Battery Swapping Market Size, Share, Trends, Industry Analysis Report

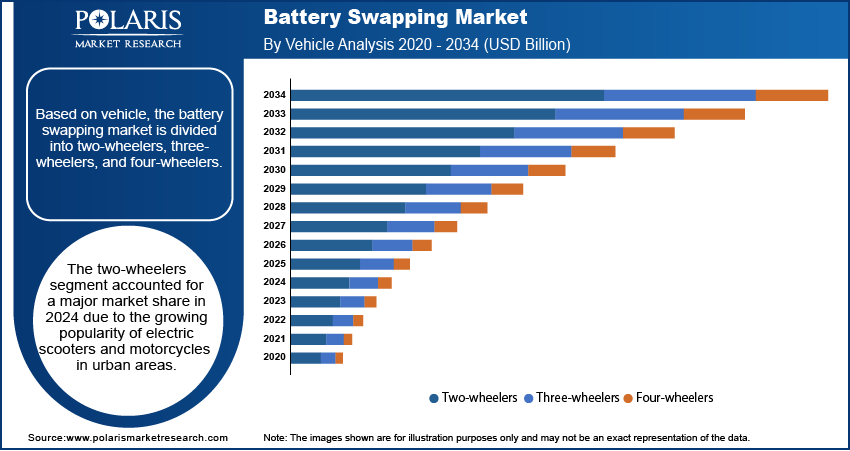

: By Vehicle (Two-Wheelers, Three-Wheelers, and Four-Wheelers), Battery Type, End User, Battery Capacity, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM3134

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

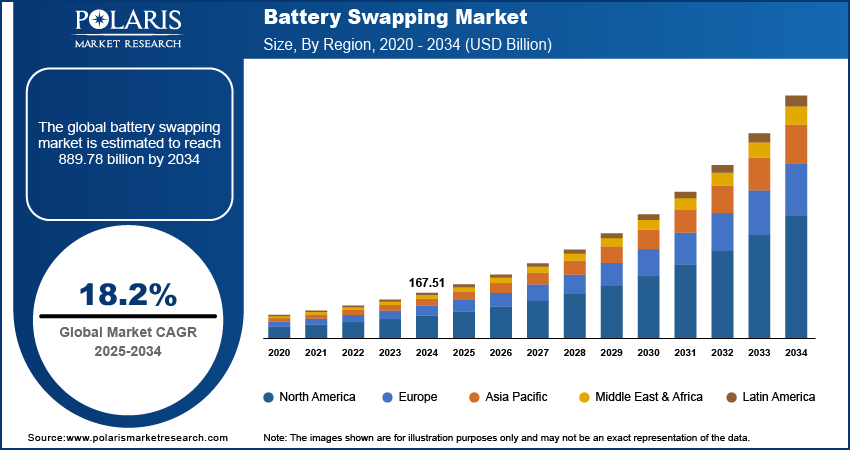

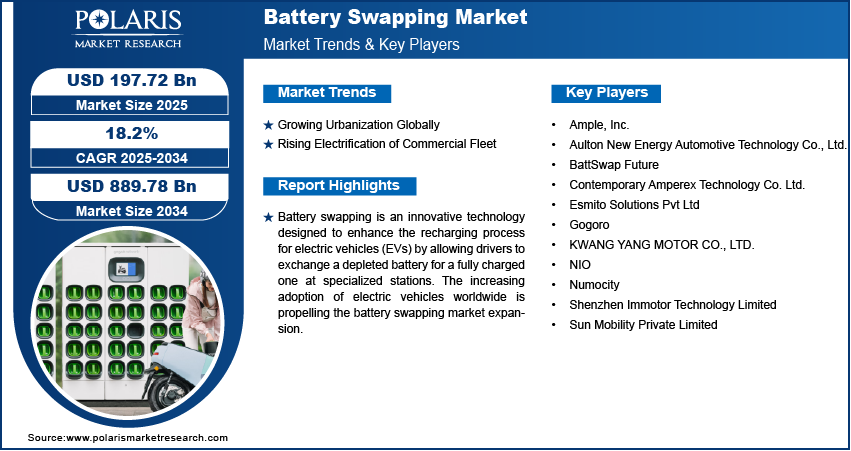

The global battery swapping market size was valued at USD 167.51 billion in 2024, growing at a CAGR of 18.2% from 2025 to 2034. Growing adoption of electric vehicles globally and rising advancements in technology are a few of the key factors driving market expansion.

Key Insights

- The two-wheelers segment led the market in 2024. The segment’s dominance is primarily attributed to the rising popularity of motorcycles and electric scooters in urban areas.

- The lithium-ion segment accounted for the largest market share in 2024, owing to the excellent performance and higher energy density of these battery types.

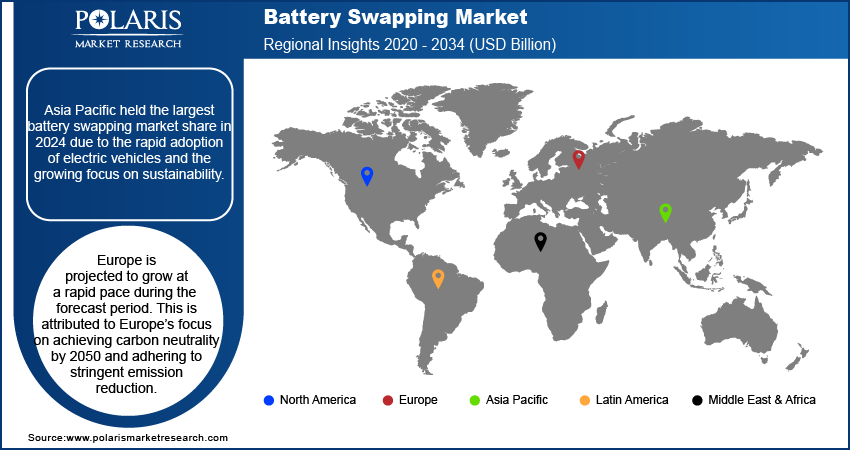

- Asia Pacific dominated the market in 2024, driven by the growing focus on sustainability and rapid adoption of EVs in the region.

- Europe is anticipated to witness rapid growth during the projection period. The adherence to stringent emission reduction targets contributes to market growth in the region.

Industry Dynamics

- The rising ownership of electric bikes, scooters, and cars among urban residents has created a need for solutions like battery swapping that address limited parking and charging infrastructure issues.

- The growing electrification of commercial fleets has increased the demand for battery swapping, as it allows commercial vehicles to stay longer on roads without lengthy charging sessions.

- Advancements in battery management systems and automated swapping technologies are expected to create several market opportunities.

- Strict regulatory norms may present market challenges.

Market Statistics

2024 Market Size: USD 167.51 billion

2034 Projected Market Size: USD 889.78 billion

CAGR (2025-2034): 18.2%

Asia Pacific: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

Battery swapping is an innovative technology designed to enhance the recharging process for electric vehicles (EVs) by allowing drivers to exchange a depleted battery for a fully charged one at specialized stations. This method aims to reduce the time required to recharge an EV, as it takes only three to five minutes to swap a battery. The concept of battery swapping operates through a network of battery swapping stations (BSS), where automated or manual systems facilitate the exchange.

The increasing adoption of electric vehicles worldwide is propelling the battery swapping market expansion. International Energy Agency published a report stating almost 14 million new electric cars were registered globally in 2023, bringing their total number on the roads to 40 million. The need for fast, efficient, and convenient energy swapping solutions grows as more people switch to EVs. Battery swapping stations allow drivers to replace depleted batteries with fully charged ones within minutes, reducing downtime compared to traditional charging. This convenience attracts EV owners who prioritize time efficiency, especially in densely populated areas or commercial sectors such as ride-hailing and logistics. Additionally, as EV adoption scales up, the demand for shared and standardized battery systems rises, making battery swapping an attractive solution for manufacturers and consumers.

The growing advancement in technology is also contributing to the battery swapping market growth. Innovations in battery design, such as modular and lightweight batteries, make swapping faster and more user-friendly. Smart swapping stations equipped with real-time monitoring and predictive analytics optimize battery performance and reduce maintenance downtime. Enhanced interoperability standards ensure compatibility across various EV models, encouraging more manufacturers to adopt the technology. Integration with renewable energy sources such as solar and wind further strengthens the appeal of battery swapping as a sustainable solution. These technological advancements make battery swapping more reliable and cost-effective, driving greater adoption among individual EV users and commercial fleet operators.

Market Dynamics

Growing Urbanization Globally

The ownership of electric scooters, bikes, and cars is rising among urban residents, which creates challenges such as limited parking spaces and the unavailability of private charging infrastructure. According to the World Bank, 56% of the world population, or some 4.4 billion people, currently live in cities, and this number is expected to double by 2050. This rapid urbanization is amplifying the need for solutions like battery swapping, which eliminates the need for private charging infrastructure, minimizes charging downtime, and keeps vehicles in operation. Furthermore, businesses and delivery services in urban areas are highly dependent on e-bikes and e-scooters for operation, driving the demand and adoption of battery swapping. Therefore, as urbanization expands, the adoption of e-bikes and scoters rises, thereby contributing to the battery swapping market development.

Rising Electrification of Commercial Fleet

Commercial businesses that operate taxis and logistics services are now turning to EVs to save on fuel costs while prioritizing the reduction of charging downtime to maintain productivity. Battery swapping allows these vehicles to stay on the road without lengthy charging sessions, driving its adoption among fleet operators. Additionally, governments worldwide are implementing stricter environmental regulations to lower emissions, which is encouraging commercial fleet owners to adopt EVs, further driving the demand for scalable and time-saving battery swapping solutions.

Segment Insights

Market Evaluation by Vehicle Insights

Based on vehicle, the battery swapping market is divided into two-wheelers, three-wheelers, and four-wheelers. The two-wheelers segment accounted for a major battery swapping market share in 2024 due to the growing popularity of electric scooters and motorcycles in urban areas. Urban commuters are increasingly opting for two-wheelers as these vehicles offer them affordability, compact size, and the ability to navigate congested city streets efficiently. Electric two-wheelers have gained traction due to government subsidies, tax incentives, and infrastructure support aimed at accelerating the adoption of environmentally friendly vehicles. Additionally, the rise of food delivery and e-commerce services has boosted the demand for electric two-wheelers, as they offer a cost-effective and sustainable solution for last-mile delivery operations.

Market Assessment by Battery Type Insights

In terms of battery type, the battery swapping market is segregated into lithium-ion, lead-acid, and other. The lithium-ion segment dominated the market share in 2024 due to its superior performance, higher energy density, and longer lifecycle compared to other battery types. Manufacturers and consumers favor lithium-ion batteries for their ability to deliver enhanced efficiency and reduced charging times. The widespread adoption of EVs, particularly in urban areas, has further propelled demand for these batteries, as they offer a lightweight and compact solution that enhances vehicle range and performance. Additionally, declining production costs due to technological advancements and economies of scale have made lithium-ion batteries increasingly accessible, contributing to their dominance in the market.

Regional Analysis

By region, the report provides the battery swapping market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific held the largest battery swapping market share in 2024 due to the rapid adoption of EVs and the growing focus on sustainability. China dominated this region, driven by strong government initiatives, such as subsidies for EVs, investments in energy infrastructure, and favorable regulatory frameworks. The country’s massive fleet of electric two-wheelers and its widespread use of shared mobility services have contributed significantly to this leadership. China’s well-established manufacturing ecosystem for batteries and EVs has reduced production costs, making battery swapping more accessible to a broader population. Additionally, the growing urbanization in countries such as India and Indonesia has increased the demand for efficient and sustainable energy solutions, further contributing to market expansion in the region.

The Europe battery swapping market is projected to grow at a rapid pace during the forecast period. This growth is attributed to Europe’s focus on achieving carbon neutrality by 2050 and adhereance to stringent emission reduction targets. These efforts have spurred the adoption of EVs, thereby driving demand for battery swapping. Germany, a hub for automotive innovation, has seen significant investments in research and development, particularly in energy storage technologies such as battery swapping. The European Union’s policies, including subsidies and grants for EV adoption, coupled with growing consumer demand for eco-friendly transportation, have created a fertile ground for battery swapping market growth. Moreover, increasing awareness of sustainable practices and the expansion of EV-friendly infrastructure across countries such as France, the Netherlands, and Norway are expected to drive regional market demand.

Key Players and Competitive Insights

Major market players are investing heavily in research and development in order to expand their offerings, which will help the battery swapping market grow even more. These market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The battery swapping market is fragmented, with the presence of numerous global and regional market players. Major players in the market include BattSwap Future; Aulton New Energy Automotive Technology Co., Ltd.; Contemporary Amperex Technology Co. Ltd. (CATL); Numocity; Esmito Solutions Pvt Ltd; Shenzhen Immotor Technology Limited; Sun Mobility Private Limited; Ample, Inc.; NIO; KWANG YANG MOTOR CO., LTD.; and Gogoro.

Gogoro, Inc. is a Taiwan-based company that is revolutionizing urban mobility through its innovative battery-swapping technology designed for electric two-wheelers. Founded in 2011, Gogoro has emerged as a major player in sustainable transportation solutions, particularly with its Smartscooter line. The company's mission focuses on making electric power accessible and convenient for urban riders, which is evident in its extensive network of battery swapping stations. Gogoro's ecosystem supports nearly 600,000 riders and boasts over 1.3 million smart batteries in circulation.

Contemporary Amperex Technology Co. Ltd. (CATL) is a major China-based battery manufacturer and technology company. The company was founded in 2011 and is headquartered in Ningde, Fujian province. The company originated as a separation from Amperex Technology Limited (ATL), which specialized in lithium-polymer batteries. CATL's product portfolio includes a diverse range of battery systems, such as lithium-ion batteries, lithium polymer batteries, and ultra-large capacity energy storage solutions. The company has established partnerships with major automotive manufacturers worldwide, including BMW, Ford, Tesla, and Volkswagen, facilitating the integration of its advanced battery technologies into various vehicle models.

List of Key Companies

- Ample, Inc.

- Aulton New Energy Automotive Technology Co., Ltd.

- BattSwap Future

- Contemporary Amperex Technology Co. Ltd. (CATL)

- Esmito Solutions Pvt Ltd

- Gogoro

- KWANG YANG MOTOR CO., LTD.

- NIO

- Numocity

- Shenzhen Immotor Technology Limited

- Sun Mobility Private Limited

Battery Swapping Industry Developments

December 2024: CATL, a china based company that manufactures batteries for electric vehicles (EVs) and energy storage systems, launched a battery swap ecosystem with nearly 100 partners

December 2023: Gogoro Inc., a global technology company in battery-swapping ecosystems that enable sustainable mobility solutions for cities, announced the immediate availability of its battery swapping ecosystem and smart scooters in India.

January 2022: Contemporary Amperex Technology Co. Ltd. (CATL) rolled out its battery swap solution EVOGO, featuring modular battery swapping at its first online launch event.

Battery Swapping Market Segmentation

By Vehicle Outlook (Revenue – USD Billion, 2020–2034)

- Two-Wheelers

- Three-Wheelers

- Four-Wheelers

By Battery Type Outlook (Revenue – USD Billion, 2020–2034)

- Lithium-Ion

- Lead-Acid

- Other

By End User Outlook (Revenue – USD Billion, 2020–2034)

- Individual Users

- Commercial Fleets

- Public Transportation

By Battery Capacity Outlook (Revenue – USD Billion, 2020–2034)

- Less than 30kWh

- More than 30kWh

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 167.51 billion |

|

Revenue Forecast in 2025 |

USD 197.72 billion |

|

Revenue Forecast by 2034 |

USD 889.78 billion |

|

CAGR |

18.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global battery swapping market size was valued at USD 167.51 billion in 2024 and is projected to grow to USD 889.78 billion by 2034.

• The global market is projected to grow at a CAGR of 18.2% during the forecast period.

• Asia Pacific had the largest share of the global market in 2024.

• Some of the key players in the market are BattSwap Future; Aulton New Energy Automotive Technology Co., Ltd.; Contemporary Amperex Technology Co. Ltd. (CATL); Numocity; Esmito Solutions Pvt Ltd; Shenzhen Immotor Technology Limited; Sun Mobility Private Limited; Ample, Inc.; NIO; KWANG YANG MOTOR CO., LTD.; and Gogoro.

• The two-wheeler segment dominated the market in 2024.