Gas Separation Membrane Market Size, Share, & Industry Analysis Report

: By Material (Cellulose Acetate, Polysulfone, and Polyimide & Polyaramide), By Module, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM4765

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

The global gas separation membrane market size was valued at USD 998.24 million in 2024, growing at a CAGR of 6.80% during 2025–2034. The increasing need for efficient and cost-effective gas separation solutions across industries such as petrochemicals, chemicals, pharmaceuticals, and electronics is fueling the market growth.

The global gas separation membrane market refers to the industry involved in the development, production, and application of membrane technologies designed to selectively separate specific gases from gas mixtures. These membranes are thin barriers that permit certain molecules or components of a gas mixture to pass through while retaining others, based on differences in permeability. This technology is widely used in various industrial applications, including natural gas processing, hydrogen recovery, carbon dioxide removal, and air separation.

To Understand More About this Research: Request a Free Sample Report

Gas separation membranes offer several distinct advantages over traditional separation methods, such as cryogenic distillation and pressure swing adsorption. One of the primary benefits is their energy efficiency; membranes typically require lower operational energy, leading to cost savings and reduced environmental impact. They are also compact, lightweight, and have a modular design, making them easier to install and scale as needed. Furthermore, membrane systems usually involve fewer moving parts, which reduces maintenance requirements and operational complexity.

Governments and regulatory agencies across the globe are enforcing stricter environmental regulations to control industrial emissions and air pollution. These policies are encouraging industries to adopt technologies such as gas separation membranes that can effectively separate and remove harmful gases such as CO₂, H₂S, and VOCs. For instance, in the European Union, regulations under the Industrial Emissions Directive (IED) and Emissions Trading System (ETS) require facilities to minimize pollutant emissions, which is accelerating the adoption of membrane technologies. Similarly, US EPA guidelines and China's Ministry of Ecology and Environment policies are promoting clean production standards. These environmental compliance requirements are pushing companies in the oil & gas, chemicals, and power generation sectors to integrate membrane-based solutions into their operations, thereby boosting market growth.

The gas separation membrane demand is driven by growing innovation in membrane material and design. Innovations in membrane materials and designs are enhancing the performance, durability, and range of applications for gas separation membranes. Advanced materials such as polyimides, polyaramides, mixed matrix membranes (MMMs), and graphene-based composites are offering superior selectivity, higher permeability, and better resistance to plasticization and fouling. These enhancements have made gas separation membranes more competitive with conventional technologies in both performance and cost, leading to their high adoption.

The development of thin-film composite membranes and multi-layer configurations is further expanding the operational capabilities of gas separation membranes. These innovations are enabling membranes to function in harsh conditions, such as high pressures and temperatures, thus broadening their adoption across sectors such as petrochemicals, refining, and carbon capture.

Industry Dynamics

Growing Urbanization Globally

Urban areas require more efficient and sustainable solutions to manage industrial emissions, purify water, and produce clean energy. Gas separation membranes play a key role in these applications by selectively filtering gases, reducing pollution, and improving energy efficiency. Rapid urbanization is driving industrialization, leading to higher emissions from factories and power plants, fueling governments and industries to adopt gas separation membranes to meet stricter environmental regulations, as these membranes capture harmful gases such as CO₂ and sulfur oxides before they enter the atmosphere. Additionally, urban wastewater treatment plants use these membranes to remove toxic gases and purify water, ensuring safer disposal or reuse. The World Economic Forum, in its 2022 report, stated that the share of the world’s population living in cities is expected to rise to 80% by 2050, from 55% in 2022. Therefore, the demand for gas separation membranes is increasing with the expanding urbanization globally.

Expansion in Hydrogen Economy

Hydrogen is produced through steam methane reforming or electrolysis, both of which require highly efficient separation technologies such as separation membranes to isolate pure hydrogen from gas mixtures. Gas separation membranes enable selective extraction of hydrogen, removing impurities such as CO₂, methane, and water vapor, and ensuring the production of high-purity hydrogen. Expansion in the hydrogen economy is further propelling investments in the transportation and storage of hydrogen, which is driving demand for advanced gas separation membranes as membranes are deployed in pipelines and storage systems to maintain hydrogen purity to prevent contamination and ensure safety. In January 2023, India launched the National Green Hydrogen Mission with an investment of USD 2.4 billion (Rs. 19,744 crores) to achieve a production capacity of 5 million metric tons of green hydrogen annually by 2030. Hence, the demand for gas separation membranes is increasing as countries scale up their hydrogen economy through rapid investments.

Segmental Insights

By Material Analysis

Based on material, the market is divided into cellulose acetate, polysulfone, and polyimide & polyaramide. The polyimide & polyaramide segment accounted for 43.55% market share in 2024 due to their exceptional thermal and chemical stability, which allows them to perform reliably under high-pressure and high-temperature conditions typical in hydrogen recovery, carbon capture, and syngas purification. The growing investments in industrial decarbonization and the expanding use of membrane technology in harsh process environments propelled demand for high-performance materials such as polyimide and polyaramide. North America and Europe, with their aggressive carbon neutrality targets and advanced petrochemical infrastructure, are expected to be the key regions fueling the segment’s rapid expansion.

The cellulose acetate segment is expected to reach USD 409.99 million by 2034 from USD 241.59 million in 2024 at a CAGR of 5.51%. This is due to its rising use in natural gas processing, particularly for carbon dioxide removal. The adoption of cellulose acetate is arising from a combination of low production costs, established manufacturing processes, and adequate selectivity for CO₂ and H₂S separation. Operators are favoring cellulose acetate membranes in regions such as Asia Pacific and the Middle East, where cost-effective gas purification solutions remain a priority. Additionally, its biodegradability and reduced environmental impact compared to synthetic polymers are further enhancing its appeal in regulatory-sensitive regions such as North America and Europe.

By Module Analysis

Based on module, the market is divided into plate & frame, hollow fiber, spiral wound, and others. The hollow fiber segment dominated the gas separation membrane market share in 2024, valued at USD 428.71 million. This dominance is attributed to its unique structural advantage, offering an exceptionally high surface area-to-volume ratio, which improves gas separation efficiency in compact systems. The ability of hollow fiber to operate at lower pressures makes it increasingly attractive for decentralized and mobile applications. Moreover, increased adoption of hollow fiber gas separator membranes in emerging regions and expanding deployment in environmental applications are expected to accelerate the segment growth during the forecast period.

The spiral wound segment is expected to register a CAGR of 6.94% during the assessment period, owing to its high packing density, superior permeation performance, and widespread use in large-scale industrial gas separation applications. Industries such as petrochemicals, natural gas processing, and hydrogen recovery are favoring spiral wound modules due to their ability to handle high flow rates with consistent selectivity and efficiency. These modules offered a compact footprint while delivering high membrane area per unit volume, making them ideal for cost-sensitive and space-constrained environments. Additionally, ongoing advancements in polymeric membrane materials are further enhancing the separation efficiency of spiral wound modules.

By Application Analysis

In terms of application, the gas separation membrane market is divided into air dehydration, H2S removal, nitrogen generation & oxygen enrichment, hydrogen recovery, vapor separation, carbon dioxide removal, and others. The hydrogen recovery segment is projected to register a CAGR of 6.96% during the forecast period, owing to the growing global efforts toward clean energy transition and the development of hydrogen economies. Refineries, petrochemical plants, and hydrogen production units are actively adopting membrane technology to purify and recover hydrogen from process streams and reduce energy costs. Gas membrane separation, such as polyimide and polyaramide membranes, is widely used in hydrogen recovery applications due to their high permeability, exceptional resistance to harsh gas mixtures, and ability to operate efficiently under elevated pressures and temperatures.

Regional Analysis

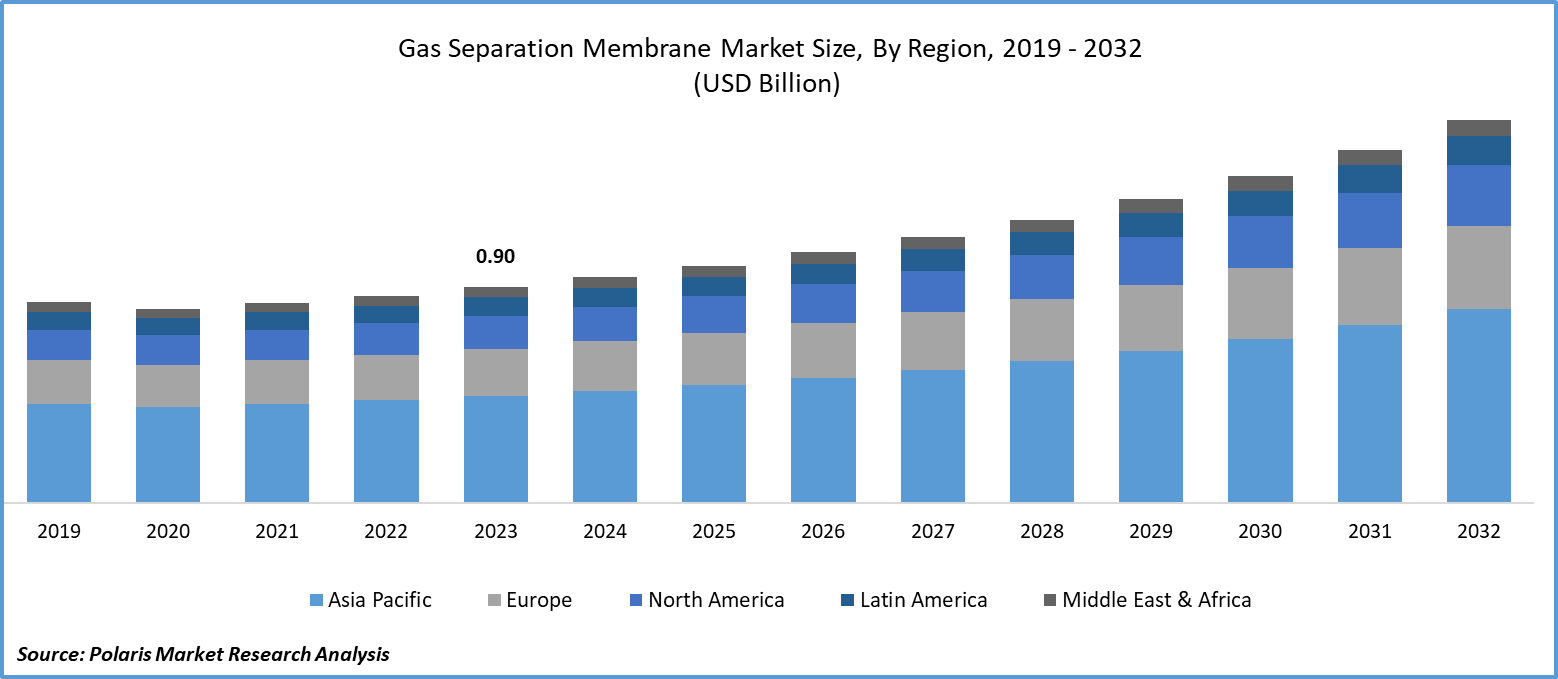

By region, the market report provides insight into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the market in 2024, holding 38.04% market share due to rapid industrial development in emerging economies such as China, India, and Southeast Asian countries. These nations witnessed an increased demand for efficient and cost-effective gas separation membranes in sectors such as petrochemicals, natural gas processing, and refining. Additionally, the region’s growing urbanization and rising energy needs have led to increased investments in clean energy technologies, including biogas upgrading and hydrogen recovery, where gas separation membranes play a crucial role. Environmental regulations aimed at reducing greenhouse gas emissions and promoting sustainable practices in countries such as India and China also accelerated the Asia Pacific gas separation membrane market growth. The increased awareness of the benefits of gas separation membranes, such as lower operational costs, compact design, and reduced energy consumption, further stimulated their demand.

The North America gas separation membrane market is expected to reach USD 447.08 million by 2034 from USD 250.08 million in 2024. This growth is attributed to technological advancements, regulatory support, and increasing demand across various industrial applications. The US, being one of the world’s leading producers of natural gas and crude oil, relies heavily on efficient gas separation membranes to improve processing efficiency and meet environmental standards. The growing focus on reducing greenhouse gas emissions and improving air quality in the US is leading to stricter environmental regulations from agencies such as the Environmental Protection Agency (EPA), which is encouraging the adoption of cleaner technologies such as membrane-based gas separation. Furthermore, the region’s emphasis on energy transition and decarbonization, especially in the US, is increasing the demand for hydrogen purification systems, where membranes play a critical role. The rising interest in carbon capture and storage (CCS) initiatives is also boosting the deployment of gas separation membranes for CO₂ removal from industrial exhaust streams.

The Europe gas separation membrane market accounted for 19.8% of the global market in 2024 due to region’s strong commitment to sustainability, energy efficiency, and stringent environmental regulations. Regulations such as the European Green Deal and EU directives targeting carbon neutrality are pushing industries to adopt gas separation membranes, particularly for applications such as carbon capture, hydrogen recovery, and biogas upgrading. Moreover, Europe's push toward a hydrogen economy, especially in countries such as Germany, France, and the Netherlands, is boosting the use of gas separation membranes for hydrogen purification and separation. The presence of a well-developed industrial base, coupled with a strong focus on R&D, is also fostering innovation and the deployment of advanced membrane technologies in the region.

Key Players and Competitive Analysis

The gas separation membrane industry is highly competitive, characterized by intense rivalry among key players focusing on expanding their product portfolios, enhancing production capacities, forming strategic partnerships, and pursuing mergers and acquisitions (M&A) to strengthen their market positions. Major companies are actively investing in product portfolio expansion to cater to diverse industrial applications, including nitrogen generation, carbon capture, hydrogen recovery, and natural gas processing. Innovations in materials, such as advanced polymers and hybrid membranes, are enabling manufacturers to improve selectivity, permeability, and durability, thereby gaining a competitive edge.

A few prominent companies in the gas separation membrane market are Air Liquide S.A.; DIC Corporation; Evonik Industries AG; FUJIFILM Manufacturing Europe B.V.; GENERON; Honeywell UOP; Parker-Hannifin Corporation; Schlumberger; Toray Industries, Inc.; and UBE Corporation.

Evonik Industries AG is one of the world’s major specialty chemicals companies, headquartered in Essen, Germany, and active in over 100 countries. Evonik’s operations span a broad range of industries, providing advanced materials and solutions that enhance the performance and sustainability of everyday products. The company’s business is organized into segments such as Specialty Additives, Nutrition & Care, Smart Materials, Performance Materials, and Technology & Infrastructure, reflecting its diverse expertise and innovation-driven approach. Evonik’s specialty chemicals are integral to sectors, including automotive, construction, agriculture, healthcare, electronics, and consumer goods, contributing to improved energy efficiency, product durability, and environmental performance. A key area of its portfolio is gas membrane separation, which falls under its Smart Materials segment. Evonik’s membrane solutions are recognized for their high selectivity, permeability, and durability, making them suitable for demanding environments in the chemical, energy, and environmental sectors.

Air Liquide S.A. is a global company headquartered in France and operating in 60 countries with ∼66,500 employees. Serving over four million customers, the company’s core business revolves around essential gases such as oxygen, nitrogen, and hydrogen, which are fundamental to life, matter, and energy. Air Liquide’s long-term vision emphasizes sustainable growth, innovation, and a strong commitment to environmental stewardship. Air Liquide is investing heavily in the future, especially in projects related to the energy transition, such as large-scale renewable and low-carbon hydrogen production, with the goal of reducing its own CO₂ emissions and supporting customers in their decarbonization efforts. Gas membrane separation is a key technological offering within Air Liquide’s portfolio, supporting both industrial efficiency and sustainability. Its expertise in membrane technology, coupled with its global reach and innovation capacity, allows it to deliver tailored solutions that help industries meet stringent regulatory requirements and sustainability targets.

Key Players

- Air Liquide S.A.

- DIC Corporation

- Evonik Industries AG

- FUJIFILM Manufacturing Europe B.V.

- GENERON

- Honeywell UOP

- Parker-Hannifin Corporation

- Schlumberger

- Toray Industries, Inc.

- UBE Corporation

Industry Developments

December 2024: Toray Industries, Inc., announced plans to install a pilot facility for its all-carbon carbon dioxide (CO2) separation membrane at its Shiga Plant.

February 2023: Evonik, a German specialty chemicals company, opened a new plant for the production of gas separation membranes in Schörfling am Attersee in Austria.

January 2023: UBE Corporation decided to expand the polyimide hollow fibre production facilities for gas separation membranes at its Ube Chemical Factory, as well as the gas separation membrane module production facilities at its Sakai Factory.

Gas Separation Membrane Market Segmentation

By Material Outlook (Revenue, USD Million, 2020–2034)

- Cellulose Acetate

- Polysulfone

- Polyimide & Polyaramide

By Module Outlook (Revenue, USD Million, 2020–2034)

- Plate & Frame

- Hollow Fiber

- Spiral Wound

- Others

By Application Outlook (Revenue, USD Million, 2020–2034)

- Air Dehydration

- H2S Removal

- Nitrogen Generation & Oxygen Enrichment

- Hydrogen Recovery

- Vapor Separation

- Carbon Dioxide Removal

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Gas Separation Membrane Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 998.24 million |

|

Market Size Value in 2025 |

USD 1,057.34 million |

|

Revenue Forecast by 2034 |

USD 1,911.34 million |

|

CAGR |

6.80% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 998.24 million in 2024 and is projected to grow to USD 1,911.34 million by 2034.

The global market is projected to register a CAGR of 6.80% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are Air Liquide S.A.; DIC Corporation; Evonik Industries AG; FUJIFILM Manufacturing Europe B.V.; GENERON; Honeywell UOP; Parker-Hannifin Corporation; Schlumberger; Toray Industries, Inc.; and UBE Corporation.

The hydrogen recovery segment is expected to witness the fastest growth during the forecast period.