Flavors and Fragrances Market Share, Size, Trends, Industry Analysis Report

By Type (Flavors, Fragrances); By Ingredient; By Application; By Region; Segment Forecast, 2024- 2032

- Published Date:Mar-2024

- Pages: 119

- Format: PDF

- Report ID: PM4664

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

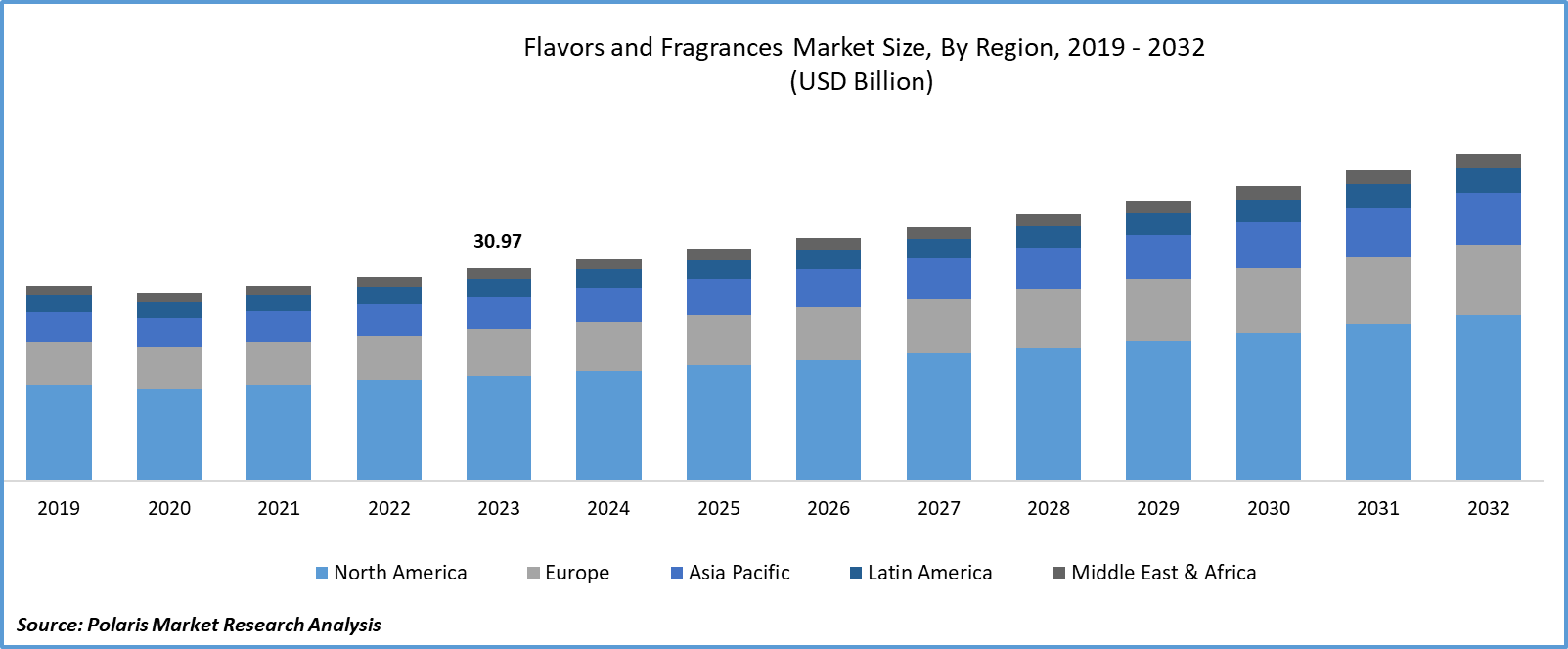

Global flavors and fragrances market size was valued at USD 30.97 billion in 2023.

The market is anticipated to grow from USD 32.33 billion in 2024 to USD 47.73 billion by 2032, exhibiting the CAGR of 5.0% during the forecast period.

Market Introduction

Rising disposable income levels globally are fueling significant growth in the flavors and fragrances market. Increased spending power prompts consumers to invest in premium food, beverage, and personal care products with enhanced flavors and fragrances. This trend is particularly noticeable among those with higher disposable incomes, who seek luxury goods and are willing to pay more for added value. As economies expand and the middle class grows, a larger consumer base emerges, driving demand for a diverse range of flavors and fragrances. Economic growth, globalization, and urbanization further contribute to rising disposable incomes, stimulating demand for these products.

In addition, companies operating in the market are introducing new products to expand market reach and strengthen their presence.

For instance, in June 2023, T. Hasegawa USA unveiled two technologies geared towards creating authentic-tasting food and beverage items with the release of ChefAroma and HASEAROMA flavor enhancers in the North American market.

To Understand More About this Research:Request a Free Sample Report

Regulatory support for natural ingredients is a significant driver of the flavors and fragrances market due to increasing consumer demand for natural products. Consumers perceive natural ingredients as healthier and safer, aligning with health and wellness trends and environmental concerns. Stringent regulations on synthetic additives encourage manufacturers to invest in natural alternatives to comply with standards and ensure product quality. Products formulated with natural ingredients offer a competitive edge by appealing to consumers seeking transparency and ethical sourcing practices. Additionally, expanding product portfolios to include natural flavors and fragrances presents growth opportunities, driving innovation in sourcing methods and extraction techniques.

Industry Growth Drivers

Population Growth and Urbanization are Projected to Spur Product Demand

Population growth and urbanization are key factors driving the flavors and fragrances market. With expanding populations, there is a heightened demand for scented products for personal and household use. Urbanization amplifies this demand due to lifestyle changes and increased disposable income. The growing middle class in urban areas spends more on luxury goods like premium fragrances and flavors. Additionally, urban consumers seek convenience and variety, leading to a diverse range of products to enhance food, beverages, and personal care items.

The Expanding Food and Beverage Industry is Expected to Drive the Flavors and Fragrances Market Growth

The expansion of the food and beverage industry is a major driver of the flavors and fragrances market. Evolving consumer preferences demand a diverse range of flavors and fragrances for product differentiation and to attract customers. Continuous innovation in new product development fuels the need for novel and appealing options. Rapid urbanization and globalization increase the demand for convenience foods tailored to diverse cultural tastes. Moreover, the focus on health and wellness drives the demand for natural flavors and fragrances. The trend towards premiumization, along with regulatory compliance with food safety standards, further stimulates flavors and fragrances market growth and innovation.

Industry Challenges

Regulatory Compliance Cost is Likely to Impede Market Growth

Regulatory compliance presents challenges for the flavors and fragrances market, with strict guidelines, safety concerns, and labeling requirements limiting options for manufacturers. Mandatory ingredient labeling adds complexity and cost to production, potentially discouraging new product introductions. Regional variations in regulations increase administrative burdens and costs across markets. Compliance entails extensive testing and certification processes, hindering market entry and innovation. The demand for natural and organic products complicates compliance, requiring additional standards. Intellectual property protection and trade barriers further restrict market access and competition, constraining growth opportunities for flavors and fragrance companies.

Report Segmentation

The flavors and fragrances market analysis is primarily segmented based on type, ingredient, application, and region.

|

By Type |

By Ingredient |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Type Analysis

The Demand for Fragrances is Expected to Increase During the Forecast Period

The demand for fragrances in expected to increase during the forecast period. Fragrances are essential in consumer products like perfumes, cosmetics, and household goods, meeting diverse preferences and stimulating demand. The personal care industry heavily relies on fragrances to enhance product appeal, contributing significantly to segment revenue. Fragrances are often associated with luxury, commanding premium prices and generating substantial income in the market. Innovative research and development efforts create unique scents, sustaining consumer interest and market dominance. Fragrances have universal appeal, sought after globally, further driving revenue growth. Collaboration with celebrities and designers to launch signature fragrance lines increases brand visibility, bolstering sales and revenue in the fragrance market.

By Ingredient Analysis

Synthetic Segment Held a Significant Market Revenue Share in 2023

The synthetic segment held a significant revenue share in 2023. Synthetic ingredients offer a cost-effective solution, ensuring competitive pricing. They provide greater consistency and stability, reducing batch variations. Additionally, synthetic ingredients are readily available in large quantities, maintaining a stable supply chain. Their versatility enables a wide range of flavors and fragrances, meeting regulatory standards. Synthetic ingredients also provide a longer shelf life, reducing product waste. Furthermore, widespread consumer acceptance, driven by consistent quality and affordability, drives growth.

By Application Analysis

Food and Beverages Segment Held a Significant Revenue Share in 2023

The food and beverages segment held a significant revenue share in 2023. Flavors are indispensable in this industry, enhancing taste and aroma while meeting diverse consumer preferences, thus driving demand for flavored products. Additionally, flavors enable product differentiation, allowing companies to create unique offerings that attract consumers. The continual demand for novel flavors fuels innovation and new product development, boosting revenue in the flavors segment. Globalization exposes consumers to diverse cuisines, fostering a demand for authentic and exotic flavors. Health-conscious consumers also drive the need for natural and clean-label flavors, contributing to revenue growth in this segment.

Regional Insights

Asia-Pacific Region Dominated the Global Market in 2023

In 2023, the Asia-Pacific region accounted for a significant market share. Its large and rapidly growing population drives substantial demand, supported by increasing consumer spending and urbanization. Economic development in countries such as China, India, and Japan boosts purchasing power and stimulates demand for consumer goods, including flavors and fragrances. Moreover, the expanding middle class, rising disposable incomes, and evolving lifestyles in emerging economies contribute to higher consumption of packaged foods, beverages, and personal care products requiring flavors and fragrances. Additionally, the region's role as a manufacturing hub, favorable regulatory environments, and cultural diversity further solidify its dominance in the market.

The North American flavors and fragrances market is a dynamic industry characterized by diverse products and strong consumer demand across food, beverages, cosmetics, personal care, and household sectors. With high consumer spending levels and a preference for premium-quality goods, the region fosters innovation in flavor and fragrance formulations, often emphasizing natural and organic ingredients. Key players range from multinational corporations to niche manufacturers catering to specific preferences. Evolving trends, technological advancements, and sustainability commitments continue to shape the North American flavors and fragrances market.

Key Market Players & Competitive Insights

The flavors and fragrances market comprises a diverse array of players, and the expected influx of newcomers is poised to intensify competitive dynamics. Established market leaders continuously enhance their technologies, striving to maintain a competitive advantage by emphasizing effectiveness, reliability, and safety. These companies prioritize strategic endeavors, including forming partnerships, improving product ranges, and participating in cooperative ventures. Their primary goal is to outperform competitors in the industry, securing a significant flavors and fragrances market share.

Some of the major players operating in the global flavors and fragrances market include:

- Alpha Aromatics

- BASF SE

- Bell Flavors & Fragrances Inc.

- Biolandes SAS

- Firmenich SA

- Givaudan SA

- Huabao International Holdings Limited

- International Flavors & Fragrances Inc. (IFF)

- Kerry Group

- Mane SA

- Ozone Naturals

- Robertet Group

- Sensient Technologies Corporation

- Symrise AG

- Takasago International Corporation

Recent Developments

- In February 2023, Bell Flavors & Fragrances, Inc. introduced its Bell Technology and Innovation Center (BTIC), a cutting-edge establishment integrating innovation, engineering, technology, research, product development, and applied sciences. This facility is designed to cultivate fresh flavor creation and broaden Bell's fundamental capacities within the industry.

- In March 2021, Royal DSM disclosed its plans to purchase the flavor and fragrance (F&F) bio-based intermediates division of Amyris, Inc., expanding DSM's portfolio in Aroma Ingredients to include bio-derived components for the flavor, fragrance, and cosmetics sectors.

Report Coverage

The flavors and fragrances market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, types, ingredients, applications, and their futuristic growth opportunities.

Flavors and Fragrances Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 32.33 billion |

|

Revenue forecast in 2032 |

USD 47.73 billion |

|

CAGR |

5.0% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

key companies in Flavors and Fragrances Market are BASF SE, Bell Flavors & Fragrances Inc., Firmenich SA, Givaudan SA, International Flavors & Fragrances Inc. (IFF)

Flavors and Fragrances Market exhibiting the CAGR of 5.0% during the forecast period.

The Flavors and Fragrances Market report covering key segments are type, ingredient, application, and region.

key driving factors in Flavors and Fragrances Market are Population growth and urbanization

The global Flavors and Fragrances market size is expected to reach USD 47.73 billion by 2032