Grass-fed Protein Market Share, Size, Trends, Industry Analysis Report

By Product Type (Powder, Shakes & drinks, Bars, Others); By Flavor; By Distribution Channel; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 115

- Format: PDF

- Report ID: PM4669

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

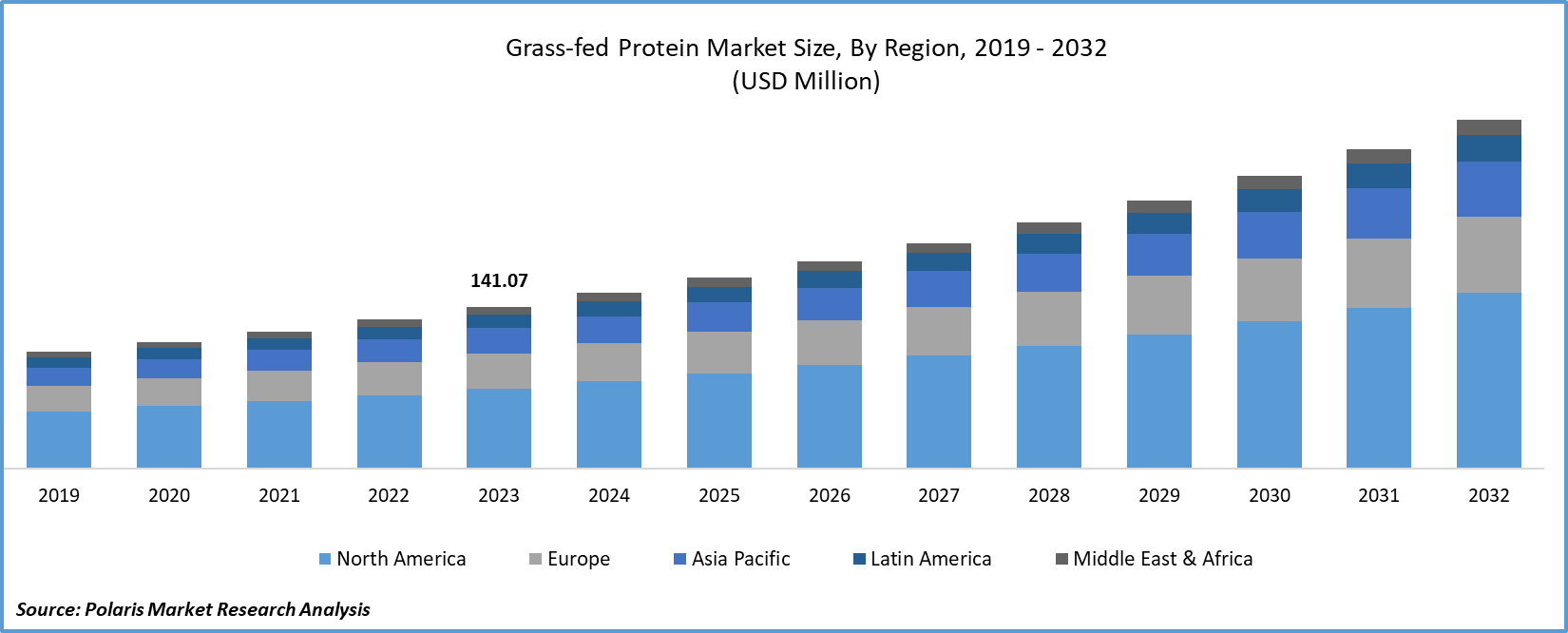

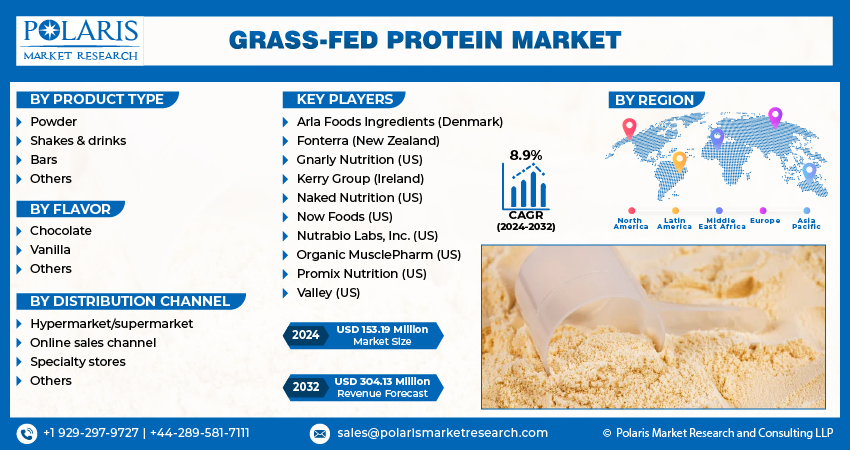

Grass-fed Protein Market size was valued at USD 141.07 million in 2023. The market is anticipated to grow from USD 153.19 million in 2024 to USD 304.13 million by 2032, exhibiting the CAGR of 8.9% during the forecast period.

Market Overview

The grass-fed protein market is gaining importance nowadays with the rising number of people opting for physical fitness with gym and exercise activities. Most of the people are showing profound interest in adopting grass-fed proteins in their diet, aiming to promote their nutritional levels. The growing concerns about food intake, primarily among sports personnel and athletes, are showing prominent demand potential for the grass-fed protein market. Furthermore, the rising incorporation of grass-fed proteins in the production of protein and energy bars is likely to stimulate market growth during the study period

For instance, in September 2023, Perfect Sports unveiled its new offering, DIESEL New Zealand Protein Bars, developed by adding grass-fed, pasture-raised proteins to its whey protein portfolio. This is for athletes, fitness practitioners, and others looking for convenient nutritional snacking.

To Understand More About this Research:Request a Free Sample Report

Moreover, the rising utility of grass-fed protein in food products, specifically by the companies engaged in offering health food and beverages, is expected to support the growth of grain-fed proteins. For instance, in February 2024, Nestle announced the launch of its initial animal-free protein powder, Orgain Better Whey with the integration of grass-fed and pasture-raised whey protein.

Growth Drivers

Rising collaborative initiatives to promote healthy food

The prevalence of strategic collaborations among the major players in the global market is driving the growth of the grass-fed protein market. For instance, in November 2023, Grass Fed Foods entered into a partnership agreement with Matador Ranch & Cattle to equip grass-fed beef in its product manufacturing activities. Furthermore, the increasing investments in the food and beverages industry is anticipated to create significant demand potential in the coming years. For instance, in January 2023, Elo raised USD 10 million and announced the launch of its second product, Smart Protein, which is made up of grass-fed whey protein.

The increasing consumer willingness to purchase healthy drinks

The global market is registering prominent demand for healthy drinks and protein bars to acquire proteins and minerals for efficient body functioning. Consumers are opting for convenience foods with higher nutritional value due to the growing difficulties in maintaining a balanced diet. The increasing demand for healthier, ethically sourced dairy products is positively influencing global market growth. For instance, in April 2023, a2 Milk Company USA announced the launch of its new milk offering derived from grass-fed cows.

Restraining Factors

The inability to meet demand for grass-fed proteins

The limited knowledge of grass-fed proteins among consumers and the lower ability to increase its supply in the marketplace are major factors impeding global grass-fed protein market growth in the long run. However, the growing initiatives taken by food and protein production companies to enhance awareness and accessibility of grass-fed protein are likely to propel the global market.

Report Segmentation

The market is primarily segmented based on product type, flavor, distribution channel and region.

|

By Product Type |

By Flavor |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Product Analysis

Powder segment is expected to receive the highest growth

The powder segment is projected to grow at a higher CAGR during the projected period, mainly driven by its convenience, enabling people to consume it by mixing it with water or other beverages and adding it to smoothies and other items. The availability of grass-fed protein powders and their potential to store and utilize for longer duration is making them a suitable option among health-conscious consumers.

The shakes and drinks segment are projected to register substantial growth in the coming years, owing to the rising adoption of keto diets in the marketplace. Keto diets involve a higher proportion of protein over carbohydrates and proteins. This in a way, significantly driving the demand for grass-fed-based protein drinks due to their superior nutritional profile.

By Flavor Analysis

Chocolate segment witnessed the largest market share in 2023

The chocolate segment experienced the largest market share in 2023 and is likely to retain its market position throughout the forecast period. This is due to the presence of a higher number of people who love chocolate flavor in the global market. The rising number of companies offering chocolate-flavored grass-fed proteins is also a significant factor contributing to its segmental growth.

By Distribution Channel Analysis

Hypermarket/supermarket segment held the significant market revenue share in 2023

The hypermarket/supermarket segment held a significant market share in revenue in 2023, which is expected to increase in the coming years due to the significant rise in consumer preference for retail stores offering multiple products in one place. The number of supermarkets established in rural and urban areas is rising significantly, with growing consumer interests in acquiring all the necessary products at a single store. This trend is likely to facilitate significant demand for grass-fed proteins in the years to come

Regional Insights

Europe region witnessed the largest share of the global grass-fed protein market in 2023

The Europe region held the dominant share in 2023. The growth of the market can be largely attributed to the rising sustainable measures to promote the production of dairy products. The rising demand for healthy food and growing concerns about environmental sustainability are driving the demand and production of grass-fed proteins in the region.

The Asia Pacific region is expected to be the fastest-growing region with a healthy CAGR during the projected period, owing to the health of wellness trends in the region. The growing initiatives to reduce wait times and increase nutritional levels among the population in the region are anticipated to boost the demand for grass-fed proteins in the marketplace

The North America region witnessed significant growth in the global grass-fed protein market in 2023 and is anticipated to promote its market position during the next few years due to rising government initiatives to support grass-fed protein production. The countries in the region, specifically the United States, are playing a vital role in driving market growth. For instance, in April 2023, Maple Hill Creamery, a provider of organic grass-fed milk, received $20 million from the USDA's Partnerships for Climate-Smart Commodities programme to promote sustainable organic dairy practices.

Moreover, the increasing collaborative frameworks in the region to expand their brand coverage is optimally influencing the adoption of grass-fed protein in the marketplace. For instance, in July 2023, Unico Nutrition, a California-based company entered into a collaboration with Perfect Day to introduce APOLLO II, a grass-fed protein powder.

Key Market Players & Competitive Insights

Strategic partnerships to boost the competition

The grass-fed protein market is witnessing fragmentation in the marketplace with the existence of several market players with lower market share in the global space. The ongoing expansion activities, specifically partnerships and collaboration, are anticipated to register significant consolidation along with the competition. For instance, in March 2023, Rastelli Foods entered a partnership with Grass Fed Foods to expand its product portfolio in the grass-fed food production segment.

Some of the major players operating in the global market include:

- Arla Foods Ingredients (Denmark)

- Fonterra (New Zealand)

- Gnarly Nutrition (US)

- Kerry Group (Ireland)

- Naked Nutrition (US)

- Now Foods (US)

- Nutrabio Labs, Inc. (US)

- Organic MusclePharm (US)

- Promix Nutrition (US)

- Valley (US)

Recent Developments in the Industry

- In April 2023, Fortifeye introduced new grass-fed protein powders into its product line, such as Super Protein Concentrate and Grass-Fed Whey Isolate, with a view to offering antibiotic- and hormone-free products.

- In January 2023, Serenity Kids, a nutrient rich products manufacturer, announced the launch of dairy-free protein with the integration of grass-fed collagen for children.

- In November 2022, Grass Fed Foods announced its plan to develop the largest grass-fed beef platform with the collaboration of two industrial giants, SunFed Ranch and Teton Waters Ranch.

Report Coverage

The grass-fed protein market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product type, flavor, distribution channel and their futuristic growth opportunities.

Grass-fed Protein Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 153.19 million |

|

Revenue forecast in 2032 |

USD 304.13 million |

|

CAGR |

8.9% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

key companies in Grass-fed Protein Market are Arla Foods Ingredients, Fonterra, Gnarly Nutrition, Kerry Group

Grass-fed Protein Market exhibiting a CAGR of 8.9% during the forecast period.

The Grass-fed Protein Market report covering key segments are product type, flavor, distribution channel, and region.

key driving factors in Grass-fed Protein Market are Rising collaborative initiatives to promote healthy food

The global grass-fed protein market size is expected to reach USD 304.13 million by 2032