Gas Insulated Switchgear Market Share, Size, Trends & Industry Analysis Report

By Configuration; By Installations (Indoor, And Outdoor); By End-Use; By Insulation; By Region; Segment Forecast, 2025 - 2034

- Published Date:Jun-2025

- Pages: 112

- Format: PDF

- Report ID: PM2726

- Base Year: 2024

- Historical Data: 2020-2023

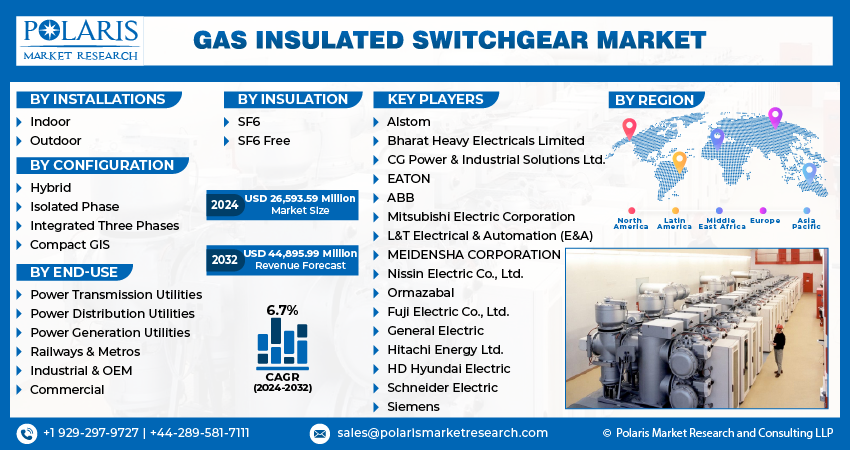

The global Gas Insulated Switchgear Market was valued at USD 30.1 billion in 2024 and is expected to grow at a CAGR of 9.90% from 2025 to 2034. Urbanization, space constraints, and the demand for efficient electrical distribution systems are driving growth in compact switchgear technologies.

Industry Trend

Gas Insulated Switchgear (GIS) has several advantages in power distribution and transmission applications, as discussed in the previous paragraph. However, like any technology, GIS also has certain limitations or restraints that need to be considered in its deployment.

To Understand More About this Research:Request a Free Sample Report

One of the main restraints of GIS is its initial cost. GIS is generally more expensive than traditional air-insulated switchgear (AIS) due to its complex design, specialized components, and the use of SF6 gas as the insulating medium. The manufacturing and installation processes of GIS require careful handling of SF6 gas, which is a potent greenhouse gas with a high global warming potential. This adds to the cost of GIS as well as the environmental considerations associated with the use of SF6 gas.

Maintenance and servicing of GIS can also be more complex and costly compared to AIS. The sealed metal-enclosed design of GIS requires specialized equipment and trained personnel for maintenance and repair tasks. Additionally, the handling and disposal of SF6 gas during maintenance or end-of-life decommissioning require careful adherence to environmental regulations and best practices. This adds to the operational and maintenance costs of GIS.

Another restraint of GIS is its size and weight. While the compact design of GIS is advantageous in terms of space-saving, it can also pose challenges in terms of transportation and installation. GIS equipment can be heavy and bulky, requiring specialized handling and transportation arrangements. The installation process may also require additional time and effort due to the complexity of the equipment, which can result in increased installation costs and delays in project timelines.

The availability of skilled personnel for the operation and maintenance of GIS can also be a constraint. GIS requires specialized knowledge and training to operate and maintain, and there may be a shortage of skilled personnel with expertise in GIS technology, especially in remote or less-developed areas. This can impact the efficient operation and maintenance of GIS installations and may require additional training or outsourcing of maintenance tasks, adding to the overall operational costs.

Additionally, the environmental concerns associated with the use of SF6 gas in GIS can pose a restraint. SF6 gas is a potent greenhouse gas with a high global warming potential, and its release into the atmosphere can contribute to climate change. Therefore, the handling, management, and disposal of SF6 gas during the lifecycle of GIS installations require careful adherence to environmental regulations and best practices, which can add to the operational complexities and costs.

In conclusion, while GIS offers several advantages in power distribution and transmission applications, it also has certain restraints that need to be considered. These include the initial cost, maintenance and servicing complexities, size and weight challenges, availability of skilled personnel, and environmental concerns associated with the use of SF6 gas. Proper planning, adherence to regulations, and proactive measures to address these restraints can help ensure the efficient and sustainable operation of GIS installations.

Key player handling the global market of Gas Insulated Switchgear which may include ABB, Alstom, Bharat Heavy Electricals Limited, CG Power, Eaton Corporation, Fuji Electric, General Electric Company, Hitachi, Hyosung, Hyundai Electric & Energy Systems Co., Ltd., Larsen & Turbo, Meidensha, Mitsubishi Electric, Nisin Electric, Ormazabal, Schneider Electric, Siemens, and Toshiba Energy Systems & Solutions Corporation.

Key Takeaway

- Asia Pacific dominated the largest market and contributed to more than 38% of the share in 2023.

- The North America market is expected to be the fastest-growing CAGR during the forecast period.

- By installations category, the outdoor segment accounted for the largest market share in 2024.

- By end-use category, the power distribution utilities segment is projected to grow at a high CAGR during the projected period.

What are the market drivers driving the demand for the gas insulated switchgear market?

Increasing demand for energy in power industries

Government initiatives to innovate smart grid infrastructure

In recent years, there has been a growing interest in developing innovative smart grid infrastructure to improve the efficiency, reliability, and sustainability of the energy sector. GIS technology is being increasingly adopted in various applications, including power generation, transmission, and distribution, as well as industrial and commercial sectors.

The global GIS market is expected to grow at a steady pace in the coming years, driven by increasing investments in renewable energy, growing demand for electricity, and governmental initiatives to improve grid infrastructure. Technological advancements in GIS, such as digitalization, automation, and integration with other smart grid components, are also expected to drive market growth. Governments around the world are taking initiatives to encourage the adoption of smart grid infrastructure, including GIS technology. For example, the US government has launched several initiatives, such as the Smart Grid Investment Grant Program and the Grid Modernization Initiative, to support the development of advanced grid technologies. Similarly, the European Union has set ambitious targets for the integration of renewable energy sources into the grid and is investing in smart grid infrastructure to support these goals.

In addition to governmental initiatives, technological advancements are also driving the growth of the gas insulated switchgear market. For instance, the integration of GIS with digitalization technologies such as the Internet of Things (IoT) and artificial intelligence (AI) is enabling advanced monitoring, control, and optimization of the grid infrastructure. GIS is also being integrated with renewable energy sources such as solar and wind power to enable efficient and reliable power distribution.

Which factor is restraining the demand for gas insulated switchgear?

High capital expenditure.

One major challenge the Gas Insulated Switchgear (GIS) market faces is high capital expenditure. The initial investment required for installing GIS is increased, which makes it difficult for small and medium-sized companies to invest in this technology. It limits the market to larger companies that can afford the high capital expenditure, reducing the potential market size.

The high capital expenditure is mainly due to the high cost of GIS equipment and installation, which is significantly higher than traditional air-insulated switchgear (AIS). GIS technology uses advanced materials and components, such as SF6 gas, which are expensive and require specialized manufacturing processes. Additionally, the installation process for GIS is complex and requires skilled labor, which adds to the cost. GIS manufacturers are exploring different strategies to reduce the capital expenditure for GIS installations to address this challenge. One approach is to optimize the design of GIS equipment to reduce the amount of material required and simplify the installation process. For example, some manufacturers are developing compact GIS equipment that requires less space and reduces installation time and cost. Another approach is to explore new business models that can reduce the initial investment required for GIS installations. For example, some GIS manufacturers offer leasing and rental options, where customers can lease or rent GIS equipment instead of purchasing it outright. This approach can help reduce customers' initial capital expenditure and make GIS technology more accessible to smaller companies. Overall, the high capital expenditure is a significant challenge for the GIS market, but GIS manufacturers are exploring different strategies to address this challenge and make GIS technology more accessible and affordable for a wider range of customers.

Report Segmentation

The market is primarily segmented based on installations, configuration, end-use, insulation and region.

|

By Installations |

By Configuration |

By End-Use |

By Insulation |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Installations Insights

Based on installations analysis, the market is segmented on the indoor, and outdoor. Outdoor held the largest market share in 2023. Outdoor GIS refers to gas insulated switchgear specifically designed to be used outdoors. It is often used in substations, where it is exposed to the elements and must withstand extreme weather conditions such as high winds, rain, snow, and ice. Outdoor applications utilize outdoor aisle-less or sheltered-aisle type enclosures designed following IEEE C37.20.2 or employ custom-designed electro-center (e-house).

One of the main advantages of outdoor GIS is its compact size. Because it is designed to be installed outdoors, it can be built to take up less space than traditional switchgear, which can be particularly useful in areas where space is limited.

Another advantage of outdoor GIS is its durability. Because it is designed to withstand harsh outdoor environments, it is typically built with materials resistant to corrosion, rust, and other forms of weathering. It makes it a reliable choice for power transmission and distribution in areas where weather conditions can be extreme. It is a reliable and efficient type of switchgear that can be used in various outdoor environments.

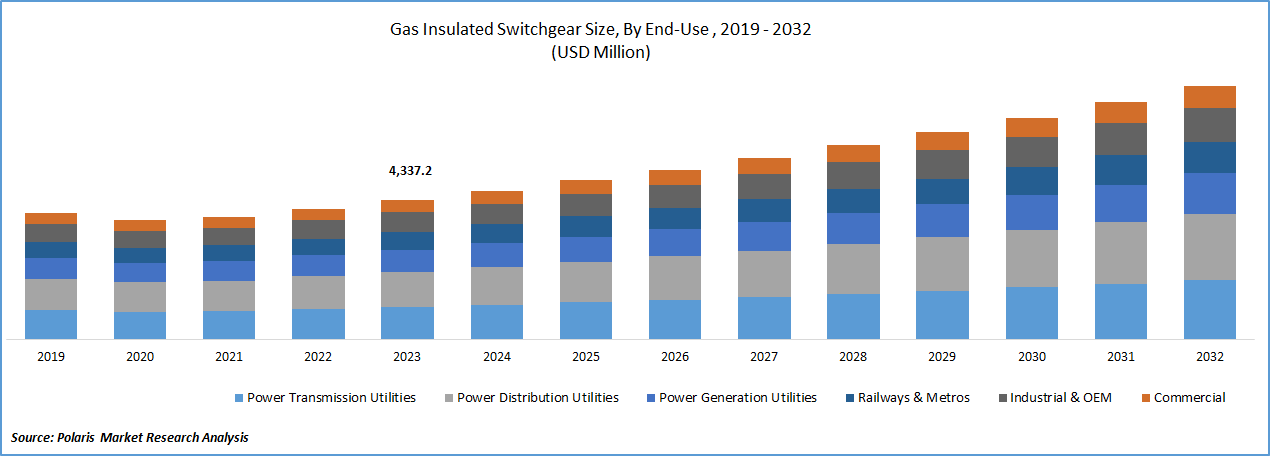

By End-Use Insights

Based on end-use analysis, the market has been segmented on the basis of power transmission utilities, power distribution utilities, power generation utilities, railways & metros, industrial & OEM, Commercial. The power distribution utilities segment expected to be the fastest growing CAGR during the forecast period. Power distribution utilities are responsible for meeting the electricity demand from various sources, including renewable and non-renewable sources. Additionally, developing economies are working towards achieving 100% electrification, which requires expanding the existing infrastructure. These factors are expected to drive the growth of power distribution utilities.

In power distribution utilities, switchgear panels are modular units that can be combined to form a complete switchgear. They typically include circuit breakers, busbars, disconnect switches, and other components necessary for switching and protection. Transformers are used to lower the voltage from the distribution level (usually 11kV or 33kV) to the customer level (typically 415V or 240V).

Ring Main Units (RMUs) are compact units that house switchgear components such as busbars, circuit breakers, disconnect switches, and other protection and control equipment in a single enclosure. RMUs are commonly used in urban areas where space is limited. For instance, Tata Power installed an 11kV RMU in Mumbai, India, which distributes electrical power to residential and commercial customers. The RMU is compact and has a small footprint, making it ideal for densely populated areas. Using SF6 as the insulating medium ensures high reliability and minimal maintenance requirements, and the RMU also has advanced protection and control equipment to ensure safe and reliable operation.

Regional Insights

Asia Pacific

Asia Pacific region accounted to be the largest market share in 2023. The Asia Pacific (APAC) region, including countries such as Japan, China, India, Malaysia, Indonesia, South Korea, and others, is witnessing significant growth in the market for gas insulated switchgear (GIS). GIS is a type of high-voltage switchgear that is compact, reliable, and environmentally friendly, making it an attractive choice for power distribution and transmission applications in the region.

Advancements in GIS technology are driving the growth of the market in the APAC region. Companies are investing in research and development to improve the performance and efficiency of GIS, including advancements in insulation materials, circuit breakers, and monitoring and control systems. These advancements are enhancing the safety, reliability, and environmental sustainability of GIS, which is contributing to the growing adoption of this technology in the APAC region.

Companies operating in the APAC region are also experiencing significant growth in their GIS business. Major players in the industry are expanding their production capacities, investing in new facilities, and establishing strategic partnerships to cater to the increasing demand for GIS in the region. These companies are leveraging their technical expertise, manufacturing capabilities, and market presence to capitalize on the opportunities offered by the growing demand for reliable and efficient power distribution and transmission solutions in the APAC region.

The investment outlook for GIS in the APAC region is optimistic. Governments in countries such as China, India, and South Korea are investing heavily in power infrastructure development to meet the increasing electricity demand driven by economic growth, urbanization, and industrialization. This includes investments in high-voltage GIS for efficient power transmission and distribution.

In China, for instance, the government's focus on renewable energy and grid modernization is expected to drive the demand for GIS in the coming years. India is also witnessing significant growth in the adoption of GIS, driven by investments in smart grid projects, renewable energy integration, and industrialization. Other countries in the APAC region, such as Malaysia, Indonesia, and South Korea, are also investing in GIS to modernize their power infrastructure and ensure reliable and efficient electricity supply.

North America

North America is expected for the growth of fastest CAGR during the forecast period. The gas insulated switchgear (GIS) industry in North America was experiencing slow growth, fueled by rising demand for reliable and effective power transmission and distribution infrastructure. United States is the largest market for GIS in North America, followed by Mexico & Canada. Some of the major players in the North American GIS market are General Electric Company, Siemens AG, ABB Ltd. and Schneider Electric SE.

One of the key drivers of the GIS market in North America was the aging infrastructure in the region, that required upgrading and replacement with modern and more efficient equipment. Additionally, rising investments in renewable energy projects including wind and solar power, were also fueling demand for GIS as a means of transmitting and distributing electricity from these sources. Establishing an electric substation at the load center is essential. Since installing a substation in the load center is both cost-effective and beneficial in many ways.

Competitive Landscape

In the realm of gas insulated switchgear (GIS), competition is fierce and dynamic, reflecting the industry's ongoing evolution and technological advancements. Major players like ABB, Siemens, Schneider Electric, and General Electric dominate the market, leveraging their extensive experience, global presence, and diverse product portfolios to maintain competitive edges. These industry giants continually invest in research and development to enhance the efficiency, reliability, and sustainability of their GIS solutions, catering to the evolving needs of utilities, industries, and infrastructure projects worldwide. Moreover, emerging players and regional manufacturers are making significant strides, introducing innovative technologies and cost-effective alternatives to challenge the established market leaders.

Some of the major players operating in the global market include:

- Alstom

- Bharat Heavy Electricals Limited

- CG Power & Industrial Solutions Ltd.

- EATON

- ABB

- Mitsubishi Electric Corporation

- L&T Electrical & Automation (E&A)

- MEIDENSHA CORPORATION

- Nissin Electric Co., Ltd.

- Ormazabal

- Fuji Electric Co., Ltd.

- General Electric

- Hitachi Energy Ltd.

- HD Hyundai Electric

- Schneider Electric

- Siemens

Recent Developments

· In May 2025, Hitachi Energy announced it will deliver the world’s first SF6-free 550 kV gas-insulated switchgear to China’s State Grid, cutting greenhouse gas emissions and promoting sustainable, reliable power grid solutions.

· In February 2023, ABB India has inaugurated its new factory in Nashik, India, to double its gas-insulated switchgear capacity, which manufactures primary and secondary GIS.

· In November 2022, Hitachi has announced the launch of a ground-breaking technology that eliminates sulfur hexafluoride (SF6) with reliable and scalable solutions, resulting in the world's first sulfur hexafluoride (SF6)-free 420-kilovolt (kV) gas-insulated switchgear (GIS). This switchgear technology promises the lowest carbon footprint achievable.

· In September 2022, ABB has invested $13 Billion in its installation products division Iberville manufacturing unit to increase production capacity and established an R&D facility in Canada.

· In September 2022, Hitachi Energy and Linxon have teamed up to bolster the London Power Tunnels (LPT), a critical power infrastructure project to provide a dependable and sustainable electricity supply to England's capital city. As part of their effort to help National Grid expedite its net-zero objectives, Hitachi Energy will supply EconiQ 420-kilovolt (kV) gas-insulated switchgear (GIS) and gas-insulated lines (GIL) that are free of sulfur hexafluoride (SF6).

Report Coverage

The gas insulated switchgear report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, installations, configuration, end-use, insulation, and their futuristic growth opportunities.

Gas Insulated Switchgear Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 33.1 Billion |

|

Revenue forecast in 2034 |

USD 65.2 Billion |

|

CAGR |

9.90% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Installations, By Configuration, By End-Use, By Insulation And By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

Gas Insulated Switchgear Market Size Worth $ 65.2 Billion by 2034

Top market players in the Gas Insulated Switchgear Market are Alstom, Bharat Heavy Electricals Limited, CG Power & Industrial Solutions Ltd., EATON, ABB

Asia Pacific contribute notably towards the global Gas Insulated Switchgear Market.

The gas insulated switchgear market exhibiting a CAGR of 9.90% during the forecast period

The Gas Insulated Switchgear Market report covering key are installations, configuration, end-use, insulation and region.