achieve energy independence, and contribute to environmental sustainability, many residential consumers are investing in solar installations. These residential solar projects rely on accurate metering for various purposes, including net metering, monitoring energy production, and ensuring proper billing, thus driving the significant demand.

The commercial segment is expected to experience the highest growth rate during the forecast period. This acceleration is attributed to businesses increasingly investing in solar energy to lower operational costs, meet corporate sustainability targets, and comply with evolving regulatory requirements. Commercial solar installations typically involve larger systems with more complex energy management needs than residential setups. This necessitates advanced metering solutions that can provide detailed analytics and real-time monitoring and integrate with building management systems, fueling the rapid expansion in the commercial end use segment.

Regional Analysis

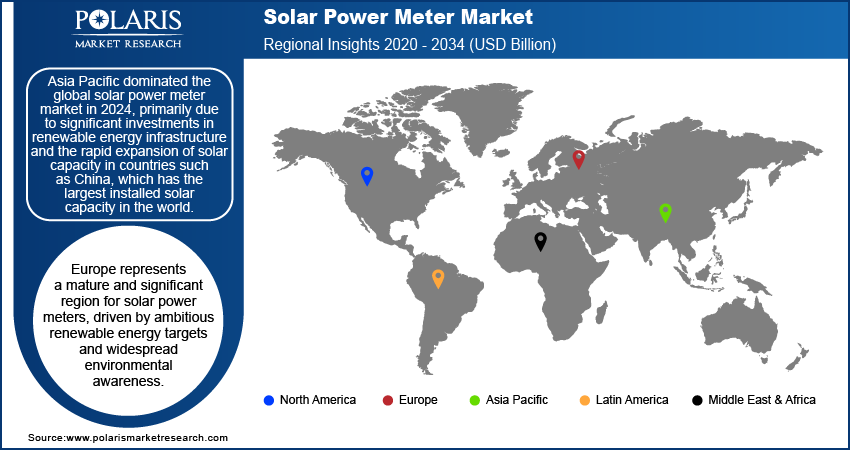

The Asia Pacific solar power meter market accounted for approximately 40% of the global market in 2024, owing to the massive investments in renewable energy infrastructure and growing demand. Countries in this region are aggressively expanding their solar capacities to address increasing electricity needs and combat climate change. Rapid industrialization and urbanization across various nations have contributed to the accelerating adoption of solar energy, creating a substantial need for meters. The China solar power meter market held the largest market share in terms of revenue in 2024. The country holds the largest installed solar capacity globally and is a leading manufacturer of solar PV panels. China's ambitious renewable energy targets and supportive policies have led to an unprecedented scale of solar installations, ranging from large utility-scale projects to distributed rooftop systems. This vast deployment generates significant demand for all types of meters, making China a cornerstone of the regional and global market.

North America Solar Power Meter Market

North America is a significant region, driven by robust solar energy adoption and supportive government policies. The region has seen substantial solar PV system investments across residential, commercial, and utility-scale sectors. Advanced metering infrastructure (AMI) deployments and an emphasis on smart grid integration also contribute to the demand for solar power meters. This proactive approach to renewable energy and grid modernization positions North America as a key contributor to the global solar power meter landscape.

US Solar Power Meter Market Insight

The US dominated the market in North America in 2024, largely due to strong federal and state incentives promoting solar energy. Programs such as the Investment Tax Credit (ITC) have significantly encouraged solar capacity installation across the country. The US market benefits from expanding home solar systems, and businesses and large-scale power plants, necessitating a rise in the use of various solar power meters for efficient monitoring and energy management. The country's commitment to grid modernization is vital to the continued demand for advanced metering solutions.

Europe Solar Power Meter Market

Europe represents a mature and significant region for solar power meters, driven by ambitious renewable energy targets and widespread environmental awareness. Many European nations have actively promoted solar energy through feed-in tariffs, grants, and other incentives, leading to a high penetration of solar PV systems. This has created a consistent demand for meters to monitor energy production and consumption and facilitate grid integration. The region's focus on decarbonization and energy independence further supports the steady adoption. Germany stands as a prominent country and has historically been a leader in solar energy adoption, with considerable installed capacity across residential, commercial (such as solar highway), and industrial segments. The country's strong commitment to the energy transition (Energiewende) has fostered a conducive environment for solar technology, including metering solutions. The extensive use of solar power in Germany, supported by a comprehensive regulatory framework, ensures a continuous and strong demand for precise meters to manage its vast solar infrastructure effectively.

Key Players and Competitive Insights

The competitive landscape of the solar power meter market is characterized by the presence of both established global players and niche specialists. Companies often differentiate themselves through product innovation, offering advanced features such as wireless connectivity, data analytics, and integration with broader energy management systems. The intense competition is driven by the rapidly expanding solar energy sector, leading players to focus on developing more accurate, reliable, and cost-effective metering solutions to gain a larger share of the growing demand across various end-use segments.

A few prominent companies in the industry include Fluke Corporation; Keysight Technologies; Hioki E.E. Corporation; Chauvin Arnoux; Testo SE & Co. KGaA; Kyoritsu Electrical Instruments Works, Ltd.; Extech Instruments (FLIR Systems); SONEL S.A., Benning GmbH; and Solmetric Corporation.

Key Players

- Benning GmbH

- Chauvin Arnoux

- Extech Instruments (FLIR Systems)

- Fluke Corporation

- Hioki E.E. Corporation

- Keysight Technologies

- Kyoritsu Electrical Instruments Works, Ltd.

- SONEL S.A.

- Solmetric Corporation

- Testo SE & Co. KGaA

Industry Developments

June 2025: Fluke Reliability announced a strategic partnership with Treon. This collaboration aims to help customers move from reactive to predictive maintenance by combining Treon's wireless sensor technology with Fluke Reliability's AI diagnostics and predictive maintenance software.

January 2025: Hioki launched its new P2010 DC High Voltage Probe, designed for safer and more efficient inspections of solar installations, especially those operating at higher voltages up to 2,000 V DC.

Solar Power Meter Market Segmentation

By Integration Type Outlook (Revenue – USD Billion, 2020–2034)

- On-Grid

- Off-Grid

- Handheld

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Net Meter

- Bi-Directional Meter

- Dual Meter

- Others

By Measurement Outlook (Revenue – USD Billion, 2020–2034)

- Current Measurement

- Voltage Measurement

- Power Measurement

- Energy Measurement

By Technology Outlook (Revenue – USD Billion, 2020–2034)

- Digital

- Analog

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Residential

- Commercial

- Industrial

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Solar Power Meter Market Report Scope:

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.69 billion |

|

Market Size in 2025 |

USD 4.07 billion |

|

Revenue Forecast by 2034 |

USD 10.08 billion |

|

CAGR |

10.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Customize your report according to your countries, regions, and segmentation requirements. |

FAQ's

The global market size was valued at USD 3.69 billion in 2024 and is projected to grow to USD 10.08 billion by 2034.

The global market is projected to register a CAGR of 10.6% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few key players in the market are Fluke Corporation; Keysight Technologies; Hioki E.E. Corporation; Chauvin Arnoux; Testo SE & Co. KGaA; Kyoritsu Electrical Instruments Works, Ltd.; Extech Instruments (FLIR Systems); SONEL S.A., Benning GmbH; and Solmetric Corporation.

The on-grid segment accounted for the largest share of the market in 2024.

The off-grid segment is expected to witness the fastest growth during the forecast period.