In-Mold Electronics Market Size, Share, Trends, Industry Analysis Report

By Components (Capacitive Touch Sensing, Lighting, Others), By Technology, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 130

- Format: PDF

- Report ID: PM6125

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

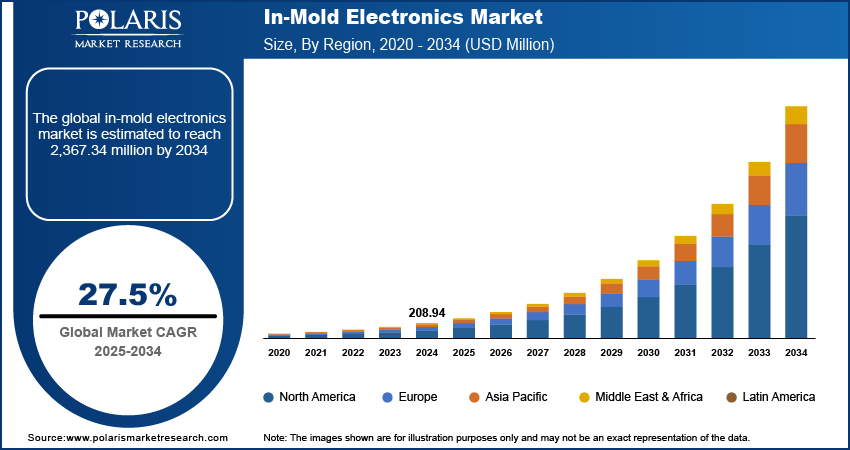

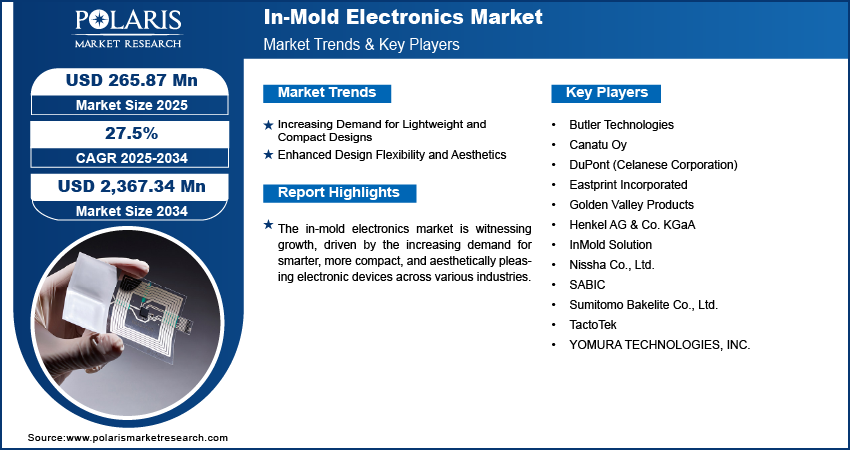

The global in-mold electronics market size was valued at USD 208.94 million in 2024 and is anticipated to register a CAGR of 27.5% from 2025 to 2034. The landscape is largely driven by the growing demand for lightweight and compact electronic components, especially within the automotive and consumer electronics sectors.

Key Insights

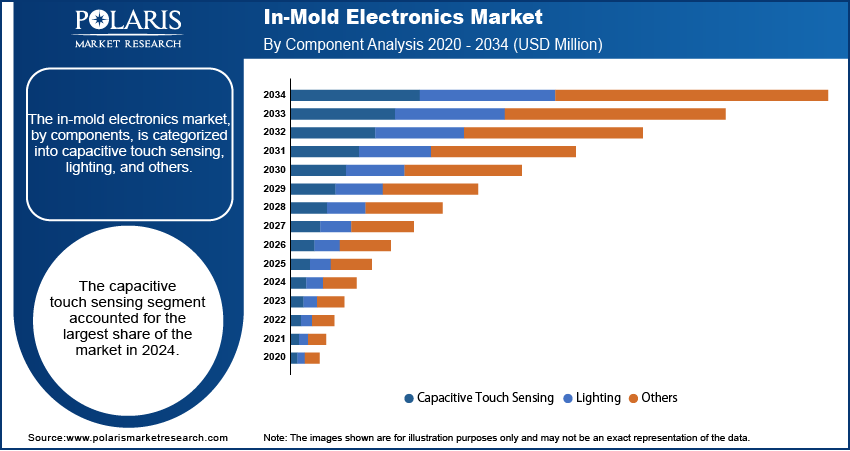

- By components, the capacitive touch sensing segment held the largest share in 2024, due to the widespread preference for sleek, button-free interfaces in various electronic products. This technology allows for the seamless integration of interactive controls, enhancing both aesthetics and user experience across industries.

- By technology, the screen printing segment held the largest share in 2024, largely owing to its established presence, cost-effectiveness, and scalability in manufacturing. This method effectively deposits conductive inks and other materials onto flexible substrates, making it a reliable choice for producing durable integrated electronic components.

- By end use, the automotive segment held the largest share in 2024, driven by the industry's continuous demand for lightweight vehicle components and sophisticated interior designs. In-mold electronics enable the integration of advanced human-machine interfaces and reduce overall vehicle weight, aligning with modern automotive trends.

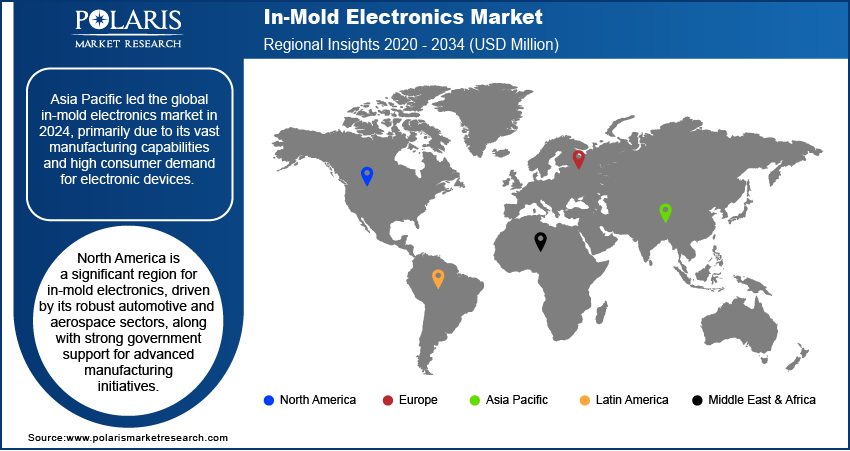

- By region, Asia Pacific stands as the leading region in the in-mold electronics industry, primarily due to its vast manufacturing capabilities and high consumer demand for electronic devices.

Industry Dynamics

- The rising demand for lightweight and compact electronic devices is a significant driver. This technology allows electronics to be directly integrated into product structures, making them thinner and lighter.

- Improved design flexibility and enhanced aesthetics are also boosting adoption. This approach enables manufacturers to create seamless, button-free surfaces with integrated touch controls and lighting effects.

- The push for more cost-effective manufacturing processes is another key factor. By combining several production steps into one, this technology reduces the number of parts needed and simplifies assembly.

Market Statistics

- 2024 Market Size: USD 208.94 Million

- 2034 Projected Market Size: USD 2,367.34 Million

- CAGR (2025–2034): 27.5%

- Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

In-mold electronics (IME) is an advanced manufacturing technique that integrates electronic functions directly into plastic parts during the molding process. This method combines traditional processes such as printing and injection molding, including rubber molding to create seamless, smart surfaces with embedded circuits, sensors, and lighting.

Factors influencing the growth include the increasing focus on sustainable manufacturing practices and the rising adoption of smart surfaces in various applications. These factors are steadily contributing to the technology's overall growth. As industries worldwide aim for more environmentally friendly production methods, IME offers a promising solution by reducing material use and streamlining assembly processes.

The rising adoption of smart surfaces is notably impacting demand. Smart surfaces integrate various electronic features, including touch controls and ambient lighting, directly into a product's exterior, replacing traditional buttons and switches. For example, in the automotive industry, IME is enabling sophisticated, touch-sensitive dashboards and control panels that offer a cleaner aesthetic and more intuitive user experience. This trend is also evident in smart home appliances, where sleek, integrated control panels are becoming more common. The National Institutes of Health (NIH) has also highlighted the importance of integrated and user-friendly interfaces in medical devices, which IME can facilitate by creating smooth, easy-to-clean surfaces with embedded functionalities.

Drivers and Trends

Increasing Demand for Lightweight and Compact Designs: The automotive industry and consumer electronics sector are continuously striving to reduce the weight and size of their products, making the demand for lightweight and compact designs a major driver for in-mold electronics. In vehicles, lighter components contribute to improved fuel efficiency and extended range for electric vehicles, while in consumer gadgets, compactness enhances portability and user convenience. In-mold electronics replace traditional bulky wiring harnesses, circuit boards, and mechanical switches with thin, flexible, integrated circuits, directly embedding them into molded plastic parts.

A review article published in PMC in April 2024, titled "Lightweighting in the automotive industry as a measure for energy efficiency: Review of the main materials and methods," highlighted that a 10% reduction in vehicle weight can lead to a 6% to 8% improvement in fuel economy. This emphasizes the critical role of lightweighting in meeting energy efficiency goals and reducing emissions in the transportation sector. By enabling significant weight reductions compared to conventional electronic assemblies, in-mold electronics directly support these industry-wide efforts, thereby driving growth.

Enhanced Design Flexibility and Aesthetics: Modern product design prioritizes sleek aesthetics and intuitive user interfaces, making enhanced design flexibility a crucial driver. Consumers and industries are increasingly seeking seamless surfaces free of visible buttons and complex wiring. In-mold electronics allow for the integration of touch sensors, lighting, and other electronic functionalities directly into curved or three-dimensional surfaces, transforming product appearance and user interaction.

A study published in PMC in November 2024, "Assessment of Drivers' Perceptions of Connected Vehicle–Human Machine Interface for Driving Under Adverse Weather Conditions: Preliminary Findings From Wyoming," discussed the importance of well-designed human-machine interfaces (HMI) in improving driver awareness and safety in connected vehicles. This research indicates a clear industry focus on intuitive and integrated interfaces, which in-mold electronics can provide by enabling advanced HMI designs. The ability of in-mold electronics to create visually appealing, durable, and highly functional integrated surfaces directly contributes to meeting these evolving design demands, thus propelling growth.

Segmental Insights

Components Analysis

Based on components, the segmentation includes capacitive touch sensing, lighting, and others. The capacitive touch sensing segment held the largest share in 2024. This dominance is driven by the increasing consumer preference for seamless, button-free interfaces in devices ranging from automotive interiors to home appliances and consumer electronics. Capacitive touch technology offers a more modern and intuitive user experience compared to traditional mechanical switches, enabling sleek designs and integrated functionalities such as gesture recognition and multi-touch capabilities. Manufacturers are increasingly integrating these sensors directly into molded plastic parts, leading to thinner, lighter, and more durable products. The technology's ability to withstand harsh environments and provide reliable performance further solidifies its leading position.

The lighting segment is anticipated to register the highest growth rate during the forecast period. This rapid expansion is primarily fueled by the growing demand for advanced and aesthetically pleasing lighting solutions in various products, especially in the automotive sector for interior ambient lighting and exterior illumination. In-mold electronics allow for the creation of intricate and flexible lighting designs that can be seamlessly integrated into curved surfaces, offering both functional illumination and enhanced visual appeal. Beyond automotive, the use of integrated lighting in smart home devices, consumer wearables, and even medical equipment is also on the rise, pushing the development and adoption of IME-based lighting solutions.

Technology Analysis

Based on technology, the segmentation includes screen printing, inkjet printing, thermoforming, injection molding, and others. The screen printing segment held the largest share in 2024. This method is widely favored due to its long-standing presence in the printing industry, offering a balance of cost-effectiveness, scalability, and robust performance. Screen printing is highly versatile, allowing for the precise deposition of conductive inks and other functional materials onto flexible substrates. Its ability to handle various material viscosities and create relatively thick layers makes it suitable for producing durable circuits and components that can withstand the subsequent thermoforming and injection molding processes including plastic infection molding machines and processes. This established reliability and the widespread availability of equipment and expertise contribute significantly to its dominant position in manufacturing integrated electronic parts for diverse applications, from automotive controls to consumer appliances.

The inkjet printing segment is anticipated to register the highest growth rate during the forecast period, driven by its inherent advantages in terms of design flexibility, high-resolution capabilities, and suitability for rapid prototyping and customization. Unlike traditional screen printing, inkjet technology is a digital process that allows for on-demand pattern creation without the need for physical masks, reducing setup times and material waste. This precision enables the development of more complex and intricate circuit designs, opening new possibilities for miniaturization and advanced functionalities. As industries increasingly demand highly customized and intricate electronic components with quicker turnaround times, inkjet printing is becoming an invaluable tool for innovation and efficient production, propelling its swift growth trajectory.

End Use Analysis

Based on end use, the segmentation includes automotive, consumer electronics, home appliances, industrial equipment, and others. The automotive segment held the largest share in 2024. This strong position is driven by the industry's continuous push for lightweight vehicles, enhanced interior aesthetics, and advanced human-machine interfaces. In-mold electronics enable car manufacturers to integrate touch controls, display lighting, and sensors directly into dashboards, door panels, and steering wheels, reducing complexity and weight while improving design flexibility. The transition toward electric and autonomous vehicles further accelerates this trend, as there is an increasing need for more electronic content and integrated smart surfaces within the vehicle's interior. The robust demand for sleek, functional, and durable electronic components in modern car designs firmly establishes the automotive industry as the leading consumer of in-mold electronics technology.

The consumer electronics segment is anticipated to register the highest growth rate during the forecast period. This rapid expansion is fueled by the continuous innovation in personal devices and home appliances, where aesthetics, user experience, and compact designs are paramount. In-mold electronics enable the creation of seamless touch interfaces for smartphones, tablets, wearables, and smart home devices, eliminating visible buttons and enhancing product durability. The increasing consumer demand for interactive features, sleek appearances, and the miniaturization of electronic components in everyday gadgets significantly drives the adoption of this technology. As companies in the consumer electronics space strive to offer innovative designs and improved functionalities, in-mold electronics provide a critical solution, propelling this segment to a fast-growing trajectory.

Regional Analysis

Asia Pacific accounted for the largest share in 2024, fueled by the region's vast manufacturing capabilities, particularly in consumer electronics and automotive production, alongside a booming demand for smart and connected devices. Countries in Asia Pacific are significant producers of electronic goods, and the adoption of IME helps them achieve cost efficiencies, lighter products, and innovative designs that appeal to a large consumer base. The increasing urbanization and disposable incomes in many parts of the region also contribute to a higher demand for advanced electronic products incorporating IME technology.

China In-Mold Electronics Market Insights

China is a dominating country in the Asia Pacific in-mold electronics market. With its expansive manufacturing infrastructure and a massive consumer sector, China is rapidly integrating IME into a wide array of products, from smartphones and home appliances to electric vehicles. The country's strong focus on technological advancements and its competitive manufacturing landscape encourage the adoption of efficient and advanced production methods such as IME. Chinese manufacturers are actively developing and deploying in-mold electronic solutions to meet the escalating demand for high-performance, integrated, and aesthetically superior electronic devices across both domestic and export markets.

North America In-Mold Electronics Market Trends

North America is a significant region for in-mold electronics, driven by its robust automotive and aerospace sectors, along with strong government support for advanced manufacturing initiatives. The region benefits from a high consumer inclination toward sophisticated electronic devices and smart products, leading to increased demand for integrated and aesthetically pleasing interfaces. Companies in North America are increasingly investing in research and development (R&D) to advance IME technology, focusing on applications that enhance user experience and product functionality. This forward-looking approach, combined with a strong industrial base, positions North America as a key region for the ongoing development and adoption of in-mold electronics solutions across various industries.

U.S. In-Mold Electronics Market Overview

In North America, the U.S. stands out as a dominant country in the in-mold electronics market. The country's leadership is significantly influenced by the rapid transition toward electric and autonomous vehicles, which creates a substantial demand for lightweight and multifunctional interior components. The country also has a large and evolving consumer electronics sector, with a high adoption rate of smart devices and wearables that benefit from the sleek, durable, and integrated designs offered by IME. Furthermore, significant investments in technological innovation and advanced manufacturing processes contribute to the U.S.’s prominent role in driving the overall growth and development of the in-mold electronics industry.

Europe In-Mold Electronics Market Analysis

Europe represents a substantial landscape for in-mold electronics, characterized by its mature automotive industry and a strong focus on advanced manufacturing technologies. The region's emphasis on vehicle weight reduction, interior design innovation, and sustainable production practices strongly supports the adoption of IME. European manufacturers are keen on integrating electronic functions directly into plastic parts to create seamless and aesthetically pleasing surfaces, particularly in high-end automotive applications. The ongoing push for smarter and more connected solutions across various industries, including medical devices and industrial equipment, further contributes to the steady expansion of in-mold electronics in Europe.

The Germany in-mold electronics market plays a pivotal role in Europe landscape. As a global hub for automotive manufacturing and engineering, Germany drives significant demand for IME solutions that enhance vehicle interiors and exteriors. The country's strong research and development ecosystem, coupled with leading companies in the plastics and electronics industries, fosters innovation in IME technology. German manufacturers are at the forefront of implementing integrated functional surfaces in cars, ranging from touch-sensitive control panels to advanced lighting features, aligning with the industry's pursuit of high-quality, lightweight, and technologically advanced components. This makes Germany a crucial country for the widespread adoption and advancement of in-mold electronics in Europe.

Key Players and Competitive Insights

The in-mold electronics market features a dynamic competitive landscape, with several key players vying for market position and innovation. Companies such as DuPont (Celanese Corporation); Nissha Co., Ltd.; TactoTek; Butler Technologies; and Eastprint Incorporated are among the significant participants shaping the industry. These firms compete through a combination of technological advancements, strategic partnerships, and expanding product portfolios tailored to diverse end-use industries such as automotive and consumer electronics. The competitive nature is driven by continuous efforts to improve material science, optimize manufacturing processes, and integrate new functionalities into IME components, leading to a constant push for more efficient and sophisticated solutions.

A few prominent companies in the industry include DuPont (Celanese Corporation); Nissha Co., Ltd.; TactoTek; Butler Technologies; Eastprint Incorporated; Golden Valley Products; InMold Solution; YOMURA TECHNOLOGIES, INC.; Canatu Oy; Henkel AG & Co. KGaA; Sumitomo Bakelite Co., Ltd.; and SABIC.

Key Players

- Butler Technologies

- Canatu Oy

- DuPont (Celanese Corporation)

- Eastprint Incorporated

- Golden Valley Products

- Henkel AG & Co. KGaA

- InMold Solution

- Nissha Co., Ltd.

- SABIC

- Sumitomo Bakelite Co., Ltd.

- TactoTek

- YOMURA TECHNOLOGIES, INC.

In-Mold Electronics Industry Developments

March 2025: Valeo licensed TactoTek's IMSE (In-Mold Structural Electronics) technology. This partnership aims to leverage IMSE for advanced interior and exterior lighting applications in vehicles, reflecting a significant move toward integrated smart surfaces in the automotive industry.

May 2024: DuPont announced a plan to separate into three distinct, publicly traded companies, with the Electronics business proposed to be spun off.

In-Mold Electronics Market Segmentation

By Components Outlook (Revenue – USD Million, 2020–2034)

- Capacitive Touch Sensing

- Lighting

- Others

By Technology Outlook (Revenue – USD Million, 2020–2034)

- Screen Printing

- Inkjet Printing

- Thermoforming

- Injection Molding

- Others

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Automotive

- Consumer Electronics

- Home Appliances

- Industrial Equipment

- Others

By Regional Outlook (Revenue-USD Million, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

In-Mold Electronics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 208.94 Million |

|

Market Size in 2025 |

USD 265.87 Million |

|

Revenue Forecast by 2034 |

USD 2,367.34 Million |

|

CAGR |

27.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 208.94 million in 2024 and is projected to grow to USD 2,367.34 million by 2034.

The global market is projected to register a CAGR of 27.5% during the forecast period.

Asia Pacific dominated the share in 2024.

A few key players include DuPont (Celanese Corporation); Nissha Co., Ltd.; TactoTek; Butler Technologies; Eastprint Incorporated; Golden Valley Products; InMold Solution; YOMURA TECHNOLOGIES, INC.; Canatu Oy; Henkel AG & Co. KGaA; Sumitomo Bakelite Co., Ltd.; and SABIC.

The capacitive touch sensing segment accounted for the largest share of the market in 2024.

The inkjet printing segment is expected to witness the fastest growth during the forecast period.