Home Surveillance Market Size, Share, Trends, Industry Analysis Report

: By Product Type, Distribution Channel, Category (Wired and Wireless), Application, and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America) – Market Forecast, 2024 - 2032

- Published Date:Oct-2024

- Pages: 116

- Format: PDF

- Report ID: PM5102

- Base Year: 2023

- Historical Data: 2019-2022

Home Surveillance Market Overview

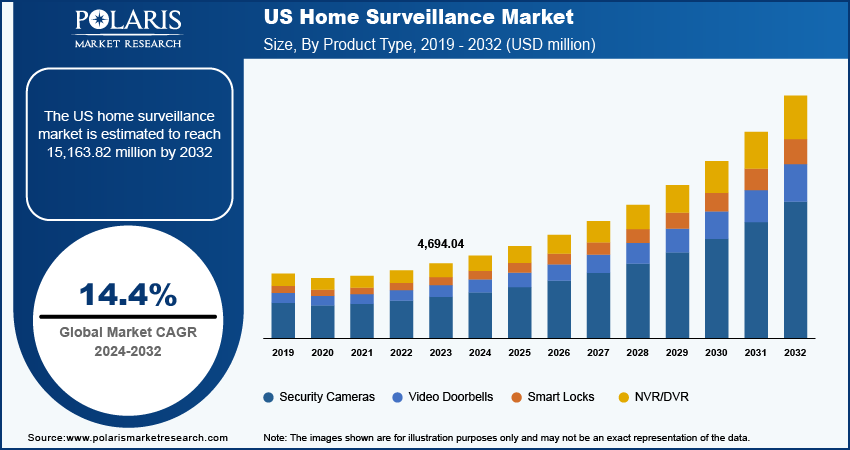

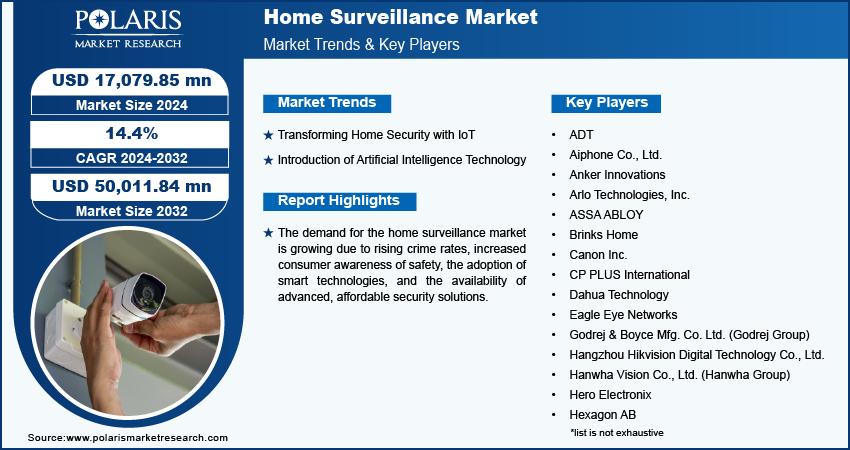

Global home surveillance market size was valued at USD 15,454.08 million in 2023. The market is projected to grow from USD 17,079.85 million in 2024 to USD 50,011.84 million by 2032, exhibiting a CAGR of 14.4% during the forecast period.

Home surveillance refers to electronic security systems such as video doorbells, smart locks, and security cameras that protect properties from theft, damage, and unauthorized access. The market is expanding rapidly due to rising security concerns, technological advancements, and the desire for greater control and convenience. Companies are expanding the market by offering integrated solutions. For instance, in April 2024, Brinks Home launched Vacation Watch for automated monitoring and package detection features, alerting homeowners to deliveries and retrievals via video clips. These innovations reflect the increasing emphasis on enhanced security and user control in home surveillance systems.

To Understand More About this Research: Request a Free Sample Report

The home surveillance market is experiencing significant growth, driven by increasing concerns over property security and rising crime rates. According to the FBI, in 2022, property crimes were recorded at a rate of 1,954.4 per 100,000 people, substantially higher than the rate of violent crimes at 380.7 per 100,000 people. This surge in property crimes has increased awareness and demand for home surveillance solutions as individuals seek effective countermeasures to protect their homes and assets.

Technological advancements are also fueling home surveillance market growth. Innovations such as high-definition cameras, AI-powered analytics, infrared night vision, and Wi-Fi connectivity have enhanced the capabilities and efficiency of home surveillance systems. Companies such as Pelco offer advanced security cameras with features including smart analytics, night vision, and secure boost systems. Their products, including the Sarix Enhanced 4P Series Bullet and Dome cameras, boast capabilities such as crowd threshold detection and privacy blurring. These advancements improve security measures and also drive the adoption and demand for advanced home surveillance solutions.

Home Surveillance Market Drivers and Trends

Introduction of Artificial Intelligence Technology

The home surveillance market is experiencing significant growth due to the integration of Artificial Intelligence (AI) in security cameras. This trend is driven by the increasing demand for advanced technologies, such as smart telematics, which enhance the capabilities of home surveillance systems. AI-based cameras offer superior precision in capturing, detecting, and distinguishing objects, providing valuable insights for analyzing specific events and enhancing home security.

AI-driven home surveillance systems are particularly beneficial for predictive analysis in residential sectors, including homes and apartments. These systems assist in analyzing information from both interior and exterior areas within urban and rural infrastructures. The data obtained from AI-enabled cameras is crucial for assessing and improving security measures for homes and personal properties. For instance, Honeywell HBT's smart AI-enabled camera, namely Impact, provides alerts for security breaches and detects suspicious activities around homes. Controlled through an app, this enables homeowners to promptly take preventive measures, further promoting the adoption of AI-driven home surveillance systems in the residential sector. Consequently, AI technology is playing a pivotal role in boosting home surveillance market growth by offering critical insights and enhancing overall security.

Transforming Home Security with IoT

The integration of the Internet of Things (IoT) has transformed the home security industry, providing homeowners with enhanced control and accessibility over their properties. IoT technology enables the creation of comprehensive home surveillance systems by connecting smart devices such as locks, motion sensors, and doorbells. These interconnected devices allow remote access and control via smartphones and tablets, giving homeowners real-time monitoring and a sense of security. Companies such as Eufy offer a range of IoT-based products, including smart locks, security cameras, and video doorbells, which seamlessly integrate to prevent unauthorized access.

Advancements in AI, machine learning, and smart telematics are further propelling the home surveillance market. As concerns over home security grow, consumers are increasingly adopting advanced security solutions to combat threats such as burglary and intrusion. The continued development and integration of IoT devices in home surveillance systems are expected to drive market growth during the forecast period, offering innovative and efficient security measures for residential properties.

Home Surveillance Market Segment Insights

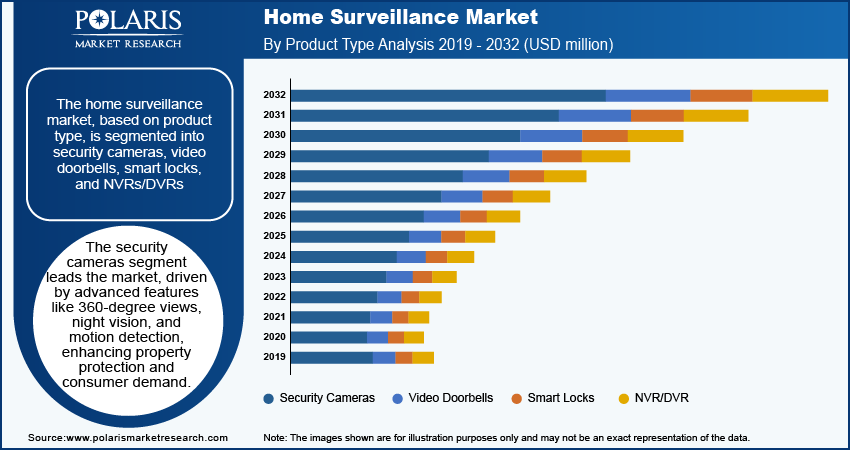

Home Surveillance Market Breakdown by Product Type Insights

The global home surveillance market segmentation, based on product type, includes security cameras, video doorbells, smart locks, and NVRs/DVRs. In 2023, the security cameras segment dominated the market, accounting for 57.8% of market revenue (8,932.4 million). Security cameras are vital for homeowners seeking robust property protection, offering features including 360-degree views, night vision, and motion detection. These capabilities, such as distinguishing between movement, noise, and people while sending instant notifications, drive their demand in the home surveillance market. For instance, in April 2024, Philips launched the Philips 5000 Series Indoor 360-degree camera in the Indian market. The ability of security cameras to record video and audio, along with advancements in resolution and viewing angles, further underscores their importance in home surveillance systems.

Home Surveillance Market Breakdown by Distribution Channel Insights

The global home surveillance market segmentation, based on distribution channels, includes security equipment retailers and online e-commerce sites. The online e-commerce sites category is expected to grow at a 14.5% CAGR over the forecast period. Online e-commerce platforms have become a popular and convenient channel for purchasing home surveillance equipment. These platforms offer a wide range of products, such as the Arlo Pro 3 Floodlight Camera, which features 2K resolution, color night vision, and a built-in siren. Consumers benefit from the ease of browsing and purchasing via smartphones, tablets, or computers, along with competitive pricing and the ability to compare features and reviews. E-commerce sites also provide detailed product descriptions and direct shipping, enhancing the shopping experience and driving growth in the home surveillance market.

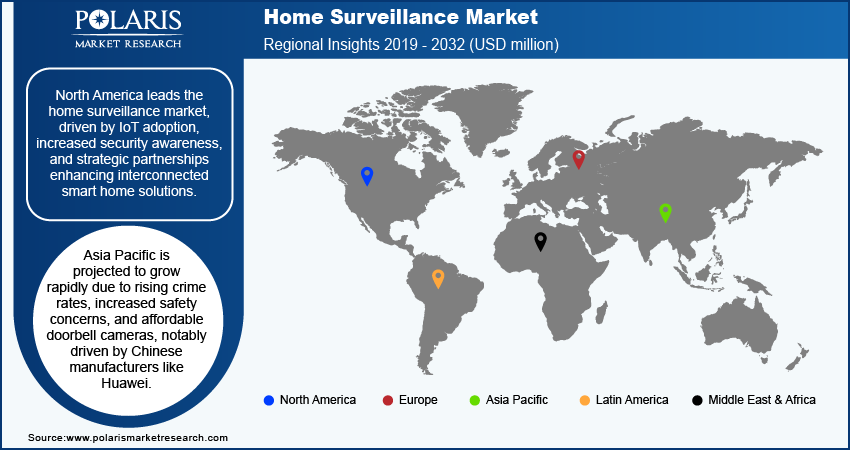

Home Surveillance Market Breakdown by Regional Insights

By region, the study provides market insights into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. North America leads the global home surveillance market in 2023. The adoption of IoT in smart homes is driving significant growth in North America's home surveillance market. Connected devices enhance real-time monitoring and control, leading to increased demand for advanced security solutions. As smart home technology becomes more common, households are seeking comprehensive, interconnected security systems. According to Alarms.org, over 60% of Americans value security in smart homes, highlighting its importance. Increased awareness of home safety and high-profile crime incidents have further boosted demand. Strategic partnerships, such as the one between Motorola Solutions and Google Cloud, are advancing innovation and meeting market needs, supporting the home surveillance market growth.

Asia Pacific is expected to grow at the highest CAGR over the forecast period. The growing demand for doorbell cameras in home surveillance market in Asia Pacific is driven by rising crime rates and increased personal safety concerns. As residents seek to protect their homes and feel more secure, the adoption of doorbell cameras has increased. The affordability of these products also drives market growth, with Chinese manufacturers playing a crucial role in making advanced surveillance solutions more accessible. For example, in May 2021, Huawei launched the Huawei Smart Doorbell Pro, which integrates seamlessly with Huawei's smart selection ecosystem, contributing to the expansion of the home surveillance market in the region.

China home surveillance market also held the largest market share in 2023. Technological advancements are driving the growth of the home surveillance market in China. Innovations such as high-definition cameras, AI-powered analytics, and cloud storage, along with increased internet penetration and mobile connectivity, enhance the effectiveness and accessibility of surveillance solutions. The ability to monitor and control systems remotely via smartphones and apps further boosts demand. Chinese manufacturers, such as Sunell Technology with its 64-channel 4K NVR, contribute to market growth by offering affordable, innovative products. This combination of advanced technology and competitive pricing fuels the widespread adoption of the home surveillance market in China.

Home Surveillance Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the home surveillance market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the home surveillance industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global home surveillance industry to benefit clients and increase the market sector. In recent years, the home surveillance market has offered some technological advancements. Major players in the market includes Hanwha Vision Co., Ltd. (Hanwha Group); Hangzhou Hikvision Digital Technology Co., Ltd.; Motorola Solutions, Inc.; Zhejiang Uniview Technologies Co., Ltd.; CP PLUS International; Huawei Technologies Co., Ltd.; Hexagon AB; Tiandy Technologies Co., Ltd.; KENT Cam Technologies; MOBOTIX; Aiphone Co., Ltd.; ASSA ABLOY; Arlo Technologies, Inc.; Anker Innovations; TP-LINK CORPORATION PTE. LTD.; netvue; Legrand Group; Schneider Electric; Koninklijke Philips N.V.; SAMSUNG; Hero Electronix; Ring; NRG Energy, Inc.; Honeywell International Inc.; Panasonic Holding Corporation; Verkada Inc.; Robert Bosch GmbH; Brinks Home; Eagle Eye Networks; Canon Inc.; Dahua Technology; Godrej & Boyce Mfg. Co. Ltd. (Godrej Group); ADT; SECUREYE.COM; Shenzhen Sunell Technology Corporation; SkyBell Technologies Inc.; VTech Holdings Limited; Wyze Labs, Inc.; and SimpliSafe, Inc.

Hanwha Vision, a Hanwha Group subsidiary, specializes in global video surveillance with AI-based solutions, leveraging advanced image processing and cybersecurity, serving diverse industries with comprehensive security products and global operations. In June 2024, Hanwha Vision introduced two new advanced AI PTZ Plus cameras - the XNP-C9310R and XNP-C7310R. These cameras utilize AI technology to achieve rapid zoom and focus capabilities, enhancing situational awareness and enabling faster response times.

Hangzhou Hikvision Digital Technology Co., Ltd. offers advanced AI, machine perception, and big data technologies, featuring comprehensive security and surveillance products, intelligent traffic systems, access control, and software solutions for diverse industries globally. In April 2024, Hikvision introduced the newest iteration of its Turbo HD series of analog security products, Turbo HD 8.0. This upgraded version offers users an enhanced and interactive security experience, allowing them to expand and enrich their visual security setup.

List of Key Companies in Home Surveillance Market

- ADT

- Aiphone Co., Ltd.

- Anker Innovations

- Arlo Technologies, Inc.

- ASSA ABLOY

- Brinks Home

- Canon Inc.

- CP PLUS International

- Dahua Technology

- Eagle Eye Networks

- Godrej & Boyce Mfg. Co. Ltd. (Godrej Group)

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Hanwha Vision Co., Ltd. (Hanwha Group)

- Hero Electronix

- Hexagon AB

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- KENT Cam Technologies

- Koninklijke Philips N.V.

- Legrand Group

- MOBOTIX

- Motorola Solutions, Inc.

- netvue

- NRG Energy, Inc.

- Panasonic Holding Corporation

- Ring

- Robert Bosch GmbH

- SAMSUNG

- Schneider Electric

- Scout Security Inc

- Secureye.com

- Shenzhen Sunell Technology Corporation

- SimpliSafe, Inc.

- SkyBell Technologies Inc.

- Tiandy Technologies Co., Ltd.

- TP-LINK CORPORATION PTE. LTD.

- Verkada Inc.

- VTech Holdings Limited

- Wyze Labs, Inc.

- Zhejiang Uniview Technologies Co., Ltd.

Home Surveillance Industry Developments

June 2024: CP PLUS launched a new line of Solar-Powered AI-enabled 4G Cameras. These cameras utilize solar energy, artificial intelligence, and 4G connectivity to provide superior security solutions for residential and commercial settings.

April 2024: Qubo introduced the Qubo InstaView Video Door Phone, a device that integrates the functionality of the Video Doorbell Pro with the Qubo Home Tab. This integration aimed to enhance homeowners' security and convenience.

May 2024: Arlo Technologies, Inc. renewed its strategic partnership agreement with Verisure, a provider of monitored security solutions in the European market.

Home Surveillance Market Segmentation

By Product Type Outlook

- Security Cameras

- Video Doorbells

- Smart Locks

- NVRs/DVRs

By Distribution Channel Outlook

- Security Equipment Retailers

- Online E-Commerce Sites

By Category Outlook

- Wired

- Wireless

By Application Outlook

- Independent Homes

- Apartments

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Malaysia

- Indonesia

- South Korea

- Thailand

- Vietnam

- Taiwan

- Philippines

- Singapore

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Home Surveillance Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 15,454.08 million |

|

Market Size Value in 2024 |

USD 17,079.85 million |

|

Revenue Forecast in 2032 |

USD 50,011.84 million |

|

CAGR |

14.4% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global home surveillance market size was valued at USD 15,454.08 million in 2023 and is projected to be valued at USD 50,011.84 million by 2032.

The global market exhibits a CAGR of 14.4% during the forecast period, 2024-2032.

North America had the largest share of the global market

The key players in the market are Hanwha Vision Co., Ltd. (Hanwha Group); Hangzhou Hikvision Digital Technology Co., Ltd.; Motorola Solutions, Inc.; Zhejiang Uniview Technologies Co., Ltd.; CP PLUS International; Huawei Technologies Co., Ltd.; Hexagon AB; Tiandy Technologies Co., Ltd.; KENT Cam Technologies; MOBOTIX, Aiphone Co., Ltd.; ASSA ABLOY; Arlo Technologies, Inc.; Anker Innovations; TP-LINK CORPORATION PTE. LTD.; netvue; Legrand Group; Schneider Electric; Koninklijke Philips N.V.; SAMSUNG; Hero Electronix; Ring; NRG Energy, Inc.; Honeywell International Inc.; Panasonic Holding Corporation; Verkada Inc.; Robert Bosch GmbH; Brinks Home; Eagle Eye Networks; Canon Inc.; Dahua Technology; Godrej & Boyce Mfg. Co. Ltd. (Godrej Group); ADT; SECUREYE.COM; Shenzhen Sunell Technology Corporation; SkyBell Technologies Inc.; VTech Holdings Limited; Wyze Labs, Inc.; and SimpliSafe, Inc.

The security cameras category dominated the market in 2023.

The security equipment retailers had the largest share of the global market.