Food Container Market Share, Size, Trends & Industry Analysis Report

By Material (Glass, Plastic, Metal, Others); By Product; By Region; Segment Forecast, 2025 - 2034

- Published Date:Jun-2025

- Pages: 118

- Format: PDF

- Report ID: PM2361

- Base Year: 2024

- Historical Data: 2020-2023

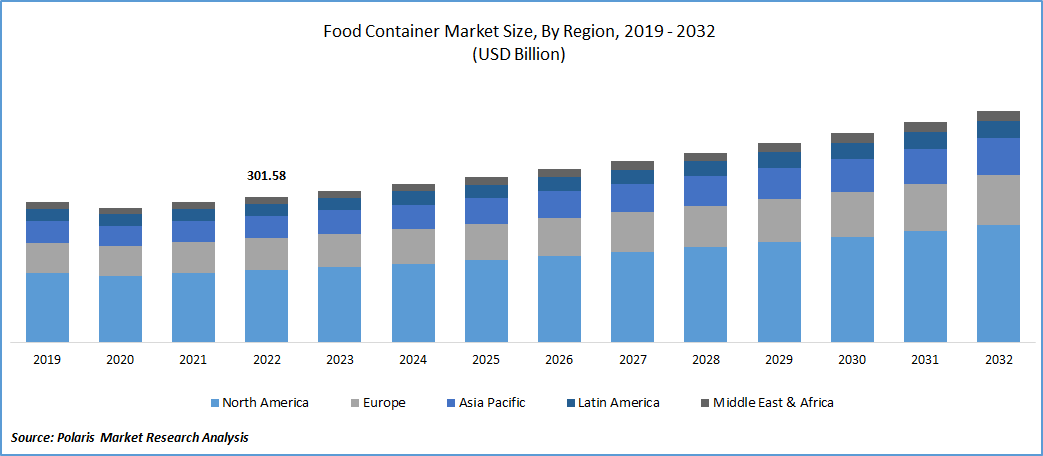

The global Food Container Market was valued at USD 148.77 billion in 2024 and is projected to grow at a CAGR of 4.5% from 2025 to 2034. The surge in food delivery services and sustainable packaging solutions are propelling market demand.

Anticipated market growth stems from the increasing worldwide demand for packaged food products. Additionally, the convenience provided by these containers in packaging, carrying, and transporting food products is a significant factor contributing to the growing demand for the product in the global industry. The spectrum of packaged foods encompasses Ready-To-Eat (RTE) meals, frozen meals, cake mixes, desserts, RTE convenience foods, snacks, and various other items. The projected rise in demand for these products is expected to prompt manufacturers to expand production capacities, thereby boosting the demand for food containers throughout the forecast period.

To Understand More About this Research: Request a Free Sample Report

Due to the essential nature of food items, there has been an increased demand for packaged food during the pandemic. Furthermore, established food brands with robust market penetration and supply chains in various economies have sustained demand for food containers. However, the turnover of major companies, including Amcor plc, experienced a decline in 2020 due to supply chain disruptions and transportation restrictions.

Food containers play a crucial role in extending the shelf life of products by preserving and protecting them from deterioration. The market is anticipated to be influenced by growing consumer awareness of sustainability and environmental concerns. Additionally, manufacturers' heightened focus on innovating and enhancing the aesthetics of food containers is a significant factor attracting food producers to utilize innovative packaging solutions, thereby contributing to the expected Food Container market growth in the near future.

Industry Dynamics

Growth Drivers

Growing Demand for Rigid Plastic Containers in Food and Beverage Packaging to Drive Market Growth

Rigid containers, characterized by their unyielding shapes, are witnessing a rise in demand within the food and beverage sectors, driven by their durability and lightweight attributes. These qualities contribute to the safety and prolonged shelf life of food items, shielding them from moisture, light, and chemicals. Additionally, the lightweight nature of rigid plastic containers makes them an efficient packaging choice for storing and transporting food products and beverages. The evolving lifestyle and heightened consumer expenditure on packaged goods are expected to further elevate the demand for rigid containers in the food and beverage industries.

Report Segmentation

The market is primarily segmented based on material, product, and region.

|

By Material |

By Product |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Material Analysis

The Plastic segment held the Largest Revenue Share in 2024

Categorized by material, the market is segmented into plastic, metal, glass, and others. Plastic stands out as the predominant material in the packaging market due to its numerous advantages over alternative options. Notably, plastic is lighter, highly energy-efficient in manufacturing, and more cost-effective compared to materials like metals and glass.

As per the American Chemistry Council, packaging 10 gallons of drinks requires only two pounds of plastic resins, while the equivalent quantity of drink necessitates eight pounds of steel, three pounds of aluminum, and around forty pounds of glass. Plastic containers are crafted from various plastic resins, including HDPE, LDPE, PET, PP, and polystyrene.

By Product Analysis

The Bottles & Jars Segment Accounted for the Highest Market Share During the Forecast Period

Bottles and jars stand out as the predominant products in the rigid food packaging category. An array of food items, including honey, sauces, cheese, jam, mayonnaise, oil, spreads, syrups, spices, processed vegetables/fruits, fish, and meat, are packaged in diverse glass and plastic jars and bottles.

The cans segment is expected to witness the highest CAGR, propelled by the growing demand for a variety of canned foods and beverages. Furthermore, significant growth is foreseen in the cups and tubs segment over the forecast period, mainly attributed to their specific use for thick and non-viscous food products. Cups and tubs are widely employed in packaging desserts, bakery items, and confectionery products such as ice cream, pudding, and cakes, with plastic and glass serving as the primary materials for manufacturing.

Regional Insights

Asia Pacific Dominated the Largest Market in 2024

This can be attributed to the rapid expansion of the food processing industry in the region, supported by robust government initiatives. Countries such as India, China, and Japan play pivotal roles in driving growth in the APAC regional market. Invest India reports the existence of 18 operational mega food parks and 19 food parks in progress in India. Key investors in the Indian food market include Danone, Nestle, Kraft Heinz Company, McCain, and Mars, among others. Notably, India exported around 1,290 kilotonnes of seafood valued at USD 6.68 billion between 2019 and 2020.

North America is expected to experience a consistent CAGR throughout the forecast period. This expansion is linked to the rising preference for packaged and convenient foods, particularly among the working population. Additionally, the growing demand for canned foods, including canned fish and meat, in the U.S. is propelling market growth in the region.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- Amcor plc

- Ardagh Group

- Ball Corp.

- Berry Plastics Corp.

- Graham Packaging Company, Inc.

- Plastipak Holdings, Inc.

- Silgan Holdings, Inc.

- Sonoco Products Company

- Tetra Pak

- Weener Plastics

Recent Developments

- In October 2024, Eco-Products launched Veda, durable reusable foodservice containers with OZZI’s tracking technology, designed for closed-loop systems in campuses and hospitals, supporting sustainability with NSF certification and up to 1,000 washes.

- In August 2022, Seal Packaging has launched innovative eco-friendly packaging solutions, including the first UKCA-marked plastic-free paper cups, the "It's not paper bag" collection, providing a sustainable alternative to traditional paper bags, and the Compostabowl, among other creative products.

- In May 2022, The ALPLA Group, a prominent packaging solutions and recycling company, collaborated with Vöslauer, Austria's leading mineral water company, to create an innovative returnable PET bottle. This sustainable bottle is purported to decrease carbon emissions by approximately 30% and reduce the weight of the bottle by nearly 90% compared to its reusable glass alternative.

- In January 2022, VPET USA LLC, located in Fontana, California, a company within the Graham Partners portfolio, has revealed its acquisition of Canyon Plastics Inc., a packaging molder based in California. Canyon Plastics serves as a supplier for consumer-packaged goods, encompassing vitamins, nutraceuticals, protein powders, and supplements. Additionally, the company is expanding its offerings to include dedicated engineered products for the medical, aerospace, and defense sectors.

Food Container Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 155 billion |

|

Revenue forecast in 2034 |

USD 230 billion |

|

CAGR |

4.50% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Material, By Product, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The key companies in Food Container Market are • The global key market players include Amcor plc, Ardagh Group, Ball Corp., Berry Plastics Corp

The global Food Container market is expected to grow at a CAGR of 4.50% during the forecast period.

Food Container Market report covering key segments are material, product, and region.

The key driving factors in Food Container Market are Growing Demand for Rigid Plastic Containers in Food and Beverage Packaging to Drive Market Growth.

Food Container Market Size Worth $ 230 Billion By 2034.