Flame Retardant Apparel Market Size, Share, Trends, Industry Analysis Report

By Product (Inherent, Treated), By Type, By Clothing Type, By End Use, and By Regions -Market Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 106

- Format: PDF

- Report ID: PM1748

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

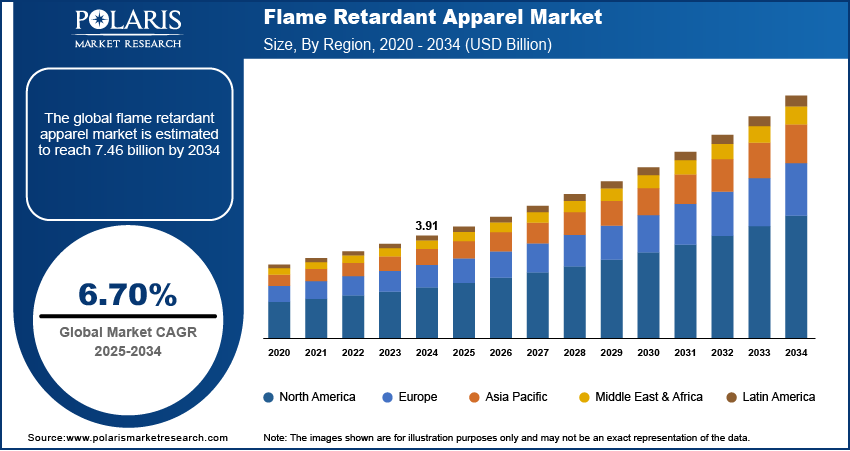

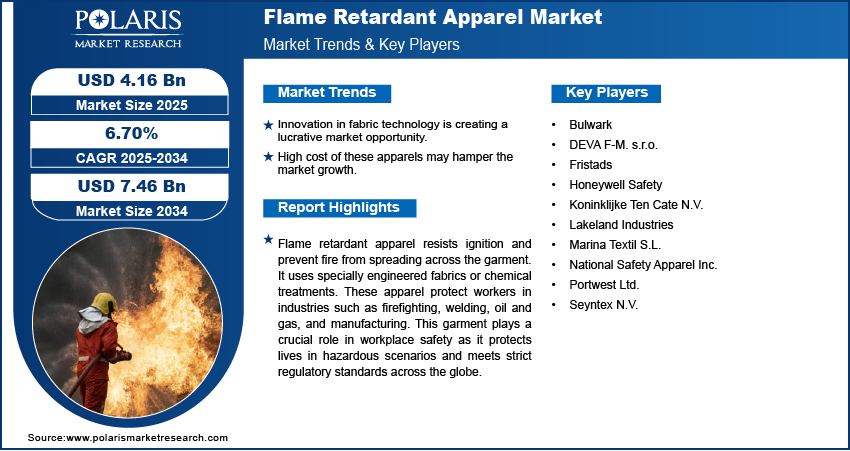

The global flame retardant apparel market size was valued at USD 3.91 billion in 2024. The market is projected to grow at a CAGR of 6.70% during 2025 to 2034. Key factors driving demand for flame retardant apparel include stringent safety regulations, growth of oil & gas, construction, and manufacturing industries, and innovations in fabric technology.

Key Insights

- In 2024, the treated flame retardant apparel segment accounted for the majority of the share. This is attributed to low cost, high efficiency, and increasing popularity in the low-income countries.

- The oil & gas segment accounted for the largest market share in 2024, as this industry is more prone to fire-related accidents.

- Europe is the largest revenue contributor in the market due to the presence of key manufacturers.

- The major countries contributing to the market revenue in the Asia Pacific are Japan, South Korea, India, and China.

Industry Dynamics

- The growing industrialization, especially in emerging economies like India, Indonesia, and South Korea, is driving the market growth.

- The growing safety regulation norms are also increasing the demand for flame retardant apparel.

- Innovation in fabric technology is creating a lucrative market opportunity.

- High cost of these apparels may hamper the market growth.

Market Statistics

- 2024 Market Size: USD 3.91 Billion

- 2034 Projected Market Size: USD 7.46 Billion

- CAGR (2025-2034): 6.70%

- Europe: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

Flame retardant apparel resists ignition and prevent fire from spreading across the garment. It uses specially engineered fabrics or chemical treatments. These apparel protect workers in industries such as firefighting, welding, oil and gas, and manufacturing. This garment plays a crucial role in workplace safety as it protects lives in hazardous scenarios and meets strict regulatory standards across the globe.

Industry Dynamics

Growth Drivers

The flame retardant apparel market is expected to witness growth over the projected period owing to the increasing demand for protective clothing in industrial applications. In addition, the growing awareness pertaining to safety of the employees working in manufacturing facilities is likely to have a positive impact on the market growth. The growing industrilization, especially in emerging economies like India, Indonesia, and South Korea, is driving the market growth. Industrilization across the globe is encouraging governments to implement strict worker safety, which is leading high adoption of flame retardant apparel. Several health associations and organizations such as OSHA, etc. in Europe, are enforcing standards and regulations which is compelling the manufacturers to use of flame retardant apparels for the workers.

Which are the emerging trends and recent innovations in the flame retardant apparel market?

The flame retardant apparel industry is witnessing various trends such as a shift from “treating” fabrics toward “intrinsic” or built-in flame resistance, multifunctionality and smart capabilities, and demand for sustainable and green chemistry products. Rising imposition of regulations related to the health and safety of new materials (both for users and during manufacturing) is also expected to emerge as a key trend in the coming years. The following table provides information on emerging trends and recent innovations in the industry, along with their brief description and use cases.

|

Innovations/Trends |

Description |

Use Cases |

|

One-step polyelectrolyte complex coating |

A single layer of non-toxic coating is applied to cotton textiles using a polyelectrolyte complex. It helps reduce the flammability of cotton. |

|

|

Functional and sustainable coatings |

Bio-based, eco-friendly, or nontoxic moieties such as nitrogen and silane are used in coatings for flame retardancy. |

|

|

Layer-by-Layer (LbL) nanocoatings with molecular glue |

Depositing alternating layers, such as phosphonic acid and silane, over pretreated fabric (e.g. polydopamine) to create flame retardant barriers. |

|

|

Nanocomposite/Nanomaterial-enhanced fabrics |

Nanoparticles such as metal oxides, graphene, MXenes, and clay nanoplatelets are embedded into textile matrices or coatings to enhance flame retardancy, char formation, and thermal stability. |

|

|

Smart/“responsive” protective textiles |

Embedded sensors, adaptive materials, and temperature-responsive elements are used to respond to heat. |

|

|

Flame-resistant electronics in garments |

Flexible, heat-resistant electronic components/circuits are integrated into fire-resistant apparel for monitoring and communication. |

|

|

Surface treatments |

Novel fire-retardant sprays are developed to slow down ignition in textile surfaces |

|

|

Innovative fiber/polymer development |

Inherently flame-resistant fibers such as PBI and improved aramids) are used. There is a rising development of modified silk with flame-retardant properties. |

|

|

Flame-retardant triboelectric nanogenerators (TENGs) |

Focus on combining flame-retardant textiles with TENG structures such as printed heat-resistant inks. The combination helps harvest energy or sensing while maintaining flame resistance. |

|

Flame Retardant Apparel Market Report Scope

The market is primarily segmented on the basis of product, type, clothing type, end use, and geographic region.

|

By Product |

By Type |

By Clothing Type |

By End Use |

By Region |

|

|

|

|

|

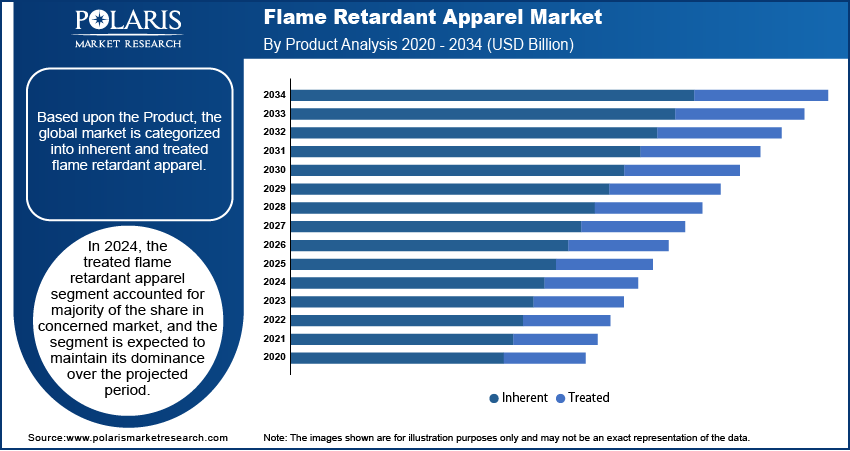

Insight by Product

Based upon the Product, the global market is categorized into inherent and treated flame retardant apparel. In 2024, the treated flame retardant apparel segment accounted for majority of the share in concerned market, and the segment is expected to maintain its dominance over the projected period. This is attributed to its low cost, high efficiency, and increasing popularity in the low-income countries. However, inherent product segment is expected to witness fastest growth rate on account of high demand in the developed countries.

Insight by End Use

On the basis of end use, the global market is categorized into oil & gas, petrochemical, power, mining, electronics & electrical, automotive & transportation, building & construction, military & law enforcement, and others. The oil & gas segment accounted for the largest market share, in 2024, as this sector is most prone to fire-related accidents during welding, construction, and handling inflammable products. This drove the demand for flame retardant apparel in oil & gas industry. Moreover, the growing energy demand in emerging countries also drove the adoption of flame retardant apparel in oil & gas industry.

Geographic Overview

On the basis of region, the flame retardant apparel market is bifurcated into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa (MEA). Europe is the largest revenue contributor followed by North America and the Asia Pacific. The growth in Europe flame retardant apparel industry is driven by advancements in the technology, presence of key manufacturers and their knowledge of technical know-how, and surge in sales through online platforms. The tier I market players in the region expanded their geographical footprint by opening sales offices, distribution stores, and opting multiple distribution channels for regional penetration. On the other hand, tier II players collaborate with the retail giants in other regions to expand their regional presence. The strictict safety regulation in many countries such as Germany, Uk, France, and others also contributed to the regional dominance.

The market in the Aisa Pacific is projected to grow at a robust apce in the coming years. The major countries contributing to the revenue in Asia Pacific are Japan, South Korea, India, and China. The shifting consumer preference to buy products online is pushing apparel manufacturers to do partnerships with third party online retailers, invest in developing company-owned digital platforms, or enhancing existing digital platforms. Additionally, prominent manufacturers of flame retardant apparels are engaged in merger & acquisition activities to expand the existing product portfolio and increasing geographical footprint. The high economic development and growing investment smart cities is also driving the market growth in the region.

Competitive Insight

The flame retardant apparel market is highly fragmented. As a result, it becomes important for local players to deliver products with improved quality and at competitive prices. This is likely to attract semi-loyal brand customers and thereby enhancing the existing customer base. The prominent players operating in the market are Honeywell Safety, Bulwark, Seyntex N.V., Fristads, Marina Textil S.L., DEVA F-M. s.r.o., Koninklijke Ten Cate N.V., Portwest Ltd., Lakeland Industries, and National Safety Apparel Inc.

Industry Developments

June 2022, DuPont announced the launch of a new, flame-resistant (FR) fabric with a bio-based chemical-repellent finish that makes protective clothing more sustainable and helps optimize worker safety.

Flame Retardant Apparel Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.91 Billion |

|

Market Size in 2025 |

USD 4.16 Billion |

|

Revenue Forecast by 2034 |

USD 7.46 Billion |

|

CAGR |

6.70% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global market size was valued at USD 3.91 billion in 2024 and is projected to grow to USD 7.46 billion by 2034.

• The global market is projected to register a CAGR of 6.40% during the forecast period.

• Europe dominated the market in 2024

• A few of the key players in the market Honeywell Safety, Bulwark, Seyntex N.V., Fristads, Marina Textil S.L., DEVA F-M. s.r.o., Koninklijke Ten Cate N.V., Portwest Ltd., Lakeland Industries, and National Safety Apparel Inc.

• The treated segment dominated the market revenue share in 2024.