Gout Therapeutics Market Size, Share, Trend, Industry Analysis Report

By Disease Condition (Acute Gout, Chronic Gout), By Drug Class, By Distribution Channel, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 128

- Format: PDF

- Report ID: PM1611

- Base Year: 2024

- Historical Data: 2020-2023

Overview

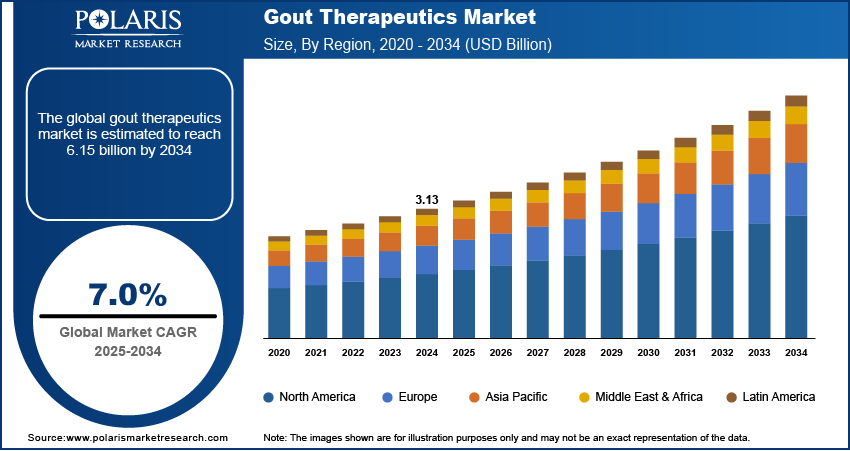

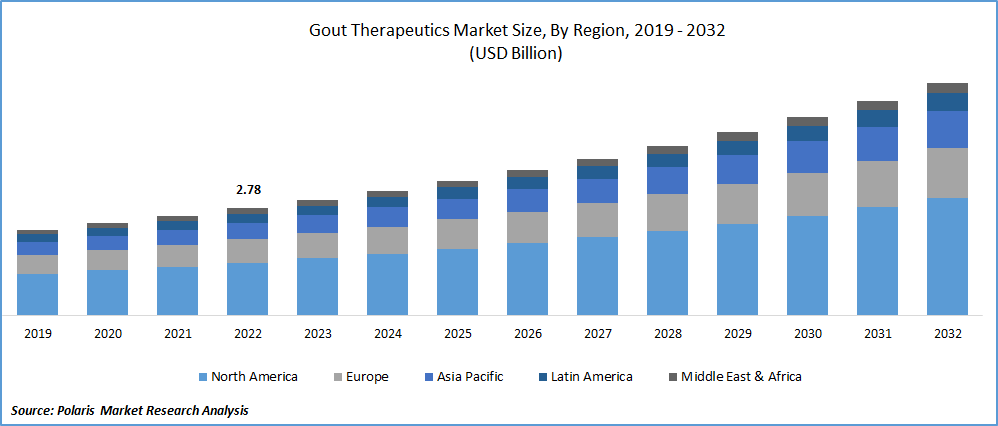

The global gout therapeutics market size was valued at USD 3.13 billion in 2024, growing at a CAGR of 7.0% from 2025 to 2034. Growing incidences of gout due to sedentary lifestyles, alcohol consumption, and obesity are driving demand for effective therapeutic options. The correlation between metabolic syndrome and gout is intensifying treatment needs, accelerating market expansion across primary and chronic care.

Key Insights

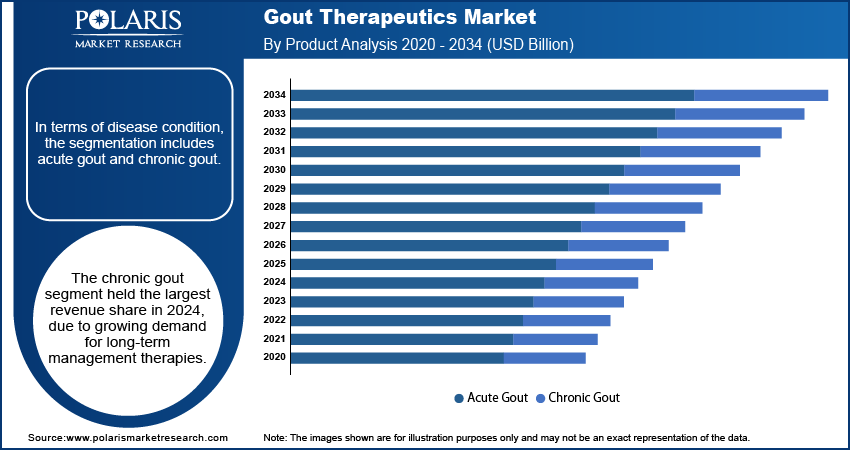

- The chronic gout segment led in 2024 due to rising demand for long-term therapies that manage uric acid levels and prevent flare-ups.

- The NSAIDs segment held ~43% of the market share in 2024, driven by fast-acting relief from inflammation and pain during acute gout flares.

- The retail pharmacy segment dominated distribution in 2024, supported by wide accessibility and high prescription dispensing rates.

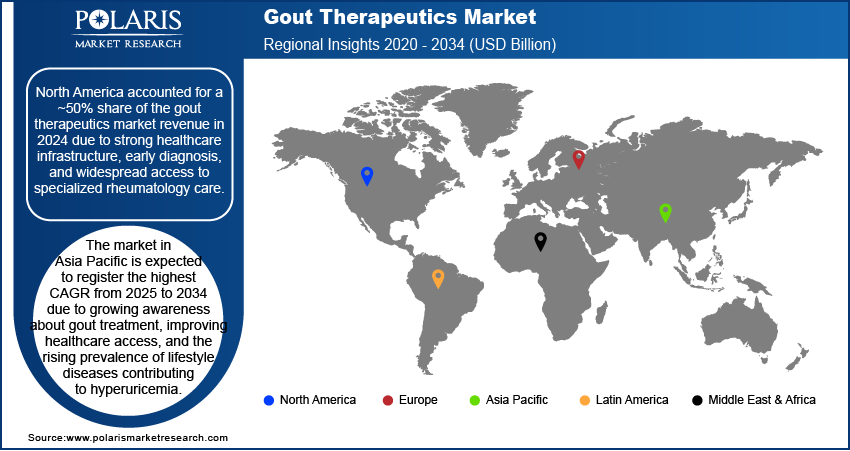

- North America accounted for ~50% of the market in 2024, driven by advanced healthcare infrastructure and widespread rheumatology access.

- The U.S. led the regional market due to high gout prevalence, strong insurance coverage, and availability of innovative therapeutics.

- The market in Asia Pacific is projected to grow fastest from 2025 to 2034, fueled by rising awareness, better healthcare access, and increasing lifestyle-related hyperuricemia.

- The industry in China is experiencing rapid growth due to rising gout cases linked to dietary changes, alcohol consumption, and an aging population.

Industry Dynamics

- Rising prevalence of hyperuricemia and gout due to lifestyle changes is increasing demand for effective long-term therapeutic solutions.

- Growing focus on targeted therapies and biologics is driving innovation in uric acid-lowering and anti-inflammatory treatment options.

- Expansion of clinical pipelines with novel agents enables improved patient outcomes and addresses unmet needs in refractory gout management.

- High cost of advanced therapies and limited reimbursement in emerging markets restrict patient access and market penetration.

Market Statistics

- 2024 Market Size: USD 3.13 billion

- 2034 Projected Market Size: USD 6.15 billion

- CAGR (2025–2034): 7.0%

- Asia Pacific: Largest market in 2024

AI Impact on Gout Therapeutics Market

- AI-based gout management systems significantly reduce CKD progression and improve serum urate target achievement compared to traditional EMR systems.

- Real-time data integration through mobile apps and lab tools enhances patient adherence and reduces gout flare frequency.

- AI enables precision medicine using pharmacogenomic profiling and wearable urate monitors to personalize treatment strategies.

- AI-powered digital health platforms, including telemedicine and remote monitoring, expand access, support dynamic treatment adjustments, and drive market growth.

Gout is a form of inflammatory arthritis caused by uric acid crystal deposition. The gout therapeutics market comprises pharmaceutical products and treatment approaches aimed at managing and alleviating symptoms of gout. The market includes urate-lowering therapies, anti-inflammatories, and novel biologics designed to prevent flare-ups, reduce uric acid levels, and address chronic complications. It serves a growing patient population driven by aging demographics, lifestyle factors, and increasing prevalence of metabolic disorders. Increased R&D in biologics and targeted inhibitors has resulted in new classes of drugs offering improved efficacy and safety. These innovations are enhancing therapeutic outcomes, especially for refractory gout patients, expanding treatment possibilities and driving physician adoption.

Increased awareness campaigns by healthcare organizations and patient advocacy groups are leading to earlier diagnosis and treatment. Earlier intervention reduces complications, encourages compliance, and supports the broader adoption of prescription therapies over traditional self-medication approaches. Moreover, the rising use of genomic screening and biomarkers in gout is enabling precision medicine approaches. Tailored therapy selection based on genetic and metabolic profiles is improving patient outcomes and supporting premium-priced therapeutics in clinical practice.

Drivers & Opportunities

Rising Prevalence of Gout and Lifestyle Disorders: Rising cases of gout linked to changing lifestyles, poor dietary habits, alcohol use, and increasing rates of obesity are creating strong demand for targeted therapeutic solutions. People who consume purine-rich diets or suffer from metabolic syndrome often experience elevated uric acid levels, leading to frequent and painful gout attacks. The rising burden of lifestyle-related diseases, such as hypertension, type 2 diabetes, and kidney disorders, is further intensifying the need for reliable gout therapies. According to the American Heart Association, Inc., in 2024, 29.3 million adults were diagnosed with diabetes. Primary care physicians and specialists are increasingly recognizing the long-term impact of untreated hyperuricemia, prompting early diagnosis and intervention. As a result, pharmaceutical innovation is moving toward safer and more effective urate-lowering therapies, including novel biologics and anti-inflammatory agents. The growing awareness among patients and healthcare professionals about managing gout as a chronic inflammatory condition is also supporting long-term treatment adherence. This combination of clinical urgency and patient-centered care is accelerating the expansion of the gout therapeutics market across care settings.

Increased Geriatric Population Base: Older adults are more likely to develop gout due to age-related metabolic changes, impaired kidney function, and the presence of multiple chronic diseases. According to the World Health Organization, by 2030, about 16.7% of the global population will be aged 60 and older. By 2050, this demographic is projected to double to approximately 2.1 billion. This population often requires consistent management of uric acid levels alongside treatment for cardiovascular and renal complications. Many elderly patients face recurring gout flares, leading to reduced mobility and quality of life, which makes effective long-term therapies a necessity. The aging demographic is also more likely to access healthcare services regularly, leading to higher diagnosis and treatment rates. Pharmaceutical developers are investing in patient-friendly formulations and lower-risk therapies tailored to geriatric needs. Clinical guidelines are evolving to include more aggressive management strategies for older patients with refractory or advanced gout. The steady rise in this population segment globally is placing sustained pressure on healthcare systems to deliver comprehensive gout care, thereby contributing to the market’s ongoing expansion. The focus on geriatric-specific outcomes and comorbidity management is expected to shape future innovation in gout therapeutics.

Segmental Insights

Disease Condition Analysis

In terms of disease condition, the segmentation includes acute gout and chronic gout. The chronic gout segment held the largest revenue share in 2024 due to growing demand for long-term management therapies. Patients suffering from recurrent flares and persistent hyperuricemia require continuous therapeutic intervention, driving the need for urate-lowering agents and maintenance strategies. Comorbidities such as kidney dysfunction and cardiovascular diseases further complicate management, prompting physicians to implement multi-faceted treatment approaches. Longer treatment duration, higher prescription frequency, and regular monitoring contribute to sustained revenue generation in this segment. Pharmaceutical innovation aimed at better controlling chronic manifestations is also supporting robust sales within this category.

The acute gout segment is witnessing increasing traction due to the need for immediate symptom relief during flare-ups. Episodes of intense joint pain and swelling drive patients to seek fast-acting treatment, pushing demand for NSAIDs, corticosteroids, and colchicine. Greater awareness about early diagnosis and availability of effective medications have improved treatment-seeking behavior, especially among younger patients experiencing their first flare. Emergency departments and outpatient clinics frequently administer acute therapies, further expanding the usage base. This segment is also supported by the growing incidence of lifestyle-related risk factors contributing to the onset of initial acute episodes.

Drug Class Analysis

Based on drug class, the segmentation includes NSAIDs, corticosteroids, colchicine, urate-lowering agents, and others. NSAIDs segment dominated the market in 2024 with ~43% of the revenue share due to their rapid action in reducing inflammation and pain associated with acute gout flares. Physicians often prescribe NSAIDs as the first-line treatment due to their broad availability, favorable safety profile for short-term use, and patient familiarity. Their cost-effectiveness compared to other therapeutic options also supports their widespread adoption across outpatient and primary care settings. Increased use in both monotherapy and combination regimens for early-stage gout cases continues to reinforce their leading position in the treatment landscape.

The urate-lowering agents segment is expected to register a significant CAGR from 2025 to 2034 driven by their effectiveness in managing chronic gout and preventing long-term joint damage. These agents, including xanthine oxidase inhibitors and uricosurics, address the underlying cause of hyperuricemia rather than just symptomatic relief. Increasing physician preference for long-term disease management strategies and rising awareness about the need to control serum uric acid levels are encouraging higher adoption rates. Additionally, ongoing research and development of novel urate-lowering therapies offering improved efficacy and reduced side effects are expected to accelerate their uptake during 2025–2034.

Distribution Channel Analysis

In terms of distribution channel, the segmentation includes hospital pharmacy, retail pharmacy, and online pharmacy. The retail pharmacy segment held the largest revenue share in 2024 due to its accessibility and high prescription fulfillment rate. Chronic gout patients often require monthly refills, and retail pharmacies offer convenience for both purchasing and pharmacist consultations. Widespread insurance coverage and discount programs available at these outlets also improve patient compliance. Many individuals prefer brick-and-mortar locations for personalized assistance, especially older adults managing long-term gout. Retail chains additionally support higher sales volume due to their presence in both urban and suburban areas, ensuring strong penetration across diverse patient populations.

The online pharmacy segment is gaining momentum due to the increasing shift toward digital health platforms and home delivery of prescription medications. Patients managing chronic gout are adopting e-commerce options for convenience, especially when dealing with mobility issues or recurring prescriptions. Competitive pricing, doorstep delivery, and discreet purchasing options are enhancing customer satisfaction. Improved integration with telemedicine platforms and e-prescriptions is enabling seamless order placement, particularly for refills of maintenance drugs such as urate-lowering agents. The segment is also benefiting from expanded regulatory support for online pharmacy operations in several regions, driving broader acceptance and rapid growth.

Regional Analysis

The North America gout therapeutics market accounted for ~50% of the revenue share in 2024 due to strong healthcare infrastructure, early diagnosis, and widespread access to specialized rheumatology care. High awareness among patients, combined with a strong presence of branded therapeutics, has supported rapid treatment initiation and adherence. Investments in research for advanced urate-lowering therapies and consistent reimbursement policies encouraged the adoption across public and private healthcare systems. Robust collaborations between pharmaceutical companies and academic institutions are helping in the continuous development of new gout drugs, driving innovation and market leadership in the region.

U.S. Gout Therapeutics Market Insights

The U.S. dominated the market in North America due to high disease burden, a large insured patient population, and availability of advanced treatment options. Strong clinical guidelines and proactive disease management approaches adopted by healthcare providers have resulted in better patient outcomes and wider acceptance of both biologics and novel small molecules. The country’s extensive clinical research ecosystem and fast-track drug approvals from regulatory bodies have also enabled quicker market entry for new therapies. Moreover, increased use of precision medicine and focus on managing chronic gout among high-risk populations continue to strengthen the country’s leadership in this space.

Asia Pacific Gout Therapeutics Market Trends

Asia Pacific is expected to register the highest CAGR from 2025 to 2034 due to growing awareness about gout treatment, improving healthcare access, and the rising prevalence of lifestyle diseases contributing to hyperuricemia. Increasing disposable income and expansion of public healthcare coverage are making advanced therapies more accessible across urban and semi-urban areas. Local pharmaceutical players are investing in affordable generics and biosimilars, creating competitive pricing and broader availability. Government-led initiatives supporting chronic disease management are also boosting demand for gout therapeutics. The George Institute for Global Health is expected to lead a USD 12.5 million Regional Health Partnership funded by the Australian Government. It is projected to help five Pacific and Southeast Asian countries to enhance diabetes and hypertension care in their primary health systems. Furthermore, clinical research and licensing collaborations with global firms are enhancing the treatment landscape across the region.

China Gout Therapeutics Market Overview

The market in China is growing rapidly due to a sharp rise in gout cases driven by dietary shifts, increased alcohol consumption, and aging demographics. Enhanced diagnostic capabilities and a strong push by healthcare authorities to tackle noncommunicable diseases are accelerating treatment demand. Chinese pharmaceutical firms are scaling up local production of gout medications and forming partnerships with global innovators to improve access to advanced therapies. Digital health platforms and telemedicine are expanding patient reach, especially in underserved regions. Additionally, national drug procurement programs are reducing treatment costs and enabling broader patient inclusion, supporting sustained market growth in the country.

Europe Gout Therapeutics Market Assessment

The market in Europe is growing due to improved treatment guidelines, higher screening rates, and the integration of gout care within primary healthcare systems. Countries across the region are emphasizing early intervention and uric acid management to prevent chronic complications. The availability of biosimilars and newer targeted therapies is encouraging more healthcare providers to initiate long-term treatment plans. Regulatory support for innovation, coupled with government funding for rare and chronic disease research, is driving product development. The region also benefits from a well-structured network of rheumatologists and pharmacists who ensure continuity in care, leading to better adherence and outcomes in gout management.

Key Players & Competitive Analysis

The competitive landscape of the gout therapeutics market is shaped by robust industry analysis focusing on innovation pipelines and treatment efficacy. Companies are adopting market expansion strategies to strengthen their presence across emerging economies where disease prevalence is rising. Strategic alliances and joint ventures are increasingly used to co-develop next-generation therapies targeting uric acid regulation and inflammation control. Mergers and acquisitions remain key tools for accessing novel drug candidates and enhancing product portfolios, often followed by focused post-merger integration to streamline operations and accelerate commercialization. Technology advancements in formulation science, particularly in targeted drug delivery, are improving patient outcomes and boosting competitiveness. Firms are prioritizing biologics and small molecules with reduced side effects to meet evolving clinical demands. Regulatory flexibility for fast-track approvals has also encouraged aggressive development timelines, enhancing the pace of product launches. This dynamic environment continues to foster innovation and collaboration, reinforcing competition and diversification across the global gout therapeutics space.

Key Players

- Arrowhead Pharmaceuticals, Inc.

- AstraZeneca

- Eisai Co., Ltd.

- GSK plc.

- Merck & Co., Inc.

- Novartis AG

- Regeneron Pharmaceuticals Inc.

- Takeda Pharmaceutical Company Limited

- Teijin Pharma Ltd.

- Zydus Group

Gout Therapeutics Industry Developments

In July 2025, Eisai Co., Ltd. launched “URECE” in China as a treatment for Gout.

In July 2024: Novartis announced approving Phase III results for LNP023, a novel chronic gout treatment, showing significant uric acid reduction and effective flare control by targeting a key inflammatory pathway.

Gout Therapeutics Market Segmentation

By Disease Condition Outlook (Revenue, USD Billion, 2020–2034)

- Acute Gout

- Chronic Gout

By Drug Class Outlook (Revenue, USD Billion, 2020–2034)

- NSAIDs

- Corticosteroids

- Colchicine

- Urate-Lowering Agents

- Others

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Gout Therapeutics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.13 billion |

|

Market Size in 2025 |

USD 3.34 billion |

|

Revenue Forecast by 2034 |

USD 6.15 billion |

|

CAGR |

7.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 3.13 billion in 2024 and is projected to grow to USD 6.15 billion by 2034.

The global market is projected to register a CAGR of 7.0% during the forecast period.

North America accounted for ~50% of the gout therapeutics market revenue share in 2024 due to strong healthcare infrastructure, early diagnosis, and widespread access to specialized rheumatology care.

A few of the key players in the market are Arrowhead Pharmaceuticals, Inc.; AstraZeneca; GSK plc.; Eisai Co., Ltd.; Merck & Co., Inc.; Novartis AG; Regeneron Pharmaceuticals Inc.; Takeda Pharmaceutical Company Limited; Teijin Pharma Ltd.; and Zydus Group.

The NSAIDs segment dominated the market with ~43% of the revenue share in 2024, due to their rapid action in reducing inflammation and pain associated with acute gout flares.

The chronic gout segment held the largest revenue share in 2024 due to growing demand for long-term management therapies.