Fertility Test Market Share, Size, Trends, Industry Analysis Report

By Product; By Mode of Purchase (Direct/Prescription Products, OTC Products, Online Products; By Application (Female Testing, Male Testing); By End-Use (Home Care Settings, Hospitals & Fertility Centers, Others); By Region; Segment Forecast, 2021 - 2028

- Published Date:Oct-2021

- Pages: 114

- Format: PDF

- Report ID: PM2055

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Outlook

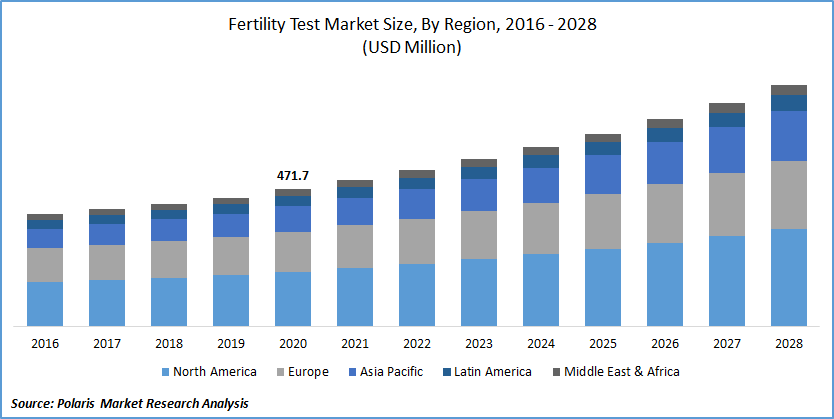

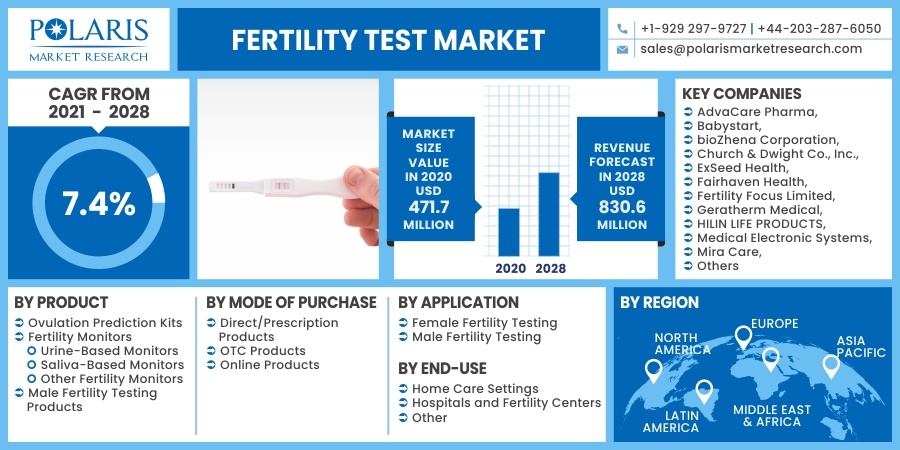

The global fertility test market was valued at USD 471.7 million in 2020 and is expected to grow at a CAGR of 7.4% during the forecast period. Fecundity denotes a disease of the reproductive system that results in the incapacity to get pregnant or incapability to conceive naturally, and its testing means medical and physical tests that examine the ability to get developed. It is basically done to assess fecundity and the conditions leading to infertility in males and females.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The key factors responsible for the market growth of fecundity tests include rising stress owing to hectic lifestyles, busier working women, drug abuse, declining fecundity rates, career consciousness among men and women, and related illnesses such as Polycystic Ovarian Disease (PCOD). It is a condition developed due to hormonal imbalance. In the U.S., it is estimated that polycystic ovarian syndrome (PCOS) is the most common hormonal disorder of the working reproductive-age woman, with a prevalence rate of 4-12%, while in Europe, it stood at 6.5-8%.

Furthermore, the COVID-19 outbreak has emerged as a massive challenge for the global fertility test market. In the early stages of the epidemic, authorities recommended the interruption of all in-person fecundity test treatments. For example, in March 2020, the American Society of Reproductive Medicine and the Canadian Fertility and Andrology Society instructed to suspend all in-person fecundity test treatments both in the U.S. and Canada due to the ongoing pandemic of COVID-19 which has hampered the growth of the market.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Foremost growth factors responsible for the global market of fecundity test if including a significant increase in onset of an average age of the females across the globe for the first time pregnancy, primarily due to career-oriented women delaying marriage, decline infertility both in men and women, owing to high work stress and faulty lifestyle.

Moreover, technological advancements in ovulation monitors and their accessibility to working women also supported fecundity test market growth due to ever-rising disposable income. The accessibility of the devices has been increased with the rise in e-commerce websites across the globe, coupled with its increased accuracy and precision.

Report Segmentation

The market is primarily segmented on the basis of product, mode of purchase, application, end-use, and region.

|

By Product |

By Mode of Purchase |

By Application |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Product

Among these, a large market share is accredited to the ovulation kits segment. This is primarily due to the rising use of ovulation kits for early detection, easy over-the-counter use of the availability of the product, its low cost, and high precision rate as compared to the natural fecundity testing techniques.

Fecundity test monitors are assumed to grow at the highest market growth rate over the study period. Rising investment and new product launches are mainly responsible for this. For instance, in June 2021, Fertility Focus, the UK-based manufacturer of OvuCore and OvuSense fecundity monitoring solutions, introduced its new patented OvuFirst product.

This is designed to measure skin temperature, providing inputs to women to understand when to conceive naturally and to figure out issues arising due to that. Hence, funding, followed by innovative product launches, will likely boost the market segment’s growth prospects.

Insight by Application

The female fecundity procedures segment is estimated to garner the largest market share. Declining female fecundity rates, increasing prevalence of PCOD, busier lifestyle of working women leading to alleviated levels of stress, and low ovary count are the foremost factors responsible for such high market share. Moreover, the availability of a wide range of fertility testing options among women and the high cost of IVF procedures also contributed to the market segment’s fortune.

Geographic Overview

Geographically, North America is the most significant revenue contributor to the global market. Furthermore, increasing awareness among women and the rising average age for first-time pregnancies in women contribute to the region’s market for fecundity test growth. In June 2021, the Brookings Institution anticipated that due to the public health crisis and related recession in the United States, it would result in 300,000 to 500,000 fewer births in 2021. As per the Guttmacher Institute survey, 2020, around 34% of the U.S working women have either deferred plans to have a child or not decided to have kids due to the ongoing COVID-19 pandemic.

Europe has the lowest fertility rates of 1.6 across the globe, as per the statistics published in the Eurostat in 2018. This decline in fertility rate is primarily due to the rise in working women seeking small families to have a work-life balance. Moreover, increased pressure of raising children also contributed to the region’s market growth.

Competitive Insight

Some of the major market players operating the fertility test market include AdvaCare Pharma, Babystart, bioZhena Corporation, Church & Dwight Co., Inc., ExSeed Health, Fairhaven Health, Fertility Focus Limited, Geratherm Medical, HILIN LIFE PRODUCTS, Medical Electronic Systems, Mira Care, PREGMATE, Swiss Precision Diagnostics, Tempdrop, Tracxn Technologies, UEBE Medical GmbH, and Valley Electronics AG.

Fertility Test Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 471.7 million |

|

Revenue forecast in 2028 |

USD 830.6 million |

|

CAGR |

7.4% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2028 |

|

Segments covered |

By Product, By Mode of Purchase, By Application, By End User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

AdvaCare Pharma, Babystart, bioZhena Corporation, Church & Dwight Co., Inc., ExSeed Health, Fairhaven Health, Fertility Focus Limited, Geratherm Medical, HILIN LIFE PRODUCTS, Medical Electronic Systems, Mira Care, PREGMATE, Swiss Precision Diagnostics, Tempdrop, Tracxn Technologies, UEBE Medical GmbH, and Valley Electronics AG. |