Glycomics/Glycobiology Market Share, Size, Trends, Industry Analysis Report

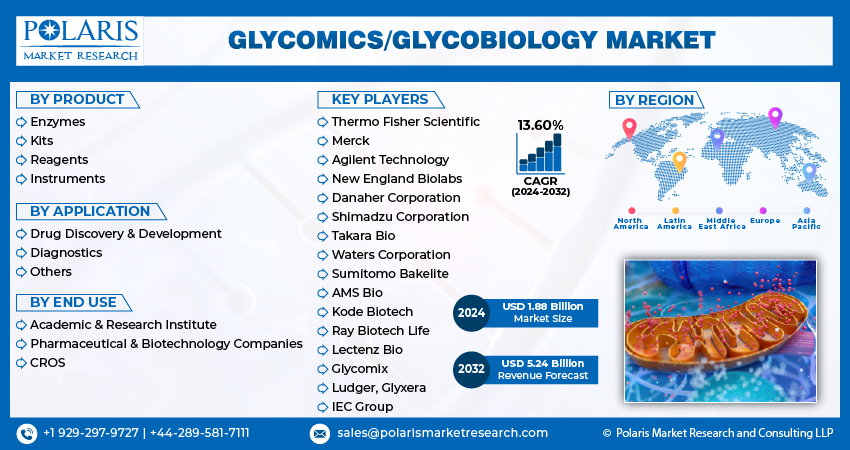

By Product (Enzymes, Kits, Reagents, and Instruments); By Application; By End-Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: pdf

- Report ID: PM3047

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

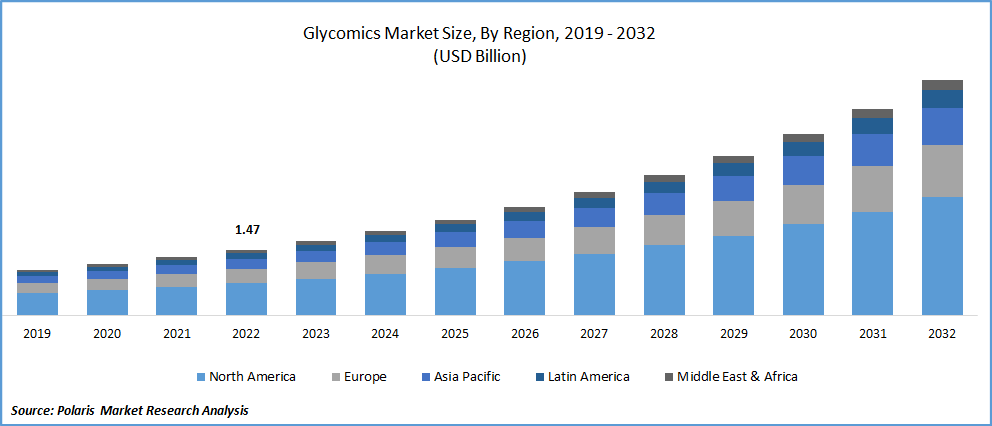

The global glycomics/glycobiology market was valued at USD 1.66 billion in 2023 and is expected to grow at a CAGR of 13.60% during the forecast period. Increasing investments in the research & development activities of novel drugs by various pharmaceutical and biotechnology companies along with the growing focus on proteomics and glycobiology across the globe are anticipated to accelerate the growth of the global market.

Know more about this report: Request for sample pages

The growing prevalence and emerging technology for analyzing glycans and proteomes, which generally play a key role in the body system and cell-to-cell interaction is also fueling the glycomics/glycobiology market growth. For instance, in August 2022, GlycoNet Integrated Services announced that it has received an investment of USD 10.68 million from the Canadian Foundation for Innovation through its Major Science Initiative Fund for the continuation of its research on glycomics tools and services.

Growing alterations in the cell surface glycans significantly contribute to neoplastic and metastatic properties of tumor cells and hence play a very crucial role in cancer biology. Continuous growth in the application of glycobiology in cancer research to develop efficient and advanced products along with the use of glycans in therapeutic monoclonal antibodies are anticipated to have a positive impact on the growth of the market and create high demand during the projected period.

The outbreak of the COVID-19 pandemic has positively impacted the market. To address the COVID-19 outbreak, many large healthcare organizations come together and was supporting the development of vaccines and planning for medicines supply chain issues. A dramatic rise in the demand for drugs to manage the spread of COVID has resulted in huge opportunities for manufacturers of drugs, as many countries worldwide were facing a shortage of drugs.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The growing prevalence and surge in the number of numerous disorders such as diabetes, obesity, and heart diseases, among others as a result of rapidly growing geriatric population across the globe, are major factors driving the expansion and growth of the global market.

The market is also witnessing significant expansion in the R&D expenditures and research efforts associated with glycomics by biotechnology and pharmaceutical firms, especially in emerging economies like India and China. According to the WHO, the total population aged 60 years and above is around 1 billion, which is projected to reach 2.1 billion by the end of 2050, out of which nearly 80% of older people will be living in low-middle income countries.

Additionally, an emerging trend of the adoption of precision medicine to treat chronic and several rare diseases and high proliferation for a variety of recombinant pharmaceuticals like therapeutic monoclonal antibodies led to pharmaceutical industry and drug regulatory bodies to easily understand the importance of glycans in therapeutics, globally are further anticipated to fuel the demand and growth of the glycomics/glycobiology market.

Report Segmentation

The market is primarily segmented based on product, application, end-use, and region.

|

By Product |

By Application |

By End Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Instruments segment accounts for the maximum market share in 2022

The growth of the segment is mainly driven by rapid growth in the usage of instruments in drug discovery and diagnostic testing-related activities. The emerging trend of more advanced and innovative instruments among key market companies worldwide to enhance overall user experience and expand their market reach is also contributing significantly to market growth.

Moreover, the enzymes segment is expected to account for a considerable market share over the projected period owing to the rising use of a variety of enzymes in cancer research and diagnostics. In addition, enzymes are also widely used in various therapeutic approaches for diseases caused by deficiencies like diabetes, Gaucher disease, and Tay Sachs disease and their therapeutic use further includes direct anti-cancer, anti-bacterial, and antiviral activities. Thus, the segment market is projected to have a positive impact on growth in the coming years.

The drug discovery & development segment held the highest market share in 2022

The drug discovery & development segment was the largest segment in terms of revenue in 2022, which is highly attributable to a rapid surge in the demand for glycomics products in the drug discovery sector and continuously increasing potential of biomarker discovery. In addition, high demand for a variety of personalized medicine to treat chronic diseases and enhancement in personalized glycol medicine coupled with the growing financial support and funding by governments across many countries to accelerate the R&D activities are also likely to propel the revenue growth of the segment market.

In recent years, with the rising burden of chronic diseases across the globe, the need to develop new and more effective drugs is also gaining traction. Glycans play a key role in many biological processes including cell-cell interaction, thereby having high importance in drug development. According to the World Health Organization, around 500 million people will be living with heart diseases, obesity, and other non-communicable diseases between the period of 2020 and 2030. And, cost of treating new cases of preventable diseases is likely to reach about USD 300 million by 2030, and every year, nearly USD 27 billion is projected to increase in healthcare costs.

Pharmaceutical & biotechnology companies are expected to witness the highest growth over the forecast period.

The pharmaceutical & biotechnology companies are likely to witness high a growth rate during the anticipated period, which is mainly attributed to a high focus on the implementation of cutting-edge technologies like regenerative medicine and expansion in the offerings by contract manufacturing organizations for biotechnology and pharmaceutical products.

Pharmaceutical & biotechnology companies are well known to provide effective and cost-saving options to their customers along with the reduction in the average time taken needed for the management and operation of facilities for both manufacturing and research. Moreover, there has been a rapid boost in incorporation of novel product categories such as nanobodies, synthetic vaccines, fusion protein, immune-therapeutics, and soluble receptors, which creates new growth opportunities for the market.

North America dominated the global market in 2022

The growth of the regional market can be attributed to rising research & development activities in the field of glycobiology and increasing prevalence of numerous types of personalized medicine and high consumer spending capacity on their health and well-being mainly in developed economies like the United States and Canada.

Furthermore, the Asia Pacific region is likely to emerge as the fastest-growing region at a highest CAGR throughout the forecast period, on account of extensive rise in the biopharmaceutical industry and heavy investments in CROs for developing biologics and drugs.

Additionally, rapidly growing population burden in countries like China and India and lack of awareness regarding importance of physical activities and exercises, led to growth in the number of chronic illnesses among people, which in turn, drive the market.

Competitive Insight

Key players in the glycomics/glycobiology market include Thermo Fisher Scientific, Merck, Agilent Technology, New England Biolabs, Danaher Corporation, Shimadzu Corporation, Takara Bio, Waters Corporation, Sumitomo Bakelite, AMS Bio, Kode Biotech, Ray Biotech Life, Lectenz Bio, Glycomix, Ludger, Glyxera, and IEC Group.

Recent Developments

- In April 2022, Bruker Corporation, acquired IonSense, to boost the DART-MS methods and development of applications. With this agreement, IonSense will get financial investments to increase its development efforts in applied markets such as food analysis and forensics.

- Furthermore, in March 2022, Vector Laboratories announced the opening of its new facility in Newark, California, which would become the company’s next headquarters. The new facility includes a new office and laboratory space of around 41,000 square feet to boost and improve the company’s research and development capabilities.

Glycomics/Glycobiology Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1.88 billion |

|

Revenue forecast in 2032 |

USD 5.24 billion |

|

CAGR |

13.60% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Thermo Fisher Scientific, Merck KGaA, Agilent Technology, New England Biolabs, Danaher Corporation, Shimadzu Corporation, Takara Bio Inc., Waters Corporation, Sumitomo Bakelite Co. Ltd., AMS Bio, Kode Biotech Limited, Ray Biotech Life Inc., Lectenz Bio, Glycomix Ltd., Ludger Ltd., Glyxera GmbH, and IEC Group. |

FAQ's

Key companies in glycomics/glycobiology market are Thermo Fisher Scientific, Merck, Agilent Technology, New England Biolabs, Danaher Corporation, Shimadzu Corporation, Takara Bio, Waters Corporation, Sumitomo Bakelite, AMS Bio, Kode Biotech, Ray Biotech Life.

The global glycomics/glycobiology market expected to grow at a CAGR of 13.6% during the forecast period.

The glycomics/glycobiology market report covering key segments are product, application, end-use, and region.

Key driving factors in glycomics/glycobiology market are rising investments in R&D of pharmaceutical and biotechnology companies and technological advancements.

The global glycomics/glycobiology market size is expected to reach USD 5.24 billion by 2032.