Gummy Market Share, Size, Industry Analysis Report

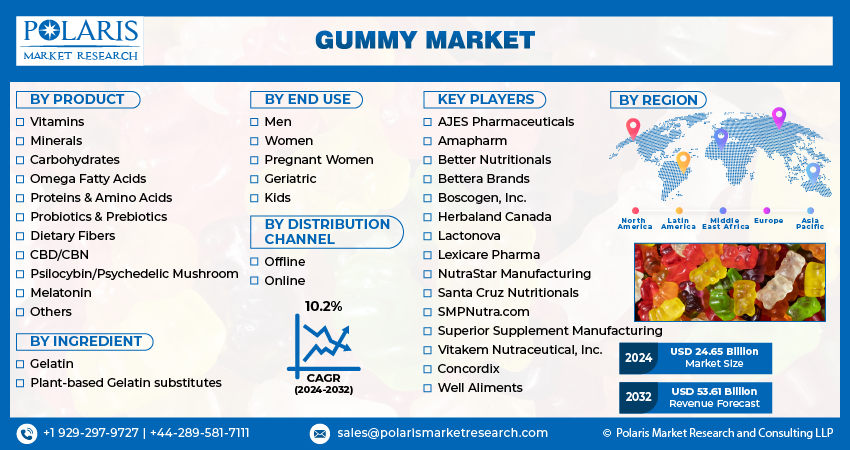

By Product, By Ingredient (Gelatin and Plant-based Gelatin substitutes), By End Use, By Distribution Channel, By Region, And Segment Forecasts, 2025-2034

- Published Date:Jun-2025

- Pages: 115

- Format: PDF

- Report ID: PM4561

- Base Year: 2024

- Historical Data: 2020-2023

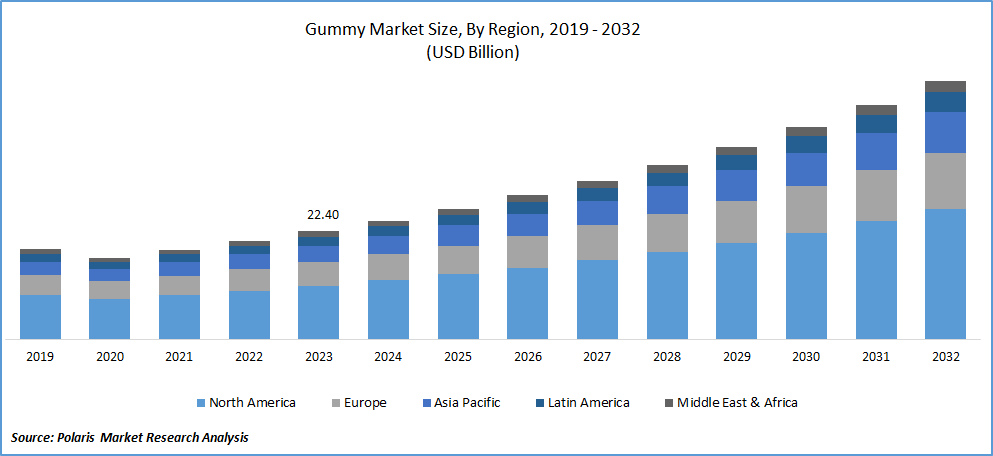

The Gummy Market stood at 22.87 billion in 2024, registering a CAGR of 12.5% from 2025. Growing popularity of convenient supplement formats and child-friendly dosage forms propel this market.

Market Overview

The surge in demand for gummies is expected from increased consumer awareness regarding the adverse effects of excessive chocolate intake, advancements in manufacturing technologies, heightened consumer preference for natural products, and a growing inclination towards vegan gummies.

The increasing consumer awareness regarding the adverse effects of excessive chocolate consumption, such as weight gain and dental issues, is fueling the expansion of the gummies market revenue. As consumers prioritize health, they are opting for gummies as a healthier substitute for conventional chocolate treats. Moreover, the sugar content in gummies plays a pivotal role. While numerous gummy products do contain sugar, there is a growing interest in sugar-free and low-sugar alternatives. Manufacturers are addressing this shift by introducing gummy products that utilize natural sweeteners like stevia or monk fruit instead of conventional sugar.

To Understand More About this Research: Request a Free Sample Report

Gummies serve as an ideal delivery method for a multitude of nutrients due to their convenient consumption and versatility in formulation. For instance, certain gummies feature vitamins and minerals aimed at bolstering immune health, while others incorporate omega-3 fatty acids vital for cardiovascular well-being. Moreover, select gummies contain probiotics and prebiotics, which contribute to maintaining a balanced and healthy gut environment.

The growing popularity of psilocybin mushrooms may stem from various factors, including shifting societal attitudes towards psychedelic substances, increasing research into their potential therapeutic effects, and a growing interest in alternative and natural remedies for mental health issues. Manufacturers may produce food or beverage products infused with psilocybin extract or powder, offering consumers a convenient and discreet way to consume the substance.

For instance, In January 2023, Galaxy Treats, a company headquartered in Nevada specializing in cannabinoids and active ingredients, introduced its latest product: Moon Shrooms Amanita Mushroom Gummies.

These gummies are infused with Amanita mushrooms, renowned for their psychoactive properties, and represent a new addition to the company's growing range of cutting-edge products. Additionally, manufacturers continually introduce fresh and inventive gummy formulations tailored to address specific health needs or cater to diverse age demographics, contributing to the expansion of the gummy market trends.

Growth Factors

Surge in Demand for Gummy Bears

Gummy bears have higher product penetration owing to their distinct texture, fruity flavors, and adorable bear-shaped design. Their chewy and elastic texture adds to the delight of consumption, complemented by a diverse array of flavors that cater to varied preferences. Furthermore, the vibrant and playful demeanor of gummy bears captivates both children and adults alike. Their compact size and ease of transport further enhance their allure as a convenient snack or indulgence. Gummy bears have solidified their status as cherished classics in the gummy market, celebrated for their whimsical charm and delectable flavor profile result in demand of gummy market.

Rise in Health and Wellness Trends

The gummy market has experienced a boost from the rising health and wellness movement, driven by consumers' quest for products that provide not only delicious taste but also functional advantages. Numerous gummies are enriched with vitamins, minerals, and other ingredients that promote health, reflecting the increasing awareness and desire for items that enhance overall well-being. This fusion of taste and utility has elevated gummies to a favored option among consumers seeking to maintain their health delightfully.

Restraining Factors

Probable Side Effects

Some gummy vitamins might incorporate artificial food colorings. Although research findings vary, certain studies suggest a potential association between food dyes and behavioral problems in children. Traditional gummies were crafted from agar, sugar, citric acid, water, & FSSAI (Food Safety Standards Authority of India) approved natural colors & flavors. Galacto-oligosaccharides (GOS) are prebiotics composed of plant sugars, gaining traction as a sugar alternative in various food, beverage, & gummy formulations. In contrast, gummies supplemented with GOS were created by substituting sugar with varying proportions, up to 100%.

Report Segmentation

The market is primarily segmented based on product, ingredient, end use, distribution channel, and region.

|

By Product |

By Ingredient |

By End Use |

By Distribution Channel |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Product Insights

Vitamin Gummies Segment Accounted for the Largest Market Share in 2024

In 2023, the vitamin gummies segment dominated the largest market share. This dominance is primarily due to a rise in vitamin deficiencies. Many individuals experience deficiencies in key vitamins, notably Vitamin D & B12, attributed to dietary and lifestyle factors. Vitamin gummies offer a convenient means to supplement these nutrients. Moreover, they are increasingly popular among working professionals for their ability to regulate glycemic index and support metabolic health and folic acid levels in the body. Additionally, robust marketing efforts, including endorsements by healthcare experts and social media influencers, have contributed to heightened awareness and demand for vitamin gummies.

For instance, as per WHO, around 2 billion individuals across the globe lack vitamins & minerals, with vitamin A, iodine, iron, & zinc being particularly deficient. These individuals reside in low-income nations and often experience deficits in multiple micronutrients.

The psilocybin/psychedelic mushroom gummies segment will grow rapidly. This growth is attributed to rising curiosity in alternative therapies, shifting perceptions towards psychedelics, improved dosage management, and taste preferences. Manufacturers are introducing novel products in response to the escalating demand for psilocybin/psychedelic mushrooms.

By End Use Insights

The Kids Segment is Anticipated to Witness the Fastest Cagr During the Forecast Period

The kids segment is anticipated to witness the fastest CAGR during the forecast period. The popularity of gummies among children aged 2 to 14 is driven by several factors, including their fun shapes and flavors, visual appeal, texture, and marketing strategies. Gummies attract kids' attention due to their vibrant colors and visually appealing appearance. Moreover, the availability of gummies in fun shapes and flavors makes them more enticing to children compared to other types of candies or sweets.

Responding to the growing demand for gummy candy supplements for kids, manufacturers are introducing innovative products targeted at this demographic. For instance, in March 2023, Avrio Health L.P., a subsidiary of Purdue Pharma L.P., launched a new dietary supplement named Senokot Kids Laxative Gummies. Specifically designed for children aged two years and above, this supplement offers gentle and safe overnight relief from occasional constipation.

Regional Insights

North America Accounted for the Largest Market Share in 2024

In 2023, North America accounted for the largest global market. The region has witnessed a surge in interest towards functional and fortified gummies, alongside continuous innovation in gummy offerings. Within the United States, gummy supplements stand as the second most favored form of supplementation after traditional capsules and tablets, indicating significant expansion in this sector.

Several factors propel the gummy market size in the U.S. One crucial driver is the increasing preference for convenient and flavorful delivery formats for supplements and medications. Gummy vitamins, for instance, enjoy popularity among both children and adults owing to their appealing taste and chewable nature. Moreover, the escalating emphasis on health and wellness has spurred demand for gummy products providing functional benefits such as immune support, beauty enhancement, and sleep aid. The availability of a diverse range of gummy products catering to different dietary preferences, including vegan, sugar-free, and organic options, has also bolstered market growth. Furthermore, the influence of social media and celebrity endorsements has contributed to the widespread adoption of gummy products as a trendy and enjoyable means of consuming vitamins and supplements.

Asia Pacific Region is Expected to Witness the Fastest Cagr During the Forecast Period

Asia Pacific region is expected to witness the fastest CAGR during the forecast period. The surge in consumer expenditure on health and wellness products, spurred by evolving lifestyles and increasing disposable incomes, is anticipated to be a primary driver of industry expansion. Moreover, gummy manufacturers in the region are meeting consumer preferences by introducing a diverse array of flavors and fusion gummies tailored to appeal to the younger demographics.

Key Market Players & Competitive Insights

Due to the abundance of players in the industry, the global gummy market is poised to experience moderate competition among companies. In response to evolving consumer preferences, many companies are diversifying their product offerings to enhance their competitive advantage in the market. The gummy marker report covers factors such as product innovation, flavor variety, packaging design, pricing strategies, distribution channels, and marketing campaigns.

Some of the major players operating in the global market include:

- AJES Pharmaceuticals

- Amapharm

- Better Nutritionals

- Bettera Brands

- Boscogen, Inc.

- Herbaland Canada

- Lactonova

- Lexicare Pharma

- NutraStar Manufacturing

- Santa Cruz Nutritionals

- SMPNutra.com

- Superior Supplement Manufacturing

- Vitakem Nutraceutical, Inc.

- Concordix

- Well Aliments

Recent Developments in the Industry

- In April 2024, Olly launched nootropic-based Cognitive-Enhancing Gummies, including Brainy Chews for focus, energy, and stress relief, featuring Thai ginger, caffeine, L-theanine, and magnesium for targeted cognitive support.

- In March 2023, Goli Nutrition introduced a 3 in 1 probiotic gummy that integrates prebiotics, probiotics, & postbiotics. Such gummies promote a balanced gut microbiome and bolster immune health.

- In February 2022, Optibac Probiotics released a novel vegan gummy supplement targeting the enhancement of gut and immune health in adults. This product features a probiotic strain known as Bacillus coagulans Unique IS-2.

Report Coverage

The gummy market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, ingredient, end use, distribution channel, and their futuristic growth opportunities.

Gummy market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 26.75 billion |

|

Revenue forecast in 2034 |

USD 52.24 billion |

|

CAGR |

12.50% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global gummy market size is expected to reach USD 52.24 billion by 2034

AJES Pharmaceuticals, Amapharm, Better Nutritionals, Bettera Brands, Boscogen, Lactonova, Lexicare Pharma are the top market players in the market.

North America region contribute notably towards the global Gummy Market.

Gummy market size is exhibiting the CAGR of 12.50% during the forecast period.

The Gummy Market report covering key segments are product, ingredient, end use, distribution channel, and region.