Green Hydrogen Market Share, Size, Trends, Industry Analysis Report

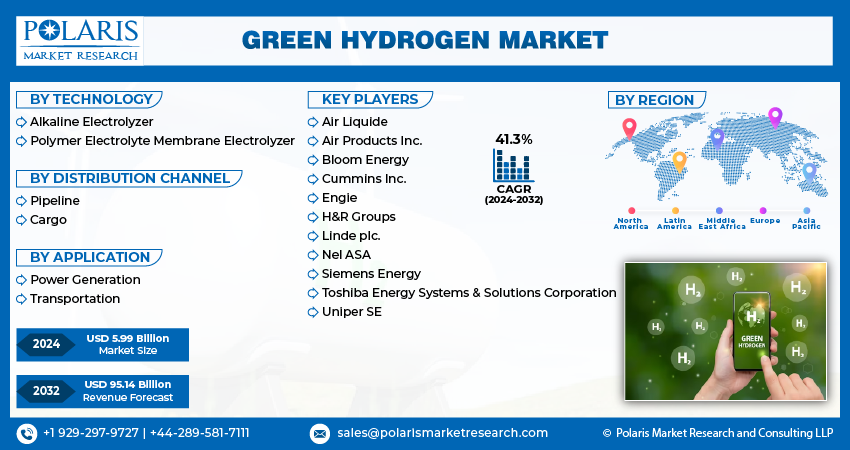

By Technology [Alkaline Electrolyzer, Polymer Electrolyte Membrane (PEM) Electrolyzer]; By Distribution Channel; By Application; By Region; Segment Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 119

- Format: PDF

- Report ID: PM2630

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

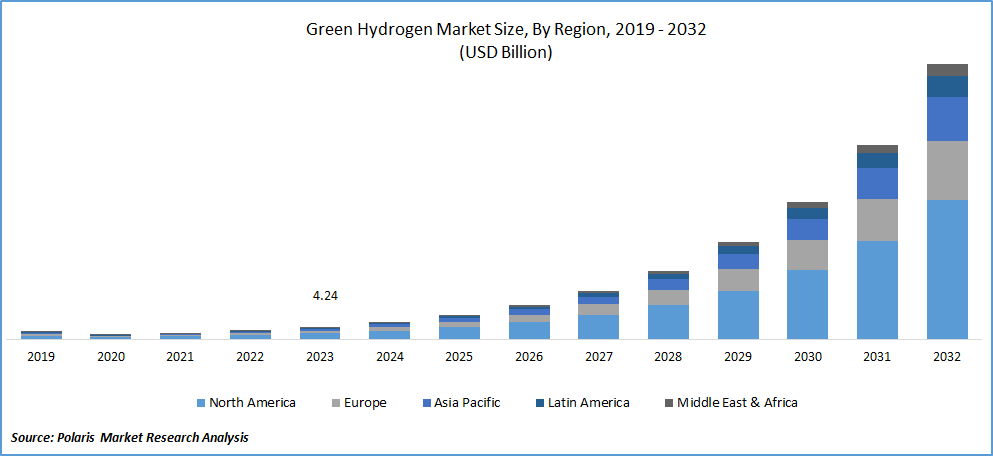

The global Green Hydrogen Market was valued at USD 12.31 billion in 2024 and is forecasted to grow at a CAGR of 41.46% from 2025 to 2034. Global decarbonization goals and investment in clean energy infrastructure are accelerating the adoption of green hydrogen technologies.

Key Insights

- In 2024, the alkaline electrolyzer segment accounted for the largest revenue share. Its longevity enables continuous improvements in efficiency and cost-effectiveness. This makes it a preferred choice for large-scale green hydrogen production.

- In 2024, the pipeline segment held the largest share. It is due to its economic viability and efficiency in transporting large volumes of hydrogen over long distances.

- In 2024, Europe accounted for the largest revenue share. It is driven by significant investments made by European economies with the objective of transitioning toward a clean hydrogen-based economy.

- The North America market is anticipated to witness the highest CAGR during the forecast period. The growth is attributed to the adoption of clean energy legislation and ambitious decarbonization goals set by the countries in the region.

Industry Dynamics

- The global shift toward cleaner and sustainable energy sources as a part of broader climate change mitigation strategies drives the green hydrogen market growth.

- Supportive government policies, incentives, and subsidies play a crucial role in promoting green hydrogen projects, which propel the adoption of green hydrogen.

- High production costs of green hydrogen hinder the industry expansion.

- Rising demand for fuel cell electric vehicles (FCEVs) is expected to offer lucrative opportunities during the forecast period.

Market Statistics

2024 Market Size: USD 12.31 billion

2034 Projected Market Size: USD 199.22 billion

CAGR (2025–2034): 41.46%

Europe: Largest market in 2024

AI Impact on Green Hydrogen Market

- Artificial intelligence (AI) optimizes the performance of electrolyzer, a crucial component in the production of green hydrogen.

- The technology helps reduce energy consumption by adjusting operational parameters in real time. It leads to improved sustainability and reduced operational costs.

- For efficient logistics and inventory management, hydrogen firms adopt AI to scale hydrogen infrastructure and ensure reliable delivery across regions.

To Understand More About this Research: Request a Free Sample Report

Green hydrogen refers to hydrogen gas created through electrolysis using renewable energy sources such as wind or solar power. It is considered "green" because the production process does not generate greenhouse gas emissions, unlike traditional methods that rely on fossil fuels.

Electrolysis involves separating water molecules (H2O) into oxygen (O2) and hydrogen(H2) utilizing an electric current. The electricity used in the process is sourced from renewable energy, making green hydrogen a clean and sustainable fuel option.

The research report offers a quantitative and qualitative analysis of the Green Hydrogen Market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

Green hydrogen holds significant potential as a renewable energy carrier and a solution for decarbonizing various sectors. It can be used in fuel cells to produce electricity and power vehicles, provide energy storage, and serve as a feedstock for industrial processes. Its versatility and zero-emission characteristics make it a promising alternative to conventional fossil fuels and a key component in transitioning to a low-carbon economy.

Green hydrogen is produced through electrolysis, separating water into oxygen and hydrogen using renewable energy sources. The market for green hydrogen is expected to grow as the cost of renewable energy and electrolysis technology decreases, driving market expansion. Various sectors, including steel, oil and gas, fertilizers, and utilities, are adopting green hydrogen to mitigate the intermittency of renewable resources.

However, the storage and transportation of green hydrogen pose challenges due to its low volumetric density and high combustibility. Extensive investment in infrastructure, such as pipelines and carriers, is required. Furthermore, the need for more skilled workers hinders the global market's expansion and growth.

Efforts are being made to address these challenges and promote the widespread adoption of green hydrogen as a sustainable energy source. Investments in research and development, infrastructure development, and workforce training are crucial for unlocking the market's full potential. The green hydrogen market faced a temporary setback due to the impact of COVID-19. However, investments continued to flow into ongoing projects, and several countries in Europe and Asia have been actively announcing new initiatives and conducting technical feasibility assessments.

The primary consequence of the pandemic on the market was the delay in project timelines caused by disruptions in the supply of raw materials due to lockdown measures. Nevertheless, the market has reached the pre-commercialization stage and is poised to contribute to the global decarbonization process significantly.

The global shift towards cleaner and sustainable energy sources as a part of broader climate change mitigation strategies is a major driver for the green hydrogen market. Many countries and corporations are setting ambitious net-zero emission targets, driving the demand for green hydrogen as a clean and renewable energy carrier. The integration of renewable energy sources, such as wind and solar power, in the production of green hydrogen is a key driver. Electrolysis powered by renewables contributes to the green and sustainable nature of hydrogen production.

Also, supportive government policies, incentives, and subsidies play a crucial role in promoting green hydrogen projects. Many governments are providing financial incentives and regulatory support to accelerate the development and adoption of green hydrogen. Europe is at the forefront of infrastructure development, followed by Asia. Expanding infrastructure will enable producers to increase their capacity and reach, reducing the costs of producing green hydrogen. The active involvement of individual governments is crucial for creating an environment that embraces green hydrogen as an alternative fuel. The global market is transforming as it progresses towards achieving net-zero emission targets. The mobility sector is the way to develop vehicles that utilize hydrogen in internal combustion engines or fuel cells.

Report Segmentation

The market is primarily segmented based on technology, distribution channel, application, and region.

|

By Technology |

By Distribution Channel |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Technology Analysis

- Alkaline electrolyzer segment accounted for the largest revenue share in 2024

In 2024, the alkaline electrolyzer segment accounted for the largest revenue share. It has been in use for longer and is considered a mature technology. This longevity has allowed for continuous improvements in efficiency, reliability, and cost-effectiveness, making them a preferred choice for large-scale green hydrogen production.

Furthermore, alkaline electrolyzers are characterized by their scalability and high production capacity, enabling them to meet the demands of industrial applications and large-scale hydrogen projects. Their robustness and ability to handle dynamic operating conditions also contribute to their market dominance.

Unlike PEM electrolyzers, alkaline electrolyzers have longer operating times and utilize a liquid alkaline solution containing potassium or sodium hydroxide as the electrolyte.

Furthermore, alkaline electrolyzers operate at a wider temperature range of 100 to 105 degrees Celsius compared to PEM electrolyzers which typically run between 70 and 90 degrees Celsius. Although alkaline electrolyzers have lower power and current densities, their ability to operate at higher temperatures makes them advantageous in certain applications.

Pipeline segment held the highest market share in 2024

In 2024, the pipeline segment held the highest market share, primarily due to its economic viability and efficiency in transporting large volumes of hydrogen over long distances. While hydrogen can be fascinated in various forms, such as liquid in thermally insulated containers, gas in high-pressure containers, or processed forms like methanol or ammonia, using pipelines is considered the most practical method.

Adapting existing natural gas tubes for upcoming hydrogen transport has been a subject of interest. In September 2020, German pipeline operators Gascade, Nowega, and Siemens Energy published a white paper on the potential for repurposing natural gas pipelines for hydrogen transportation. These highlight the importance of utilizing existing pipeline infrastructure to facilitate the efficient and widespread distribution of hydrogen.

Europe accounted for the largest revenue share in 2024

In 2024, the Europe accounted for the largest revenue share due to significant investments made by European economies with the objective of transitioning towards a clean hydrogen-based economy in the coming years. Green hydrogen is produced using renewable energy sources, such as wind or solar power, and is considered a cleaner alternative to traditional hydrogen production methods.

For instance, in December 2023, the UK government has introduced a £2 billion (approximately $2.19 billion) investment initiative to promote the expansion of green hydrogen production across the country, covering regions from England to the other Highlands during the next 15 years. In the initial three years, an advance funding of around £400 million (approximately $438.2 million) is anticipated to develop 125 MW of green hydrogen capability. This capacity will serve various industries, contributing to the advancement of the country's green economy.

The primary objective of this initiative is to position the UK as a leading global player in the rapidly growing hydrogen industry. During the launch of the initiative, Energy Security Secretary Claire Coutinho announced government support for 11 projects employing electrolysis for green hydrogen production. This strategic move ensures a guaranteed price from the government for suppliers involved in the clean energy sector. It represents the largest concurrent announcement of commercial-scale green hydrogen production projects in Europe, marking a significant step toward the country's sustainable energy goals.

In North America, the market is anticipated to witness fastest CAGR throughout the forecast period, driven by the adoption of clean energy legislation. The United States and Canada are gradually expanding their markets. California currently dominates the U.S. market with its ambitious decarbonization goals, including eliminating gas or diesel-powered public transportation by 2040. For instance, Air Liquide's construction of a 20 MW large-scale PEM electrolyzer in Canada, utilizing hydropower to create green hydrogen. This initiative, along with other projects in the pipeline, is expected to benefit Canada's green hydrogen sector's growth significantly.

Key Market Players & Competitive Insight

The Green Hydrogen Market is characterized by dynamic competition as industry players strive to capitalize on the increasing demand for sustainable energy solutions. Established global players, as well as emerging startups, vie for prominence in the green hydrogen market. Industry leaders leverage their experience and resources, while innovative newcomers bring fresh perspectives and technologies to the forefront.

Some of the major players working in the global market include:

- Air Liquide

- Air Products Inc.

- Bloom Energy

- Cummins Inc.

- Engie

- H&R Groups

- Linde plc.

- Nel ASA

- Siemens Energy

- Toshiba Energy Systems & Solutions Corporation

- Uniper SE

Recent Developments

- In March 2025, Kandla Port in Gujarat will launch India’s first green hydrogen plant by June 2025, using wind and solar energy to produce clean hydrogen for industries, boosting renewable energy and job creation.

- In November 2020, the Adani Group made a significant announcement to invest US$ 70 billion in green energy. This substantial investment is expected to be crucial in India's transition towards green energy. Leveraging its position in the renewable energy industry, the Adani Group is anticipated to make significant contributions to the production of green hydrogen.

- In May 2022, Air Liquide S.A., Toyota Motor, and CaetanoBus made a collaboration to develop integrated hydrogen solutions jointly. The partnership aims to encompass various aspects, such as infrastructure development and the establishment of vehicle fleets. The ultimate goal is accelerating the widespread adoption of hydrogen mobility, catering to both light-duty and heavy-duty vehicles. This collaboration signifies a significant step towards advancing sustainable transportation options and promoting hydrogen as a clean energy source.

Green Hydrogen Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 17.41 billion |

|

Revenue forecast in 2034 |

USD 199.22 billion |

|

CAGR |

41.46% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Technology, By Distribution Channel, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Gain profound insights into the 2024 Green Hydrogen Market with meticulously compiled statistics on market share, size, and revenue growth rate by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into historical trends but also unfolds a roadmap with a market forecast extending to 2032. Immerse yourself in the comprehensive nature of this industry analysis through a complimentary PDF download of the sample report.

FAQ's

Green Hydrogen Market report covering key segments are technology, distribution channel, application, and region.

Green Hydrogen Market Size Worth $ 199.22 Billion By 2034

The global green hydrogen market is expected to grow at a CAGR of 41.46% during the forecast period.

Europe is leading the global market.

The key driving factors in Green Hydrogen Market is Net-Zero Emission Targets.