Cell Isolation/Cell Separation Market Size, Share, Trends, Industry Analysis Report

: By Product, Technique, Cell Type (Human Cell and Animal Cell), Application, End Users, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM2259

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

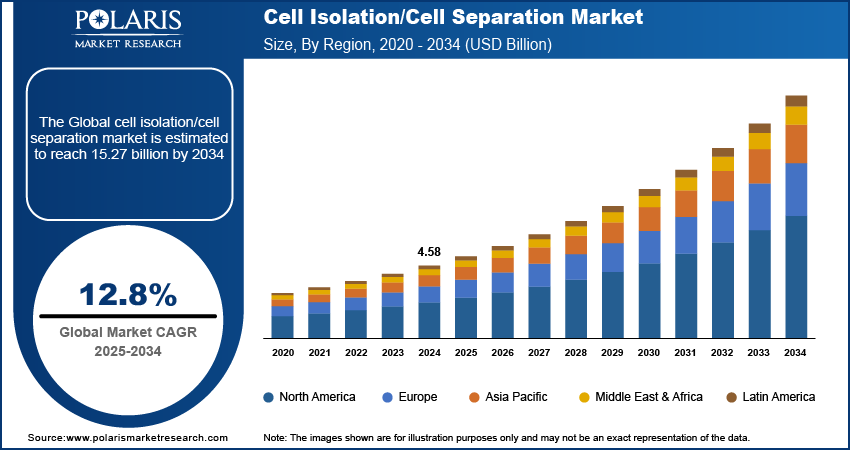

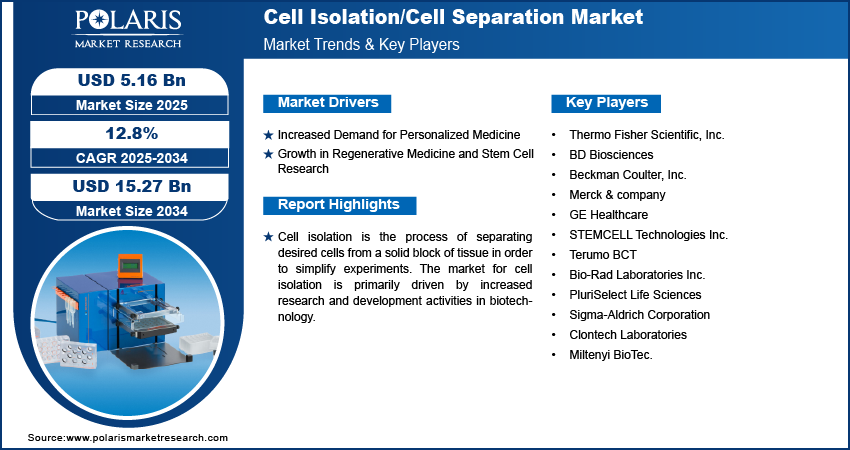

The cell isolation/cell separation market size was valued at USD 4.58 billion in 2024. The market is projected to grow from USD 5.16 billion in 2025 to USD 15.27 billion by 2034, exhibiting a CAGR of 12.8% from 2025 to 2034. The market is driven by increasing demand for precise cell sorting in research and clinical applications, advancements in centrifugation and microfluidic technologies, and growing investments in biotechnology and personalized medicine, enhancing diagnostic and therapeutic outcomes globally.

Key Insights

- The instruments segment is expected to grow significantly due to technological advancements in separation techniques and improved centrifugation machines enhancing efficiency and precision.

- Centrifugation is projected to dominate the cell isolation market by separating cells based on density, enabling high-purity isolation of specific cell types from 2025 to 2034.

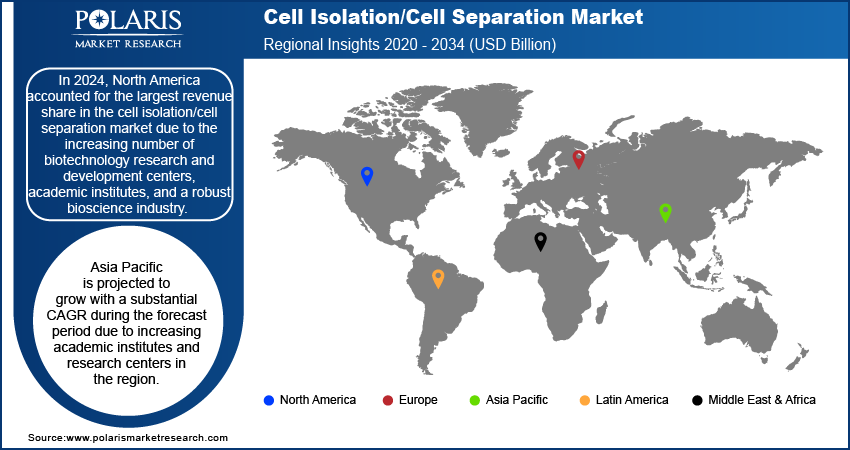

- North America held the largest revenue share in 2024, driven by numerous biotechnology R&D centers, academic institutions, and a strong bioscience industry supporting market growth.

- Asia Pacific is forecasted to register substantial CAGR growth due to increasing investment in academic institutes and research centers boosting the bioscience sector in the region.

Industry Dynamics

- Growing demand for precise cell separation in biotechnology and medical research is driving robust growth in the cell isolation/cell separation market globally.

- Expansion of advanced instrument suppliers and service providers is improving market accessibility and adoption across diverse research and clinical settings.

- High costs of cutting-edge cell separation technologies and regulatory variability across regions challenge widespread adoption and market expansion.

- Innovations in separation techniques and automation are enhancing efficiency, accuracy, and scalability, promoting sustainable growth and technological advancement in the market.

Market Statistics

- 2024 Market Size: USD 4.58 billion

- 2034 Projected Market Size: USD 15.27 billion

- CAGR (2025-2034): 12.80%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Cell isolation is the process of separating desired cells from a solid block of tissue in order to simplify experiments. The market for cell isolation is primarily driven by increased research and development activities in biotechnology. With rising investment and demand for medicinal biotechnological research, institutes have started expanding their research domains to meet the high demand from the market, which is expected to drive the cell isolation market in the coming years.

Advancements in centrifugation machines and cell separation techniques have given researchers the ability to conduct a range of experiments efficiently, with lower budgets and in less time. For instance, StemCell Technologies reports that cell separation under certain conditions takes several hours to complete using magnetic-activated cell sorting or density gradient cell sorting. New technologies such as RoboSep have reduced the time as well as enabled the separation of various samples simultaneously without contaminating the sample provided. Such advancements save time, operational capital, and many other daily routine requirements, due to which many research institutes have started expanding their research that requires cell isolations. Thus, expansion and advancement in research are expected to boost the cell separation market in the forecast years.

The cell isolation/cell separation market is expected to grow due to the expansion of applications in cancer research and treatment. Cell isolation is beneficial in studying tumor biology, identifying cancer biomarkers, and developing targeted cell therapies for treatment. For example, when circulating tumor cells are isolated from blood samples, researchers can easily analyze the molecular characteristics of tumors and their growth factors. Furthermore, the increasing incidence of cancer has increased the demand for cell isolation equipment worldwide. For instance, according to the International Agency for Research on Cancer, Asia was the most affected region, recording 9 million cancer cases in 2022. Europe was the second worst-hit region, with 4.4 million cases during the same year. North America recorded 2.6 million cases in 2022 across all types of cancer, age groups, and genders. Thus, due to the increasing applications in cancer research and growing incidents of cancer worldwide, the demand for cell separation equipment is expected to rise from 2025 to 2034.

Drivers and Opportunities

Increased Demand for Personalized Medicine

Increasing demand for personalized medicine for the treatment of rare diseases as well as cancers is anticipated to fuel the cell isolation market in the forecast years. Personalized medicine majorly focuses on unique genetics and molecular profiles of patients for the treatment of patients suffering from rare diseases. The cell isolation technique enables researchers to study exact cell types and gives a better understanding of disease mechanisms. For instance, according to the Centers for Disease Control and Prevention (CDC), there are ~300 million active patients with rare diseases globally. The United States has around 25 million patients with 8000 types of rare diseases. Meanwhile, Europe has 27 million patients with rare diseases, of which 70%-80% of rare diseases are of genetic origin. Notably, 70% of rare diseases in Europe start from childhood. Additionally, the demand for personalized medicine has also increased for common diseases to support speedy recoveries. Consequently, as the demand for personalized medicines keeps on increasing, the market for cell isolation is anticipated to grow during the study period.

Growth in Regenerative Medicine and Stem Cell Research

The growth in regenerative medicine and stem cell research is anticipated to drive the expansion of the cell isolation market. Regenerative medicine aims to repair or replace damaged tissues and organs through innovative techniques, often relying on stem cells due to their unique ability to differentiate into various cell types. Effective progress in this field necessitates precise isolation of specific stem cells and other critical cell types to understand their properties, optimize their growth conditions, and develop effective treatments. Advanced cell isolation methods enable researchers to extract and purify these cells with high accuracy, facilitating the creation of robust models for studying disease mechanisms and testing new therapeutic strategies. As regenerative medicine and stem cell research advance, there is a heightened demand for sophisticated cell isolation technologies to support the development of personalized and effective therapies. This demand drives continuous innovation in isolation techniques, thus propelling the growth of the cell isolation/cell separation market during the forecast period.

Segment Analysis

By Product Outlook

The cell isolation/cell separation market segmentation, based on product, includes consumables and instruments. The instruments segment is expected to experience significant growth with a high CAGR in the global market. This is due to advancements in the technology of separation techniques and centrifugation machines. New advanced instruments come with minimal requirements and reduce the time of the overall procedure, resulting in high demand from research institutes.

By Technique Outlook

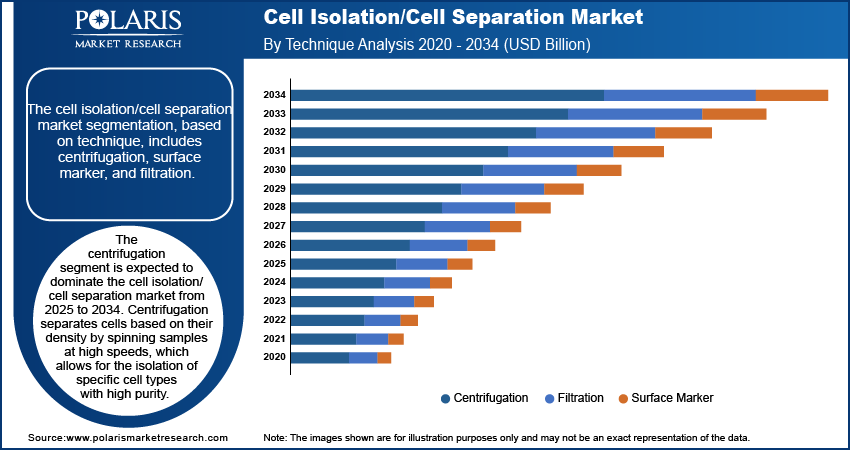

The cell isolation/cell separation market segmentation, based on technique, includes centrifugation, surface marker, and filtration. The centrifugation segment is expected to dominate the cell isolation/cell separation market from 2025 to 2034. Centrifugation separates cells based on their density by spinning samples at high speeds, which allows for the isolation of specific cell types with high purity. This method is particularly advantageous for its scalability and adaptability across various applications, including clinical diagnostics, research, and regenerative medicine. It is widely used for isolating blood cells, stem cells, and other critical cell types, making it integral to many laboratory workflows. Additionally, advancements in centrifugation technology, such as improved rotor designs and automated systems, enhance its precision and throughput, further solidifying its market position. The ability of centrifugation to handle large sample volumes and provide high-yield separations drives its continued dominance in the market. As demand for efficient and cost-effective cell separation solutions grows, centrifugation’s proven track record and ongoing technological improvements will sustain its leading role.

Regional Insights

By region, the study provides the cell isolation/cell separation market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest revenue share in the market due to the increasing number of biotechnology research and development centers, academic institutes, and a robust bioscience industry. For instance, according to the Council of State Bioscience Association, the growth in the bioscience industry has been increasing in the US. In 2021, the United States saw the establishment of 127,000 new businesses in the market, with these companies employing 2.1 people across the country. California has the highest number of established bioscience companies compared to other states. In a year, around 15000 new players. Additionally, the United States has around 8000 biotechnology research and development firms and around 3000 research institutes, the highest numbers compared to other countries. Due to the large number of bioscience companies and research institutes compared to other regions, North America is expected to dominate the cell separation market in the forecast years.

Asia Pacific is projected to grow with a substantial CAGR during the forecast period due to increasing academic institutes and research centers in the region. Countries like China, India, and Japan are witnessing an increased focus on biomedical research and cellular therapies, stimulated by substantial investments in the healthcare and biotechnology sectors. This increasing research activity is facilitating advancements in cell isolation technologies as scientists and researchers look to enhance their understanding of cellular functions and develop innovative treatments. Academic institutions in the region are also expanding their research capabilities, establishing specialized laboratories and collaborations that contribute to the demand for advanced cell isolation tools and techniques. Additionally, government initiatives and funding aimed at promoting scientific research and development are further accelerating cell isolation market growth. Thus, as the region continues to strengthen its research infrastructure and foster academic excellence, the market is expected to experience rapid expansion in the coming years.

The cell isolation/cell separation market in India is poised for significant growth due to the increasing pharmaceutical and biotechnology companies and rising research activities. A notable increase in mergers and acquisitions underscores the consolidation and expansion efforts within the industry. For instance, in the first half of 2022, Indian healthcare companies invested $4.32 billion in M&A activities, a significant rise from $2.02 billion during the same period the previous year. This increase in investment is intensifying research capabilities and accelerating the development of innovative cell isolation technologies. As pharmaceutical and biotechnology firms expand their operations and integrate new technologies, the demand for advanced cell isolation tools is set to increase, further stimulating cell isolation market growth in India.

Key Players & Competitive Insights

The market is always evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, advanced manufacturing technologies, and significant capital to maintain a competitive edge. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are influencing the market by introducing innovative medical devices and meeting the needs of specific market sectors. This competitive environment is further amplified by continuous progress in product offerings and techniques, greater emphasis on sustainability, and the rising requirement for single-use products in diverse industries. Major players in the market include Thermo Fisher Scientific, Inc.; BD Biosciences; Beckman Coulter, Inc.; Merck & Company; GE Healthcare; STEMCELL Technologies Inc.; Terumo BCT; Bio-Rad Laboratories Inc.; PluriSelect Life Sciences; Sigma-Aldrich Corporation; Clontech Laboratories; and Miltenyi BioTec.

Thermo Fisher Scientific Inc., headquartered in Waltham, Massachusetts, is a global provider of scientific instrumentation, reagents, and consumables. The company serves a diverse range of sectors including biotechnology, pharmaceuticals, and environmental testing, offering products and services that support research, clinical, and industrial applications. Thermo Fisher operates through four key segments: Life Sciences Solutions, Analytical Instruments, Specialty Diagnostics, and Laboratory Products and Services. It is recognized for its extensive portfolio that aids in scientific research and improves patient outcomes, with a focus on delivering high-quality solutions and maintaining operational excellence. In June 2024, l Thermo Fisher Scientific Inc. launched the Gibco CTS DynaCellect Magnetic Separation System, designed to streamline the transition from process and clinical development to commercial manufacturing for cell therapy. This advanced instrument, featuring next-generation cell isolation, activation, depletion, and Dynabeads magnetic beads removal, offers a scalable, flexible, and automated solution. DynaCellect aims to optimize cell therapy manufacturing, ensuring precise cell isolation and reducing manufacturing failures, thus supporting the commercialization of innovative therapies and future breakthroughs in cell therapy.

GE Healthcare, headquartered in Chicago, Illinois, is a global provider of medical technologies and services. The company offers a broad range of products including imaging and diagnostic equipment such as MRI, CT, and ultrasound systems, along with healthcare IT solutions for data management and patient monitoring. GE Healthcare serves various healthcare providers, including hospitals and research institutions, focusing on enhancing clinical outcomes and operational efficiency. Through its comprehensive portfolio, the company aims to support healthcare professionals and address the evolving needs of the industry.

List of Key Companies

- Thermo Fisher Scientific, Inc.

- BD Biosciences

- Beckman Coulter, Inc.

- Merck & company

- GE Healthcare

- STEMCELL Technologies Inc.

- Terumo BCT

- Bio-Rad Laboratories Inc.

- PluriSelect Life Sciences

- Sigma-Aldrich Corporation

- Clontech Laboratories

- Miltenyi BioTec.

Market Developments

May 2024: Applied Cells announced the launch of MARS Ingenuity Reagent kits for rapid, high-quality cell isolation. Designed for use with the MARS® Bar platform, these kits include both RUO and GMP-grade reagents optimized for cell therapy development. The Ingenuity kits feature biodegradable superparamagnetic beads for diverse isolation needs, such as CD4+, CD8+, and CD14+. This integrated solution enhances efficiency in developing CAR-T and CAR-macrophage therapies, offering a seamless transition from small-scale to full-scale manufacturing with reduced costs and time.

November 2023: LevitasBio introduced the LeviCell EOS system, a new advancement in cell isolation and enrichment developed in collaboration with Planet Innovation. Launched mid-year, the LeviCell EOS builds on the Levitation Technology of its predecessor, LeviCell 1.0, offering higher throughput with the ability to process four samples simultaneously and connect up to four modules. The system features real-time analysis software and a flexible design with interchangeable modules. Early installations at leading research labs highlight its impact on sample processing and characterization.

January 2022: Sony Corporation launched the CGX10 Cell Isolation System, designed for high-speed, high-purity cell sorting within a completely closed environment. This innovation ensures cells are isolated and analyzed while maintaining sterility, which is crucial for fields like cell-based immunotherapy. The CGX10 addresses the growing need for high-purity, viable cell isolation in sterile conditions, supporting the production of advanced therapies for cancer and autoimmune disorders. This new system represents a significant advancement in cell therapy technology.

Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Consumables

- Reagents & Kits

- Beads

- Disposables

- Instruments

- Magnetic Activated Cell Separated

- Filtration System

- Centrifuge

- Flow Cytometers

By Technique Outlook (Revenue – USD Billion, 2020–2034)

- Centrifugation

- Surface Marker

- Filtration

By Cell Type Outlook (Revenue – USD Billion, 2020–2034)

- Human Cell

- Differentiated Cells

- Stem Cells

- Animal Cell

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Biomolecule Isolation

- Therapeutics

- Cancer Research

- In Vitro Diagnostics

- Stem Cell Research

By End Users Outlook (Revenue – USD Billion, 2020–2034)

- Academic and Research Laboratories

- Cell Banks

- Biotechnology and Biopharmaceutical Companies

- Hospitals and Diagnostics Laboratories

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 4.58 billion |

|

Market Size Value in 2025 |

USD 5.16 billion |

|

Revenue Forecast in 2034 |

USD 15.27 billion |

|

CAGR |

12.8% from 2025 – 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Cell Type |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The cell isolation/cell separation market size was valued at USD 4.58 billion in 2024 and is projected to grow to USD 15.27 billion by 2034.

The market is projected to grow at a CAGR of 12.8% from 2025 to 2034.

North America had the largest share of the market.

The key players in the market are Thermo Fisher Scientific, Inc.; BD Biosciences; Beckman Coulter, Inc.; Merck & Company; GE Healthcare; STEMCELL Technologies Inc.; Terumo BCT; Bio-Rad Laboratories Inc.; PluriSelect Life Sciences; Sigma-Aldrich Corporation; Clontech Laboratories; and Miltenyi Biotec

The centrifugation segment is expected to dominate the cell isolation/cell separation market from 2025 to 2034.