Home Security Systems Market Size, Share, Trends, Industry Analysis Report

By Home Type (Independent Home, Apartments), By Security, By System, By Services, and By Region -Market Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 119

- Format: PDF

- Report ID: PM2864

- Base Year: 2024

- Historical Data: 2020-2023

Overview

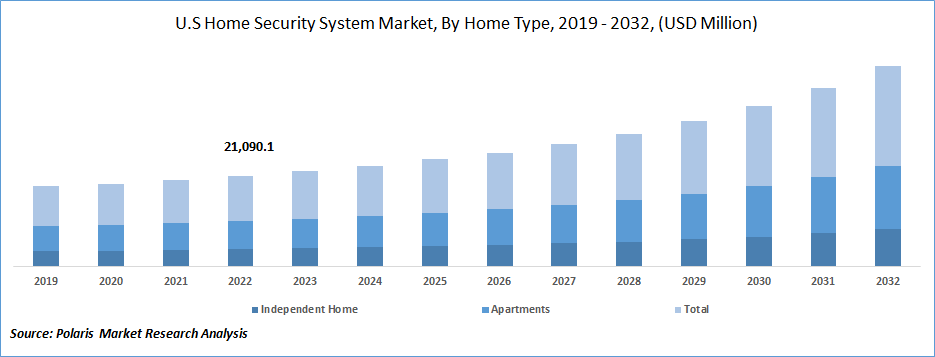

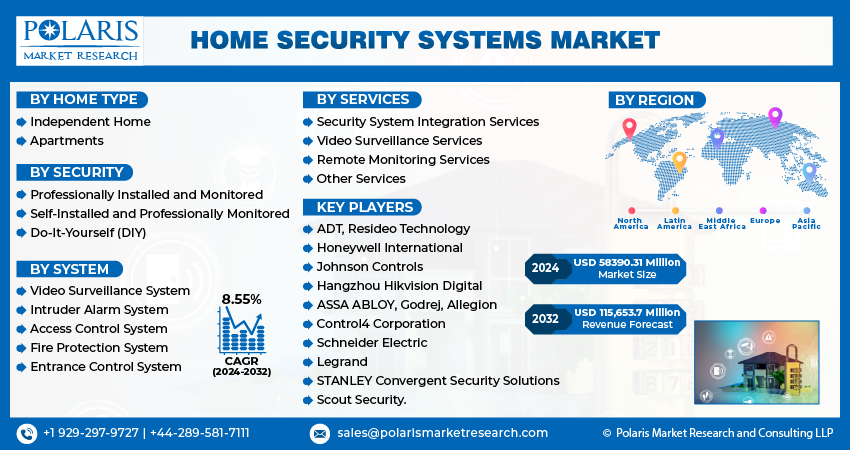

The global home security systems market size was valued at USD 59,988.2 million in 2024. The market is projected to grow at a CAGR of 8.55% during 2025 to 2034. Key factors driving demand for home security systems include rising crime rates and concerns for personal and property safety, advancements in technology, and the popularity of DIY security solutions.

Key Insights

- The apartment segment accounted for the largest revenue share in the market in 2024, due to the unique security challenges apartment living presents, including shared spaces and higher break-in rates.

- The video surveillance system segment dominated the revenue share in 2024, due to advancements in digital video cameras for surveillance.

- North America held the largest revenue share in 2024, due to companies in the region expanding their expertise in access control systems.

- Asia Pacific is projected to grow at the fastest pace during the forecast period, owing to the increasing public spending on smart city projects.

Industry Dynamics

- The rising concerns regarding safety and security fuel the demand for home security systems.

- Technological advancements like IoT and cloud computing are further propelling market growth by making home security systems more efficient, accessible, and affordable.

- The increasing investment in smart homes is creating a lucrative market opportunity.

- System complexity may hamper the market growth.

Market Statistics

- 2024 Market Size: USD 59,988.23 Million

- 2034 Projected Market Size: USD 129,581.41 Million

- CAGR (2025-2034): 8.55%

- North America: Largest Market Share

AI Impact on Home Security Systems Market

- AI helps in enhanced threat detection.

- AI helps in providing personalized security through facial and voice recognition.

- AI helps in real-time detection through predictive analytics.

Home security systems use cameras and sensors connected to a central hub to prevent theft. This hub manages the entire security system, including motion and window sensors, security cameras, and door sensors. The security systems also include window stickers and alarms. The advancement of wireless technologies and the Internet of Things are the primary drivers of the global market. Additionally, the growing awareness regarding the safety of homes and surroundings and increased theft activities have raised the demand for home security systems.

Numerous companies are using IoT technology to create advanced security systems that enhance home security through remote monitoring. Integrating IoT makes homes more interconnected and controllable through smartphones, resulting in increased security. Combining IoT and cloud computing enables the system to be accessed from different locations, improving efficiency and data storage capabilities. This help residential users to easily manage complex software in a simplified manner.

Home security systems are designed to be compatible with Alexa or Google Assistants. They can be interconnected with smartphone apps, intelligent locks, doorbells, cameras, thermostats, and wall-mounted touchscreen displays. Furthermore, these systems are equipped with additional features such as fire alarms, smoke detectors, and flood and freeze alarms, which have increased the demand for home security systems. These systems also use Wi-Fi-enabled cameras and are compatible with Z-Wave, allowing them to detect any sound.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

The rising concerns regarding safety and security fuel the demand for home security systems. With increasing crime rates, homeowners seek ways to protect their families and properties. Technological advancements like IoT and cloud computing make home security systems more efficient, accessible, and affordable. These technologies enable homeowners to remotely monitor their homes, receive alerts, and control their security systems through smartphones and other devices.

Furthermore, government initiatives promoting home security systems and the increasing adoption of smart homes are driving market growth. Governments worldwide are encouraging the use of home security systems through various policies and schemes while adopting smart homes is integrating security systems into the overall smart home ecosystem.

Report Segmentation

The market is primarily segmented based on home type, security, system, services, and region.

|

By Home Type |

By Security |

By System |

By Services |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Apartments Segment Accounted for Largest Revenue Share in 2024

Apartment segment is accounted for the largest revenue share in the market in 2024. This is due to the unique security challenges apartment living presents, including shared spaces and higher break-in rates. To cater to this demand, home security companies have begun offering tailored solutions for apartment dwellers, typically including wireless sensors, motion detectors, and video surveillance that can be easily installed without invasive drilling. Additionally, these apartment-specific systems are often more affordable than traditional home security systems, which contributed to the segment dominance.

Professionally Installed and Monitored Segment Held the Largest Revenue Share in 2024

Professionally installed and monitored segment accounted for largest revenue share in 2024. There is a growing demand for professional installation of wireless sensors and security cameras among customers willing to pay more for the service. This is because they want to ensure the correct placement and maintenance of equipment and receive expert assistance in optimizing the view and reducing the theft risk. Professional installers handle tasks that may be challenging for the average person, such as climbing ladders, drilling, and electrical work, as well as planning, testing, and troubleshooting the system. These factors are key drivers of revenue growth in this segment.

The do-it-yourself (DIY) segment had a moderate revenue share in 2024. This segment is driven by consumer demand for eco-friendly products, a desire for transparency in expenses, and avoiding long-term contracts. Customers who opt for DIY installation also avoid commission-based salespeople who may pressure them into purchasing unnecessary and expensive add-ons with complicated contracts.

Video Surveillance System Segment Dominated the Market in 2024

The video surveillance system segment dominated the market, due to advancements in digital video cameras for surveillance that offer better viewing angles and higher quality. The user-friendly nature of these systems also drives demand, as customers can monitor their surveillance feeds from anywhere in the world using PCs, mobile devices, and tablets. Moreover, the ability to view recorded or live feeds further boosts revenue growth in this segment.

The fire protection system (FPS) segment is predicted to experience a high CAGR over the forecast period. The increasing need for FPS via traditional methods such as smoke alarms drive growth, as these systems provide an affordable way to safeguard properties and the people who live in them. Fire alarms, in particular, can significantly reduce fire-related fatalities by up to 82%, fueling consumer awareness and driving market expansion in the long term.

Remote Monitoring Services Segment is Anticipated to hold Highest CAGR During Forecast Period

The remote monitoring services segment is expected to hold highest CAGR over the forecast period. The remote monitoring services segment is an important and rapidly growing area. It allows homeowners to monitor their homes remotely through a smartphone app or web portal, offering greater peace of mind and the ability to respond quickly to potential security threats. Features include live video feeds, alerts for suspicious activity, and the ability to arm or disarm the security system from afar. This service is often packaged with home security systems but can also be purchased separately. Remote monitoring services are particularly useful for frequent travelers, second homeowners, and those living in high-crime areas. As technology advances, remote monitoring services are becoming increasingly sophisticated and are expected to continue growing in popularity.

North America Accounted for a Major Revenue Share in 2024

North America accounted for the largest market share in 2024. Companies in this region are expanding their expertise in access control systems to develop unique innovations and services, gaining a competitive advantage over rivals from other countries. Due to mandated fire safety and prevention standards, builders must incorporate fire prevention systems into their building constructions. Several fire protection equipment and system options are available in this area, including smoke and flame detectors and fire alarms.

Asia Pacific experienced the highest CAGR growth in the market during the forecast period. The increasing public spending on smart city projects, such as smart surveillance and monitoring, drives this growth. These projects aim to enhance urban safety and security, improve traffic flow, and optimize resource allocation, among other things. These developments are significant drivers of market expansion in the Asia Pacific region.

Competitive Insight

Some of the major players operating in the global market include ADT, Resideo Technology, Honeywell International, Johnson Controls, Hangzhou Hikvision Digital, ASSA ABLOY, Godrej, Allegion, Control4 Corporation, Schneider Electric, Legrand, STANLEY Convergent Security Solutions, and Scout Security.

Recent Developments

- In April 2022, Home safety product supplier First Alert was purchased by the Resideo Technologies. First Alert provides a wide range of detection and suppression tools, such as combination alarms, Carbon Monoxide alarms, connected fire, fire extinguishers, Carbon Monoxide devices, smoke alarms, CO alarms, and connected devices.

- In March 2022, in a signed agreement, ASSA ABLOY agreed to purchase, JOTEC services, & Vertriebsgesellschaft. This acquisition aims to improve Assa Abloy's entrance automation offering.

- In January 2022, Snap One bought Staub Electronics, a long-time Canadian distribution partner, to improve the partner experience in Canada and increase the company's local branch network across North America.

Home Security Systems Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 59,988.23 million |

| Market size value in 2025 | USD 65,117.27 million |

|

Revenue forecast in 2034 |

USD 129,581.41 million |

|

CAGR |

8.55% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Segments Covered |

|

|

Regional scope |

|

|

Key Companies |

ADT, Resideo Technology, Honeywell International, Johnson Controls, Hangzhou Hikvision Digital, ASSA ABLOY, Godrej, Allegion, Control4 Corporation, Schneider Electric, Legrand, STANLEY Convergent Security Solutions, and Scout Security. |

FAQ's

The Home Security Systems Market report covering key segments are home type, security, system, services, and region.

Home Security Systems Market Size Worth $ 129,581.41 Million By 2034.

The global Home Security Systems market expected to grow at a CAGR of 8.55% during the forecast period.

North America is leading the global market.

key driving factors in Home Security Systems Market are Emergence of internet of things (IOT)and wireless technologies.