Healthcare Analytical Testing Services Market Share, Size, Trends, Industry Analysis Report

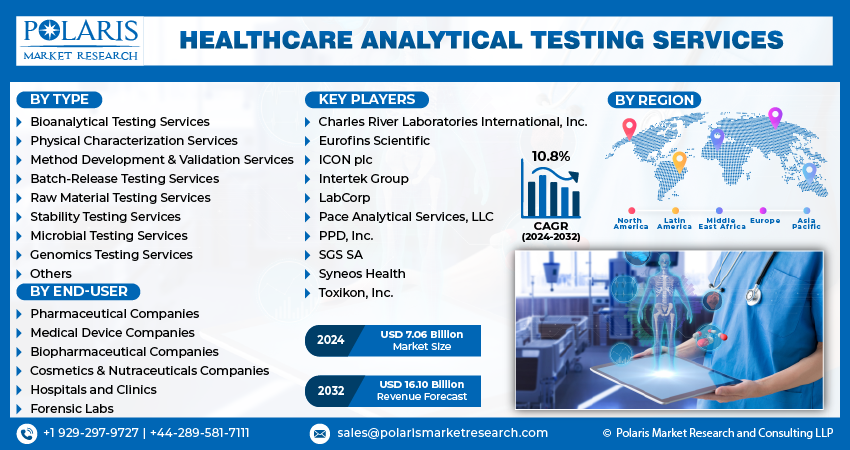

By Type; By End-Use (Pharmaceutical Companies, Medical Device Companies, Biopharmaceutical Companies); By Region; Segment Forecast, 2024- 2032

- Published Date:Jun-2024

- Pages: 116

- Format: PDF

- Report ID: PM4920

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

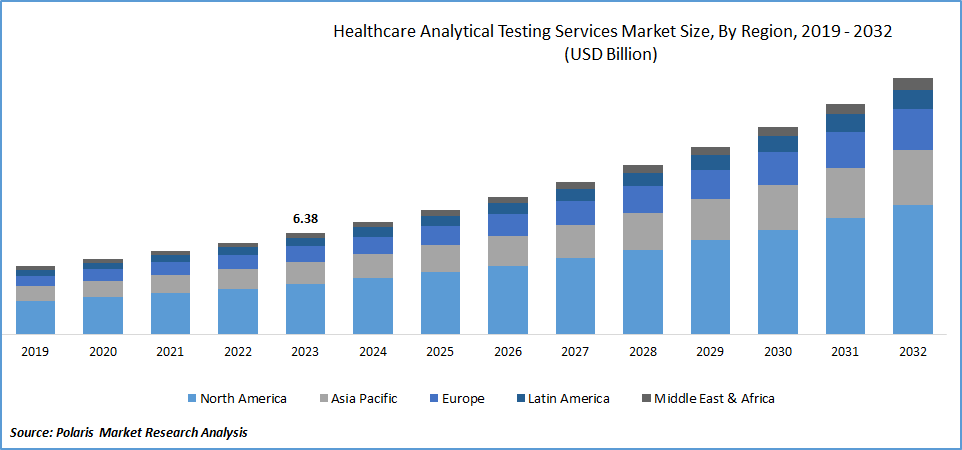

Healthcare Analytical Testing Services Market is size is valued at USD 16.10 Billion by 2032 and CAGR 10.8% Market by Indications by Distribution Channels. size was valued at USD 6.38 billion in 2023. The market is anticipated to grow from USD 7.06 billion in 2024 to USD 16.10 billion by 2032, exhibiting the CAGR of 10.8% during the forecast period

Healthcare Analytical Testing Services Market Overview

Healthcare analytical testing services market is experiencing rapid growth covering a wide range of diagnostic and investigative procedures that aim to evaluate different aspects of patient health, disease conditions, and treatment effectiveness. These services utilize advanced analytical technologies and other indicators in healthcare analytical testing assisting in disease identification, prognosis, and monitoring, supporting informed clinical decision-making and personalized patient care. Additionally, these services are crucial in the pharmaceutical and biotechnology sectors, aiding in drug development, efficacy evaluation, and regulatory compliance during preclinical and clinical trials.

To Understand More About this Research:Request a Free Sample Report

- In July 2023, Broughton enhanced its range of analytical testing services with the introduction of new Extractables and Leachables (E&L) testing service. Broughton's latest offering will provide customized E&L studies, incorporating a comprehensive approach that integrates technical and analytical services, in-house toxicology consultancy, and regulatory compliance assistance.

Healthcare analytical testing services encompasses a wide range of applications within healthcare delivery systems carried out in hospitals and clinics to specialized assays conducted by contract research organizations and academic institutions, these services contribute to enhanced patient outcomes. With continuous technological advancements leading to innovation in analytical techniques and data analysis capabilities, healthcare analytical testing is constantly evolving, providing increasingly sophisticated solutions to tackle the complex challenges of modern healthcare.

Healthcare Analytical Testing Services Market Dynamics

Market Drivers

- Rising in adoption of technology

The healthcare analytical testing service market is witnessing a surge in popularity due to the rise of technological advancements. Leading market participants are developing cutting-edge technologies to maintain their market presence. This comprehensive drug testing platform, powered by AI, assists in the creation of drug molecules, synthesis capabilities, and DNA-encoded libraries. It efficiently converts biological testing data into refined preclinical analytical data outcomes, thereby improving drug discovery and analytical testing processes.

- Surge in clinical trials

The growth of the healthcare analytical testing services market is anticipated to be propelled by the rising number of clinical trials. These trials involve research studies with human participants to assess the effectiveness and safety of medical treatments or interventions. Within clinical trials, healthcare analytical testing services play a crucial role in evaluating drug safety and efficacy, dosing and formulation, data integrity, and quality control. With ongoing innovation and development of new products by pharmaceutical, biopharmaceutical, and medical device companies, the need for healthcare analytical testing services is on the rise.

Market Restraints

- High cost of testing services

The high cost associated with healthcare analytical testing services can be attributed to the utilization of advanced analytical equipment and technologies in the testing processes that often demand a substantial capital investment for procurement, maintenance, and upgrades. Additionally, the stringent regulatory requirements necessitate compliance measures that add in the operational expenses. Moreover, the accurate interpretation of tests and analysis of results require specialized expertise, thereby contributing to labor costs.

Report Segmentation

The market is primarily segmented based on type, end-user, and region.

|

By Type |

By End-User |

By Region |

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Healthcare Analytical Testing Services Market Segmental Analysis

By Type Analysis

- The bioanalytical testing services segment holds a considerable market share in the healthcare analytical testing services market due to its wide array of services designed for different drug types, such as vaccines, small molecules, and biologics. These services are essential in ensuring the safety, effectiveness, and quality of pharmaceutical products. Through the provision of comprehensive bioanalytical testing solutions, which include assays for drug quantification, metabolite identification, and pharmacokinetic analysis, this segment addresses the varied requirements of pharmaceutical companies throughout the drug development process. Moreover, continuous improvements in analytical techniques and technologies have allowed the segment to enhance its capabilities, further establishing itself as a key player in the market.

- The cell assay segment held significant market share during the projected period, mainly driven by its wide applications in biomedical research as well as drug-discovery screening to effectively measure cytotoxicity, biological activity, biochemical mechanisms, and off-target interactions. Cell-based assays offer several benefits, such as enabling the production of intricate and biologically significant data. In contrast to conventional biochemical assays, cell-based assays provide a more accurate representation of physiological conditions and allow for the simultaneous evaluation of compound properties.

By End-User Analysis

- The pharmaceutical companies segment held a significant market share in 2023, as analytical services are crucial in ensuring the safety, quality, and effectiveness of pharmaceutical products at every stage of their development, from initial phases to large-scale manufacturing. Pharmacological testing, on the other hand, involves conducting experiments on non-human subjects in laboratory settings. The growing need for testing services is driven by the rising demand from raw material suppliers and pharmaceutical manufacturers, as well as the development of new products that require testing. Additionally, the increasing complexity and number of standards that a single product must adhere to further contribute to the demand for analytical services.

- The medical devices segment is anticipated to grow at the fastest CAGR over the forecast period owing to its assistance to manufacturers in mitigating different types of product risks, enabling them to deliver high-quality devices to the medical industry. These devices are designed to perform their intended functions while ensuring the safety and well-being of patients adhering to regulatory standards and supported by global network of medical professionals. Monitoring regulatory updates and ensuring consistent compliance with medical device standard regulations.

Healthcare Analytical Testing Services Market Regional Insights

The North America region dominated the global market with the largest market share

The North America region dominated the global market with the largest market share and is expected to maintain its dominance over the anticipated period. The growth of the segment market can be largely attributed to its uses in the healthcare sector, including pharmaceutical companies, biopharmaceutical companies and medical device companies. These services provide a reliable source for accuracy, quality and efficiency. Moreover, rising usage and development of a large number of analytical services and increased investments are factors accelerating the market growth.

The Europe region is expected to be the fastest growing region with a healthy CAGR during the projected period, owing to the integration of digital devices like IoT and healthcare applications, surge in data records, leading to an increased adoption of advanced analytics. This aims to provide faster data-driven insights, lower healthcare costs by digitizing healthcare records, patient patterns and histories can be identified more efficiently.

Competitive Landscape

The healthcare analytical testing services market is fragmented and is anticipated to witness competition due to several players' presence. The surge in the healthcare analytical testing services market is propelled by the increasing demand from diverse industries that prioritize quality assurance and adherence to regulations. The need for precise analytical techniques presents opportunities for service providers, while government initiatives encourage investment and innovation. These factors contribute to the global growth of the market, which is further fueled by trends such as outsourcing driven by cost considerations and advancements in the pharmaceutical sector. Moreover, exploring new markets amplifies the demand for customized testing, thereby intensifying the need for healthcare analytical testing services.

Some of the major players operating in the global market include:

- Charles River Laboratories International, Inc.

- Eurofins Scientific

- ICON plc

- Intertek Group

- LabCorp

- Pace Analytical Services, LLC

- PPD, Inc.

- SGS SA

- Syneos Health

- Toxikon, Inc.

Recent Developments

- In March 2024, Merck expanded its M Lab Collaboration Center in Shanghai with a significant investment of €14 million. This expansion includes the addition of a new biology application lab, a process development training center, and an upstream application lab. These new facilities complement the existing M LabTM Collaboration Center in Shanghai, further enhancing Merck's capabilities in research and development.

- In December 2023, Sterling Accuris Diagnostics has revealed plans to broaden its scope by venturing into pharmaceutical and analytical testing with the acquisition of Vaibhav Analytical Services. This collaboration will enhance Sterling Accuris's range of services, specifically in the field of pharmaceutical analytical testing.

Report Coverage

The Healthcare Analytical Testing Services market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, end-user, and their futuristic growth opportunities.

Healthcare analytical testing services Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 7.06 billion |

|

Revenue forecast in 2032 |

USD 16.10 billion |

|

CAGR |

10.8% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

Healthcare Analytical Testing Services Market report covering key segments are type, end-user, and region.

Healthcare Analytical Testing Services Market Size Worth $ 16.10 Billion By 2032

Healthcare Analytical Testing Services Market exhibiting the CAGR of 10.8% during the forecast period

North America is leading the global market

The key driving factors in Healthcare Analytical Testing Services Market are Rising in adoption of technology