Human Capital Management Market Size, Share, Trends, & Industry Analysis Report

By Component (Software, Services), By Deployment Model, By Organization Size, By Vertical, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 114

- Format: PDF

- Report ID: PM2442

- Base Year: 2024

- Historical Data: 2020 - 2023

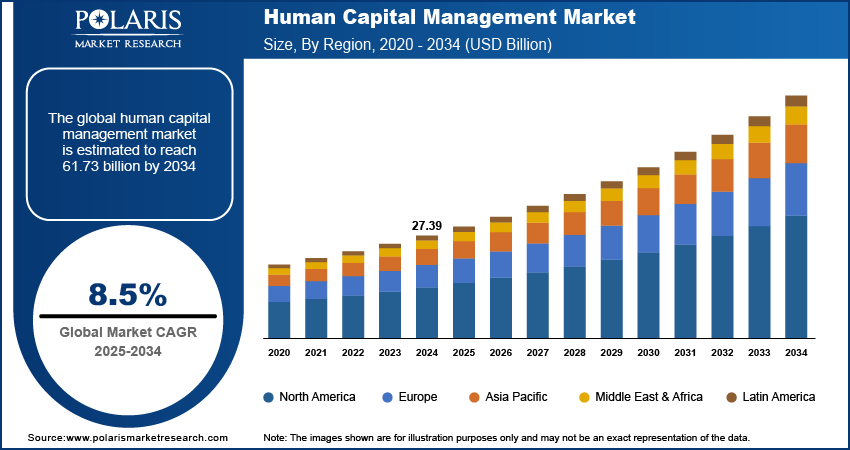

The global human capital management market was valued at USD 27.39 billion in 2024 and is expected to grow at a CAGR of 8.5% during the forecast period. One of the significant factors designed to encourage businesses to use human capital management solutions is digitizing business operations. These solutions reduce the manual labor required to complete time-consuming tasks in the human resources (HR) department. Also, due to the presence of so many players, the human capital management sector is highly competitive and highly fragmented.

Key Insights

- The BFSI segment is expected to be the most significant revenue contributor in the market due to rising demand for human capital management software to create a centralized system.

- The SMEs segment is expected to witness significant growth during the forecast period due to growing need to manage a diverse workforce, improve productivity, and comply with regulations.

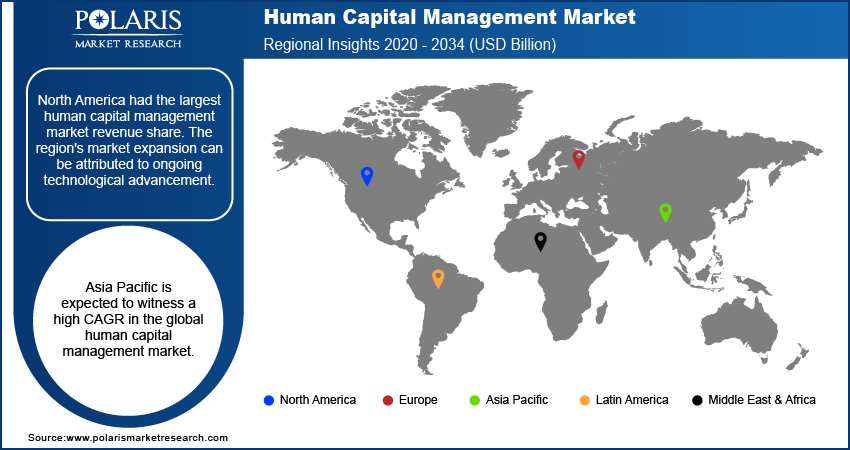

- The North America is accounted for largest share in 2024 due to technological advancement and rising number of large enterprises.

- Asia Pacific is expected to witness fastest growth during the forecast period due to rising usage of cloud-native technologies.

Industry Dynamics

- Rising adoption of artificial intelligence and machine learning fuels the expansion of the industry.

- Rising number of strategic mergers and acquisition among the major players fuels the market growth.

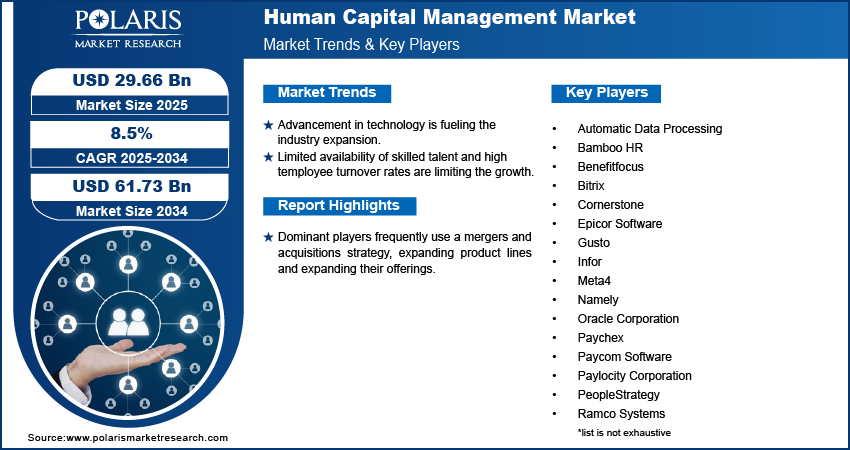

- Advancement in technology is fueling the industry expansion.

- Limited availability of skilled talent and high employee turnover rates are limiting the growth.

Market Statistics

- 2024 Market Size: USD 27.39 Billion

- 2034 Projected Market Size: USD 61.73 Billion

- CAGR (2025-2034): 8.5%

- Largest Market: North America

To Understand More About this Research: Request a Free Sample Report

Impact of AI on Industry

- Adoption of AI helps to improve major enterprise tasks such as talent acquisition, payroll, employee engagement and retention.

- Personalized AI-based training platforms accelerate employee skill development and continuous learning.

- Adoption of AI is expected to fuel privacy and ethical concerns which may impact consumer behavior negatively

Dominant players frequently use a mergers and acquisitions strategy, expanding product lines and expanding their offerings. For instance, in September 2021, Workday, Inc announced that Google LLC had signed to Workday Adaptive Planning, Extend, Prism Analytics, and Strategic Sourcing to assist its employee base. It will also enlarge its existing use of Workday human capital management as part of the ongoing investment in talent management, introducing additional applications to deliver improved staff experiences and hiring to assist its global workforce.

Furthermore, significant growth in the e-commerce sector is driving up demand for HCM software to drive employee engagement value. Due to the increased COVID-19 pandemic, businesses worldwide have adopted a remote work culture, posing new challenges for HCM software and service providers. The major challenge is keeping offerings up to date with changing organizational cultures. This is projected to increase the uptake of human capital management software. However, enterprises' cutting costs and project delays may limit the adoption of human capital management software.

Industry Dynamics

Growth Drivers

Important factors such as adopting technological innovations, such as AI and ML, with HCM software, have emerged as one of the most potent factors influencing human capital management software and its advantages across regions. Most businesses across market sectors face a shortage of highly skilled workers as business operations become more complex as new technologies and innovations are adopted. As a result, HR managers worldwide are having difficulty hiring the right people for the right jobs. AI and ML can automate and streamline the recruitment process and provide filters to find the right person.

Furthermore, businesses worldwide embrace digitalization and the latest technologies such as AI, ML, and IoT. These technologies generate massive amounts of data in various formats. In March 2021, Zellis launched Zellis HCM Cloud, its flagship HCM solution. The new system includes the most recent cloud, automation, and AI developments to provide engaging employee experiences, empower businesses with transformative data analytics, and open incredible payroll and HR procedures efficiencies.

Zellis HCM Cloud can be implemented as a standalone, greatest payroll offering, integrated with a current HR system, or a complete complement that addresses all payroll and HR needs, "from hire to retire," in a solitary, highly expandable platform. This digital storefront allows consumers to conveniently access additional Zellis alternatives and connectors to third-party applications, allowing them to build their human capital management ecosystem.

Which Trends are Driving the Human Capital Management Market growth?

The human capital management (HCM) market is experiencing several transformative trends. They reflect the evolving nature of work and employee expectations. Organizations focus on flexibility, employee well-being, and continuous learning. These trends help them build a future-ready workforce. Market players are focusing on adopting these trends to stay ahead in the competitive market landscape. The following table provides information on key trends and their impact on HCM market.

|

Trend |

Description |

Impact on HCM |

|

AI-Enabled Talent Management |

AI adoption to predict skill requirements and personalize learning. |

Improves strategic workforce alignment and leads to recruitment efficiency. |

|

Emphasis on Human Skills |

Rising emphasis on creativity, critical thinking, and emotional intelligence as automation is used for repetitive tasks. |

Ensures workforce adaptability and resilience. |

|

Hybrid and Flexible Work Models |

Adoption of flexible and hybrid work arrangements. |

Increases job satisfaction and enables work-life balance. |

|

Integration of Employee Well-being |

Comprehensive wellness programs that manage physical, mental, and emotional health. |

Supports productivity and workforce health. |

|

Data-Driven Decision Making |

Advanced data analytics for recruitment, performance, and workforce planning. |

Enables informed strategic HR decisions. |

|

Gig and Freelance Work |

Integration of freelance and contract workers into workforce strategies. |

Encourages flexible work models and access to specialized talent. |

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on component, deployment mode, organization size, vertical, and region.

|

By Component |

By Deployment Mode |

By Organization Size |

By Vertical |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Insight by Vertical

Based on the vertical segment, the BFSI segment is expected to be the most significant revenue contributor in the global market. The vertical has primarily used human capital management software to create a centralized system for managing the information of all employees, resulting in efficient coordination and improved performance, particularly during pandemic outbreaks. Advanced technologies and various software and services can assist this vertical in prioritizing its actions and managing its workforce efficiently.

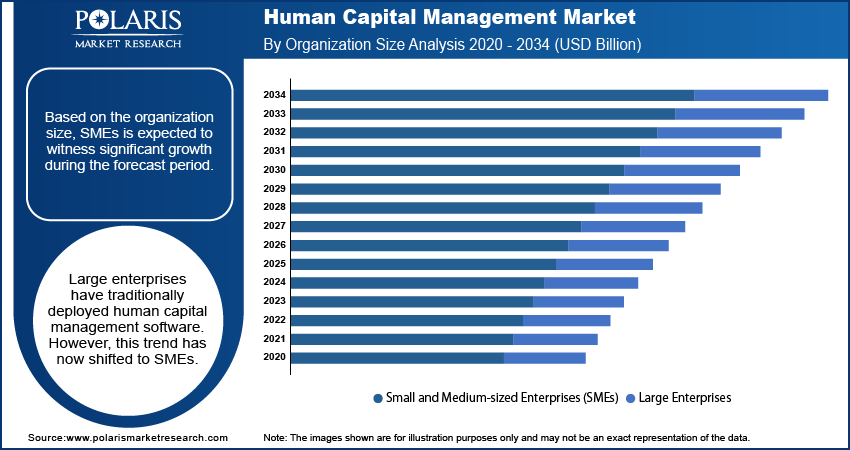

Insight by Organization Size

Based on the organization size, SMEs is expected to witness significant growth during the forecast period. Large enterprises have traditionally deployed human capital management software. However, this trend has now shifted to SMEs. It is anticipated to be there within the forecast years, with SMEs contributing the most to the HCM market. Some of the factors responsible for this rapid growth include the growing need to manage a diverse workforce, enhance productivity, and comply with regulations. SMEs are dispersed geographically, necessitating a centralized system to manage this data.

Geographic Overview

In terms of geography, North America had the largest human capital management market revenue share. The region's market expansion can be attributed to ongoing technological advancement. Increased globalization and better work culture will positively impact North American growth. Rapid advances in artificial intelligence (AI) and information technology (IT) are also required to contribute to the expansion of the North American HCM market. Another component expected to drive demand for human capital management market is the investigation of efforts and aggressive investment opportunities in digitizing human capital resource processes to improve organizational productivity. The growth principally for HCM solutions delivered through a Software as a Service (SaaS) delivery model is expected to fuel the development of the market.

Asia Pacific is expected to witness a high CAGR in the global human capital management market. Large numbers of HCM vendors and the rising usage of cloud-native technologies drive growth in the region. The major countries are witnessing massive investments in market verticals such as BFSI, retail, healthcare, manufacturing, telecommunication services, and IT, resulting in Asia countries' economic growth. The market in the Asia Pacific is expected to be driven by organizations' increasing adoption of industry 4.0, data analytics, and cloud computing.

Competitive Insight

Major market players operating in the global human capital management market include Automatic Data Processing, Bamboo HR, Benefitfocus, Bitrix, Cornerstone, Epicor Software, Gusto, Infor, Ultimate Kronos Group, Meta4, Namely, Oracle Corporation, Paychex, Paycom Software, Paylocity Corporation, PeopleStrategy, Ramco Systems, Sage Group, SAP SE, Workday, Inc, Workforce Software, Zenefits, and Zoho.

Human Capital Management Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 27.39 Billion |

| Market size value in 2025 | USD 29.66 Billion |

|

Revenue forecast in 2034 |

USD 61.73 Billion |

|

CAGR |

8.5% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2024 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Component, By Deployment Mode, By Organization Size, By Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Automatic Data Processing, Bamboo HR, Benefitfocus, Bitrix, Cornerstone, Epicor Software, Gusto, Infor, Ultimate Kronos Group, Meta4, Namely, Oracle Corporation, Paychex, Paycom Software, Paylocity Corporation, PeopleStrategy, Ramco Systems, Sage Group, SAP SE, Workday, Inc, Workforce Software, Zenefits, and Zoho. |

FAQ's

• The market size was valued at USD 27.39 billion in 2024 and is projected to grow to USD 61.73 billion by 2034.

• The market is projected to register a CAGR of 8.5% during the forecast period.

• A few of the key players in the market are Automatic Data Processing, Bamboo HR, Benefitfocus, Bitrix, Cornerstone, Epicor Software, Gusto, Infor, Ultimate Kronos Group, Meta4, Namely, Oracle Corporation, Paychex, Paycom Software, Paylocity Corporation, PeopleStrategy, Ramco Systems, Sage Group, SAP SE, Workday, Inc, Workforce Software, Zenefits, and Zoho.

• The BFSI segment dominated the market revenue share in 2024.

• The SMEs segment is projected to witness the significant growth during the forecast period.