Halal Cosmetics Market Share, Size, Trends, & Industry Analysis Report

By Product (Personal Care, Color Cosmetics, Fragrance); By Application Type; By Distribution Channel; By Region; Segment Forecast, 2025 - 2034

- Published Date:May-2025

- Pages: 118

- Format: PDF

- Report ID: PM1125

- Base Year: 2024

- Historical Data: 2020-2023

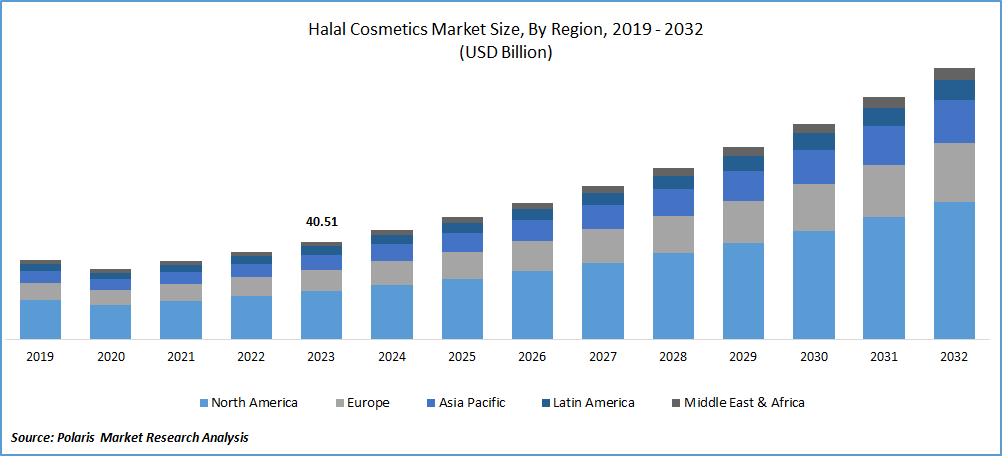

The global halal cosmetics market was valued at USD 42.44 billion in 2024 and is projected to grow at a CAGR of 11.70% from 2025 to 2034. The market is driven by the increasing Muslim population and the rising awareness of halal-certified beauty products.

Halal cosmetics are products that adhere to Islamic principles and are formulated with ingredients found acceptable (Halal) according to Islamic law. This market has witnessed significant growth globally because of the increasing awareness among consumers, especially in regions with significant Muslim populations, about the ingredients used in cosmetic products, which has led to a growing demand for halal cosmetics market.

Another key driver for market growth is the rising disposable income and purchasing power of the middle-class population in Muslim-majority regions, such as the Southeast Asia, Middle East, and parts of Africa, is another key driver for the market growth. This shift has led to an increased demand for premium and specialty products, including halal cosmetics, which are often perceived as higher quality and ethically produced. Also, the global focus on cruelty-free and sustainable products has further boosted the halal cosmetics market.

To Understand More About this Research: Request a Free Sample Report

Despite this, the halal cosmetics market faces certain challenges and restraints, such as the lack of standardized regulations and certification processes across different regions. The absence of a uniform Halal certification standard can lead to confusion and hinder market growth. In addition, the perception that halal products are limited in terms of innovation and variety poses a challenge for market players to meet diverse consumer preferences and demands continually. The halal cosmetics market faces competition from mainstream cosmetic brands that are increasingly incorporating halal practices into their manufacturing processes or introducing separate product lines to cater to the growing demand for ethical and Halal-certified products.

Halal Cosmetics Market Trends:

Increased Awareness Regarding Halal-Certified Cosmetics Products

The increasing growth of the halal cosmetics market is significantly driven by the increasing awareness among consumers regarding the significance of Halal-certified cosmetic products. This raised awareness is because of growing consciousness among consumers, particularly in regions with significant Muslim populations, about the ingredients used in cosmetic formulations and a desire for products that align with their religious beliefs. This awareness has not only propelled the demand for halal cosmetics but has also boosted trust and loyalty among consumers toward brands that prioritize transparency and religious compliance in their product offerings. As a result, cosmetic manufacturers are increasingly focusing on obtaining halal certification for their products, recognizing it as a strategic idea to tap into this expanding market and serve the evolving preferences of a discerning consumer base.

For instance, SABA personal care company provides a variety of halal-certified cosmetic products to meet the diverse needs of consumers. One of their standout items is the SABA Breathable Halal Vegan Wudhu-Friendly Nail Polish, which is designed to be water-permeable, allowing water to reach the nails during ablution. The growing awareness of halal-certified cosmetics is not only boosting sales but also shaping ethical and religious considerations in the cosmetics industry, influencing purchasing decisions worldwide.

Rising Interest and Demand for Ethical Products

The halal cosmetics market is experiencing significant growth, driven by consumers' interest in ethical, cruelty-free, and clean beauty products. Halal cosmetics, which adhere to strict ethical guidelines, appeal to a broad audience beyond the Muslim community, including those who prioritize cruelty-free and clean beauty.

Consumers today are more informed about the ingredients in their beauty products and their ethical implications. They seek transparency from brands regarding sourcing, manufacturing, and testing practices. There is a growing awareness of the potential health risks associated with certain synthetic chemicals and animal-derived ingredients commonly found in conventional cosmetics. The halal cosmetics align with the ethical values of consumers who oppose animal testing and seek cruelty-free products. Such consumers are increasingly concerned about the environmental impact of their purchases.

Halal products often emphasize eco-friendly practices, such as sustainable sourcing and biodegradable packaging. Social media platforms and influencers play a crucial role in raising awareness about the benefits of halal and ethical cosmetics.

For instance, in March 2023, Indonesia’s Mad for Makeup highlighted how it benefits from its social club of over 1,000 members to aid in new product development for its acne-friendly cosmetics and enhance its marketing efforts. Founded in 2017 by an aesthetician, the Indonesian brand offers a range of color cosmetics, including serum concealer, lip moisturizer, serum mascara, and eyebrow pencil, as well as accessories like makeup bags, blenders, and eyebrow curlers. All products are halal-certified.

The brand’s Instagram profile features videos of social media influencers trying out and reviewing the products and organizing face-to-face social gatherings to connect users with similar interests in cosmetics. They educate consumers and create trends around ethical beauty, which seek to drive the consumer's interest and halal cosmetics market revenue.

Halal Cosmetics Market Segment Insights:

Halal Cosmetics Product Insights:

The global halal cosmetics market segmentation, based on product, includes personal care, color cosmetics, and fragrances. The personal care segment held the largest market share in 2023 because personal care products play an important role in the daily routines of consumers, coupled with a growing awareness and preference for halal-certified options. Personal care consists of a wide range of products, including skin care, hair care, and face care, all of which are important to an individual’s grooming practices. The emphasis on halal certification in this segment fits well with the trend of consumers seeking products that adhere to their religious beliefs and ethical standards. Manufacturers within the personal care segment are introducing a diverse range of halal-certified products, conducting innovation to meet the specific needs of consumers.

The increasing prevalence of hair problems presents a significant opportunity for manufacturers to innovate. In June 2023, the FDA approved Pfizer’s LITFULO for adults and adolescents with severe hair issues. This development highlights the growing consumer initiative towards hair care, which also boosts awareness and demand for halal cosmetic personal care products and the industry’s overall growth.

Halal Cosmetics Distribution Channel Insights:

The global halal cosmetics market segmentation, based on distribution channels, includes online and offline. The online segment is projected to dominate the market over the forecasted period. Online stores allow consumers to shop for halal cosmetics from anywhere and at any time, offering unparalleled convenience. This accessibility is particularly important for consumers in regions where physical stores might not carry a wide range of halal products.

E-commerce platforms offer a broader selection of products than physical stores. This variety enables consumers to find specific halal-certified items that meet their preferences and needs. E-commerce platforms often feature customer reviews and ratings, helping consumers make informed purchasing decisions. Recommendations based on previous purchases or browsing history can also enhance the shopping experience.

Manufacturers are formulating online stores for halal cosmetics products, further solidifying their dominance within the halal cosmetics market.

For instance, in May 2023, Qeblawi Cosmetics, a California-based halal-verified company, launched an online store to offer halal-certified beauty products. This move enhances convenience and accessibility, provides a wider product range, and extends global reach. These factors have accelerated customer interest in digital shopping and increased the demand in the halal cosmetics market.

Halal Cosmetics Regional Insights:

By region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. In 2023, the North American region accounted for the highest market share because of its diverse consumer base and its demand for halal-certified products, including cosmetics. The region's population is increasingly conscious of product ingredients and production processes, aligning with the principles of halal. Also, the presence of a robust regulatory framework and consumer protection laws in North America has influenced consumer demand for halal-certified cosmetics. The region's strong economic stability, linked with higher disposable incomes, has enabled consumers to prioritize quality and ethical considerations in their purchasing decisions.

The key market players are merging, acquiring, and collaborating to strengthen their market presence and offer better offerings in North America, further driving the market during the forecast period.

The U.S. halal cosmetics market held a significant demand due to the Muslim people pursuing beauty products that align with their religious faiths but also by a broader audience attracted to the ethical, natural, and quality aspects of halal skincare. Regulatory bodies in the U.S. have shown support for halal certification processes, ensuring transparency and authenticity in the halal cosmetics market. This regulatory backing fosters consumer trust in the cosmetics and personal care products industry, contributing to the growing demand for halal cosmetics.

For instance, in June 2024, the Personal Care Products Council (PCPC) released its latest report titled "The Beauty of Impact," highlighting the significant economic and social contributions of the U.S. cosmetics and personal care products industry. This report further underscores the positive impact and increasing relevance of halal cosmetics in the market.

The Canadian halal cosmetics market is expected to grow at a significant rate due to its diverse population, including a significant Muslim community. The demand for halal cosmetics is driven by Muslim consumers seeking products that comply with their religious beliefs and ethical standards. There is an increasing awareness among Canadian consumers about the ingredients used in cosmetics and personal care products; many consumers prioritize natural, ethical, and cruelty-free products, including those that are halal-certified.

For instance, As per the International Trade Administration, the Canadian cosmetics market yielded around USD 1.24 billion in revenue in 2021. Projections indicate a yearly growth rate of 1.45%, aiming to reach USD 1.8 billion by 2024. Given the increasing consumer inclination, organic and ethically sourced products now account for approximately 40% of Canada's skincare market. This upward trend in the cosmetic industry is expected to contribute to the expansion of the halal cosmetics market in Canada.

Further, the Asia-Pacific halal cosmetics market accounted for the significant growth rate in the global market owing to a substantial Muslim population, increasing consumer awareness and demand for products sticking to Islamic concepts, and a robust cosmetics industry infrastructure. Countries in the Asia Pacific region, particularly those with significant Muslim populations such as Indonesia and Malaysia, have witnessed a surge in the usage of halal cosmetics. The cultural and religious significance of halal products has matched strongly with consumers in these regions, influencing their purchasing decisions in favor of halal cosmetics.

Further, the major countries studied in the market report are The US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil, and others.

Halal Cosmetics Key Market Players & Competitive Insights

Leading market players in the halal cosmetics market are making significant investments in research and development to broaden their product offerings, thereby fueling market growth. These market participants are also engaging in various strategic initiatives to expand their presence globally. This includes important market developments such as new product introductions, strategic partnerships, mergers and acquisitions, increased investments, and collaborations with other organizations.

Manufacturing locally to minimize operating costs is one key business tactic used by manufacturers in the global halal cosmetics industry to benefit clients and increase the market sector. In recent years, the halal cosmetics industry has delivered some technological advancements.

Major players in the halal cosmetics market, including Clara International, IBA Halal Care, INGLOT Cosmetics, Inika, Ivy Beauty Corporation, One Pure, PHB, Ethical Beauty, SABA Personal Care, Sampure Minerals, Talent Cosmetic Co. Ltd., The halal cosmetics Company, Wardah Cosmetics.

SABA Personal Care offers all-natural, non-toxic, 100% halal, and vegan personal care products. Their cosmetics are free from alcohol, parabens, and any najis ingredients. The French formula used in SABA's breathable nail paints allows water to reach the skin. The company manufactures its products adhering to the best practices, ensuring no unfair labor, hazardous materials, or animal testing. These cosmetics are certified halal and comply with standards based on Hadith and the Quran. In August 2023, SABA Personal Care introduced a range of halal-certified cosmetic products designed to meet the diverse needs of consumers. Among these offerings, the SABA pure aloe vera gel provides a natural, halal-certified skincare solution that soothes and nourishes the skin.

Talent Cosmetic Co. Ltd began its business in 1980 under the name TALENT in Myeong-dong, Seoul. The company sells cosmetic products and serves customers both domestically and internationally. With the rise of K-pop, Talent Cosmetic has emerged as a global brand extending beyond Asia. It offers cosmetic products for women of all ages worldwide. Its brands include Levenne, Sunwoo Cosme, JAC Skin, HUIHUANG, and SABASA. Notably, Talent Cosmetic's Sunwoo Cosme was the first in Korea to acquire the Halal certification mark. Their halal product line includes 141 items, encompassing makeup, skincare, masks, and body care.

Key Companies in the Halal Cosmetics Market Include:

- Clara International

- IBA Halal Care

- INGLOT Cosmetics

- Inika

- Ivy Beauty Corporation

- One Pure

- PHB Ethical Beauty

- SABA Personal Care

- Sampure Minerals

- Talent Cosmetic Co. Ltd.

- The Halal Cosmetics Company

- Wardah Cosmetics

Halal Cosmetics Industry Developments

- In February 2023, a new halal makeup brand was launched in India, catering to religious women seeking faith-compliant beauty products. The brand’s introduction addresses a growing demand among Muslim consumers for cosmetics that align with their religious beliefs.

- August 2022: Saba Personal Care announces the launch of its French-formulated breathable range of nail paints in India, specifically targeting the halal segment of Indian consumers. With this launch, Saba positions itself as a pioneering provider of high-quality halal cosmetic products in the Indian market.

Halal Cosmetics Market Segmentation:

Halal Cosmetics Product Outlook

- Personal Care

- Color Cosmetics

- Fragrance

Halal Cosmetics Application Outlook

- Skin Care

- Hair Care

- Face Care

Halal Cosmetics, Distribution Channel Outlook

- Online

- Offline

Halal Cosmetics Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Halal Cosmetics Report Scope:

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 42.44 billion |

|

Market size value in 2025 |

USD 47.4 billion |

|

Revenue Forecast in 2034 |

USD 127.3 Billion |

|

CAGR |

11.70% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Halal Cosmetics Market Size Worth USD 127.3 billion By 2034

The top market players in Halal Cosmetics Market players are include Amara Cosmetics, Clara International, IBA Halal Care, Inika, Ivy Beauty Corporation, Mena Cosmetics, MMA Bio Lab, One Pure

North America is the region contribute notably towards the Halal Cosmetics Market.

The global halal cosmetics market is expected to grow at a CAGR of 11.70% during the forecast period.

Halal Cosmetics Market report covering key segments are product, application type, distribution channel, and region.