Genomic Biomarkers Market Share, Size, Trends, Industry Analysis Report

By Disease Indication (Oncology, Cardiovascular Diseases, Neurological Diseases, Renal Disorders, Others); By Validation; By Type; By End-Use; By Region; Segment Forecast, 2021 - 2029

- Published Date:Dec-2021

- Pages: 132

- Format: PDF

- Report ID: PM2133

- Base Year: 2020

- Historical Data: 2017 - 2019

Report Outlook

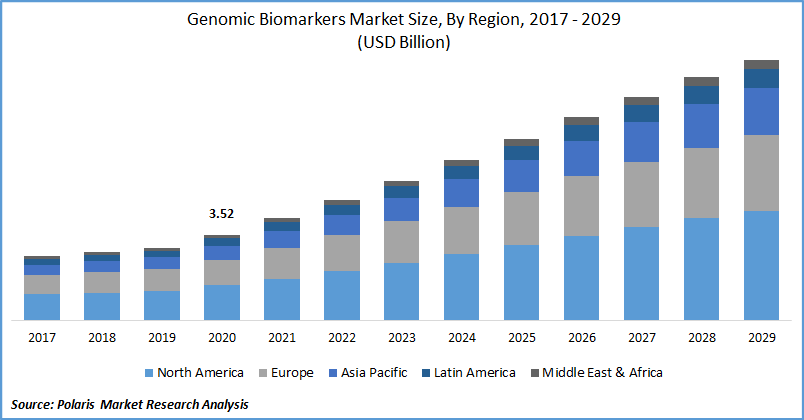

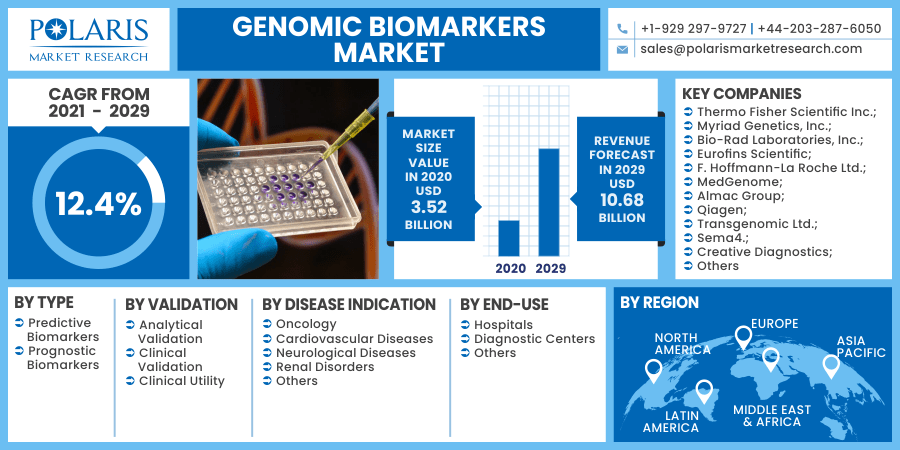

The global genomic biomarkers market was valued at USD 3.52 billion in 2020 and is expected to grow at a CAGR of 12.4% during the forecast period. The growing innovation in the healthcare industry by using novel medicines, increasing research & development programs to diagnose chronic diseases, and growing proliferation of minimally invasive procedures are positively influencing the genomic biomarkers market. In addition, the rising focus on the availability of personalized medicines for enabling better patient care, along with favorable government initiatives relating to genomic research, is also augmenting the growth outlook for the global market. Furthermore, the use of genomic biomarkers for pharmaceutical development is also likely to complement demand.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The recent outbreak of the COVID-19 pandemic is extensive around the world, tapping communities, countries, and societies under massive pressure. As the ongoing pandemic (COVID-19) has spread worldwide, pharma companies and healthcare laboratories are undergoing to perform several researchers that can mitigate the risk of such disease. In this situation, the biomarkers play a considerable role in diagnosing and identifying the COVID-19 disease. These markers demonstrated notably higher levels in patients with severe complications of COVID-19 infection in comparison to their non-severe counterparts. In particular, genomics biomarkers have witnessed a drastic increase in their demand, which eventually created high genomic biomarker market growth in recent years.

Industry Dynamics

Growth Drivers

Technological advancement in genomics and constant development in laboratory tests have accelerated the market scenario. Besides, the rise in the cases of ovarian cancer and the rising consumption of genomic biomarkers-based medicine are significant factors, among others driving the global market. According to the Alzheimer’s Association, in 2019, around 5.8 Mn U.S. individuals aged above 50 are likely to suffer from Alzheimer’s dementia, which is bound to increase to 14 million by 2050. Thus, the increasing number of neurological disease patients has created the urgent need for genomics biomarkers that could reinforce the market growth around the world.

Moreover, the rise in the integration of new technological breakthroughs and modernization concepts in the healthcare infrastructure is favoring the market growth. Apart from these factors, companion diagnostics and biomarkers have also become widely relevant in the practice of medicine, which eventually leads to increased diagnosis, treatment, and intensive care across several disease areas. Thus, genomic biomarkers have further gained enormous popularity, and several healthcare providers and pharma companies are demanding it, making a significant impact on the market growth across the globe. In addition, the growing demand for genomic biomarkers in prostate cancer is also expected to have a positive impact on market growth.

Know more about this report: request for sample pages

Report Segmentation

The market is primarily segmented on the basis of type, validation, disease indication, end-use, and region.

|

By Type |

By Validation |

By Disease Indication |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Disease Indication

Among the disease indication segment, the oncology segment is expected to hold the highest revenue share in 2021. The significant stake can be accredited to the increased number of cancer patients worldwide, along with the growing technological advancements in biomarkers techniques. In recent years, genomic biomarkers have had several potential applications in oncology, including risk assessment, determination of prognosis, screening differential diagnosis, monitoring of cancer progression, and prediction of response to treatment.

According to the World Health Organization (WHO), cancer is considered the second-leading cause of death globally, accounting for 70% of deaths in low- and middle-income countries. The WHO also estimated that 18.1 million new cancer cases and 9.6 million cancer deaths were reported globally in 2018.

On the contrary, the cardiovascular disease segment is likely to account for a considerable share in the overall market. Factors such as the rising cases of cardiovascular diseases and the remarkable application of genomic biomarkers in ischemic heart diseases are major factors propelling the demand for the genomic biomarkers market. The increased prevalence of CVD directly impacts the demand for genomic biomarkers since it provides access to reliable health interventions with high-quality control. Therefore, it significantly towards the high market growth globally.

Insight by End-Use

Based on end-use, the diagnostic center segment is expected to hold the largest market share in 2020. Factors such as the use of genomics biomarkers for the effective diagnosis of multiple diseases, such as cancer, infectious diseases, neurological disorders, and cardiovascular disorders, are on the surging trend. As a result, genomic biomarkers find extensive application in preclinical drug development related to such chronic disease. They can use them to examine efficacy or screen for adverse impact in model systems before human testing. Therefore, this factor is likely to create a lucrative growth prospect for the higher segmental growth in the overall market.

On the contrary, the hospital segment is projected to register a significant growth rate in the overall market during the forecast period. Factors such as the growing availability of genomic biomarkers in hospitals, the increasing investment by government authorities in the healthcare industry, and various hospitals projects providing chronic disease treatment are likely to support the market growth. For instance, according to the Centers for Medicare & Medicaid Services (CMS), America’s national health spending has contributed to growing at an average rate of 5.5% annually for 2018-27 and is also expected to reach nearly USD 6.0 trillion 2027. Therefore, this factor will be critical in driving the market growth for biomarkers worldwide.

Geographic Overview

Geographically, North America dominated the global market in 2020 and is estimated to continue its dominance owing to the rising adoption of genomic biomarkers in the early diagnosis of diseases and a growing number of healthcare and life science research programs in the region. Furthermore, the rise in regulatory approvals by the Food and Drug Administration (FDA), favorable regulations for reimbursement and usage of biomarkers, and the growing strategic alliance between market vendors are a few factors that significantly pave towards the higher market growth in the region.

For instance, in January 2020, Color Genomics, in partnership with NorthShore University HealthSystem, announced the completion of the delivery of clinical genomics in routine health care under its US program. The company also backed Sanford's genomics program - Imagenetics, to enhance clinical decision-making. Such initiative is further responsible for the high adoption of genomic biomarkers in the region.

Moreover, Asia Pacific is projected to perceive a significant growth rate over the forecast period. Over the last decades, Asian countries have undergone the greatest transformation in the healthcare industry. The growth of healthcare infrastructural projects in the Asian economy and the high presence of sophisticated research laboratories creating a massive prospect for market growth in emerging nations, including China, India, and Japan, is expected to drive demand for biomarkers.

In addition, the regional growth is also expected to incline by the surging adoption of genomic technologies arising out of the initiation of several research programs. For instance, the GenomeAsia 100K Project sequencing (WGS) project allows genetic discoveries across the Asian economy. The study covered several countries from Asia, including South Korea, Malaysia, India, Indonesia, and more, to capture the broadest wealth of genetic diversity. This, in turn, is expected to leverage the growth prospect for the global biomarkers market.

Competitive Insight

Some of the major players operating in the global market include Thermo Fisher Scientific Inc.; Myriad Genetics, Inc.; Bio-Rad Laboratories, Inc.; Eurofins Scientific; F. Hoffmann-La Roche Ltd.; MedGenome; Almac Group; Qiagen; Transgenomic Ltd.; Sema4.; Creative Diagnostics; Cancer Genetics Inc.; Genome Life Sciences; Foundation Medicine, Inc.; Centogene N.V.; and Quanterix.

Genomic Biomarkers Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 3.52 billion |

|

Revenue forecast in 2029 |

USD 10.68 billion |

|

CAGR |

12.4% from 2021 - 2029 |

|

Base year |

2020 |

|

Historical data |

2017 - 2019 |

|

Forecast period |

2021 - 2029 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2029 |

|

Segments covered |

By Type, By Validation, By Disease Indication, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Thermo Fisher Scientific Inc.; Myriad Genetics, Inc.; Bio-Rad Laboratories, Inc.; Eurofins Scientific; F. Hoffmann-La Roche Ltd.; MedGenome; Almac Group; Qiagen; Transgenomic Ltd.; Sema4.; Creative Diagnostics; Cancer Genetics Inc.; Genome Life Sciences; Foundation Medicine, Inc.; Centogene N.V.; and Quanterix. |