Fine Blanking Tools Market Share, Size, Trends, Industry Analysis Report

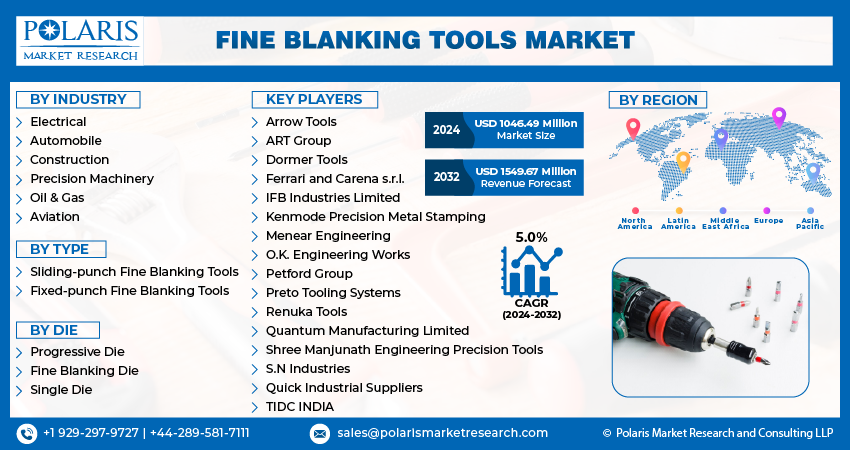

By Industry (Electrical, Automobile, Construction, Precision Machinery, Oil & Gas, Aviation); By Type; By Die; By Region; Segment Forecast, 2024- 2032

- Published Date:Dec-2023

- Pages: 118

- Format: PDF

- Report ID: PM4150

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

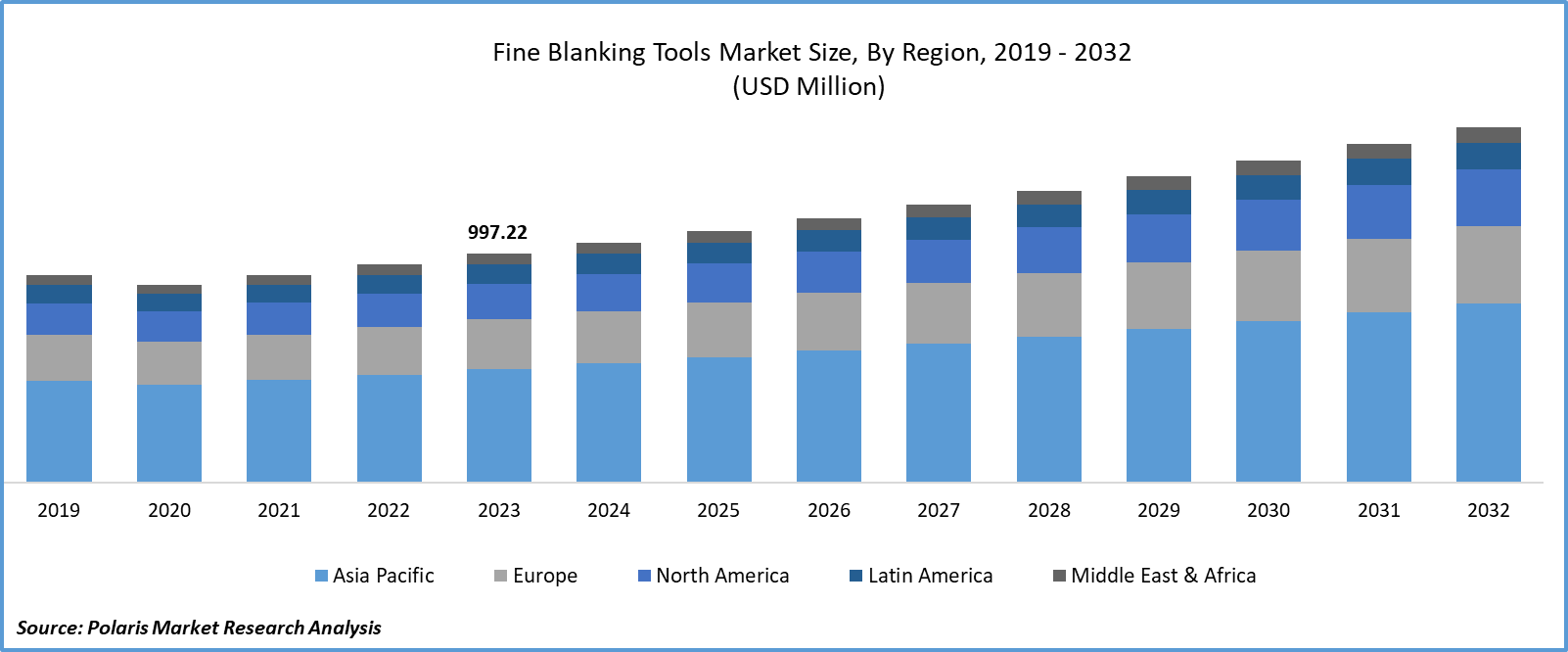

The global fine blanking tools market was valued at USD 997.22 million in 2023 and is expected to grow at a CAGR of 5.0% during the forecast period.

Fine blanking, commonly referred to as precision blanking, is an advanced stamping technique built on general blanking. Although fine blanking and general blanking belong to the same separation group, fine blanking has several unique characteristics. The parts created by fine blanking have distinctive qualities. The increasing focus by the market players on creating effective fine blanking tools is fueling product innovations, along with the rising investments by the companies in research and development activities

To Understand More About this Research: Request a Free Sample Report

- For instance, in October 2022, the UTIL Group made investments of $5 million in its primary fine blanketing technology company in North America. This investment enables Util to continue offering completed goods of the highest caliber in terms of high accuracy, strict adherence to design tolerances, flatness—down to a hundredth of a millimeter—and a precise edge finish.

Moreover, the growing automotive industry is enhancing the demand for fine blanking tools due to the existence of specialized needs in the automotive sector for the fabrication of highly precise parts for gearboxes, door latches, window lifters, braking systems, gearbox ports, and engines.

However, one of the factors hampering the adoption of fine blanking tools is their higher initial costs. The smaller companies specializing in automotive, electronics, and more are unable to afford this product due to the lack of funding for the production process, restraining demand for the product in the future.

For Specific Research Requirements, Request for a Customized Research Report

Growth Drivers

- The ability of fine blanking tools to create appealing surfaces is driving their demand

Fine blanking tools are known to be effective in creating smoother surfaces due to their process of operation. The ring gear plate is utilized during the punching process of fine blanking tools to exert force on the material, providing pressure on the surface of the V-shaped material. This aids in preventing lateral metal flow and ripping in the shear zone. Ejector counterpressure is used to compress the material while the punching dies are driven into it.

This, combined with the use of a narrow gap and a concave die with a rounded edge, reduces tensile stress and increases the flexibility of the material by placing the metal in the shear zone under three-way compressive stress. This method avoids the usual bending, stretching, and tearing that happens during conventional blanking and instead causes the material to be blanked into sections through pure shear along the die's edge form, producing high-quality, even, and smooth shear surfaces. This is driving the demand for manufacturers, who are interested in having smoother surfaces in their production and manufacturing processes.

Report Segmentation

The market is primarily segmented based on Industry, type, die and region.

|

By Industry |

By Type |

By Die |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Industry Analysis

- Automobile segment is expected to witness the highest growth during the forecast period

The automobile segment is projected to grow at a CAGR during the projected period, mainly driven by its effectiveness in ensuring the safety and functioning of vehicles. Initially, the watch and clock industries were the principal users of fine blanking technology, but today, the automotive industry uses more than 60% of these parts. They are an assurance that the airbag, the brakes, and the safety belt are all functioning properly in an automobile. Safety in daily life is therefore greatly influenced by finely blanked portions. The demands placed on tool steel are tremendous and frequently borderline. Furthermore, growing new innovations in the automotive industry, primarily electric vehicles, are driving demand for fine blanking tools due to their effectiveness in creating specialized components for them.

The precision machinery segment witnessed a substantial revenue share largely imputable to the ongoing demand for industrial and medical machinery. In many stainless steel, aluminum, and exotic alloys, fine blanking can generate net-form and nearly net-form components to reduce or eliminate the requirement for machining. Applications in the medical industry include those for surgical instrument components, endoscopic equipment, orthopedic equipment, and diagnostic equipment. Its various applications in precision tools will drive its demand in the future.

By Type Analysis

- Sliding-Punch Blanking Tools segment accounted for the largest market share in 2023

The sliding punch blanking tools segment witnessed the largest fine blanking tools market share in 2023 and is likely to continue its market position during the study period. These tools are mostly used in small and less complex parts due to their versatility. One of the primary factors driving the growth and demand for sliding punch blanking tools is their cost effectiveness compared to fixed punch blanking, as there is a lower cost for set-up and maintenance, driving their demand for large and small-scale industries in the future.

The fixed punch fine blanking tools segment is expected to grow at the fastest rate in the coming years owing to the rising demand for precision tools for the larger and more complex parts in the industrial space. The rigidity of these tools is further boosting their demand in the coming years as they can be used in every application, unlike the sliding punch blanking tools.

By Die Analysis

- Progressive Die segment held at the significant market revenue share in 2023

The progressive die segment witnessed a significant market share in revenue in 2023, which is highly fueled by its applications in various industries, including healthcare, mining, appliances, aerospace, food, and beverage, automotive, and more. Progressive die stamping is a feasible option for industry as it provides a quick and inexpensive way to produce parts in larger quantities. Furthermore, this die stamping reduces labor costs and time by integrating several operations at once, driving its demand by industrials in the coming years.

Regional Insights

- Asia Pacific region registered the global market in 2023

The Asia Pacific region witnessed the largest market share in the global market in 2023 and is likely to continue its dominance over the study period. Growing demand for electric vehicles in the region is enhancing the manufacturers’ ability to produce more vehicles to cater to ongoing consumer demand, fueling the need for precision tools like fine blanking in the next few years. According to the Automotive Ecosystem Vision Study by the Zebra Technologies, more than half of the people, 53% globally and 60% in APAC, showed preference for hybrid electric vehicles. This demonstrates the rising consumer interest in the consumption of electric vehicles. This will further fuel the production process of EVs by manufacturers, which in turn will fuel the growth and demand for fine blanking tools in the coming years in the region.

The Europe region is projected to be the fastest-growing region with a healthy growth rate in the coming years due to the expanding automotive industry in the region, driving demand for fine blanking tools as they are essential in precision tools. Furthermore, manufacturing industries increase the production process to meet ongoing consumer demand, fueling growth and demand for fine blanking tools in the coming years.

Key Market Players & Competitive Insights

The fine blanking tools market is witnessing rapid growth attributable to the presence of larger companies in this space, fueling new product launches with new technologies and driving awareness about the products in the marketplace. Companies are working on partnerships, mergers, and acquisitions to expand their market presence and gain a competitive advantage to increase global market share.

Some of the major players operating in the global market include:

- Arrow Tools

- ART Group

- Dormer Tools

- Ferrari and Carena s.r.l.

- IFB Industries Limited

- Kenmode Precision Metal Stamping

- Menear Engineering

- O.K. Engineering Works

- Petford Group

- Preto Tooling Systems

- Renuka Tools

- Quantum Manufacturing Limited

- Shree Manjunath Engineering Precision Tools

- S.N Industries

- Quick Industrial Suppliers

- TIDC INDIA

Recent Developments

- In June 2022, UTIL Group, a manufacturer of fine blanking tools, partnered with the Kaizen Institute Italy and Kaizen Institute North America to support the development and growth of the company through the implementation of strategic planning and to enhance operational performance.

Fine Blanking Tools Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1046.49 million |

|

Revenue forecast in 2032 |

USD 1549.67 million |

|

CAGR |

5.0% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Industry, By Type, By Die, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global fine blanking tools market size is expected to reach USD 1.54 billion by 2032

Key players in the market are Arrow Tools, ART Group, Dormer Tools, Ferrari and Carena, Menear Engineering

Asia Pacific contribute notably towards the global fine blanking tools market

The global fine blanking tools market is expected to grow at a CAGR of 5.0% during the forecast period.

The fine blanking tools market report covering key segments are Industry, type, die and region.