Functional Bakery Ingredients Market Size, Share, Trends, & Industry Analysis Report

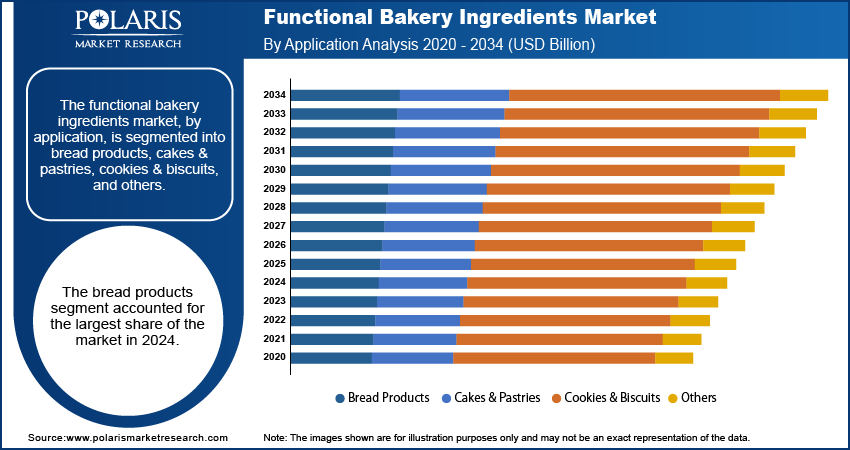

By Application (Bread Products, Cakes & Pastries, Cookies & Biscuits, and Others), By Ingredients, By Functionality, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 130

- Format: PDF

- Report ID: PM5786

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

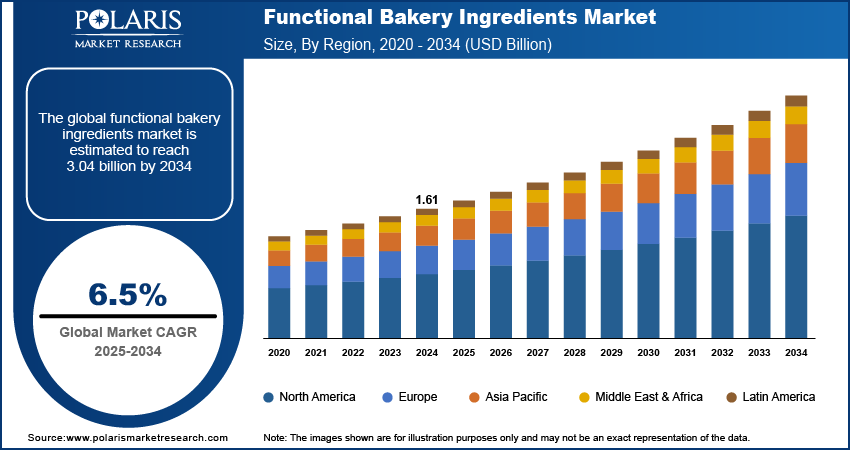

The global functional bakery ingredients market size was valued at USD 1.61 billion in 2024, growing at a CAGR of 6.5% during 2025–2034. The demand for functional bakery ingredients is largely driven by a growing interest in health and wellness, as consumers seek products with added nutritional benefits such as fiber or protein. Another key driver is the increasing occurrence of food allergies and dietary restrictions, which boosts the demand for gluten-free and dairy-free options.

The functional bakery ingredients are added to baked goods to provide health benefits beyond basic nutrition or to improve the texture, shelf life, or processing qualities of the bakery items. These ingredients contain fibers, proteins, enzymes, emulsifiers, and fortifying agents.

One major driver for the functional bakery ingredients market growth is the increasing consumer focus on health and wellness. Consumers are becoming more aware of the link between diet and overall well-being, leading them to seek food products that offer additional nutritional advantages or address specific health concerns. This increases demand for bakery items enriched with vitamins, minerals, high proteins, and dietary fiber.

Another important driver is the rising preference for clean-label products. Consumers are increasingly seeking food items with simple, recognizable ingredients and fewer artificial additives. This trend encourages bakery contract manufacturers to use naturally derived functional ingredients and more transparent labeling, which impacts the types of ingredients being developed and adopted in the industry.

The increasing incidence of food allergies and intolerances globally has led to a substantial demand for "free-from" bakery products, particularly those that are gluten-free, dairy-free, or allergen-free. For instance, numerous studies highlight the prevalence of conditions such as celiac disease and lactose intolerance, which necessitate the consumption of specialized dietary products. This drives the use of alternative flours such as rice, almond, or tapioca, milk substitutes such as plant-based milk, specialized binders, and dough conditioners to achieve desirable textures in these alternative baked goods.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics

Increasing Consumer Focus on Health and Wellness

The growing awareness among consumers regarding the direct link between diet and health drives the demand for functional bakery ingredients. As people become more proactive about their well-being, they seek food products that offer more than basic sustenance. This demand extends to baked goods, where consumers seek added benefits such as improved digestive health, enhanced immunity, and specific nutrient fortification. This driver is pushing bakers to incorporate prebiotics, probiotics, omega-3 fatty acids, and various vitamins and minerals into their products to cater to these evolving preferences.

A study titled "Habits, Health and Environment in the Purchase of Bakery Products: Consumption Preferences and Sustainable Inclinations before and during COVID-19," published in PubMed in April 2023, highlighted that health and the environment significantly influence consumer attitudes and intentions to purchase safe and environmentally friendly bakery products. This indicates a clear consumer shift toward bakery premixes and items that taste good and contribute positively to their health. This strong consumer demand for healthier options is significantly driving the growth.

Rising Incidence of Food Allergies and Intolerances

The increasing prevalence of food allergies and intolerances worldwide boosts the demand for functional bakery ingredients. Conditions such as celiac disease, lactose intolerance, and various nut allergies necessitate the development of specialized baked goods that do not contain allergens. This creates a significant need for alternative flours, binders, and other ingredients replicating traditional components' texture, taste, and functionality without triggering adverse reactions. Manufacturers are innovating to provide high-quality gluten-free, dairy-free, and other allergen-friendly options.

Data from the Centers for Disease Control and Prevention (CDC) in their "Diagnosed Allergic Conditions Among Adults, United States, 2021" and "Diagnosed Allergic Conditions Among Children Aged 0–17 Years: United States, 2021" reports, released in January 2023, indicate that nearly 1 in 3 US adults and more than 1 in 4 US children reported having a seasonal allergy, eczema, or food allergy in 2021. Specifically, almost 6% of US adults and children have a food allergy. This widespread prevalence of allergies and intolerances creates a substantial demand for bakery products catering to these dietary restrictions, thereby strongly driving the growth.

Segmental Insights

By Application

The bread products segment held the largest share of approximately 37% of the overall market in 2024, as bread is a staple food in diets across the globe, making it an ideal food for delivering added health benefits to a wide consumer base. As consumers increasingly seek healthier versions of everyday foods, fortifying bread with ingredients such as extra fiber, protein, and ancient grains becomes highly attractive. This includes a rise in demand for whole grain and multi-grain breads and those fortified with specific nutrients.

The cookies and biscuits segment is experiencing a notably high growth rate. This surge in demand is fueled by the consumer trend of seeking "indulgence with health benefits." As lifestyles become busier, there is a growing preference for convenient, on-the-go snacks that still offer some nutritional value. This has led manufacturers to innovate with cookies and biscuits that are fortified, low in sugar, gluten-free, or incorporate plant-based ingredients, appealing to health-conscious consumers who do not want to compromise on taste and convenience.

By Ingredients

The enrichments segment held the largest share of the overall market in 2024. This segment includes vitamins, minerals, and other fortifying agents added to baked goods to boost their nutritional profile. As consumers become more health-conscious and seek out products that offer additional dietary benefits, the demand for enriched bakery items, such as fortified bread and cereals, continues to grow. This widespread interest in enhancing the nutritional value of staple foods ensures the dominance of enrichments.

The dough conditioners segment is poised for significant growth. These ingredients, which include various enzymes and emulsifiers, are crucial for improving the texture, volume, and shelf life of baked products, particularly in large-scale industrial baking. As the demand for consistent quality, extended freshness, and efficient production processes rises, especially in ready-to-eat and packaged bakery goods, the importance of dough conditioners becomes increasingly apparent. Innovations in clean-label and natural dough conditioners are further driving this growth.

By Functionality

The nutritional fortification segment holds the largest share of the market in 2024. This is driven by a pervasive consumer desire for healthier food beyond basic sustenance. Consumers are increasingly conscious of their dietary intake and actively seek out baked goods that offer added vitamins, minerals, fiber, protein, or other beneficial compounds. This widespread focus on preventive health and wellness makes fortification a critical aspect for many bakery products.

The shelf-life extension segment is witnessing robust growth, owing to the increasing demand for convenience foods and the need to reduce food waste across the supply chain. Ingredients that can keep baked goods fresh, soft, and free from microbial spoilage for longer periods are highly valued by manufacturers and consumers alike. This includes using anti-staling enzymes, natural preservatives, and moisture-retaining agents.

Regional Analysis

The North America functional bakery ingredients market accounted for 31% of the global market share in 2024, due to a strong consumer drive toward health and wellness. There is a growing preference for baked goods that offer additional benefits, such as higher fiber content, reduced sugar, and vitamins and minerals. This trend is further amplified by the rising prevalence of food allergies and dietary restrictions, particularly gluten sensitivity, which fuels the demand for specialized ingredients to create gluten-free and other "free-from" bakery items. The region's aging population also contributes to this demand, as older adults often seek foods that support healthy aging.

US Functional Bakery Ingredients Market Insight

The US market for functional bakery ingredients in North America witnesses rapid growth due to its high consumer awareness regarding specific health concerns such as obesity and diabetes. This heightened focus leads to a strong demand for products with functional benefits, including those with reduced sugar, increased protein, and added fiber. The emphasis on "clean label" products and the preference for natural and plant-based ingredients also significantly shape the dynamics in the US, driving innovation in ingredient formulation and product development to meet these evolving consumer preferences.

Europe Functional Bakery Ingredients Market

Europe represents a mature and significant region for functional bakery ingredients, characterized by a strong consumer inclination toward healthy eating, sustainability, and transparency in food production. The region's consumers are highly discerning, seeking bakery products that offer nutritional fortification and align with ethical and environmental considerations. This drives the demand for organic, non-GMO, and sustainably sourced functional ingredients, fostering innovation in clean-label solutions and natural preservatives.

In Europe, the Germany functional bakery ingredients market is positively influenced by a strong emphasis on locally sourced, organic, and allergen-free ingredients, reflecting a deep consumer preference for transparency and health-conscious choices. There is also a notable trend toward advanced ingredient technologies, such as encapsulation, which improve the stability and delivery of functional components in baked goods, further enhancing product quality and shelf life.

Asia Pacific Functional Bakery Ingredients Market Overview

The Asia Pacific market is experiencing rapid growth, primarily due to increasing urbanization, changing dietary habits, and rising disposable incomes. As Western dietary patterns become more prevalent, there is a growing appetite for processed and packaged bakery products. This, combined with increasing health awareness, fuels the demand for functional ingredients that can provide nutritional enhancement, improve texture, and extend the shelf life of these convenient bakery items. As a major Asian Pacific economy, China is a significant driver of this regional growth. The large population and rapidly expanding middle class in China are increasingly adopting westernized food habits, leading to a surge in demand for various bakery products. This burgeoning consumption and a rising awareness of health benefits translate into a growing need for functional ingredients to enhance local bakery offerings' nutritional value and sensory appeal.

Key Players and Competitive Insights

The competitive landscape is dynamic, characterized by continuous innovation and strategic collaborations. Companies are focused on developing novel ingredients that address evolving consumer preferences for health, wellness, and convenience while improving baking processing efficiency and product quality. This involves significant investments in research and development to create solutions that meet diverse functional requirements, from enhancing nutritional profiles to extending shelf life and improving texture in a wide range of baked goods.

A few prominent companies in the functional bakery ingredients market are Cargill, Incorporated; Archer Daniels Midland Company (ADM); Kerry Group plc; Ingredion Incorporated; Royal DSM N.V.; Corbion; Lesaffre; AAK AB; Puratos; AB Mauri (Associated British Foods plc); and Tate & Lyle PLC.

Key Players

- AAK AB

- AB Mauri (Associated British Foods plc)

- Archer Daniels Midland Company (ADM)

- Cargill, Incorporated

- Corbion

- DSM-Firmenich (formerly Royal DSM N.V.)

- Ingredion Incorporated

- Kerry Group plc

- Lesaffre

- Puratos

- Tate & Lyle PLC

Industry Developments

October 2024: Crespel & Deiters Group, a company specializing in wheat ingredients, revealed a new method to boost the nutritional value of baked goods such as pizza and pasta. They launched Lory Starch Elara, a special wheat starch that adds fiber and cuts down on carbohydrates in items such as burger buns and cookies.

May 2024: ADM introduced a new online store called ADMbuydirect.com. This website makes it easier and more convenient for food producers across the US to buy essential ingredients.

Functional Bakery Ingredients Market Segmentation

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Bread Products

- Cakes & Pastries

- Cookies & Biscuits

- Others

By Ingredients Outlook (Revenue – USD Billion, 2020–2034)

- Encapsulates

- Dough Conditioners

- Enrichments

- Delivery Systems

- Tablets

- Others

By Functionality Outlook (Revenue – USD Billion, 2020–2034)

- Texture & Dough Improvement

- Nutritional Fortification

- Shelf-Life Extension

- Flavor & Aroma Enhancement

- Color Enhancement

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Netherlands

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Malaysia

- Latin America

- Argentina

- Brazil

- Mexico

- Middle East & Africa

- UAE

- Saudi Arabia

- Israel

- South Africa

Functional Bakery Ingredients Market Report Scope:

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.61 billion |

|

Market Size in 2025 |

USD 1.72 billion |

|

Revenue Forecast by 2034 |

USD 3.04 billion |

|

CAGR |

6.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Customize your report according to your countries, regions, and segmentation requirements. |

FAQ's

The global market size was valued at USD 1.61 billion in 2024 and is projected to grow to USD 3.04 billion by 2034.

The global market is projected to register a CAGR of 6.5% during the forecast period.

North America dominated the market share in 2024.

A few key players in the market are Cargill, Incorporated; Archer Daniels Midland Company (ADM); Kerry Group plc; Ingredion Incorporated; Royal DSM N.V.; Corbion; Lesaffre; AAK AB; Puratos; AB Mauri (Associated British Foods plc); and Tate & Lyle PLC.

The bread products segment accounted for the largest share of the market in 2024.

The cookies and biscuits segment is expected to grow fastest during the forecast period.