Food Grade Lubricants Market Share, Size, Trends, Industry Analysis Report

By Type (Mineral Oil and Synthetic); By Form; By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jul-2022

- Pages: 118

- Format: PDF

- Report ID: PM2526

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

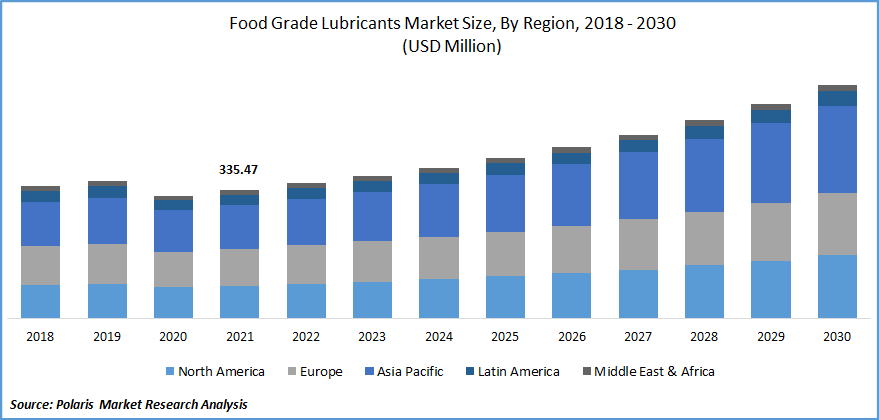

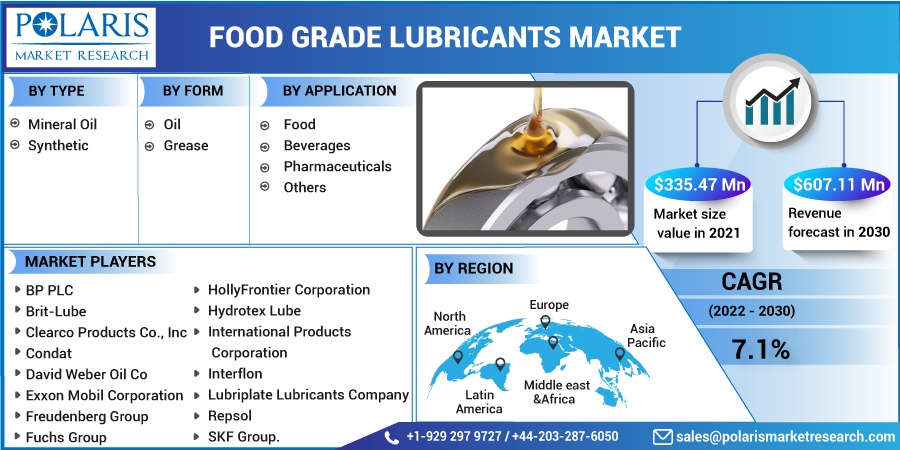

The global food grade lubricants market was valued at USD 335.47 million in 2021 and is expected to grow at a CAGR 7.1% during the forecast period. These are manufacturing lubricants that are safe for consumption by humans or animals within the approved concentration. The commodities which require such food-grade lubricants for production are F&B, medicines, cosmetics, and animal & pet nutrition.

Know more about this report: Request for sample pages

These are made to be completely safe, graded on levels H1, H2, and H3. H1 grade lubricant is used where there is a risk of contact with the consumables. H2 lubricant is used where there is no risk of contact with the consumables. H3 lubricant is used where there is direct contact with the eatables. Aerosols and sprays have been included in the oil form of lubricants.

The outbreak of COVID-19 has had a significant impact on the food-grade lubricants market. The food-grade lubricant market is heavily dependent on the F&B industry for its growth. The shutdown of the consumables processing and manufacturing plants in the early stages of the pandemic adversely affected the industry. However, with easing restrictions subsequently and being classified as essential services, the industry recovered steadily.

The COVID-19 pandemic also resulted in the disruption of supply chains. With disrupted supply chains and a myriad of raw material requirements from different countries across the world, engaged players in the industry are looking for locally sourced raw materials. Nevertheless, the demand for food-grade lubricants will continue to grow post-COVID-19 with increasing consumer awareness regarding food safety.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The market is driven by bio-based grade lubricants to proliferate the market in the coming years. They are manufactured with the base of white oil, a product obtained from the distillation of petroleum. The use of petroleum for lubricant production is neither sustainable nor will it be feasible in the long run.

As a result, research is being conducted on the usage of vegetable and grain-based oil as a base for manufacturing emollients used in the F&B industry. These oils are natural, with fewer additives added during the production of the emollients.

Raw materials used for the production of bio-based oils resources are renewable, much more sustainable, and environment-friendly. The use of bio-based emollients in the food grade lubricant will result in increased adoption from environmentally conscious companies, thus providing lucrative opportunities in the industry.

Report Segmentation

The market is primarily segmented based on type, form, application, and region.

|

By Type |

By Form |

By Application |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Mineral oil segment accounted for the largest market share in 2021 under type

By type, the food grade lubricants market is classified into synthetic or mineral oil. The market for mineral oil is expected to dominate the market growth during the forecast period. Mineral-based lubricant is made from naturally available petroleum. It is obtained via distillation of petroleum and is a white colorless, and odorless liquid.

Often known as white oil, it is traditionally used as a lubricant in many industries. Some additives are used to make the lubricants safe so that it can be used in the food industry. These are less costly as compared to synthetic emollients.

Mineral-based lubricants have been used for a long time in industries as the main lubricating agent for machinery. It is almost completely natural, with only a few additives used to make the lubricants safe and less toxic.

It is relatively cheap and readily available, making it a preferred type of lubricant for many companies that want to save costs to the company. Mineral oils have a shorter life span than synthetic emollients and have to be changed frequently, which forces the companies to buy these emollients more often, thus increasing the sale of mineral-grade lubricants.

Oil segment is expected to be the fastest growing segment during the forecast period

Based on form, the food-grade emollients are categorized into oil and grease. The oil segment is to be the largest market in the food grade lubricants market and is expected to be the fastest growing segment as well during the forecast period. Lubricant oils used in the F&B industry are viscous, non-toxic liquids.

They are used to make the processes carried out by the machinery smoother while increasing the lifespan of the machinery. Gearboxes, hydraulics, and other closed systems make use of lubricating oils. It is also available in the form of sprays that can be applied directly to the machinery parts.

Food grade lubricant oils are natural or synthetically made oils that are applied to machinery in the consumables, beverages, pharmaceutical, and cosmetic industries. They are viscous fluids that are applied to the internal parts of machinery to ensure the smooth functioning of the parts and to reduce damage to those parts.

It is mostly used in closed systems where there is less risk of leakage. As it is a liquid, it penetrates all parts of the machine where it is applied without much effort. The ease of applicability and effectiveness of the oil is a major contributors to its popularity. Furthermore, it can also be drained and cleaned easily, which makes its extensive use in a myriad of industries.

Food segment accounted for the largest market share

By application, the food grade lubricants market is segmented into food, beverages, pharmaceuticals, and others. Oils used in these industries have to be completely nontoxic, as they can sometimes make contact with the consumables being produced, which should not make them unfit for consumption.

The food segment accounted for the largest market share. The F&B industry produces all kinds of edibles and consumables that are sold in the market. Strict safety and sanitary guidelines are followed by the companies operating in the F&B industry to ensure that the products that they deliver are of good quality and free of any kind of harmful contaminations.

Consumers are becoming more aware of health and safety, and they expect the same from the industry. F&B companies make sure that all materials they use while processing have to be completely safe for consumption. The machinery used in the industries requires extensive lubrication; however, at times, it is difficult to prevent the lubricant from coming in contact with the consumables being produced.

Therefore, the lubricant being used must be nontoxic and safe if contacted with eatables accidentally. Novel innovations that make the emollients safer, more effective, and cheaper will aid in the increased adoption of these food-grade lubricants across the world. The overall growth of the F&B processing industry will further drive the growth of the food-grade lubricants industry.

North America region will lead the global food grade lubricant market by 2030

The North American region is expected to account for a larger share in the food-grade lubricant market. The U.S. leads in terms of production and usage of the industry. It is followed by Canada and Mexico, which have less stringent laws regarding food safety. The use of food-grade lubricants in processing is adopted in all of the major beverages, pharmaceutical, and cosmetic companies across this region.

The U.S. FDA has very strict laws regarding the processes undertaken in the production of F&B in the country. All chemicals and oils used in the manufacturing facility must be compliant with Title 21 Code of Federal Regulations (21CFR) 178.3570 resulting in widespread adoption of emollients in the U.S. Maintaining brand reputation has also forced end users to use food grade emollients or processing. The region is witnessing increased adoption of synthetic emollient.

Competitive Insight

Some of the major players operating in the global market include BP PLC, Brit-Lube, Clearco Products Co., Inc, Condat, David Weber Oil Co, Exxon Mobil Corporation, Freudenberg Group, Fuchs Group, HollyFrontier Corporation, Hydrotex Lube, International Products Corporation, Interflon, Lubriplate Lubricants Company, Repsol, and SKF Group.

Recent Developments

In February, 2021, Metalube launched Metachain FG-30 chain oil for use in equipment such as traveling bakery ovens, rolling hotplates, and more.

In November, 2020, Fuchs acquired PolySi Technologies and its divisions that include PolySi Lubricants, a manufacturer of lubricants for markets such as industrial equipment, automotive, electrical, electronic, utility, and so on.

Food Grade Lubricants Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 335.47 million |

|

Revenue forecast in 2030 |

USD 607.11 million |

|

CAGR |

7.1% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Form, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

BP PLC, Brit-Lube, Clearco Products Co., Inc, Condat, David Weber Oil Co, Exxon Mobil Corporation, Freudenberg Group, Fuchs Group, HollyFrontier Corporation, Hydrotex Lube, International Products Corporation, Interflon, Lubriplate Lubricants Company, Repsol, and SKF Group. |