Coating Additives Market Share, Size, Trends, & Industry Analysis Report

Information By Function (Wetting & Dispersion, Anti-Foaming, Biocides, Rheology Modification, Others), By Formulation, By Application, And By Region – Market Forecast, 2025 - 2034

- Published Date:May-2025

- Pages: 115

- Format: PDF

- Report ID: PM1120

- Base Year: 2024

- Historical Data: 2020-2023

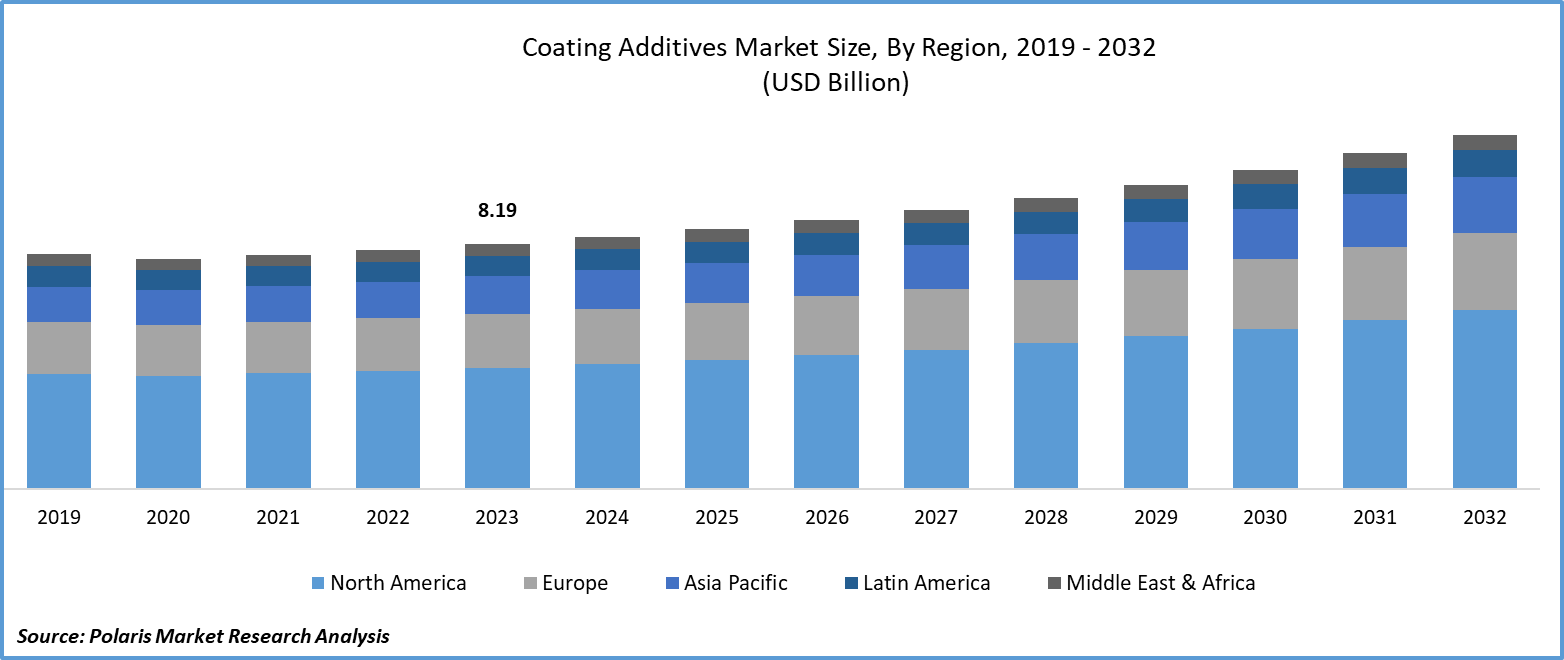

The global coating additives market was valued at USD 8.51 billion in 2024 and is projected to grow at a CAGR of 5.60% from 2025 to 2034. Growth is attributed to the rising demand for high-performance coatings in various industries, including automotive and construction.

The coating additives industry development is experiencing a surge in demand due to the growing emphasis on environmental sustainability. Strict environmental regulations are compelling businesses to innovate and offer environmentally friendly products. Additionally, many countries are implementing stricter regulations regarding volatile organic compounds (VOCs), hazardous air pollutants, and their overall environmental impact. These regulations are influencing the formulation of coatings by encouraging producers to transition to low-VOC, bio-based, and water-based additives, thereby reducing the environmental footprint of coatings.

To Understand More About this Research: Request a Free Sample Report

Moreover, rising consumer awareness and preference for environmentally friendly products are boosting demand for sustainable solutions. This trend is influencing the growth dynamics of the coating additives market and compelling businesses to adopt greener practices. Furthermore, in a competitive market, extensive research and development (R&D) efforts to create new additive formulations that meet both high-performance standards and ecological objectives offer opportunities for innovation and market differentiation, leading to a promising outlook for the market.

However, the automotive and aerospace sectors require high-performance coatings to protect surfaces from wear, corrosion, and harsh environments. There is significant potential for coating additives that enhance adhesion, scratch resistance, durability, and UV protection in these industries. Producers of coating additives are expected to capitalize on this coating additives market opportunity by providing additives that meet the stringent specifications of various industries, as the demand for high-performance coatings is expected to rise.

Coating Additives Market Trends

Growing Demand for Eco-Friendly Products

Manufacturers are leading the charge in adopting innovative strategies to drive a significant transformation. By incorporating bio-based additives, they are boosting the environmental sustainability of coatings, appealing to environmentally conscious consumers who prioritize eco-friendly products. This evolution reflects a harmonious alignment between consumer preferences and industrial responsibility in the coating additives market. Increasingly, consumers are opting for cleaner and sustainable formulations to meet their coating and decorative needs, echoing the global emphasis on sustainability within the industry. The surge in demand for eco-friendly solutions, both from consumers and businesses, is propelling the adoption of bio-based alternatives, highlighting the urgent necessity for chemicals that minimize their environmental impact.

Growing Need Across a Range of Industries

The coating additives market growth is driven by increasing demand from various end-use sectors such as industrial applications, wood products, automotive, and construction. Particularly, the automotive industry utilizes additives to enhance the longevity, appearance, and durability of car coatings, impacting consumer satisfaction and vehicle lifespan. Additionally, the construction sector is increasingly relying on these additives to improve the performance and aesthetics of architectural coatings, which are crucial for both protective and decorative purposes. With urbanization and industrialization on the rise globally, there is a growing need for coatings that can withstand harsh environments, resist corrosion, and maintain their visual appeal over time. This is driven by increased investments in infrastructure and manufacturing resulting from these trends.

Coating Additives Market Segment Insights

Coating Additives Function Insights

The global coating additives market segmentation, based on function, includes wetting & dispersion, biocides, anti-foaming, rheology modification, and others. The wetting & dispersion segment is projected to grow at the fastest CAGR during the coating additives market forecast period. Wetting and dispersing agents play a crucial role in construction and architectural coatings by ensuring the uniform dispersion of pigments and additives, enhancing both performance and visual appeal. The increasing demand for these chemicals is driven by higher solid content is necessary for coatings to achieve improved color acceptability. Moreover, there is a simultaneous push to reduce the volatile organic compound (VOC) content in formulations to comply with stringent environmental regulations in various regions. Additionally, the market is witnessing a notable rise in the requirement for pigment-dispersing agents and higher standards for precise color reproduction. In response to these industry dynamics, key players in the coatings additives market continually innovate and introduce new wetting agents tailored to meet specific performance requirements.

For instance, in February 2023, Evonik's coating additives business line introduced two new wetting agents: TEGO Wet 296 and TEGO Wet 290. These products are versatile and suitable for substrates including plastic, wood, and metal surfaces. They are particularly designed for waterborne automotive and wood coatings, enhancing wetting and anti-cratering properties, as well as improving flow and leveling characteristics. This innovation is expected to strengthen Evonik's position in the coating additives market.

Coating Additives Application Insights

The global coating additives market segmentation, based on application, includes industrial, wood & furniture, architectural, automotive & transportation, and others. The architectural segment is expected to grow at the fastest CAGR during the coating additives market forecast period. In the coating additives industry, the architectural sector is poised for rapid growth. Coating additives play a vital role in safeguarding building structures against environmental damage. By enhancing both the aesthetic appeal and protective capabilities of structures, these additives provide essential defense against dampness, UV rays, chipping, and related issues. They significantly enhance the performance of architectural coatings, improving key attributes such as weather resistance, durability, and overall attractiveness. Architectural coatings often need to be customized based on specific project requirements or environmental conditions. Coating additives enable companies to tailor coatings to meet these diverse needs, whether it's for extreme climates, high-traffic areas, or specialized applications.

For instance, Evonik Coating Additives is pleased to unveil two groundbreaking defoamers, TEGO Foamex 16 and TEGO Foamex 11, at the American Coatings Show 2024. This event will take place from April 30 to May 2 at the Indiana Convention Center in Indianapolis. These cutting-edge additives are specifically crafted to enhance both the sustainability and performance of waterborne architectural coatings, contributing to a rise in the coating additives market demand.

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Coating Additives Regional Insights

By region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. The North America region dominated the global market with the largest market share in 2023 and is expected to maintain its dominance over the anticipated period. A discerning consumer base, stringent environmental regulations, and advancements in technology are propelling the North American market. Additionally, the automotive industry's progress, the burgeoning manufacturing sector, and heightened investments in construction and restoration are driving the demand for top-tier coatings with specialized additives. The region is notably inclined toward innovative and sustainable coatings, with a rising preference for water- and bio-based additives. This shift is driven by stricter regulations on volatile organic compound (VOC) emissions and an increasing consumer awareness of environmental concerns.

The key market players are merging, acquiring, and collaborating to strengthen their market presence and to serve better offerings in North America, further driving the market during forecast period.

United States coating additives market accounts for the largest market share due to its large construction sector, industrial activities, and ongoing maintenance requirements for infrastructure. The demand for coating additives continues to grow as new construction projects emerge and existing structures require refurbishment and maintenance. Companies involved in coating additives are continually advancing their technologies to meet evolving customer needs and regulatory requirements. These advancements include the development of additives that improve performance characteristics such as durability, UV resistance, scratch resistance, and chemical resistance.

For instance, according to the American Coating Association, Gerdau Graphene has introduced two novel additives tailored for the paint and coatings sector: NanoDUR and NanoLAV. These additives, developed using Gerdau Graphene's proprietary G2D technology, incorporate graphene nanoplatelets that maintain pH levels unchanged. Gerdau Graphene states that these additives also diminish or eliminate the necessity for certain conventional manufacturing inputs, additives, and procedures. This advancement significantly enhances technological advancement in the coating additives market.

The Asia Pacific coating additives market is expected to be the fastest-growing region, with a healthy CAGR during the projected period. It offers substantial growth prospects for coating additives and is poised to become a highly attractive global market in the coming years. With advancements in house renovation methods and a surge in residential construction, the coating additives market demand in this region is expected to maintain its robust growth trajectory. The region's appeal is further enhanced by the increasing demand in key industries such as building, industrial, furniture, and automotive. Moreover, the Asia Pacific region is witnessing remarkable advancements, evident in its significant population growth and steadily improving living standards. It's important to consider factors such as increasing employment rates, rising disposable income among the population, and growing foreign investments in various economic sectors. Collectively, these elements bolster the Asia Pacific region's standing as a vibrant and promising market for the coating additives industry.

The China coating additives market accounts for the largest market share due to rapid urbanization and infrastructure development driving significant demand for architectural coatings. Coating additives play a crucial role in enhancing the performance and sustainability of these coatings, which are essential for protecting buildings and infrastructure against environmental factors. Companies in China are increasingly focusing on developing advanced coating additives such as wetting and dispersing agents. These additives improve pigment dispersion and substrate wetting, leading to better coating adhesion, color consistency, and overall durability. PTFE-free additives are also gaining traction due to environmental concerns and regulatory pressures to reduce harmful emissions.

For instance, in November 2023, Clariant will unveil its latest innovations at ChinaCoat 2023, featuring a new portfolio of industrial coatings and PTFE-free additives. Among these advancements are specialized wetting and dispersing agents designed for water-based formulations in industrial coating applications, targeting sectors such as containers, transportation, and construction, driving innovation and sustainability in the coating additives market.

Further, the major countries studied in the market report are The US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, Brazil, and others.

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Coating Additives Key Market Players & Competitive Insights

The coating additives market is a dynamic arena, with numerous players competing for dominance. Notably, major service providers are leveraging unique strategies to maintain their competitive edge. These strategies include continuous technological advancements, strategic partnerships, and product upgrades. By doing so, these players are not only ensuring efficiency, integrity, and safety but also capturing a significant market share.

The coating additives market is highly competitive and comprises several key players who drive innovation, influence market trends, and shape industry dynamics.

Major players in the coating additives market, including Allnex GMBH, ALTANA AG, Arkema S.A., Ashland Inc., BASF SE, Clariant AG, Dow Inc., Eastman Chemical Company, ELEMENTS global, Evonik Industries AG, Lubrizol Corporation, Momentive Performance Materials Inc, MÜNZING Corporation, Nouryon, etc.

BASF SE, a global chemical corporation, operates across seven distinct business segments. The company's chemical segment, which supplies petrochemicals and their intermediates, is a key player in the coating additives market. In April 2024, BASF's Coatings division made a significant stride in eco-efficiency with the launch of a new lineup of clearcoats and undercoats. These advanced coatings not only enhance quality and boost productivity but also contribute significantly to reducing CO2 emissions. Designed to streamline operations in body shops, the innovative portfolio aims to drastically cut process times while minimizing material usage and energy consumption, thereby demonstrating BASF's commitment to sustainability.

Evonik is a specialty chemicals company that operates in over 100 countries, achieving sales of €18.5 billion and an adjusted EBITDA of €2.49 billion in 2022. With a workforce of around 34,000, Evonik is dedicated to developing innovative, profitable, and sustainable solutions for its customers. The company offers more than 350 additives and resins for paints, coatings, and inks, including renowned brands like TEGO, ACEMATT, AEROSIL, and SURFYNOL, ensuring a solution for every formulation need. In October 2023, Evonik Coating Additives introduced the TEGO Rad range, a series of custom silicone acrylates featuring a unique, radically cross-linkable additive designed for radiation-curing coatings and inks.

Key Companies in the Coating Additives market include

- Allnex GMBH

- ALTANA AG

- Arkema S.A.

- Ashland Inc.

- BASF SE

- Clariant AG

- Dow Inc

- Eastman Chemical Company

- ELEMENTIS global

- Evonik Industries AG

- Lubrizol Corporation

- Momentive Performance Materials Inc

- MÜNZING Corporation

- Nouryon

Coating Additives Industry Developments

- In March 2025, Evonik Coating Additives launched its first mass balanced products, TEGO® Wet 270 eCO and TEGO® Foamex 812 eCO, enabling sustainable, high-performance coatings and inks with reduced carbon footprints and ISCC PLUS certified sourcing.

- June 2024: Evonik is expanding its TEGO Therm product line to include fire-resistant and heat-protection coatings for EV battery covers and housings. As the EV market rapidly expands, safety standards for lithium-ion batteries are becoming more rigorous. Evonik's TEGO Therm-based coatings offer a strong solution to the industry's need for effective thermal insulation barriers, crucial for preventing thermal runaway in EV batteries.

- July 2023: Eastman is introducing Advantis, the cutting-edge adhesion promoters that are designed to meet the latest regulatory requirements. Advantis elevates product sustainability and compliance by reducing or eliminating materials of concern. These solutions excel in improving adhesion as a primer between the substrate and coating, between coating layers, and as a stir-in additive.

- September 2022: BASF Coatings has opened a new research center for electrophoretic descent coating at its office in Münster-Hiltrup, Germany. The cathodic, or electrophoretic dip coating (e-coat), shields car body edges, surfaces, and cavities from corrosion and smooths out the roughness of pre-treated metal surfaces, providing an ideal foundation for subsequent paint layers.

Coating Additives Market Segmentation

Coating Additives Function Outlook

- Wetting & Dispersion

- Anti-Foaming

- Biocides

- Rheology Modification

- Others

Coating Additives Formulation Outlook

- Solvent-Borne

- Water-Borne

- Powder-Based

Coating Additives, Application Outlook

- Industrial

- Wood & Furniture

- Architectural

- Automotive & Transportation

- Others

Coating Additives Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Coating Additives Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 8.51 billion |

|

Market size value in 2025 |

USD 8.9 billion |

|

Revenue Forecast in 2034 |

USD 13.3 billion |

|

CAGR |

5.60% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global coating additives market size was valued at USD 8.51 billion in 2024

The global market is projected to grow at a CAGR of 5.60% during the forecast period, 2024-2034

North America held the largest share in the global market

The key players in the market are Allnex GMBH, ALTANA AG, Arkema S.A., Ashland Inc., BASF SE, Clariant AG, Dow Inc., Eastman Chemical Company, ELEMENTS global, Evonik Industries AG, Lubrizol Corporation, Momentive Performance Materials Inc, MÜNZING Corporation, Nouryon, etc.

The wetting & dispersion segment is projected to grow at the fastest CAGR during the coating additives market forecast period

The architectural segment is expected to grow at the fastest CAGR during the coating additives market forecast period