Hemodialysis And Peritoneal Dialysis Market Share, Size, Trends, Industry Analysis Report

By Product (Device, Consumables, Service); By End-Use (Home-based, Hospital-based); By Dialysis Type; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 114

- Format: PDF

- Report ID: PM1384

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

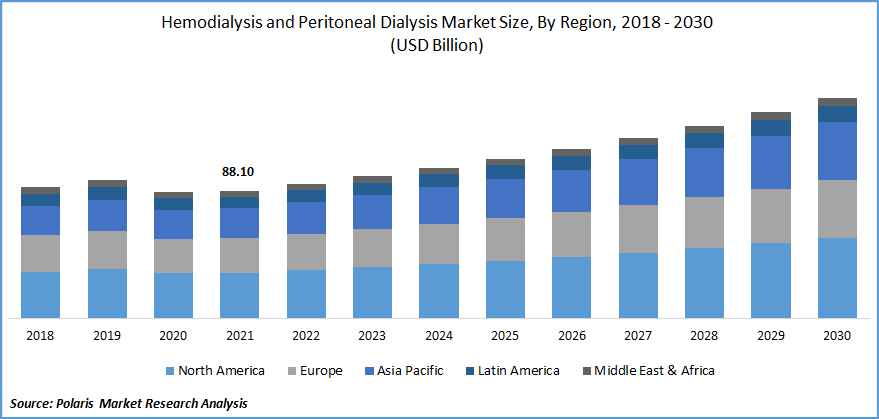

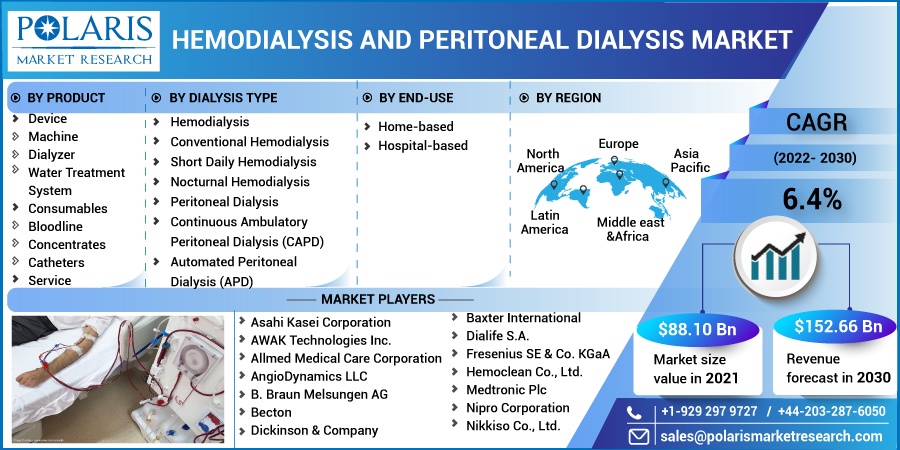

The global hemodialysis and peritoneal dialysis market was valued at USD 88.10 billion in 2021 and is expected to grow at a CAGR of 6.4% during the forecast period. The major factors such as the approval of innovative products and consumables by regulatory bodies, the involvement of public authorities in the prevention and control of renal diseases, and the cooperative efforts of numerous organizations to provide effective renal services in the specialized areas of developing regions will all contribute to the hemodialysis and peritoneal dialysis market expansion.

Know more about this report: Request for sample pages

Dialysis is a treatment used to eliminate waste products from the blood, such as urea and creatinine, due to poor kidney function; it is commonly required for chronic renal failure. The process is essential for a kidney transplant. During this procedure, the electrolyte balance is recovered, the blood is purified, and superfluous fluid and toxins are removed.

There are two ways to perform dialysis: hemodialysis and peritoneal dialysis. During hemodialysis, extracorporeal waste products like urea are removed from the patient's circulation. In peritoneal dialysis, the membrane in the stomach is used for the dialysis process.

The coronavirus outbreak presents several challenges for patients and clinical healthcare providers worldwide. The rise in COVID cases and the severity rate are expected to increase the number of renal injuries. The worldwide need for renal replacement fluids has risen due to the outbreak.

Compared to previous US populations, the need for RRT has increased fivefold in COVID-19 patients. Home hemodialysis therapy had been on the rise before the pandemic, and patients' interest in HD therapy has dramatically grown due to worries about the COVID-19 virus's spread. This factor will push people to use home hemodialysis equipment when the pandemic strikes.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Chronic kidney disease (CKD) causes kidney damage, making them less effective in removing waste products from the blood than healthy kidneys. Ineffective kidneys cause the body to amass toxic waste and extra fluid, which can cause high blood pressure, heart disease, stroke, and early death. However, those who have CKD or are at risk of developing it can take precautions to safeguard their kidneys with the assistance of their medical professionals.

The prevalence of CKD has significantly increased, driving the demand for quick-access renal facilities. As per the CDC, chronic kidney disease affects 15% of adults in the U.S., or around 37 million people. Thirty-seven million adults in the U.S. have CKD or 15% of the population. Up to 90% of persons with CKD are unaware of their condition. Nearly 25% of persons with severe CKD are unaware of their condition.

Further, the number of renal care centers has grown in industrialized nations due to the availability of highly qualified nephrologists. Additionally, investors are concentrating more on expanding renal treatment facilities in countries like India, China, Mexico, etc., to meet the growing need for renal care in emerging economies. This is anticipated to fuel the hemodialysis and peritoneal dialysis market revenue generation for hemodialysis for the following years. The number of visits to these facilities is rising due to the accessible healthcare these nations provide.

Report Segmentation

The market is primarily segmented based on product, dialysis type, end-use, and region.

|

By Product |

By Dialysis Type |

By End-Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Services in hemodialysis and peritoneal dialysis market segment industry accounted for the highest market share in 2021

Services made up the largest portion of sales, primarily due to the development of modern renal care facilities for chronic and emergency treatment worldwide and service providers' increasing emphasis on providing patients with high-quality care. Additionally, the demand for services is growing due to the service providers' enhanced business models, which are patient-centric and profit-driven.

The major player's key activities and technological advancements are anticipated to accelerate market expansion for hemodialysis. For instance, in February 2021, DaVita launched a telehealth solution named DaVita Care Connect for its home dialysis business. It was just one of the numerous connected technologies incorporated into its service portfolio to improve treatment and outcomes for patients who choose self-care at home.

During the projection period, the consumables category is anticipated to grow at the greatest CAGR. Governments are expected to make significant investments to improve patient safety and efficacy. Reducing the likelihood of malfunction can help catheters last longer.

Additionally, there is a growing market for catheters with an antibacterial coating, reducing the likelihood of infections caused. Similar to how new membrane dialyzers for better diffusion and surface contact positively affect the expansion of the consumable segment, so do new production technologies for membrane dialyzers.

Hemodialysis segment is expected to witness fastest growth

Hemodialysis is divided into traditional, brief daily hemodialysis and nighttime hemodialysis. Hemodialysis uses a hemodialyzer to eliminate excess and waste chemicals and bodily fluids. As the blood goes through the filter, it comes into touch with dialysate, which resembles physiological fluid except for the presence of contaminants. In addition, this type of dialysis is rather complex, requiring a rigid treatment plan and having little room for patient mobility, time, or transportation.

Access to the high blood flows necessary for dialysis also involves setting up and maintaining vascular access, such as a dialysis catheter or creating an AV fistula or graft in the arm or groin. Key drivers include a rise in ESRD patients, a growth in the elderly population with kidney diseases, and an increase in the frequency of hypertension. The segment growth is anticipated to be significantly accelerated by the aging population and the increased risk of CKD.

Hospital-based segment is expected to hold the significant revenue share

The substantial supply of highly skilled and seasoned healthcare staff at hospitals will likely allow the industry to maintain its lead over the coming years. The presence of a skilled and knowledgeable renal medical team in healthcare settings, including hospitals and dialysis clinics, ensures successful treatment and enhanced dialysis results. This is due to the advantageous reimbursement renal facilities and hospitals give for renal therapies, the growing patient population suffering from CKD and ESRD, and the population's rising healthcare spending.

The demand in North America is expected to witness significant growth

The major factors expected to drive the market's rise during the forecast period are the high prevalence of CKD and ESRD in the U.S. and Canada and increased treatment rates in these nations. Due to the rising number of coronavirus infections and the ensuing renal failures, the U.S. is also expected to experience a rise in the demand for the products and services.

As the second-largest region in terms of market size, Europe is predicted to experience moderate growth over the long run. The region's high rate of senior population living from renal ailments is primarily responsible for the growth. The older people in Brazil are experiencing an increase in the prevalence of CKD, fueling the expansion of the services and goods industry.

Rising renal failure cases, an aging population, and increased product development are anticipated to fuel market expansion throughout the projected period. In addition, the IDF estimates that 88 million adults in Southeast Asia currently have diabetes, with 153 million likely to have the disease by 2045. In addition, rising government programs, CKD awareness programs, the availability of newly built advanced healthcare facilities in the area, and growing health expenditures are a few other factors influencing the market growth.

Competitive Insight

Some of the major players operating in the global hemodialysis and peritoneal dialysis market include Asahi Kasei Corporation, AWAK Technologies Inc., Allmed Medical Care Corporation, AngioDynamics LLC, B. Braun Melsungen AG, Becton, Dickinson & Company, Baxter International, Dialife S.A., Fresenius SE & Co. KGaA, Hemoclean Co., Ltd., Medtronic Plc, Nipro Corporation, Nikkiso Co., Ltd., Outset Medical, Inc., Quanta Dialysis Technologies, Toray Medical Co. Ltd., and Teleflex, Inc.

Recent Developments

- In June 2021, Baxter International Inc. has introduced Sharesource Analytics 1.0, the next-generation eHealth solution for peritoneal dialysis (PD) patients receiving care at home. This technological advancement is a clinical management tool included in the Sharesource remote patient monitoring system that gives medical practitioners complete information about the treatment of their home dialysis patients

Hemodialysis And Peritoneal Dialysis Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 88.10 billion |

|

Revenue forecast in 2030 |

USD 152.66 billion |

|

CAGR |

6.4% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Product, By Dialysis Type, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Asahi Kasei Corporation, AWAK Technologies Inc., Allmed Medical Care Corporation, AngioDynamics LLC, B. Braun Melsungen AG, Becton, Dickinson & Company, Baxter International, Dialife S.A., Fresenius SE & Co. KGaA, Hemoclean Co., Ltd., Medtronic Plc, Nipro Corporation, Nikkiso Co., Ltd., Outset Medical, Inc., Quanta Dialysis Technologies, Toray Medical Co. Ltd., and Teleflex, Inc |