Germany Accident Insurance Market Size, Share, & Industry Analysis Report

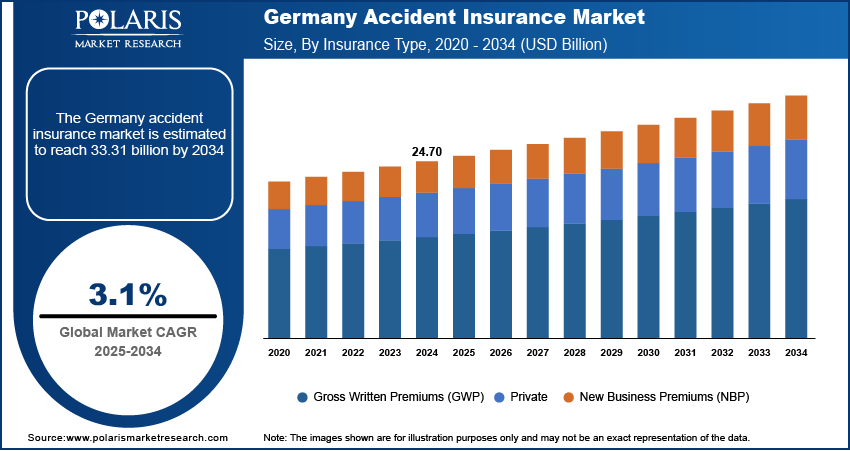

: By Insurance Type [Gross Written Premiums (GWP), Private, and New Business Premiums (NBP)], By Policy Type, and By Distribution Channel – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 125

- Format: PDF

- Report ID: PM5695

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

The Germany accident insurance market size was valued at USD 24.70 billion in 2024. It is projected to grow from USD 25.43 billion in 2025 to USD 33.31 billion by 2034, exhibiting a CAGR of 3.1% during 2025–2034.

Accident insurance brokerage is a type of policy that provides financial compensation for injuries, disability, or death caused by unexpected accidents. It helps cover medical expenses, hospital stays, and lost income resulting from accidental events.

More people in Germany are starting to understand the importance of protecting themselves from unexpected events. Individuals are now more likely to invest in supplemental health insurance to manage potential costs from injuries with growing awareness of personal accident coverage. Many realize that while health insurance covers treatment, it may not fully cover lost income or recovery costs. Consequently, German accident policy benefits are becoming a popular option for families and workers who want to avoid unforeseen accidents, thereby driving the growth of the Germany accident insurance market revenue.

To Understand More About this Research: Request a Free Sample Report

Digital platforms and apps have made it much easier for consumers to access, compare, and manage accident insurance premiums in Germany. The rise of insurtech platforms such as Getsafe and Clark has enabled private accident insurance providers in Germany to offer user-friendly services online, which appeal to younger, tech-savvy consumers. Innovations in technology also support better accident risk assessment in Germany, making it possible to deliver more tailored and flexible insurance solutions. This digital transformation is bridging the gap between traditional insurers and modern customer expectations, thereby driving the Germany accident insurance market expansion.

Market Dynamics

Rising Elderly Population

Germany is one of the countries in Europe comprising high geriatric populations, and the number of people aged 60 continues to rise. According to the Statistisches Bundesamt, people aged between 60 and 80 years contributed 22.6% of total country's total population in 2023. Aging increases the risk of injuries from falls and other accidents, leading to a higher demand for disability insurance in Germany. This demographic shift is driving growth in both statutory accident insurance and private accident insurance providers in Germany. Many older adults look for extra coverage beyond what the government offers, making accident insurance premiums in Germany a key consideration in long-term financial planning, thereby driving the Germany accident insurance market development.

Strong Regulatory Framework and Mandatory Coverage

The German social insurance system requires that all employees are covered under statutory accident insurance. According to the Germany Trade and Invest, the expenses associated with accident insurance are fully absorbed by the employer. This legal structure ensures that workplace safety are handled efficiently, driving consistent demand for accident insurance. Workplace injury coverage in Germany is not just a safety net but a legal necessity. This structure gives consumers confidence in private accident insurance providers in Germany who offer additional, voluntary plans for broader protection beyond the required coverage, thereby driving the market growth.

Segment Analysis

Market Assessment by Insurance Type

The Germany accident insurance market segmentation, based on insurance type, includes gross written premiums (GWP), private, and new business premiums (NBP). The gross written premiums segment is expected to witness fastest growth during the forecast period, driven by rising demand for personalized and voluntary accident coverage, especially among self-employed individuals and aging citizens. People are willing to pay for additional protection beyond basic statutory coverage as they become more aware of personal risk. The increase in outdoor activities, workplace safety concerns, and flexible policy options from private accident insurance providers in Germany also contribute to this trend, thereby driving the segmental growth.

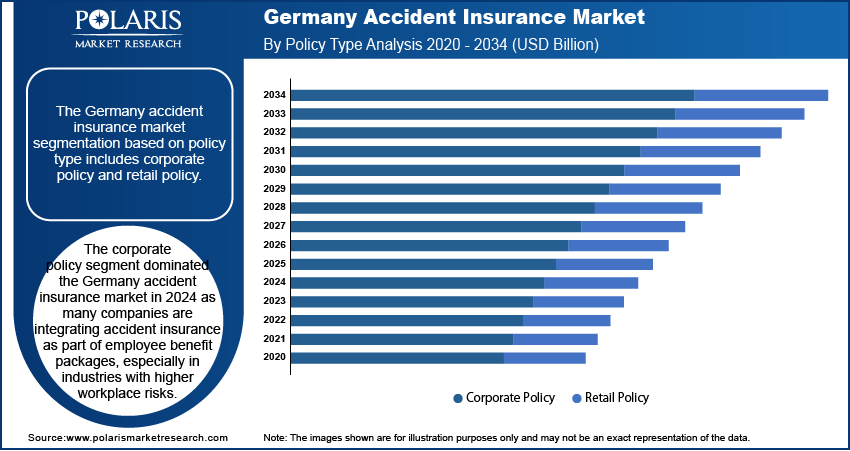

Market Evaluation by Policy Type

The segmentation, based on policy type, includes corporate policy and retail policy. The corporate policy segment dominated the market in 2024. Many companies in Germany offer accident insurance as part of employee benefit packages, especially in industries with higher workplace risks. This helps businesses comply with safety regulations and boosts employee satisfaction and retention. The strong role of statutory accident insurance in Germany further supports the demand for corporate plans. The preference for corporate accident insurance policies is growing as employers become more focused on worker well-being and risk management, thereby driving the segmental growth.

Key Players and Competitive Analysis

The German accident insurance market stats is undergoing a significant transformation, driven by a wave of innovation and the desire for differentiation among industry players. Major global firms are leveraging their extensive research and development capabilities, along with advanced technologies, to maintain competitive advantage in this increasingly dynamic environment. These organizations are actively pursuing strategic initiatives, including mergers and acquisitions, partnerships, and collaborative ventures, aimed at improving their product portfolios and penetrating new market segments.

Emerging companies are making notable strides by introducing innovative products tailored to meet the specific demands of various market niches. The continuous advancement of product technology and functionality intensifies the competitive landscape, compelling all market participants to consistently adapt and elevate their offerings to stay relevant. This relentless evolution drives differentiation and fosters a more complex ecosystem where agility and responsiveness are paramount. Major players in the market includes Allianz SE, AXA Konzern AG, Debeka Krankenversicherungsvere A.G., DKV, ERGO, Generali Deutschland, R+V Versicherung AG, and Signal Iduna.

Generali Deutschland is an insurance group in Germany and part of the global Generali Group. Based in Munich, it serves over 9 billion customers with a workforce of around 9,250 employees. Generali Deutschland operates through a holding structure that includes about 20 insurance companies, with brands such as Generali Versicherungen, AachenMünchener, CosmosDirekt, Dialog, Advocard Rechtsschutzversicherung, and Deutsche Bausparkasse Badenia. The company offers a range of insurance products, including life insurance, property and casualty insurance, health insurance, legal protection insurance, and building society services. Generali Deutschland Lebensversicherung primarily manages life insurance, while Generali Deutschland Versicherung handles property and casualty coverage. Generali Deutschland Krankenversicherung oversees health insurance. CosmosDirekt is involved in direct insurance, and Dialog focuses on broker insurance. Advocard Rechtsschutzversicherung specializes in legal protection insurance, and Deutsche Bausparkasse Badenia is one of the largest private building societies in Germany. Additionally, Generali Deutschland provides asset management and real estate brokerage services. Generali Deutschland operates exclusively within Germany, focusing on the domestic market as part of the broader DACH region (Germany, Austria, and Switzerland). Its products are distributed through various channels, including exclusive agents, direct sales, brokers, and partnerships with financial consulting firms such as Deutsche Vermögensberatung.

ERGO Group, based in Düsseldorf, Germany, is a major European insurance company and a subsidiary of Munich Re. Founded in 1997, ERGO operates in more than 20 countries and employs around 37,000 to 40,000 people worldwide. It provides a variety of insurance platforms and services for both individual and corporate clients, focusing on meeting different financial protection needs. The company’s product range covers several main segments, including life insurance, health insurance, property and casualty insurance, and legal expenses insurance. Life insurance products include life and annuity plans aimed at long-term financial security. Health insurance is a significant part of ERGO’s business, especially in Europe. Property and casualty insurance covers risks related to property damage, liability, and accidents for both individuals and businesses. ERGO is also a leading provider of legal expenses insurance in Europe. In addition, the company offers specialized products such as personal accident insurance, daily hospital income insurance, emergency medical evacuation, and coverage for specific risks such as dengue fever and accidental dental treatment. These products are tailored to meet the needs of local markets. ERGO’s main market is Germany, where it holds a significant position in life, health, and property insurance. Internationally, the company operates in several European countries, including Poland, Belgium, Austria, Spain, and Greece. It has also expanded into emerging markets in Asia, such as India and China. About 25% of ERGO’s premium income is generated outside Germany. The company is organized into three units: ERGO Deutschland AG for the German market, ERGO International AG for international operations, and ERGO Technology & Services Management AG for technology and services.

List of Key Companies in Germany Accident Insurance Market

- Allianz SE

- AXA Konzern AG

- Debeka Krankenversicherungsvere A.G.

- DKV

- ERGO

- Generali Deutschland

- R+V Versicherung AG

- Signal Iduna

Germany Accident Insurance Industry Development

In June 2022, Getsafe’s, a German company, expanded its insurance portfolio with digital insurance products in Austria, offering liability, household, and dog owner liability coverage, enabled by its own license and powered by a mobile-first, end-to-end digital platform.

Germany Accident Insurance Market Segmentation

By Insurance Type Outlook (Revenue USD Billion, 2020–2034)

- Gross Written Premiums (GWP)

- Private

- New Business Premiums (NBP)

By Policy Type Outlook (Revenue USD Billion, 2020–2034)

- Corporate Policy

- Retail Policy

By Distribution Channel Outlook (Revenue USD Billion, 2020–2034)

- Traditional Distribution Channels

- Digital/ Online Distribution Channel

Germany Accident Insurance Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 24.70 billion |

|

Market Size Value in 2025 |

USD 25.43 billion |

|

Revenue Forecast in 2034 |

USD 33.31 billion |

|

CAGR |

3.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 24.70 billion in 2024 and is projected to grow to USD 33.31 billion by 2034.

The market is projected to register a CAGR of 3.0% during the forecast period.

A few key players in the market are Allianz SE, AXA Konzern AG, Debeka Krankenversicherungsvere A.G., DKV, ERGO, Generali Deutschland, R+V Versicherung AG, and Signal Iduna.

The corporate policy segment dominated the market in 2024 as many companies are integrating accident insurance as part of employee benefit packages, especially in industries with higher workplace risks.

The gross written premiums segment is expected to witness fastest growth in the forecast period driven by rising demand for personalized and voluntary accident coverage, especially among self-employed individuals and aging citizens.