Forklift Market Size, Share, Trends & Industry Analysis Report

: By Class (Class 1, Class 2, Class 3, and Class 4/5), Power Source, and Region– Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 130

- Format: PDF

- Report ID: PM3197

- Base Year: 2024

- Historical Data: 2020-2023

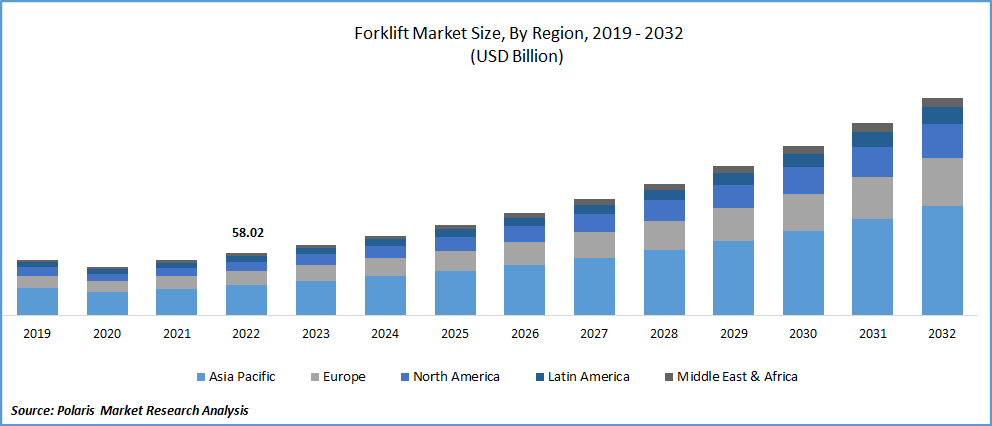

The forklift market size was valued at USD 72.06 billion in 2024, exhibiting a CAGR of 13.5% during 2025–2034. The forklift market is driven by growing e-commerce, warehouse automation, industrialization, construction activity, and demand for efficient material handling solutions across logistics, manufacturing, and retail sectors globally.

Market Overview:

Forklifts are industrial trucks that are used widely in construction and manufacturing because they lift heavy materials over short distances. They are extremely useful as they can stack organized goods that are usually placed on pallets. Forklifts are utilized in various environments including warehouses, factories, retail inventory stores, and supply depots due to their enhanced features such as spatial stacking and improved efficiency. The diverse properties of modern construction and industrial equipment mean that technology is rapidly being integrated with logistics and supply chains, and continuously improving efficiency is vital in modern automated systems.

One of the growth factors is the rapid development of e-commerce at the global level, requiring online retailers to have efficient warehousing and logistics systems for proper order fulfillment and distribution. In addition, increased industrial activity, together with expansion in construction works, increases the need for these utility trucks for transportation purposes. Enhanced standards, construction safety codes, construction equipment, and the need to improve emission levels from forklifts are changing the face. Electric-powered, automated, and even hydrogen fuel cell-powered forklifts are changing the outlook by improving efficiency and emissions, operational capabilities, and enhanced emission control.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics:

E-commerce Expansion and Logistics Growth

The sustained boom in e-commerce globally acts as a significant driver for the forklift market, necessitating increased warehousing and efficient logistical operations. As online retail continues its rapid penetration, the demand for sophisticated material handling solutions, including various types of forklifts, intensifies. For instance, US retail e-commerce sales reached $1.19 trillion in 2023, marking an 8.9% annual increase, according to the US Census Bureau (2024). This consistent upward trend in online purchasing directly correlates with the need for more warehouse space and the equipment required to manage vast inventories. Furthermore, employment in the warehousing and storage sector in the US has shown a notable increase, reaching 1,853.4 thousand employees in April 2025, as reported by the Bureau of Labor Statistics (2025). This expansion of storage and distribution networks globally fuels the demand for new and technologically advanced forklifts, significantly driving the forklift’s growth.

Rising Industrial Production and Manufacturing Activity

Global industrial production and manufacturing output serve as fundamental drivers for the forklift market, as these vehicles are indispensable for moving raw materials, work-in-progress, and finished goods within production facilities. An increase in manufacturing output directly translates to a higher demand for efficient material handling solutions to maintain production lines and manage factory logistics. The industrial production index in the US, for instance, was at 103.88 in April 2025, representing a 1.49% increase from one year prior, according to the Federal Reserve Board (2025). Such positive trends in industrial activity emphasize the continuous need for reliable and robust forklifts to support manufacturing processes. The ongoing development and optimization of global supply chains also contribute to this demand, as companies strive for greater efficiency in their production and distribution networks. This sustained growth in industrial output remains a core growth factor.

Infrastructure Development and Construction Activities

Significant investments in infrastructure development and an uptick in construction activities worldwide present another crucial driver. Modern construction projects, particularly large-scale public and private infrastructure initiatives, require heavy-duty construction equipment for lifting, moving, and placing materials on site. Forklifts, with their versatility and lifting capabilities, are vital in these demanding environments. In the US, construction spending reached an estimated seasonally adjusted annual rate of $2,192.2 billion in December 2024, showing a 4.3% increase from December 2023, as reported by the US Census Bureau (2025). This sustained investment in building and infrastructure projects, encompassing warehouses, factories, and commercial complexes, directly escalates the demand for material handling equipment. The ongoing expansion and modernization of infrastructure globally contribute significantly to the demand and long-term potential.

Segmental Insights:

Market Assessment By Class

Class 3, comprising electric motor hand or hand/rider trucks, holds the largest share due to its pervasive deployment across numerous sectors. These vehicles, commonly referred to as pallet jacks or walkie-riders, are important machinery for loading, unloading, and moving materials over short distances in a warehouse, retail store, or manufacturing plant. As a result, the broad reach of class 3 forklifts emphasizes their primary impact on the enhancement of logistical functions and the attainment of operational value throughout the supply chain.

Class 1 motorized vehicles, primarily electric counterbalance forklifts, are expected to witness the highest growth in the forklift market during the forecast period. This surge is driven by the global shift toward sustainable and eco-friendly solutions, with electric forklifts offering zero emissions, lower operating costs, and reduced noise levels. Additionally, advancements in battery technology, such as lithium-ion batteries, have significantly improved efficiency and reduced charging times. Increasing adoption in indoor applications like warehouses, logistics centers, and manufacturing facilities further fuels demand. Regulatory pressures and corporate sustainability goals also contribute to the preference for electric models over traditional internal combustion forklifts.

Market Evaluation By Power

The electric subsegment holds the highest share during the forecast period. An increasing global emphasis on sustainability and the reduction of carbon emissions across industrial operations drives this dominance. Electric forklifts offer significant environmental advantages, producing zero tailpipe emissions and considerably less noise, making them ideal for indoor environments like warehouses and manufacturing plants. Advances in battery technology, particularly the wider adoption of lithium-ion batteries, have enhanced their operational efficiency, offering longer run times and faster charging, thereby bolstering their demand and overall industry penetration.

The electric subsegment is also experiencing the highest growth rate during the forecast period. This robust growth is a direct result of stringent environmental regulations and corporate sustainability initiatives pushing businesses to transition from traditional fossil fuel-powered equipment. The lower operational costs associated with electric forklifts, stemming from reduced fuel expenses and maintenance requirements, also serve as a strong financial driver for their adoption. This shift, coupled with continuous technological development in electric vehicle components, is significantly accelerating the potential and development trajectory of electric forklifts across various applications.

Regional Analysis

The Asia Pacific forklift market consistently holds the largest share, primarily due to the region’s extensive manufacturing base in India and China, which requires significant volumes of material handling equipment for production and logistics. The rise of e-commerce in the Asia Pacific has led to the establishment of new warehouses and distribution centers, further increasing the demand for forklifts. Factors such as urbanization, increased investment in infrastructure, and supportive government policies on automation contribute to the size and ongoing development of the forklift market in this region.

Moreover, the Asia Pacific region market is also driven by sustained industrial and urban development in many emerging economies. Countries in the region are competing by modernizing their supply chains and implementing advanced material handling systems to enhance efficiency. The increasing use of electric forklifts and automated warehouses, prompted by environmental regulations, is another factor driving growth. Due to its vast size, development, and strong emphasis on technological advancement, the Asia Pacific region is expected to remain the center of market expansion and potential.

The North America forklift market represents a robust segment characterized by a mature yet consistently evolving demand outlook. The region's significant e-commerce infrastructure and comprehensive warehousing and logistics networks are primary drivers for the ongoing need for material handling equipment. There is a notable trend toward adopting advanced technologies, such as electric and automated forklifts, as companies prioritize operational efficiency, sustainability, and worker safety. Investments in modernizing existing facilities and developing new distribution hubs further enhance the steady growth and overall development of the forklift market in this region.

Key Players and Competitive Insights

The competitiveness within the forklift market is marked by new innovations, partnerships, and streamlining operations to improve efficiency and sustainability. In response to the demand for intelligent logistics and environmental responsibility, companies are investing in R&D to provide electric and automated forklift solutions. The competitive dynamics of the industry speed up technological advances, requiring companies to grow their offerings, services, and level of digitization, which now includes fleet and telematics management systems. Such activities intensify for companies to keep pace with the shift in global material handling equipment demand, seeking new opportunities to widen their market capture.

List of Key Companies:

- Anhui Heli Co., Ltd.

- CLARK Material Handling Company

- Crown Equipment Corporation

- Hangcha Group Co., Ltd.

- Hyster-Yale Materials Handling, Inc. (Hyster and Yale brands)

- Jungheinrich AG

- KION Group (Linde Material Handling, STILL, Baoli)

- Komatsu Ltd.

- Mitsubishi Logisnext (Mitsubishi Heavy Industries)

- Toyota Material Handling (Toyota Industries Corporation)

Industry Developments

- May 2025: Mitsubishi Logisnext Americas announced the completion of a major expansion at its Houston manufacturing campus, with the inauguration of a new 73,500-square-foot electrification fabrication facility.

- January 2025: Toyota Material Handling unveiled two new high-performance, eco-friendly forklift offerings: the Integrated Mid & Large Electric Pneumatic Forklifts and a refreshed Core Electric Forklift series.

Market Segmentation

By Class Outlook (Revenue – USD Billion, 2020–2034)

- Class 1

- Class 2

- Class 3

- Class 4/5

By Power Source Outlook (Revenue – USD Billion, 2020–2034)

- Internal Combustion Engine

- Electric

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 72.06 billion |

|

Market Size Value in 2025 |

USD 81.61 billion |

|

Revenue Forecast by 2034 |

USD 255.09 billion |

|

CAGR |

13.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 72.06 billion in 2024 and is projected to grow to USD 255.09 billion by 2034.

The market is projected to register a CAGR of 13.5% during the forecast period, 2024-2034.

Asia Pacific had the largest share of the market.

Key players include Toyota Material Handling (Toyota Industries Corporation), KION Group (Linde Material Handling, STILL, Baoli), Jungheinrich AG, Mitsubishi Logisnext (Mitsubishi Heavy Industries), Crown Equipment Corporation, Hyster-Yale Materials Handling, Inc. (Hyster and Yale brands), Anhui Heli Co., Ltd., Hangcha Group Co., Ltd., Komatsu Ltd., and CLARK Material Handling Company.

The class 3 segment accounted for the largest share of the market in 2024.

The following are some of the market trends: ? Automation and Robotics Integration: This involves the increasing adoption and integration of autonomous forklifts and AGVs with cobots and other forms of automation into various manufacturing and warehousing processes for enhanced productivity and improved safety. ? IoT and Connected Systems: IoT devices and telematics integration for monitoring forklift performance in real-time, fleet maintenance, fleet optimization, and data-driven decision-making analysis.

A piece of industrial power equipment commonly known as a forklift truck is used for lifting and transporting materials over short distances. It has a set of steel forks mounted on a hydraulic lift that can be raised or lowered to stack heavy loads that are placed on pallets. This type of machine is widely used worldwide for material handling in a variety of industries, including warehousing and manufacturing, alongside distribution centers and construction sites. Moreover, forklifts enhance logistical and supply chain processes by permitting the fast and safe movement of goods.