Fluorosilicic Acid Market Size, Share, Trends, Industry Analysis Report

: By Grade (25%, 35%, 40%, and Others), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 369

- Format: PDF

- Report ID: PM3178

- Base Year: 2024

- Historical Data: 2020-2023

Fluorosilicic Acid Market Overview

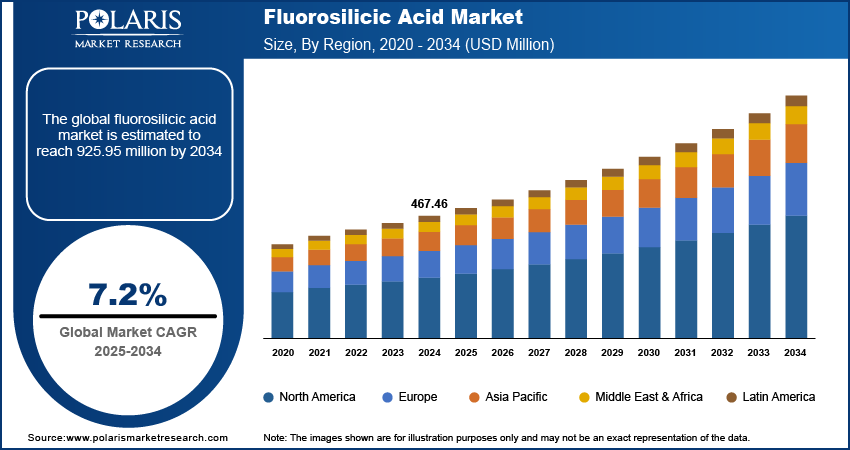

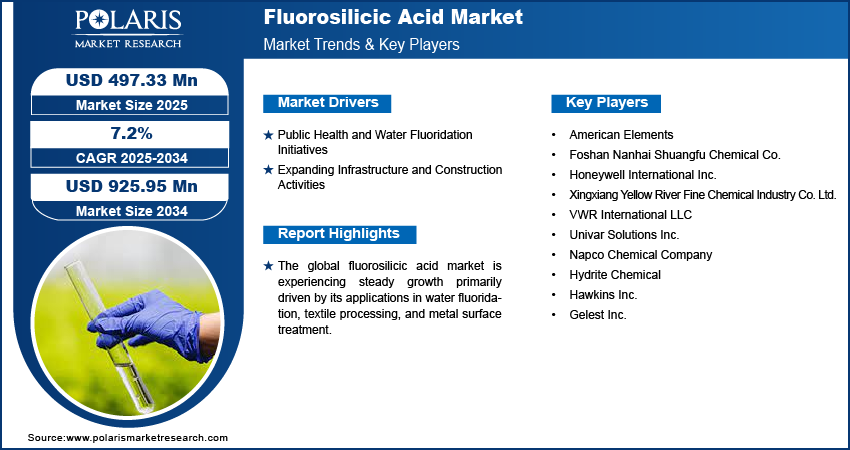

The fluorosilicic acid market size was valued at USD 467.46 million in 2024. The market is projected to grow from USD 497.33 million in 2025 to USD 925.95 million by 2034, exhibiting a CAGR of 7.2% during 2025–2034.

Fluorosilicic acid, also known as hexafluorosilicic acid, is a by-product of phosphate fertilizer production. Fluorosilicic acid is commonly used to fluoridate drinking water supplies as a means of preventing dental decay. The global fluorosilicic acid market growth is primarily driven by its rising applications in water fluoridation, textile processing, and metal surface treatment.

Increasing awareness and initiatives toward public health have boosted the demand for fluorosilicic acid for water treatment applications. Additionally, the rise in urbanization and industrialization, particularly in developing countries, has expanded the usage of fluorosilicic acid in various manufacturing processes. The chemical's unique properties, such as its ability to clean metal surfaces, have also found applications in industries such as electroplating and metal surface treatment.

The textile industry is another significant end user of the fluorosilicic acid market. In textile processing, fluorosilicic acid is utilized for cleaning and descaling, which enhances the quality and durability of the fabric. With the textile sector's expansion in regions such as Asia Pacific, the demand for fluorosilicic acid is projected to grow during the forecast period. The compound is also applied in hide processing and oil well acidizing, albeit to a lesser extent.

To Understand More About this Research: Request a Free Sample Report

Fluorosilicic Acid Market Driver and Trend Analysis

Public Health and Water Fluoridation Initiatives

The growing urbanization worldwide propels the water demand, and fluorosilicic acid is extensively used in water fluoridation programs. The acid is a key compound for adding fluoride to public water systems, which helps prevent dental decay and improve overall health. Countries such as the US, Canada, and some parts of Europe have long-standing fluoridation programs. Furthermore, emerging economies are increasingly adopting fluoridation practices as part of broader public health initiatives. This trend is likely to continue during the forecast period as global health organizations and local governments emphasize preventive health care, leading to higher demand for fluorosilicic acid across established and developing markets.

Expanding Infrastructure and Construction Activities

The global expansion of infrastructure and construction activities, particularly in emerging economies where urbanization is accelerating, is propelling the global fluorosilicic acid market demand. Fluorosilicic acid is used in the cement industry to harden and enhance the quality of cement, contributing to its demand in large-scale construction projects. Major infrastructure initiatives, such as India’s smart city projects and housing developments, are increasing the need for construction materials and chemicals such as fluorosilicic acid. Asia, Latin America, and the Middle East are experiencing expanding infrastructure and construction activities as government spending on infrastructure development is substantial. The link between infrastructure growth and chemical demand in the construction sector positions fluorosilicic acid as an essential material in supporting long-term urbanization and modernization projects.

Fluorosilicic Acid Market Segment Analysis

Fluorosilicic Acid Market Assessment by Grade Insights

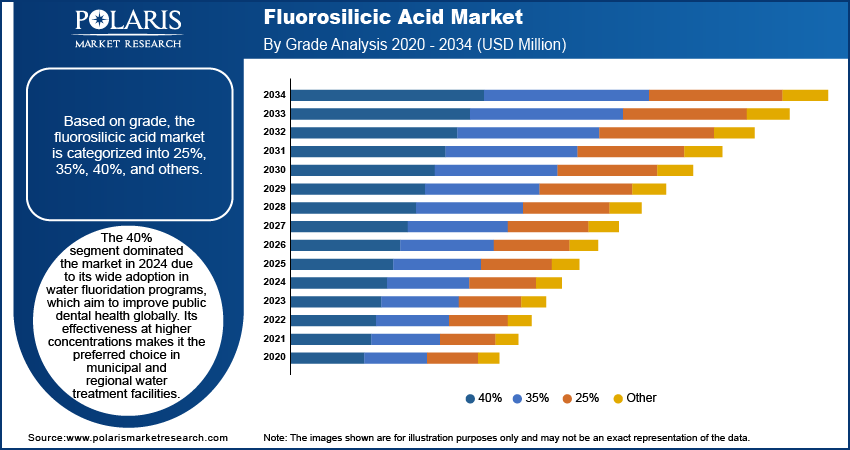

Based on grade, the fluorosilicic acid market is segmented into 25%, 35%, 40%, and others. The 40% segment dominated the market in 2024 and is expected to grow from USD 204.93 million in 2024 to USD 360.85 million by 2032 at the highest CAGR of 7.25%. Fluorosilicic acid, with a 40% grade, is widely used in water fluoridation programs, which aim to improve public dental health globally. Its effectiveness at higher concentrations makes it the preferred choice in municipal and regional water treatment facilities. The robust CAGR of 7.25% reflects increased investments in public health and infrastructure, particularly in developing economies, as well as continuous demand in North America and Europe, where water fluoridation is widely adopted. The anticipated rise in public health initiatives is expected to drive this segment's growth during the forecast period.

The 35% segment is estimated to experience a CAGR of 6.69% during the forecast period owing to its diverse applications in metal surface treatments, where its moderate concentration level is ideal for descaling and surface preparation in various industries. The increasing industrialization—especially in regions such as Asia Pacific, where expanding metal and manufacturing sectors are spurring demand for surface treatment chemicals—is further driving the fluorosilicic acid market expansion.

Fluorosilicic Acid Evaluation by Application Insights

In terms of application, the fluorosilicic acid market is divided into water fluoridation, textile processing, metal surface treatment, hide processing, oil well acidizing, and others. The water fluoridation segment held the largest share of the market in 2024 and is expected to grow from USD 162.52 million in 2024 to USD 286.54 million by 2032, at a CAGR of 7.27%. This segment is driven by initiatives aimed at enhancing public dental health through municipal water treatment. The continued adoption of water fluoridation programs, particularly in North America, parts of Europe, and several developing regions, has sustained a high demand for fluorosilicic acid. This segment is projected to experience strong growth during the forecast period with increasing awareness of oral health benefits and ongoing public health campaigns,

Fluorosilicic Acid Market Regional Insights

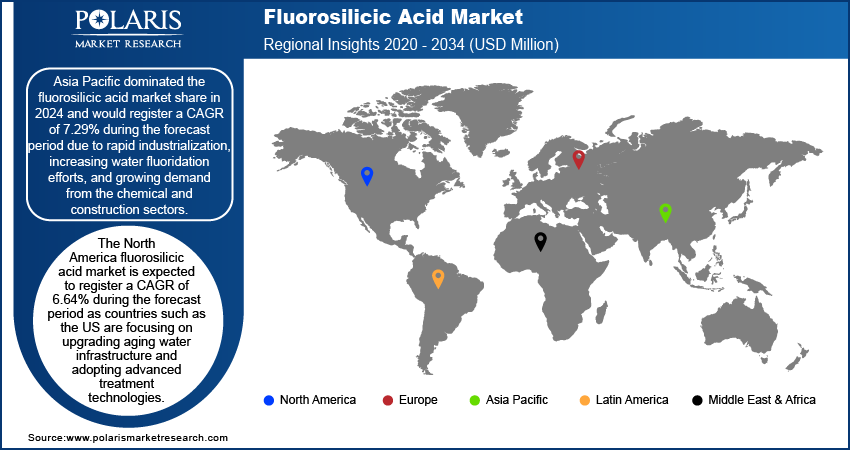

By region, the study provides the fluorosilicic acid market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific dominated the market, holding the largest share and growing at a CAGR of 7.29% due to rapid industrialization, increasing water fluoridation efforts, and growing demand from the chemical and construction sectors. In this region, China emerged as the major country, driven by its robust chemical manufacturing base, increasing population, and stringent water quality initiatives. The high production capacity and availability of raw materials in the region have also boosted its leadership position. Additionally, the region's giant construction industry, particularly in India and Southeast Asian nations, has amplified the need for coating additives and chemical applications that utilize fluorine-based compounds. Governments in Asia Pacific continue to invest in infrastructure and public health initiatives, further fueling fluorosilicic acid market expansion in the region.

The North America fluorosilicic acid market is expected to register a CAGR of 6.64% during the forecast period since countries such as the US are focusing on upgrading aging water infrastructure and adopting advanced treatment technologies. Growing awareness of waterborne diseases and stringent environmental regulations are driving investments in water treatment solutions. Additionally, North America's increasing demand stems from its emphasis on ensuring safe drinking water amid rising concerns about pollution. Enhanced government funding and technological advancements are key factors that continue to support the regional fluorosilicic acid market development.

Fluorosilicic Acid Market – Key Players and Competitive Analysis

Major market players are investing heavily in research and development to expand their offerings, which will drive the fluorosilicic acid market growth. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments, including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The fluorosilicic acid market is fragmented, with the presence of numerous global and regional market players. A few major market players are American Elements, Foshan Nanhai Shuangfu Chemical Co., Honeywell International Inc., Xingxiang Yellow River Fine Chemical Industry Co. Ltd., VWR International LLC, Univar Solutions Inc., Napco Chemical Company, Hydrite Chemical, Hawkins Inc., and Gelest Inc.

American Elements is a global player in materials science, specializing in the production and distribution of advanced materials for a wide range of industries, including electronics, aerospace, energy, healthcare, and defense. Established in 1997 and headquartered in Los Angeles, California, the company supplies an extensive catalog of high-purity elements, compounds, alloys, and materials in various forms such as powders, sheets, foils, and nano-sized particles. With over 15,000 products, American Elements supports cutting-edge research and production, collaborating with clients in over 60 countries. Their innovative solutions focus on critical areas such as rare earth elements, ceramics, and nanotechnology, making them a trusted source for industrial applications and academic research.

Foshan Nanhai Shuangfu Chemical Co., Ltd. is a Chinese company based in Foshan City, in the Guangdong Province. Established with a focus on chemical manufacturing, the company specializes in producing a wide range of adhesives and related products. Their product line includes hot melt adhesives, polyurethane adhesives, and other industrial bonding agents widely used across various sectors such as packaging, furniture, automotive, textiles, and electronics. Foshan Nanhai Shuangfu Chemical Co. prides itself on innovation and quality control, adhering to international standards to meet the diverse needs of global clients. The company also emphasizes sustainability and environmental responsibility, employing eco-friendly processes to minimize environmental impact.

Key Companies in Fluorosilicic Acid Market

- American Elements

- Foshan Nanhai Shuangfu Chemical Co.

- Honeywell International Inc.

- Xingxiang Yellow River Fine Chemical Industry Co. Ltd.

- VWR International LLC

- Univar Solutions Inc.

- Napco Chemical Company

- Hydrite Chemical

- Hawkins Inc.

- Gelest Inc.

Fluorosilicic Acid Market Developments

April 2024: Hydrite, an integrated manufacturer and supplier of chemicals and related services, announced its acquisition of Fife Water Services Inc., a supplier of water treatment and water process products and automation, and Precision Polymer Corporation (PPC), a custom blend manufacturer.

October 2024: Hawkins, Inc. announced the acquisition of Water Guard, Inc. to expand water treatment footprint in North Carolina.

Fluorosilicic Acid Market Segmentation

By Grade Outlook (Volume: Kilotons, Revenue, USD Million, 2020–2034)

- 25%

- 35%

- 40%

- Others

By Application Outlook (Volume: Kilotons, Revenue, USD Million, 2020–2034)

- Water Fluoridation

- Textile Processing

- Metal Surface Treatment

- Hide Processing

- Oil Well Acidizing

- Others

By Regional Outlook (Volume: Kilotons, Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Fluorosilicic Acid Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 467.46 Million |

|

Market Size Value in 2025 |

USD 497.33 Million |

|

Revenue Forecast by 2034 |

USD 925.95 Million |

|

CAGR |

7.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in Kilotons, Revenue in USD Million, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global fluorosilicic acid market size was valued at USD 467.46 million in 2024 and is projected to grow to USD 925.95 million by 2034.

The global market is projected to register a CAGR of 7.2% during the forecast period.

Asia Pacific held the largest share of the global market in 2024.

American Elements, Foshan Nanhai Shuangfu Chemical Co., Honeywell International Inc., Xingxiang Yellow River Fine Chemical Industry Co. Ltd., VWR International LLC, Univar Solutions Inc., Napco Chemical Company, Hydrite Chemical, Hawkins Inc., and Gelest Inc. are a few key fluorosilicic acid market players.

The 35% segment is projected for significant growth in the global market during the forecast period.

The 40% segment dominated the fluorosilicic acid market revenue share in 2024.