Scooters Market Share, Size, Trends, & Industry Analysis Report

By Product Type (Normal Scooter, Electric Scooter), By Electric Scooter Type (Conventional Electric Scooter, Swappable Electric Scooter), By Region, And Segment Forecasts, 2025 - 2034

- Published Date:Aug-2025

- Pages: 130

- Format: PDF

- Report ID: PM4223

- Base Year: 2024

- Historical Data: 2020 - 2023

The Scooters Market is projected to be valued at USD 25.3 billion in 2025 and grow at a CAGR of 6.0% through 2034. Demand for urban mobility, rising fuel efficiency awareness, and the shift toward electric scooters are fueling market growth.

The increasing pace of urbanization and enhanced road connectivity in emerging economies has generated a significant demand for transportation. The lack of public vehicles in remote areas motivates consumers to invest in personal vehicles. There is a growing preference for lightweight, easy-to-drive, and cost-effective vehicles, making scooters a popular choice. Battery-powered electric scooters, which eliminate the need for fuel and contribute to reduced vehicular pollution, are driving the growth of the market.

To Understand More About this Research: Request a Free Sample Report

The economic progress of a nation is closely tied to its road infrastructure. Governments in developing countries are actively investing in the construction of safe and efficient roads, creating new avenues for growth in the transportation and logistics sector. This has led to a surge in entrepreneurs entering the logistics market by establishing their firms or forming partnerships with existing ones. Consequently, there is a growing demand for vehicles that can swiftly transport goods with minimal time and cost, with scooters emerging as a preferred choice. Scooters offer the advantage of easy maneuverability through traffic and lower fuel consumption compared to bikes, mopeds, and cars.

Moreover, manufacturers of scooters are predominantly concentrating on integrating advanced technology into their vehicles to boost speed, improve battery efficiency, and enhance cost-effectiveness for consumers. Additionally, electric scooter manufacturers have launched a variety of scooter models in emerging economies. For example, in February 2022, Silence, a Spanish company, unveiled the Silence 01 and 02 models in South Africa, featuring fast charging capabilities, ample load-carrying capacity, and removable batteries. As a result, these strategies implemented by automakers are anticipated to generate fresh growth opportunities for scooters market.

Industry Dnyamics

Growth Drivers

Rising Demand for Electric Scooters

Increasing adherence to regulatory standards, the prohibition of internal combustion engine (ICE) vehicles, reduced import duties on electric vehicles, and enhanced battery charging infrastructure have led to a shift in consumer preferences towards electric scooters as opposed to conventional ones. Electric scooters , known for their lightweight design, ease of operation, and battery-powered functionality, are becoming popular for short-distance travel and local sightseeing. The high mechanical efficiency, lower noise levels, reduced total cost of ownership, and lower maintenance requirements of electric scooters contribute to their growing demand. Additionally, the adoption of electric scooters for sharing services in developed countries is anticipated to drive market growth further.

Report Segmentation

The market is primarily segmented based on product, type, and region.

|

By Product |

By Type |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

Normal Scooters Segment Held the Largest Share in 2024

The normal scooter segment held the largest share. Growing consumer preference for vehicles that provide comfortable rides with gearless driving systems and operate at a minimal cost has propelled the sales of standard scooters. These scooters offer high mileage and sturdy bodies, enhancing maneuverability and contributing to the significant share in the segment.

The electric scooters segment is projected to grow at the fastest rate. Growing awareness regarding greenhouse gases, carbon emissions, & pollutants, coupled with a surge in demand for fuel-efficient 2-wheelers, is expected to drive the expansion of the segment. Additionally, governments globally are implementing new policies & regulations to boost the adoption of electric scooters, offering various incentives and benefits to consumers. The surge in the use of electric scooters for rental-sharing services has further contributed to the growth prospects.

By Type Analysis

Conventional Scooter Segment Registered the Largest Market Share in 2024

Conventional scooters segment accounted for the largest share. Traditional electric scooters are known for their lightweight design, durability, and lower initial and maintenance costs compared to their counterparts, making them widely embraced by consumers. Additionally, manufacturers in the traditional electric scooter segment prioritize the development of technologically advanced models at a competitive price, contributing to the high share within the segment.

The battery-swappable scooter segment will grow rapidly. This growth is driven by the automotive industry's growing emphasis on developing battery-swapping technology, enabling scooter owners to exchange depleted batteries with fully charged ones. Manufacturers of battery-swappable electric scooters are introducing models without pre-installed batteries, providing consumers with the flexibility to choose batteries based on their budget and specific requirements.

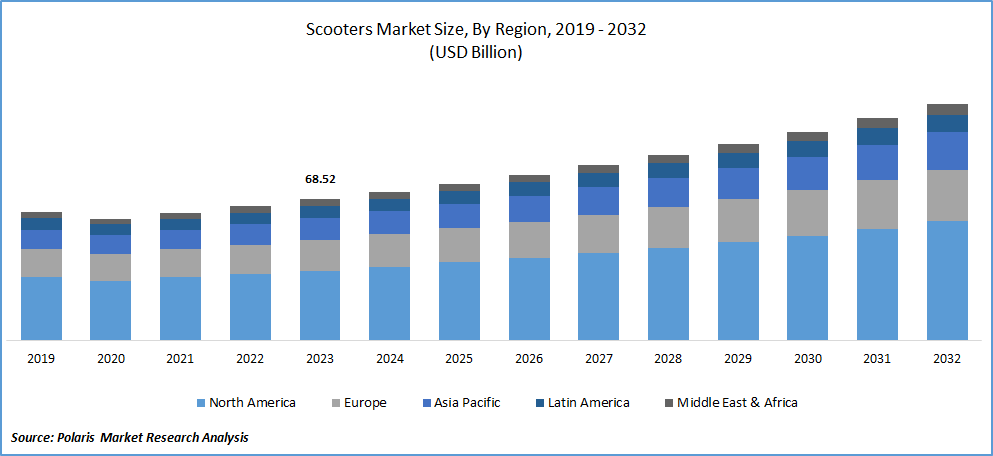

Regional Insights

APAC Held the Largest Share of the Global Market in 2024

APAC dominated the market. This dominant position is linked to the rising disposable income among consumers in the region. Individuals prefer personal vehicles over public buses, seeking to save time during traffic congestion. Additionally, electric scooters present a cost-effective option compared to electric motorcycles and mopeds, both in terms of initial purchase prices and ongoing maintenance expenses. The battery-powered nature of electric vehicles offers consumers a reprieve from the impact of escalating oil prices in the region.

North America is projected to grow at a rapid pace. Growth is attributed to the changing preferences of consumers towards rental electric scooters compared to other two-wheelers in the market. This shift reflects a growing trend where consumers are increasingly opting for the convenience and flexibility offered by rental electric scooters as a sustainable and efficient mode of urban transportation. The availability and accessibility of rental electric scooters contribute significantly to their popularity among consumers in these regions, fostering the overall growth of the market.

The European market is witnessing a surge in technological advancements, with manufacturers introducing vehicles equipped with cutting-edge features. These advancements include enhanced security measures, alert systems, self-diagnosis capabilities, remote telemetry, GPS tracking, motor and power deactivation, and speed limitation features. By integrating these intelligent and secure features, electric scooters in the European market are becoming smarter and more reliable.

The growth in innovation within the European electric scooter sector is expected to play a pivotal role in driving consumer demand for these vehicles. The incorporation of advanced technologies not only enhances the overall user experience but also addresses concerns related to safety and security. As a result, consumers are likely to be more inclined toward adopting electric scooters, contributing to the increasing popularity and demand for technologically advanced electric vehicles in the European market.

Key Market Players & Competitive Insights

The primary strategy employed by key players in the market continues to be organic growth. Electric scooter manufacturers are actively engaging in product launch initiatives, particularly in emerging markets. For instance, Bird introduced an e-scooter in Helsinki in April 2022. This scooter stands out with advanced safety features and is equipped with an IP68-rated waterproof battery.

Some of the major players operating in the global market include:

- Yadea Technology Group Co., Ltd.

- Ninebot Ltd

- NEUTRON HOLDINGS, INC.

- Bird Rides, Inc.

- Spin

- GOTRAX

- SEGWAY INC.

- Razor USA LLC.

- Uber Technologies Inc.

- OKAI Inc.

Recent Developments

- In July 2025 - Kinetic Green revives the iconic DX scooter as an electric model

- In February 2023, Ola Electric unveiled the Ola S1 Air, a new series of e-scooters. This line-up is anticipated to include 3 variants with different battery capacities: 2, 3, & 4KWh. Furthermore, the company has introduced a new S1 model equipped with a 2 KWh battery pack.

- In January 2023, Yadea Technology presented the Yadea Keeness VFD at the Consumer Electronics Show (CES) in Las Vegas. Featuring a 10KW high-performance motor, the Keeness VFD model boasts a top speed of 100 km/h.

- In January 2023, Hero Electric & Maxwell established a long-term agreement for the provision of cutting-edge battery management technologies. As part of this arrangement, Maxwell aimed to deliver more than 1 million Battery Management Systems (BMS) to Hero Electric by 2026.

- In October 2022, Niu International unveiled the KQi3 Max, its latest kick scooter model. The KQi3 Max kick scooter offers exceptional performance, comfort, and stability, boasting a top speed of 20 mph and a range of 40 miles.

Scooters Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 26.5 billion |

|

Revenue forecast in 2034 |

USD 44.8 billion |

|

CAGR |

6.00% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Power Source, By Product, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

Explore the market dynamics of the 2025 Scooters Market share, size, and revenue growth rate, meticulously examined in the insightful reports crafted by Polaris Market Rersearch Industry Reports. The analysis of Scooters Market extends to a comprehensive market forecast up to 2034, coupled with a retrospective examination. Avail yourself of a complimentary PDF download to sample this in-depth industry analysis.

Browse Our Top Selling Reports

Metal Stamping Market Size, Share 2024 Research Report

3D Imaging Market Size, Share 2024 Research Report

Managed SIEM Services Market Size, Share 2024 Research Report

Personal Cloud Market Size, Share 2024 Research Report

High-speed Data Converter Market Size, Share 2024 Research Report

FAQ's

The global scooters market size is expected to reach USD 44.8 billion by 2034

Yadea Technology, Ninebot, NEUTRON HOLDINGS, Bird Rides, Spin are the top market players in the market.

APAC region contribute notably towards the global Scooters Market.

The global scooters market is expected to grow at a CAGR of 6.00% during the forecast period.

Product, type, and region are the key segments in the Scooters Market.