Fatty Acid Methyl Ester (FAME) Market Share, Size, Trends, Industry Analysis Report

By Source (Vegetable Oils, Animal Fats, and Used Cooking Oils); By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 118

- Format: PDF

- Report ID: PM2618

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

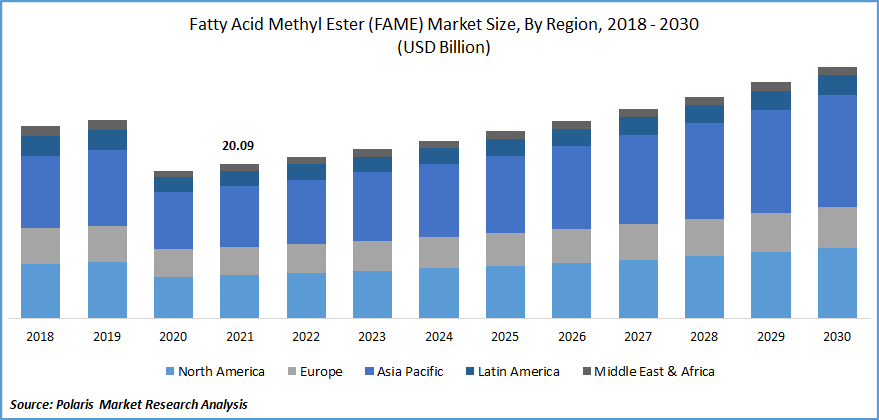

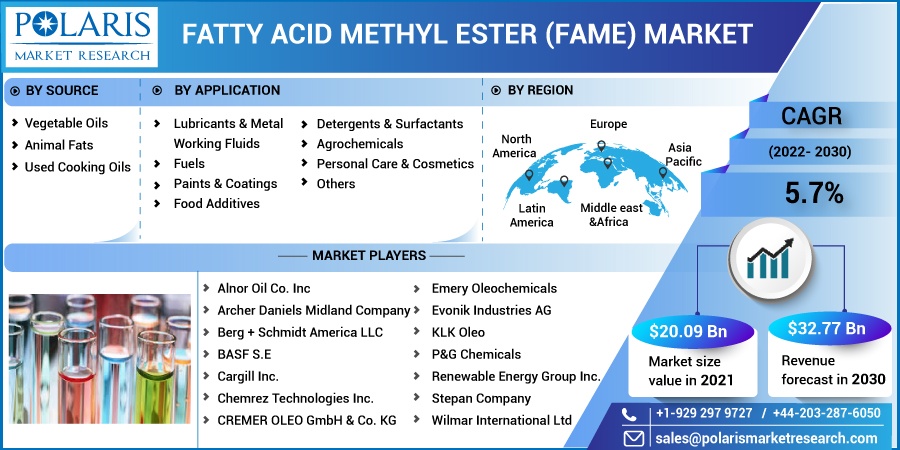

The global fatty acid methyl ester (FAME) market was valued at USD 20.09 billion in 2021 and is expected to grow at a CAGR of 5.7% during the forecast period. The fatty acid methyl ester is obtained from the condensation of a fatty acid with methanol. It is usually obtained from vegetable oils through the process of transesterification.

Know more about this report: Request for sample pages

FAME is derived from oils and fats such as used cooking oils, soya oil, palm oil, rapeseed oil, sunflower oil, and animal fats. It is increasingly being used for the production of biodiesel. Some other application of fatty acid methyl ester includes paints and coatings, lubricants, agricultural products, and personal care products, among others.

Majority of consumption of FAME is in Europe and North America. It is increasingly being used as blends in diesel. Several regulations have mandated the use of blends of up to 10% biodiesel into diesel (B10). The use of fatty acid methyl ester in biodiesel prevents corrosion in engines and production facilities. The demand for biodiesel has increased on account of its domestic production and clean burning.

Its popularity has increased as a renewable substitute for petroleum diesel. Application of biodiesel as a vehicle fuel results in reduced air degradation and enhanced safety. Greater environmental concerns coupled with strict regulations have increased the demand for biodiesel. Several countries are supporting the use of biodiesel to reduce dependency on fossil fuels and ensure fuel security.

The biodiesel sector is a major consumer of FAME. The fatty acid methyl ester is being used as an alternative mineral diesel and gas oil for vehicles and static engines. The amount of FAME is up to 7% in currently used pump diesel. The rise in the sale of passenger vehicles, modernization of vehicles, and greater demand for commercial vehicles to address demand from e-commerce and logistics support the growth of the industry.

Several countries across the world have introduced stringent regulations associated with carbon emissions, thereby increasing the demand for biodiesel. The rise in environmental concerns and implementation of supportive schemes and subsidies to promote alternative fuels has increased the adoption of biodiesel worldwide.

The occurrence of the pandemic has, however, influenced the growth of the global fatty acid methyl ester market. The market experienced a shortage of raw materials, disruption in distribution, and supply chain disruptions. Limited manufacturing activities, restricted acquisition of feedstock, transportation delays, and travel restrictions further hampered the growth of the market.

Reduced demand for FAME from automotive and transportation, chemicals, agriculture, and industrial sectors was observed during the pandemic. However, ease of restrictions associated with lockdown and trade post-pandemic is expected to support the growth of the market owing to increasing environmental concerns and supportive government policies.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The global fatty acid methyl ester market is driven by a rise in environmental concerns and an increasing shift toward sustainable solutions. Initiatives taken by public and private organizations across the world to decrease dependency on fossil fuels support market growth. Efforts are being taken to adopt sustainable fuel sources such as biodiesel to meet energy demand while reducing carbon emissions.

Restriction on carbon emissions from vehicles and the adoption of cleaner fuels has increased the demand for FAME. Reducing oil supplies and the ability to ensure greater fuel security has increased the popularity of FAME. Greater demand from developing nations, rise in industrialization, and growth in penetration of automobiles further boosts the demand for FAME.

There has been increasing demand for fatty acid methyl ester for applications such as lubricants, paints & coatings, detergents & surfactants, agrochemicals, personal care & cosmetics, and others. Technological advancements and investments in research and development would encourage market players to develop new products and explore novel technologies.

Report Segmentation

The market is primarily segmented based on source, application, and region.

|

By Source |

By Application |

By Region |

|

|

|

Know more about this report: Request for sample pages

Vegetable Oils Accounted for a Major Market Share in 2021

On the basis of source, the global FAME market has been segmented into vegetable oils, animal fats, and used cooking oils. The vegetable oil segment accounted for a major share of the market in 2021. Vegetable oil is widely used for the production of fatty acid methyl ester to be used in applications such as fuels, surfactants, agrochemicals, and emulsifiers, among others.

Vegetable oil that can be used in the production of fatty acid methyl ester includes rapeseed oil, palm oil, sunflower oil, and palm oil, among others. The fatty acid methyl ester is produced from vegetable oils through the process of transesterification, which involves the reaction of glyceride with an alcohol in the presence of a catalyst. The process results in a mixture of fatty acids, esters, and alcohol. The ease of availability and affordability associated with vegetable oil increases its adoption across various applications.

The Fuel Segment Accounted for a Considerable Share

Based on application, the global FAME market has been segmented into lubricants & metal working fluids, fuels, paints & coatings, food additives, detergents & surfactants, agrochemicals, personal care & cosmetics, and others. The fuel segment accounted for a considerable share of the market. Increasing environmental concerns and the adoption of sustainable solutions supports the growth of this segment.

Increasing awareness and conscious efforts taken by public and private organizations across the world have increased the demand for fatty acid methyl ester in this sector. The development of modernized vehicles, implementation of stringent vehicular regulations, and increasing penetration of luxury vehicles have influenced the growth of this sector.

Regulations on carbon emissions and the adoption of green technologies and chemistry offer growth opportunities for market players operating in this segment. The greater need for fuel-efficient vehicles coupled with the requirement to reduce maintenance costs of commercial vehicles boosts the adoption of fatty acid methyl ester.

Asia Pacific Expected to Experience Significant Growth During the Forecast Period

Greater demand for biodiesel, rising environmental concerns, and growing population in Asia Pacific drive the growth of the fatty acid methyl ester market in the region. A rising need to control environmental pollution and restrict emissions have been observed in the region. Governments in the region are introducing supportive initiatives for the adoption of sustainable fuel in the region.

Investment in research and development activities and technological advancements further accelerate the adoption of fatty acid methyl ester in the region. The expansion of international players in Asia Pacific and an increase in foreign direct investment for economic development are factors expected to offer growth opportunities.

Competitive Insight

Some of the major players operating in the global fatty acid methyl ester market include Acme Synthetic Chemicals, Incorporated, Alnor Oil Co. Inc, Archer Daniels Midland Company, Berg + Schmidt America LLC, BASF S.E, Cargill Inc., Chemrez Technologies Inc., CREMER OLEO GmbH & Co. KG, Emery Oleochemicals, Evonik Industries AG, KLK Oleo, P&G Chemicals, Renewable Energy Group Inc., Stepan Company, and Wilmar International Limited among others.

These leading market players are investing in research and development and material advancements to cater to a wider customer base. They are entering into partnerships and collaborations to address government regulations and strengthen their market presence across the globe.

Recent Developments

- In September 2020, Emery Oleochemicals introduced EMERY E, which is a range of general purpose fatty acid esters. The launch was aimed at expanding its portfolio of sustainable solutions and offering alternative to petrochemical-based materials with high performance and efficiency.

- In June 2020, PT Pertamina, an oil company based in Indonesia announced production of 3,000 barrels per day of 'green' diesel made from 100% palm oil. This development aimed at addressing use of diesel containing 30% bio content made up of fatty acid methyl ester (FAME) according to mandates implemented by Indonesia.

Fatty Acid Methyl Ester Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 20.09 billion |

|

Revenue forecast in 2030 |

USD 32.77 billion |

|

CAGR |

5.7% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Source, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Acme Synthetic Chemicals, Incorporated, Alnor Oil Co. Inc, Archer Daniels Midland Company, Berg + Schmidt America LLC, BASF S.E, Cargill Inc., Chemrez Technologies Inc., CREMER OLEO GmbH & Co. KG, Emery Oleochemicals, Evonik Industries AG, KLK Oleo, P&G Chemicals, Renewable Energy Group Inc., Stepan Company, and Wilmar International Limited |