Fortified Salts Market Share, Size, Trends, Industry Analysis Report

By Product (Iodine, Iron, Double Fortified); By Application; By Distribution Channel; By Region; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 119

- Format: PDF

- Report ID: PM4316

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

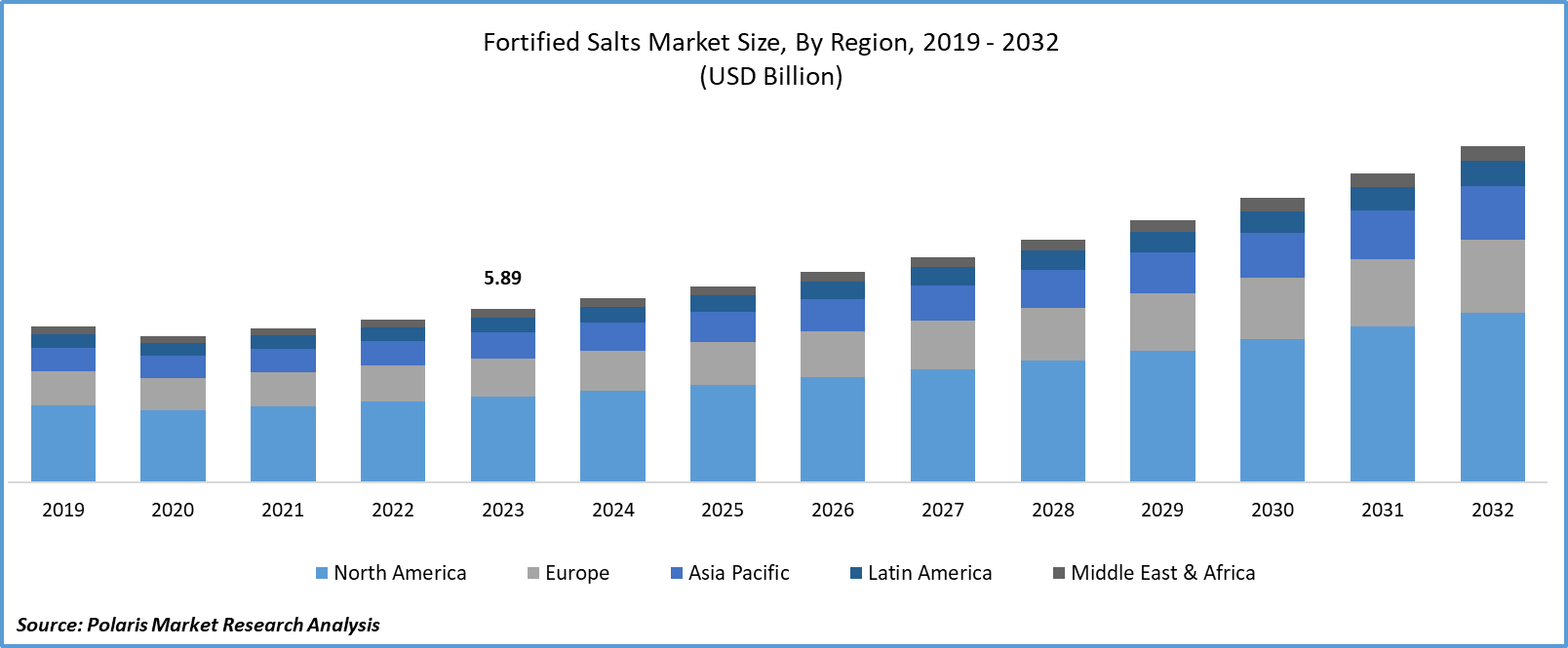

The global fortified salts market size and share was valued at USD 5.89 billion in 2023 and is expected to grow at a CAGR of 7.8% during the forecast period.

Fortified salts are gaining traction nowadays, primarily attributable to the rising anemia and iodine deficiency among the population, specifically women. Iron deficiency is one of the most prevalent nutritional deficiencies, affecting around 5 billion people globally. The increasing research activities on fortification are creating awareness among the population about its benefits and importance. A study addressed the issue of iron deficiency anemia through iron water fortification. The rising demand for fortification in various disciplines is driving the demand and growth of fortification salts, driven by rising consumer acceptance of fortification.

- For instance, in January 2023, a study published in PubMed Central surveyed the consumer acceptability of fortified salts in Tanzania. The results showcased equalized acceptance of quadruple-fortified salts and double-fortified salts and pertained to similar sensory scores compared to standard iodized salt.

Moreover, the growing government initiatives to promote health and wellness among its population are propelling the growth of the global market. The Indian government initiated the supply of double-fortified salts in the public distribution systems with a view to promoting the availability of fortified salts to a wider consumer base at subsidized prices.

To Understand More About this Research: Request a Free Sample Report

However, the lower awareness about fortified salts, along with the prevalence of iron and iodine supplement intake among the population, may hinder the demand for fortified salts in the next few years.

Industry Dynamics

Growth Drivers

Rising Importance of Iodine and Iron Among the Consumers

Growing anemia disorders among females are a rising concern for governments. Females at reproductive age require higher amounts of iron and iodine for healthy maternal and fetal outcomes. According to a study, iron and iodine deficiency among pregnant women may affect infant growth and development. Iodized salt and iron supplements showed a positive impact on thyroid status among newborns and mothers in the study.

Furthermore, according to a study published in Lancet Hematology conducted by the Institute for Health Metrics and Evaluation (IHME) and its Global Burden of Disease anemia collaborators, the dietary deficiency of iron will constitute 66.2% of the total anemia cases in 2021, while 825 million women and 444 million men will be affected globally. This demonstrates that rising anemia cases are highly influenced by the lower intake of iron in food. The rising awareness and importance of micronutrients, including iron and iodine, will strengthen the growth of the market.

Report Segmentation

The market is primarily segmented based on product, application, distribution channel, and region.

|

By Product |

By Application |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

Double Fortified Segment is Expected to Witness the Highest Growth During the Forecast Period

The double-fortified segment is expected to grow rapidly, mainly driven by its ability to stabilize iodine and iron. It was developed by Ember India's National Institute of Nutrition (NIN) to tackle ongoing health issues related to the lower intake of iodine and iron. Double-fortified salts are expected to provide 100% of daily dietary iodine, which constitutes 30–60% of the daily dietary iron requirement. This is enforcing government agencies to formulate suitable policies to increase the availability and acceptance of double-fortified salts among their citizens, driving the growth of the market in the coming years.

By Application Analysis

Hospitality & Service Industry Segment Accounted for the Largest Market Share in 2022

The hospitality & service segment held the largest share. The increasing concerns about ingredient quality among the population are forcing restaurants and hotels to incorporate healthy and quality ingredients in making various dishes and recipes. This trend is likely to stimulate the use of fortified salts in the food industry, as it is healthy and adds additional nutrition to consumers.

The household segment will grow rapidly, owing to a rapid increase in awareness programs about the health benefits associated with fortified salts by government agencies. The increasing anemia cases are contributing to the adoption of fortified salts by households. Furthermore, the use of fortified salts in animal feedstock is gaining importance due to the outbreak of cattle diseases, driving the growth of the global market.

By Distribution Channel Analysis

Online Stores Segment Held a Significant Market Revenue Share in 2022

The online stores segment garnered the largest share due to the development of specialized online stores. The evolution of specialized online stores, particularly for grocery items, is contributing to the expansion of the global market. For instance, Zepto and Big Basket provide grocery items through their online e-commerce portals. These companies are enabling consumers to access a wide range of grocery items, including fortified salts, by various brands, enforcing convenience among the people to place an order with one click and reducing transaction costs.

Regional Insights

Asia Pacific Region Registered the Largest Share in the Global Market in 2022

The Asia Pacific region held the global market with the largest market share in 2022 and is expected to continue its dominance over the study period. The lower presence of iodine in soil among the countries in this region, primarily India, is leading to lower levels of iodine in their diets, necessitating the need for fortified salts. According to the 5th National Family Health Survey (2019–21), 58.4% of children (6–59 months) and 53.1% of women of reproductive age are anemic. This is one of the rising health concerns in the country, as the nation's largest number of children are born at risk of iron deficiency disorder. 92% of the population in India consumes iodized salt currently. This trend is expected to continue in the coming years, driven by the growing adoption of fortified salts in the region.

The North America region will grow at a healthy CAGR due to the rising demand for healthy food additives. The prevalence of fortified salts in the region is expected to witness a rapid surge in the coming years, attributable to the rising micronutrient deficiency. Furthermore, 90% of the population in the US has access to iodized salt, considering this region is self-sufficient in iodine concentration.

Key Market Players & Competitive Insights

The fortified salts market is expected to witness competition in the marketplace driven by rising demand for fortified salts. This is forcing companies to increase their production and gain a competitive edge over others through collaborations and partnerships. For instance, Hindustan Salts and the National Federation of Farmers' Procurement (NACOF) entered a partnership in association with RKJ Agro and Foods with the aim of improving the availability of high-quality salt to the residents of Uttar Pradesh.

Some of the major players operating in the global market include:

- Ahir Salt Industry

- AkzoNobel

- Ankur Salt

- Cargill

- China National Salt Industry

- Compass Minerals

- Kutch Brine Chem Industries

- Sambhar Salt

- Schweizer Salinen

- Tata Chemicals

- United Salt Corporation

- Windsor Salt

Recent Developments

- In April 2022, a study published in PubMed Central focused on finding the effectiveness of double fortified salts compared to iodized salt by measuring the level of iron and iodine among all age groups. The random control treatment revealed that double fortified salts are capable of slightly improving hemoglobin concentration compared to iodized salt.

Fortified Salts Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 6.26 billion |

|

Revenue Forecast in 2032 |

USD 11.45 billion |

|

CAGR |

7.8% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product, By Application, By Distribution Channel, By Region |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Explore the landscape of fortified salts in 2024 through detailed market share, size, and revenue growth rate statistics meticulously organized by Polaris Market Research Industry Reports. This expansive analysis goes beyond the present, offering a forward-looking market forecast till 2032, coupled with a perceptive historical overview. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

FAQ's

key companies in Fortified Salts Market are Ahir Salt Industry, AkzoNobel, Ankur Salt, Cargill, Compass Minerals

The global fortified salts market is expected to grow at a CAGR of 7.8% during the forecast period.

The Fortified Salts Market report covering key segments are product, application, distribution channel, and region.

key driving factors in Fortified Salts Market are Rising importance of iodine and iron among the consumers

The global fortified salts market size is expected to reach USD 11.45 billion by 2032