Financial Planning Software Market Share, Size, Trends, Industry Analysis Report

By Type (Solution, Service); By Deployment; By End Use; By Application; By Region; Segment Forecast, 2025- 2034

- Published Date:Sep-2025

- Pages: 115

- Format: PDF

- Report ID: PM2890

- Base Year: 2024

- Historical Data: 2020-2023

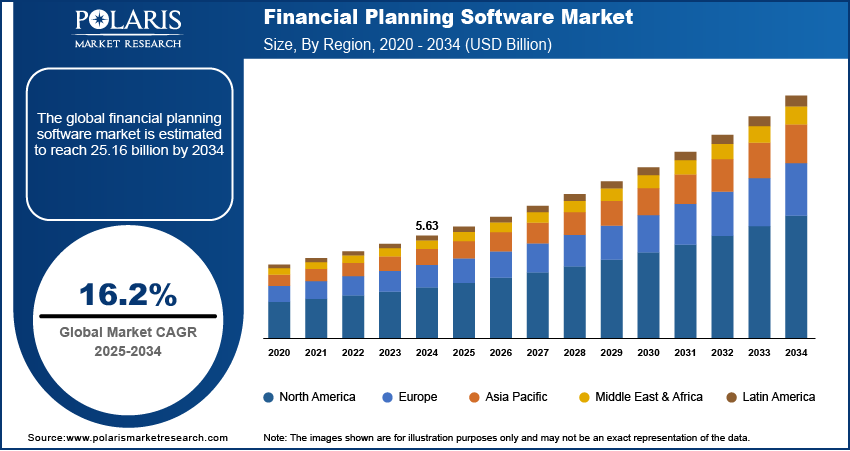

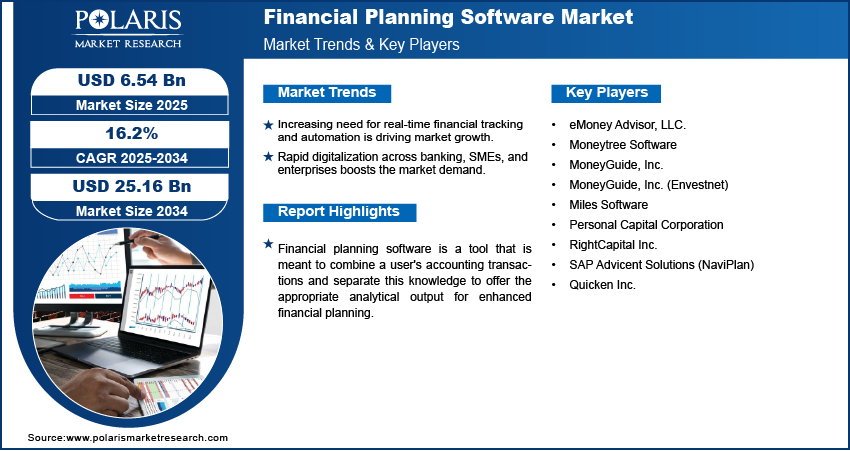

The global financial planning software market was valued at USD 5.63 billion in 2024 and is expected to grow at a CAGR of 16.2% during the forecast period. The increased demand for customers to track and manage their income, as well as the boom in mobile applications throughout the world, are the primary drivers driving the financial planning software market expansion.

Key Insights

- The software segment is projected to grow significantly during the forecast period. This is driven by rising need for automation, real-time analytics, and integrated financial solutions.

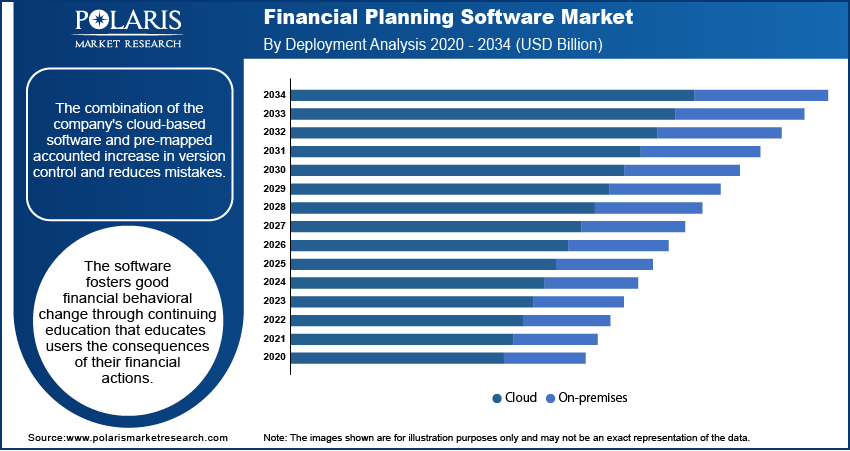

- Cloud deployment dominated the market in 2024. This is due to its scalability, cost-efficiency, and increasing adoption among SMEs and large enterprises.

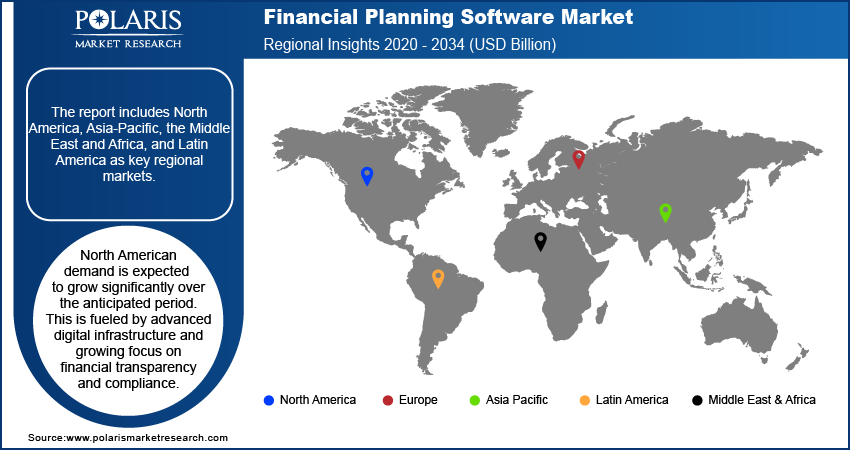

- North American demand is expected to grow significantly over the anticipated period. This is fueled by advanced digital infrastructure and growing focus on financial transparency and compliance.

Industry Dynamics

- Increasing need for real-time financial tracking and automation is driving market growth.

- Rapid digitalization across banking, SMEs, and enterprises boosts the market demand.

- The market is growing due to rising focus on compliance and regulatory reporting fuels.

- Continuous innovation in AI, cloud computing, and data security expands software capabilities and market opportunities.

Market Statistics

- 2024 Market Size: USD 5.63 Billion

- 2034 Projected Market Size: USD 25.16 Billion

- CAGR (2025-2034): 16.2%

- North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

AI Impact on Financial Management Software Market

- AI helps to speed product development by analyzing user behavior and financial trends.

- AI help to optimize operations by forecasting demand and streamlining resource allocation.

- AI help to enhance system reliability through real-time monitoring and fraud detection.

- AI help to personalize user experiences using financial data and feedback insights.

Financial planning software is a tool that is meant to combine a user's accounting transactions and separate this knowledge to offer the appropriate analytical output for enhanced financial planning. This piece of software accepts a variety of economic data as input and may be used to handle bank records, banking transactions, investments monitoring, asset management, financial planning, and other duties. The epidemic impacted both investors and financial advisory businesses, and investors saw immediate effects on their existing investments. Furthermore, enterprises with bigger customer bases have depended on electronic ways to interact with consumers, which has become a challenge to the financial planning software industry.

The growing need for financial planning software has fueled the expansion of the financial market, as more businesses shift their focus to the software section. Furthermore, an increase in the focus of companies on digitalizing their financial services, as well as an increase in internet users globally, drive market growth.

However, changing client preferences and rigorous regulations are expected to have a negative impact on the financial planning software market throughout the projected period.

Industry Dynamics

Growth Drivers

Automation is often regarded as time-saving and useful in manufacturing and other industries. Financial technology has been employed in a variety of ways in the finance business. The digitalization of the financial services industry has increased the use of online systems for trading and other financial transactions. Automation has also altered the methods of financial advisors in a specific environment. Collecting client data, for example, has traditionally been a time-consuming procedure that required the physical gathering of client papers, the transfer of those materials from the customer to the adviser, and the human extraction of relevant pieces of data from those papers before being fed into various systems held by the advisor.

Communication is essential at many stages of the planning cycle. Money managers spend a significant amount of time engaging with their customers, both verbally and nonverbally. Numerous means of communication are now possible because of technological advancements. Such technology has the potential to either enhance or decrease the time spent on financial planning.

Report Segmentation

The market is primarily segmented based on type, deployment, application, end-use, and region.

|

By Type |

By Deployment |

By Application |

By End-Use |

By Region |

|

|

|

|

|

Software segment is projected to witness significant growth during the forecast period

The software category is expected to grow significantly during the forecast period. This is because of the notion that it demonstrates the tolerance for loss and the flexibility of investment possibilities. It also recommends acceptable product combinations. Access dynamic "what-if" analysis to compare various financial planning alternatives, alternative investment methods, commitment or income levels, and portfolio terms. As a result, they are the most important growth variables for wealth management solutions.

Financial planning solutions assist in assessing investment eligibility, displaying possible loss, and aligning financial products and services with a client's risk profile and allocation of resources necessary. It shows how a certain investment portfolio matches the client's objectives by recreating the overall risk, catastrophe risk, and sequencing of outcomes risk.

Cloud deployment dominated the market in 2024

The combination of the company's cloud-based software and pre-mapped accounted increase in version control and reduces mistakes. The software fosters good financial behavioral change through continuing education that educates users the consequences of their financial actions. New mobile formats allow planning technology to embrace customer experience and human relationship that have proven extremely effective in other sectors' mobile apps. These technologies provide financial experts with a long-desired form of communication with newer people of those without significant means in a hybrid approach.

Keeping up with law changes may be a significant issue for finance, especially with recent developments like as Brexit, Covid-19 rules, GDPR, and Making Tax Digital, to mention a few. As older software systems sometimes do not accommodate new updates due to compliance requires a significant amount of human labor.

The demand in North America is expected to witness significant growth during the forecast period

North America is expected to dominate the market during the forecast period. This is due to reasons such as greater internet dependency, higher mobile app usage, increased adoption of financial planning computer, and the accessibility of open-source solutions, which are driving the expansion of the personal finance software field in this area. According to a 2021 poll, financial planning software packages are the most significant technology tool for financial advisers. While many businesses utilize some of the software groupings, others are extremely specialized to financial advisers. Solutions for customer engagement, risk tolerance, and data management are ubiquitous across sectors.

For instance, MoneyGuidePro is the most prominent financial adviser software application in terms of market share, accounting for further over 30% of the industry's customer base by user in 2021. MoneyGuidePro, which debuted in 2020, is regarded to be among the most complete tools. MoneyGuidePro success may be credited in part to its visually appealing, user-friendly presentation. The primary gateway is intended to completely engage the client, featuring a Play Zone where the customer may enter various choices and options to view potential outcomes. The adviser retains complete control over the software.

eMoney provides a comprehensive software and is well-known for its extensive cash flow analysis tool. eMoney Pro's market share increased to more than 20% in 2021, from 15% in 2020. RightCapital finished third in 2021, with more over 8% of the market dominance. It is a relatively young program, having been founded in 2015 in North America, particularly in comparison to the other technology leaders.

Competitive Insight

Key players include RightCapital, quicken, MoneyGuide, Miles Software, Personal Capital Corporation, SAP Advicent Solutions (NaviPlan), eMoney Advisor, and Moneytree Software.

Recent Developments

- In April 2025, BMO partnered with Conquest Planning to launch My Financial Progress provides personalized, real-time financial planning.

- In 2022, Moneytree Software incorporates Riskalyze into its Financial Planning Tool Suite.

- In 2022, Bambu introduces a financial services predictive planner for Microsoft Cloud.

- In 2022, Advyzon is the latest wealthtech company to introduce a TAMP. Advyzon, is one of the latest wealthtech business, offering out-sourced investment services.

Financial Planning Software Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 5.63 billion |

| Market size value in 2025 | USD 6.54 billion |

|

Revenue forecast in 2034 |

USD 25.16 billion |

|

CAGR |

16.2% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Deployment, Component, End-Use, Application, and By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

RightCapital Inc., quicken inc., MoneyGuide, Inc., Miles Software, MoneyGuide, Inc. (Envestnet), Personal Capital Corporation, SAP Advicent Solutions (NaviPlan), eMoney Advisor, LLC., Moneytree Software |

FAQ's

• The global market size was valued at USD 5.63 billion in 2024 and is projected to grow to USD 25.16 billion by 2034.

• The global market is projected to register a CAGR of 16.2% during the forecast period.

• North America dominated the market in 2024.

• A few of the key players in the market are RightCapital, quicken, MoneyGuide, Miles Software, Personal Capital Corporation, SAP Advicent Solutions (NaviPlan), eMoney Advisor, and Moneytree Software.

• The cloud segment dominated the market revenue share in 2024.

• The software segment is projected to witness the fastest growth during the forecast period.