Cellulose Acetate Market Share, Size, Trends & Industry Analysis Report

By Type (Fiber, Plastics); By Application; By Region; Segment Forecast, 2025 - 2034

- Published Date:Jun-2025

- Pages: 116

- Format: PDF

- Report ID: PM2214

- Base Year: 2024

- Historical Data: 2020-2023

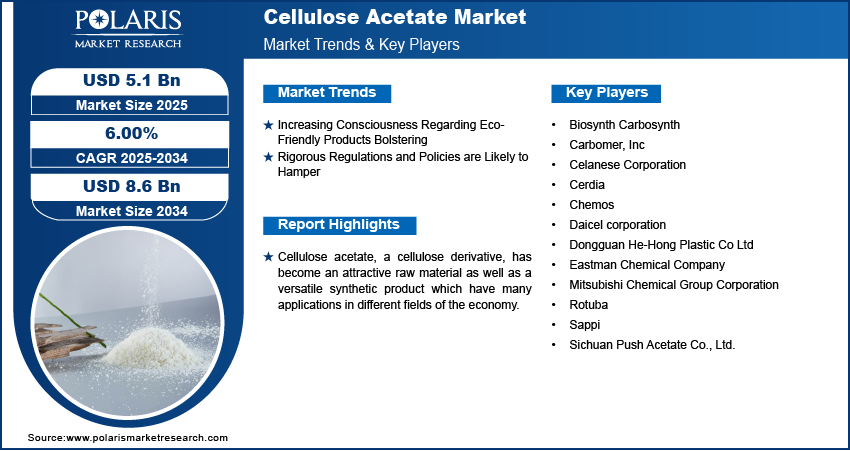

The global Cellulose Acetate Market was valued at USD 4.80 billion in 2024 and is projected to grow at a CAGR of 6.0% from 2025 to 2034. Demand in textiles, films, and sustainable products is supporting steady market growth.

Cellulose Acetate Market Overview

Cellulose acetate, a cellulose derivative, has become an attractive raw material as well as a versatile synthetic product which have many applications in different fields of the economy. The synthesis of acetylated cellulose by treating cellulose with acetic anhydride or acetic acid would assist in creating a novel material that, not a while back, had combined the altitudes of the synthetic and natural entities. Considered an outstanding shade because of its excellent availability, stable lifetime, and better-controlled ness, cellulose acetate has made a mark in the craft market. These, for example, are cooking-grade starch, three-ply toilet paper, 16mm film for photography, and cellulose derivative yarns for weaving. The capacity of bioplastics to disintegrate and its facts with the recycling procedure are other traits that endorse bioplastics.

To Understand More About this Research: Request a Free Sample Report

The major factor of the growing demand for cellulose acetate in materials and packaging industries faultlessly paves the way for market expansion. Beyond that, elevated demand for cellulose acetate throughout spectacle frame manufacturing and in all the other major end-user branches in emerging economies is forecasted to contribute to the market growth. In addition to the awareness creation of their cost effectiveness, versatility, biodegradability, and eco-friendliness, huge investment in research and development by major companies worldwide is also a pointer to the fact that the sector will continue to thrive. More so, industrialization is currently experiencing an upsurge, and modernized production largely takes center stage in all sectors. Consequently, this market has great potential to grow.

Furthermore, the cellulose acetate market experiences significant influence from escalating demand in various sectors such as textiles and cigarette filters. Moreover, the increasing preference for cellulose acetate in manufacturing photographic films and eyewear frames contributes substantially to market growth. Additionally, the rising awareness and adoption of environmentally sustainable products drive the utilization of cellulose acetate owing to its biodegradable characteristics, thus propelling market expansion. Furthermore, the burgeoning healthcare and pharmaceutical sectors' need for cellulose acetate in drug delivery systems further fuels cellulose acetate market size growth. Advancements in innovations and technology in cellulose acetate production processes, along with a surge in research and development endeavors to explore new applications, also positively impact market expansion.

Cellulose Acetate Market Dynamics

Market Drivers

Increasing Consciousness Regarding Eco-Friendly Products Bolstering the Growth of the Cellulose Acetate Market Share

The cellulose acetate market is benefiting from the increasing importance of eco-friendly products; with sustainability becoming a priority across consumer markets and industries, the biodegradable nature of cellulose acetate stands out. Unlike conventional plastics, cellulose acetate can naturally degrade, offering a solution to plastic pollution concerns. This eco-friendly feature has garnered attention from sectors such as packaging, textiles, and consumer goods. As consumers prioritize sustainability and governments enforce stricter environmental regulations, the demand for cellulose acetate rises, positioning it as a preferred option for sustainable product development and driving cellulose acetate market growth.

The surge in awareness and adoption of environmentally friendly products is fueling the cellulose acetate market. With sustainability rising in importance for consumers, manufacturers, and governments, cellulose acetate's biodegradable properties are gaining traction. Unlike traditional plastics, cellulose acetate can decompose naturally, reducing environmental impact and addressing plastic pollution concerns. This characteristic has attracted interest from various sectors, including packaging, textiles, and consumer goods. As the demand for sustainable materials grows among consumers and environmental regulations tighten, cellulose acetate emerges as a favored choice for sustainable product development, driving market expansion.

Market Restraints

Rigorous Regulations and Policies are Likely to Hamper the Growth of the Market

The Environmental Protection Agency (EPA) and the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) enforce stringent regulations governing the application of cellulose acetate as an indirect food additive. Similarly, the US Food and Drug Administration (FDA) upholds rigorous standards outlined in the Code of Federal Regulation (CFR) 21 Part 175. Within the European Union (EU), specific guidelines are outlined under regulation EU- No 10/2011 concerning the utilization of indirect food additives, including cellulose acetate. Adherence to these rigorous standards inevitably results in increased production costs, potentially limiting the growth of the cellulose acetate market throughout the forecast period.

Report Segmentation

The market is primarily segmented based on type, application, and region.

|

By Type |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Cellulose Acetate Market Segmental Analysis

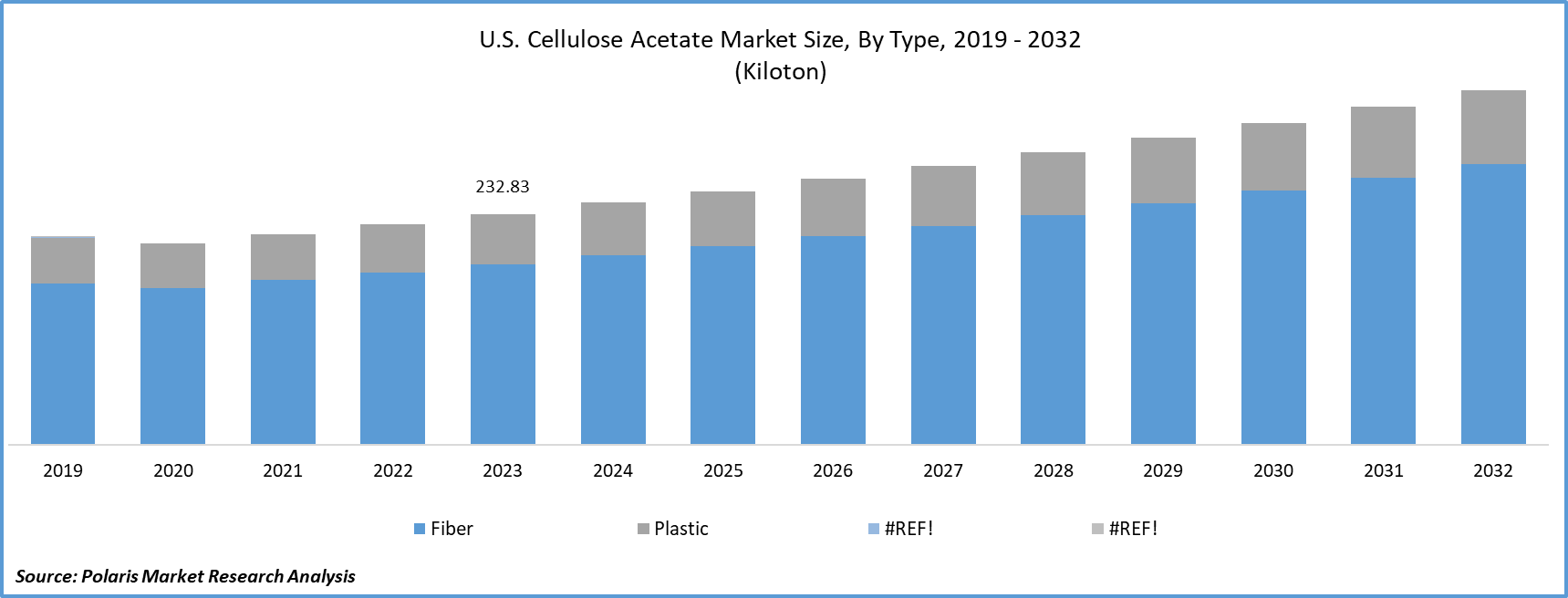

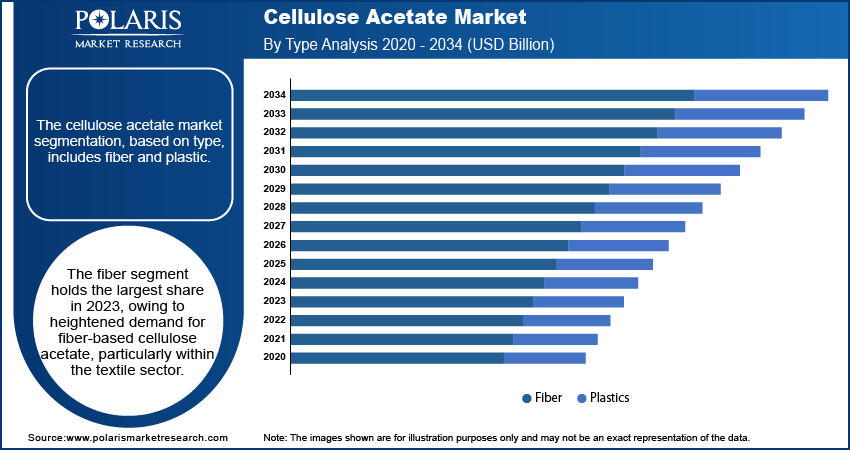

By Type Analysis

The fiber segment holds the largest share in 2023, owing to heightened demand for fiber-based cellulose acetate, particularly within the textile sector. Widely utilized in the manufacturing of various consumer goods such as cigarette filters, furniture, linings, felts, apparel, umbrellas, and carpets, fiber-based cellulose acetate offers a versatile solution. Recognized for its excellent draping characteristics and cost-effectiveness, cellulose acetate fiber stands as a prominent synthetic fiber type. Moreover, staple acetate fibers serve as a viable alternative to wool in the production of diverse knitwear and luxurious fabrics, further bolstering the segment's growth potential amidst the expanding textile industry landscape.

By Application Analysis

In 2023, the cigarette filters segment dominated the cellulose acetate market and is anticipated to maintain its position in the industry in the foreseeable future. Cellulose acetate is extensively used as a filter material in cigarette filters due to its effective filtration properties and biodegradability. Additionally, the industry is poised for growth owing to a rise in the number of smokers, particularly in developing economies like India and China. However, heightened public awareness regarding the adverse health effects associated with smoking is expected to impede the segment's expansion.

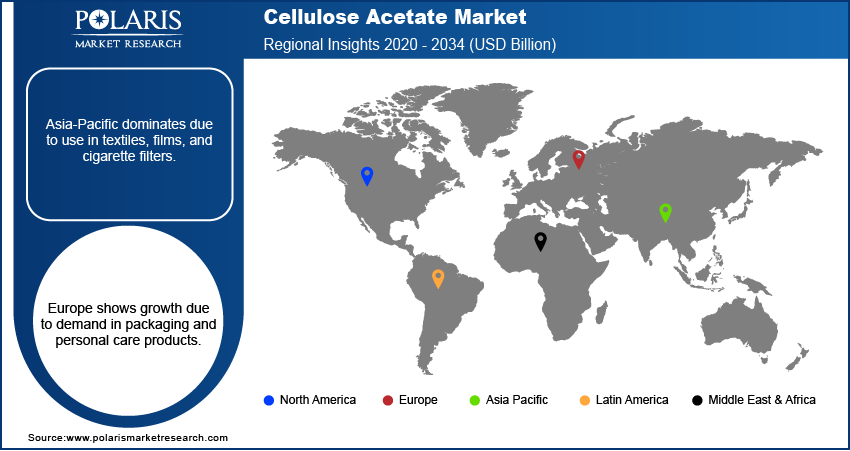

Cellulose Acetate Market Regional Insights

The Asia Pacific Region Dominated the Global Market with the Largest Market Share in 2024

Asia Pacific dominated the global market with largest market share in 2023. The region's significant market presence is attributed to its large population and diverse industrial landscape. Rapid industrialization in countries like India and China fuels the demand for materials such as cellulose acetate, which finds applications across various sectors. Within the Asia-Pacific region, the textile industry emerges as a major consumer of cellulose acetate, utilizing it in the production of fibers and fabrics. The thriving textile sector significantly contributes to the market's growth trajectory. Moreover, in several nations, rising disposable income prompts increased consumer expenditure on products, particularly those made of cellulose acetate, thereby fostering expansion across industries utilizing the material.

Competitive Landscape

Cellulose Acetate market players enhance their product portfolio and stimulate further growth in the market; companies allocate substantial resources to research and development endeavors. Alongside, market participants are engaged in diverse strategic initiatives aimed at expanding their market presence. These include the introduction of new products, forging contractual agreements, engaging in mergers and acquisitions, making substantial investments, and fostering collaborations with other entities.

Some of the major players operating in the global market include:

- Biosynth Carbosynth

- Carbomer, Inc

- Celanese Corporation

- Cerdia

- Chemos

- Daicel corporation

- Dongguan He-Hong Plastic Co Ltd

- Eastman Chemical Company

- Mitsubishi Chemical Group Corporation

- Rotuba

- Sappi

- Sichuan Push Acetate Co., Ltd.

Recent Developments

- In 2023, Eastman Chemical Company introduced a new range of cellulose acetate products specifically developed for sustainable packaging solutions.

- In August 2023, Eastman Chemical Company, a significant player in cellulose acetate production, unveiled plans to develop a novel grade of cellulose acetate tailored specifically for 3D printing applications. Anticipated to hit the market in 2024, this new grade of cellulose acetate will be readily available in commercial volumes.

- In July 2023, Mitsubishi Chemical Group, Masdar, and INPEX revealed plans to establish the world's inaugural commercial-scale polypropylene production facility utilizing CO2 and green hydrogen.

- In April 2023, Eastman Chemical Co intends to launch additional products in the forthcoming years to broaden its presence in the region.

Report Coverage

The Cellulose Acetate market report emphasizes key regions worldwide to help users better understand the product. It also provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis of various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive type, application, and futuristic growth opportunities.

Cellulose Acetate Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 5.1 Billion |

|

Revenue Forecast in 2034 |

USD 8.6 Billion |

|

CAGR |

6.00% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD Billions and CAGR from 2025 to 2034 |

|

Segments Covered |

By Material, By Application |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global Cellulose Acetate market is expected to reach 8.6 Billion by 2034

Key players in the market are Biosynth Carbosynth, Carbomer Inc, Celanese Corporation, Cerdia, Chemos, Daicel Corporation, Dongguan He-Hong Plastic Co Ltd

Asia Pacific contribute notably towards the global Cellulose Acetate Market

Cellulose Acetate Market exhibiting a CAGR of 6.00% during the forecast period

The Cellulose Acetate Market report covering key segments are type, application, and region