Forensic Genomics Market Size, Share, Trends, & Industry Analysis Report

By Product, By Method, By Application, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6071

- Base Year: 2024

- Historical Data: 2020-2023

Overview

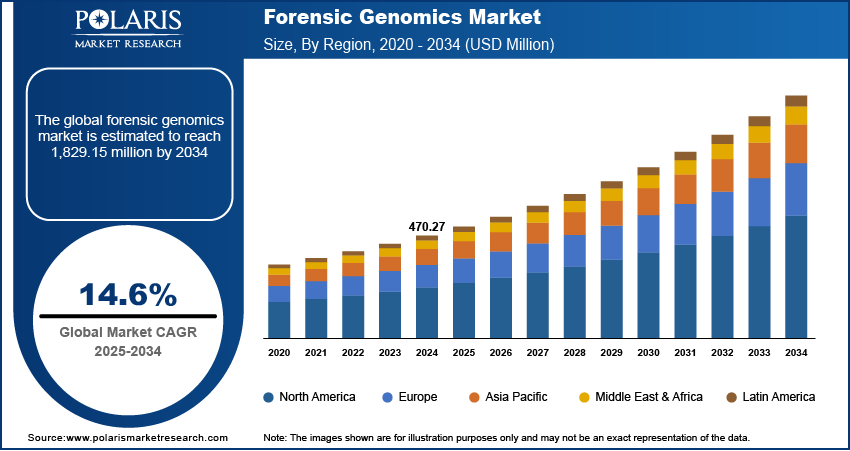

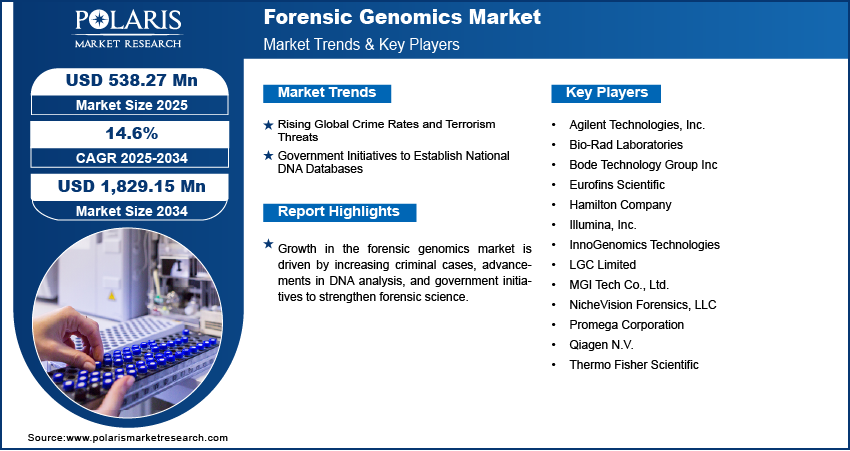

The global forensic genomics market size was valued at USD 470.27 million in 2024, growing at a CAGR of 14.6% from 2025–2034. Growing crime and terrorism propel forensic genomics demand, while national DNA database projects fast-track adoption.

Key Insights

- Instruments segment dominated 2024 share, fueled by sequencing and PCR instruments.

- PCR segment to advance at fastest CAGR for cost-saving and degraded DNA applications.

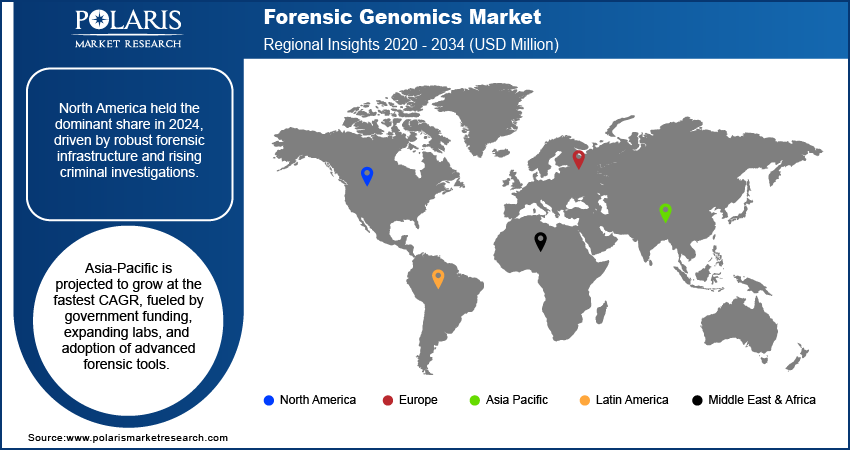

- North America commanded 2024 share with robust forensic infrastructure.

- The U.S. dominated North America share, fueled by crime levels and federal expenditure.

- Asia Pacific poised for highest CAGR, supported by forensic lab investments.

- Fast growth in China with state-directed DNA modernization and NGS adoption.

Industry Dynamics

- Growth in crime and terror attacks drives need for precise genomics.

- National DNA database programs drive worldwide adoption.

- Sequencing, bioinformatics, and mobile DNA equipment advancements open up possibilities for the industry.

- Synched sequencing expenditures and infrastructure gaps restrain adoption.

Market Statistics

- 2024 Market Size: USD 470.27 million

- 2034 Projected Market Size: USD 1,829.15 million

- CAGR (2025–2034): 14.6%

- North America: Largest Market Share

Forensic genomics utilizes DNA sequencing and analysis for investigation, paternity testing and identity identification. Some of the essential technologies utilized are NGS, PCR, bioinformatics platforms and extraction kits. The solutions facilitate correct DNA profiling, genetic variation identification and bolstering confidence in evidence. Use by law enforcement, forensic laboratories and research is effective in bolstering criminal justice and civil law success.

NGS and PCR platforms recover DNA detail from degraded evidence and bioinformatics software facilitates interpretation and database matching. Cloud and electronic platforms enable secure storage and real-time collaboration to minimize case backlogs. In 2023, QIAGEN purchased Verogen for USD 150 million, incorporating MiSeq FGx and GEDmatch databases in efforts to further develop NGS for forensics. This acquisition is simplifying workflows and enhancing genomics' role in forensic science.

The market is growing with growing applications of DNA profiling in crime, security and human identification. Improvements in sequencing precision, automation and cost are fueling growing applications. Government-funded national DNA databases in countries such as the US and UK are leading adoption. Compact DNA analysis, improved sample preparation and data analysis are predicted to propel long-term industry growth.

Drivers & Opportunities

Rising Global Crime Rates and Terrorism Threats: Global terrorism and crime are generating demand for cutting-edge forensic genomics. Organized crime affects 83% of the world population and terrorism-related deaths rose 22% in 2023 to 8,352. Criminal justice officials require faster and more accurate instruments for transnational crime and terrorism investigations. Forensic genomics enables rapid profiling from degraded samples with a high accuracy rate of connecting suspects, victims and crime scenes.

Government Initiatives to Establish National DNA Databases: Government programs to create national DNA repositories are hastening genomic uptake. Governments are focusing on large databases to enhance identification and enhance public safety. The systems aid missing persons investigations and disaster victim identification. Advanced sequencing and bioinformatics platforms integration guarantees high-capacity storage and comparison of the profiles. Increased global uptake is fueling demand for forensic genomics solutions even more.

Segmental Insights

Product Analysis

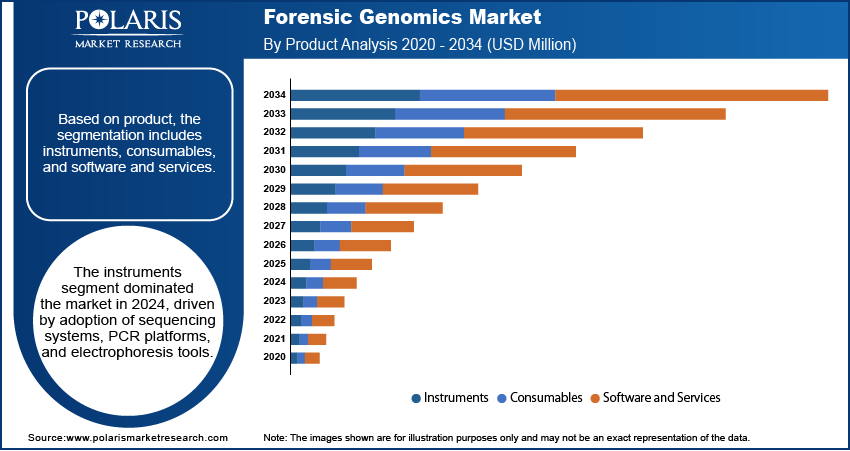

Based on product, the segmentation includes instruments, consumables, and software and services. The instruments segment led the market in 2024, as adoption of sequencing systems, PCR platforms and electrophoresis tools in forensic labs has picked up. Their use for processing degraded samples and increasing upgrades in sensitivity continue to lead.

The software and services business is expected to develop at the fastest CAGR, driven by demand for bioinformatics and safe information solutions. Cloud-based solutions and increased offerings like interpretation of data are accelerating development.

Method Analysis

Based on method, the segmentation includes next-generation sequencing (NGS), capillary electrophoresis (CE), polymerase chain reaction (PCR), microarray, and others. The NGS segment had the largest market share in 2024 as it can provide high-resolution profiles from degraded DNA. Coupled with bioinformatics tools and application in large-scale comparisons, it further solidifies its position.

The PCR segment is expected to expand at the highest CAGR in the forecast period as a result of the quick amplification of small-sized samples and decreasing costs. Portable PCR technology advancements are fueling increased use in field-based applications.

Application Analysis

Based on application, the segmentation includes criminal investigation, human identification, paternity and kinship testing, missing person identification, disaster victim identification, and other application. The criminal investigation segment led the market in 2024 due to increased crime rates and the need for accurate evidence analysis. Inclusion of genomic data in national databases also enhances this segment.

The human identification application segment is estimated to develop with the highest CAGR over the forecast period, as it finds application in missing persons and disaster victim identification. Government programs for DNA and handheld sequencing systems are driving adoption.

End User Analysis

Based on end user, the segmentation includes forensic laboratories, law enforcement agencies, research and academic institutes, government agencies, and contract research organizations (CROs). The segment of forensic laboratories led the market throughout 2024 due to its leading role in DNA processing in criminal as well as civil cases. Higher investments in infrastructure and keeping step with agencies buttress their leadership. The Government of India sanctioned USD 11.48 million for a new CFSL in Jammu and sanctioned USD 98.82 million to establish seven more under the national scheme of forensics in March 2025.

The ambulatory surgery centers segment growing at the highest rate with increasing demand for minimally invasive and outpatient procedures. These centers offer cost savings, faster recovery, and rising adoption of new implantable technologies. Worldwide healthcare cost containment activities also enhance growth.

Regional Analysis

North America held the largest market share in the forensic genomics market in 2024, driven by high government expenditure in forensic technology to enhance investigations and security. Organization investments by the government bodies such as FBI and Department of Justice drove the adoption of DNA technology tools. Mature forensic centers and technology providers enable mass deployment, and U.S. initiatives to modernize infrastructure and expand DNA databases created favorable growth environments.

The U.S. Forensic Genomics Market Insight

The U.S. recorded the highest proportion of North America in 2024, driven by investments by the government to improve forensic facilities and law enforcement. Growth in CODIS amplified DNA technology adoption, with high demand for quick testing facilitating the timely closure of cases. Research organizations collaborating with biotech companies are leading innovation. In February 2024, Bode Technology launched an in-house forensic genealogy capability through AVITI sequencing, delivering high-quality case results on challenging cases.

Europe Forensic Genomics Market

Europe is set to capture a significant percentage by 2034, facilitated by legislation support and cross-border cooperation on forensic data exchange. ENFSI plays a pivotal role in unifying DNA profiling techniques throughout EU member states. Investments in digital crime databases and sequencing technologies are optimizing efficiency. Increased organized crime and terrorism activities throughout Europe are also raising the need for enhanced forensic genomics solutions.

Asia Pacific Forensic Genomics Market

The Asia Pacific is expected to expand at the highest CAGR during 2034, with government investment in upgrading forensic infrastructure to combat crime expansion. China, India, and Japan are growing laboratories and implementing next-gen sequencing for quicker case closure. Urbanization and population growth are adding crime pressure, while collaborations between institutes, law enforcement, and government bodies are boosting adoption. As per UNICEF, almost 55% of the population in Asia is projected to reside in urban settings by 2030 as cities in the continent are growing very fast.

China Forensic Genomics Market Overview

China is becoming a growth driver, aided by massive government investment in forensic expansion and modernization and large-scale building out of national DNA databases. Increased crime in urban areas is driving dependence on genomics-based identification. Local technology companies are working with research institutions to create cost-effective forensic products designed for large-volume application, augmenting China's commanding position in the Asia Pacific forensic genomics market.

Key Players & Competitive Analysis Report

The forensic genomics industry is moderately competitive, with companies developing sequencing platforms, consumables, and software to enhance testing speed and accuracy. Companies are growing portfolios with NGS, PCR, and bioinformatics tools for criminal investigations as well as human identification. Convergence of laboratories, agencies, and technology providers is fueling innovation and take-up of region-specific solutions, enhancing competitiveness in legal and security markets.

Key companies in the forensic genomics industry include Illumina, Inc., Thermo Fisher Scientific, Qiagen N.V., Agilent Technologies, Inc., Bio-Rad Laboratories, Promega Corporation, Hamilton Company, LGC Limited, Bode Technology Group Inc, Eurofins Scientific, NicheVision Forensics, LLC, MGI Tech Co., Ltd., and InnoGenomics Technologies.

Key Players

- Agilent Technologies, Inc.

- Bio-Rad Laboratories

- Bode Technology Group Inc

- Eurofins Scientific

- Hamilton Company

- Illumina, Inc.

- InnoGenomics Technologies

- LGC Limited

- MGI Tech Co., Ltd.

- NicheVision Forensics, LLC

- Promega Corporation

- Qiagen N.V.

- Thermo Fisher Scientific

Industry Developments

- September 2024: Promega introduced Reduced Stutter Polymerase to reduce stutter artifacts and enhance STR analysis in forensic DNA testing.

- May 2024: QIAGEN collaborated with the FBI to create a digital PCR assay on QIAcuity to enable precise DNA analysis in degraded samples.

Forensic Genomics Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- Instruments

- Sequencers

- Electrophoresis Systems

- Genetic Analyzers

- Consumables

- Kits

- Reagents

- DNA Extraction Solutions

- Software and Services

By Method Outlook (Revenue, USD Million, 2020–2034)

- Next-Generation Sequencing (NGS)

- Capillary Electrophoresis (CE)

- Polymerase Chain Reaction (PCR)

- Microarray

- Others

By Application Outlook (Revenue, USD Million, 2020–2034)

- Criminal Investigation

- Human Identification

- Paternity and Kinship Testing

- Missing Person Identification

- Disaster Victim Identification

- Other Application

By End User Outlook (Revenue, USD Million, 2020–2034)

- Forensic Laboratories

- Law Enforcement Agencies

- Research and Academic Institutes

- Government Agencies

- Contract Research Organizations (CROs)

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Forensic Genomics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 470.27 Million |

|

Market Size in 2025 |

USD 538.27 Million |

|

Revenue Forecast by 2034 |

USD 1,829.15 Million |

|

CAGR |

14.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Techniqueat |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 470.27 million in 2024 and is projected to grow to USD 1,829.15 million by 2034.

The global market is projected to register a CAGR of 14.6% during the forecast period.

North America dominated the forensic genomics market in 2024, driven by early adoption of DNA sequencing, forensic databases and rising criminal casework.

A few of the key players in the market are Illumina, Inc., Thermo Fisher Scientific, Qiagen N.V., Agilent Technologies, Inc., Bio-Rad Laboratories, Promega Corporation, Hamilton Company, LGC Limited, Bode Technology Group Inc, Eurofins Scientific, NicheVision Forensics, LLC, MGI Tech Co., Ltd., and InnoGenomics Technologies.

The instruments segment dominated the market in 2024, driven by adoption of sequencing systems, PCR platforms and electrophoresis tools.

The PCR segment is projected to grow at the fastest CAGR, due to its ability to rapidly amplify small DNA samples at lower cost.