Rubber Molding Market Size, Share, Trends, Industry Analysis Report

: By Molding Type (Transfer Molding, Injection Molding, Compression Molding, and Others), Material, End-User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 117

- Format: PDF

- Report ID: PM1587

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

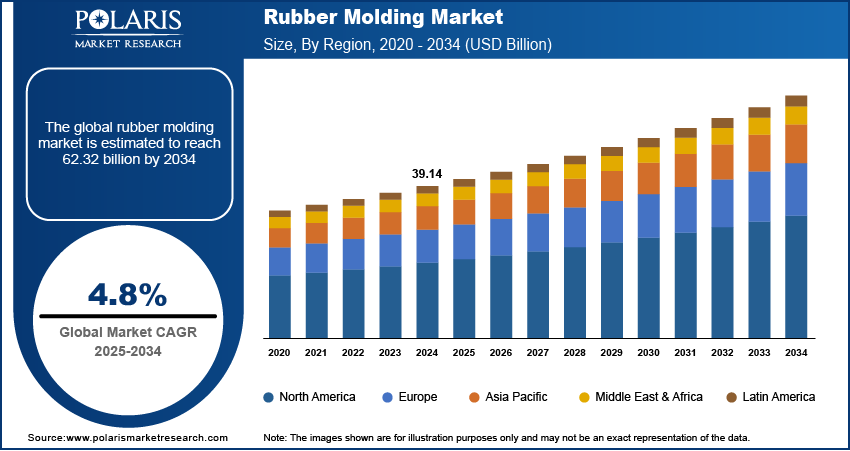

The global rubber molding market size was valued at USD 39.14 billion in 2024 and is projected to grow at a CAGR of 4.8% from 2025 to 2034. The market growth is primarily driven by increased demand for consumer goods utilizing rubber molding, growing urbanization in developing nations, and rising demand from the automotive industry.

Key Insights

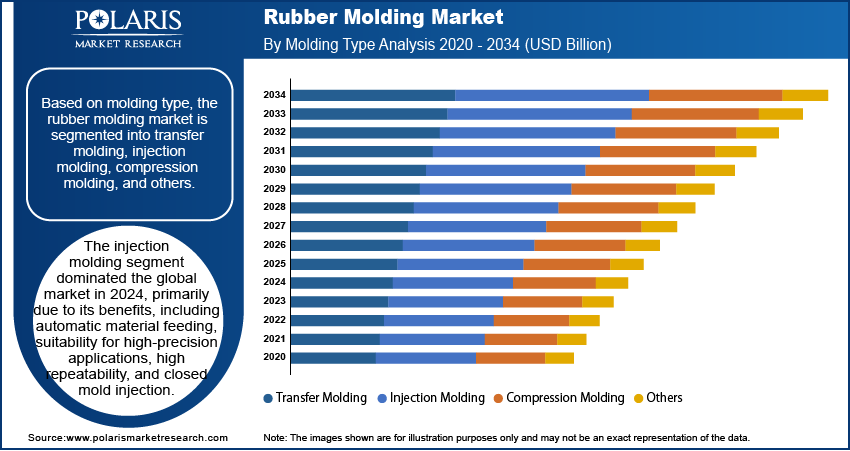

- The injection molding segment led the market in 2024, primarily due to its cost-effectiveness in the production of large volumes of medium to high-precision components.

- The ethylene propylene diene monomer (EPDM) segment accounted for the largest market share in 2024, owing to increased demand from the automotive industry and rising adoption of electric vehicles.

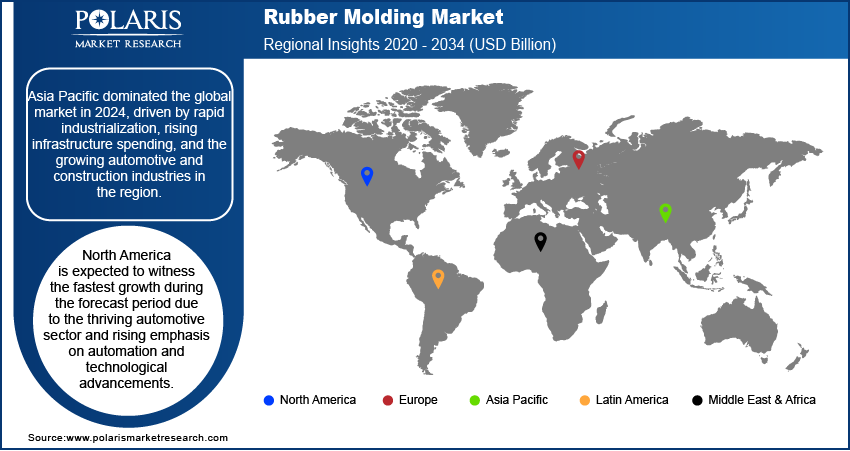

- Asia Pacific dominated the market in 2024. The regional market dominance is attributed to its rapid urbanization and increased infrastructure spending.

- North America is anticipated to witness sustained growth during the projection period. The region’s growing automotive industry is driving significant demand for rubber-molded parts.

Industry Dynamics

- The growing need for rubber-molded parts in the automotive industry, including seals, bumpers, and gaskets, is driving market expansion.

- Technological advancements in injection molding techniques, such as the use of solenoid valves and the introduction of liquid injection molding, contribute to market growth.

- The shift towards greener materials and increased R&D activities is projected to provide several market opportunities in the coming years.

- Material variability may present challenges to market development.

Market Statistics

2024 Market Size: USD 39.14 billion

2034 Projected Market Size: USD 62.32 billion

CAGR (2025-2034): 4.8%

Asia Pacific: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

Rubber molding is a manufacturing process that shapes raw rubber into finished products using heat and pressure. It is widely used to create various rubber parts, including gaskets, seals, grommets, and O-rings. The process begins by placing the rubber into a metal mold, which is then closed. Heat and pressure are applied, causing the rubber to cure or vulcanize. This process forces excess rubber into grooves in the mold, known as flash. Once cooled, the finished product is removed from the mold. There are three main types of rubber molding processes: injection molding, compression molding, and transfer molding.

The growing demand for consumer goods utilizing rubber molding is one of the key factors driving the rubber molding market growth. Other major factors driving the market expansion, particularly in developing nations, include growing urbanization and rising demand from the automotive industry. In the automotive industry, rubber molding is used to produce a variety of parts, including vibration dampers, and gaskets and seals. The market for rubber molding is experiencing a shift driven by technical advancements and environmental regulations.

To meet the demand for intricate and highly precise parts in sectors such as aerospace and healthcare, manufacturers are adopting advanced rubber molding techniques. The introduction of industrial robotics has streamlined manufacturing processes, enabling market players to operate more efficiently. The rising demand for innovative technologies in developing countries, a shift towards green materials, and increased research and development activities are projected to provide several rubber molding market opportunities during the forecast period.

Rubber Molding Market Dynamics

Rising Demand from Automobile Industry

The growing demand for rubber-molded products in the automotive industry, particularly in developing nations, is driving the rubber molding market expansion. Rubber-molded components, such as bumpers, seals, and gaskets, play an essential role in reducing wear and tear on car body parts, while enhancing the durability and longevity of automotive components. Market growth is further fueled by technological advancements in the industry and the increasing shift toward lightweight and fuel-efficient vehicles. Additionally, rising disposable incomes and the demand for eco-friendly materials in the automobile sector are contributing to this expansion.

Technological Advancements in Injection Molding Techniques

Injection molding machines utilize advanced technology to process rubber materials and produce a wide range of products, including toys, water bottle caps, home goods, automobile and aerospace components, televisions, appliances, electronic devices, and medical items. These machines create specialized molds of the items and inject organic rubber into them. One key advantage of this process is that it eliminates the need for operators to insert pre-forms, while the rubber's low viscosity allows it to flow easily into the mold cavities. The use of solenoid valves in the machines helps regulate the hydraulic flow of fluids. Injection molding also enables the cost-effective production of similar parts and enhances manufacturing efficiency. Furthermore, liquid injection molding improves cycle speeds, biocompatibility, flexibility, stability, inertness, and heat resistance, while reducing contamination. Thus, technological advancements in injection molding techniques are boosting the rubber molding market revenue.

Rubber Molding Market Segment Insights

Assessment by Molding Type Insights

The rubber molding market segmentation, based on molding type, includes transfer molding, injection molding, compression molding, and others. The injection molding segment dominated the market in 2024 and is predicted to witness the fastest growth during the forecast period. This is largely due to injection molding’s cost-effectiveness in producing large volumes of medium to high-precision components. Key advantages of this technique include automatic material feeding, suitability for high-precision applications, a high level of repeatability, and the use of closed mold injection. Additionally, injection molding generates minimal waste when producing over-molded components, enhancing its popularity and driving segmental growth in the global market.

Evaluation by Material Insights

The rubber molding market, based on material, is segmented into styrene-butadiene rubber (SBR), ethylene propylene diene monomer (EPDM), natural rubber (NR), and others. The ethylene propylene diene monomer (EPDM) segment dominated the market in 2024, driven by increased demand from the automotive industry, growing adoption of electric vehicles (EVs), and stringent regulatory requirements. EPDM is known for its excellent ozone and UV resistance, exceptional weatherability, and performance across a wide temperature range. These properties make it ideal for outdoor applications exposed to harsh weather conditions, such as roofing membranes, automotive seals, and outdoor gaskets. Additionally, EPDM is compatible with various molding processes, including extrusion molding, compression molding, and injection molding, making it the material of choice for rubber molding.

Regional Analysis

By region, the report offers rubber molding market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Asia Pacific dominated the global market in 2024, driven by rapid industrialization, expanding automotive and construction industries, and increased infrastructure spending. Additionally, the region's focus on technological advancements, urbanization, and rising disposable incomes have fueled the demand for rubber-molded components in sectors such as automotive, electronics, and construction.

The North America rubber molding market is expected to witness the fastest growth during the forecast period. The thriving automotive sector in the region is driving significant demand for rubber-molded parts, particularly for vehicles. Companies are innovating and developing advanced rubber-molded products to meet the evolving needs of key industries, including electronics and construction. Focused efforts on automation, technological advancements, and sustainability are projected to further fuel the regional market growth.

Key Players and Competitive Insights

The key players in the market are focusing on research and development to enhance their products and services offerings and drive market demand. Besides, they are adopting various strategic initiatives, including collaborations, mergers and acquisitions, new product launches, and increased investments, to improve their global footprint. To expand and survive in a more competitive environment, market participants must offer innovative solutions.

In recent years, the market for rubber molding has witnessed several innovations, with key players seeking to provide advanced solutions that help meet sustainability goals. The rubber molding market research report offers a market assessment of all the key players, including Continental AG, Freudenberg and Co. Kg, Sumitomo Riko Co. Ltd., NOK Corporation, Bohra Rubber Pvt. Ltd., Federal-Mogul Corporation, Toyoda Gosei Co. Ltd., Hutchinson SA, Trelleborg AB, and Steele Rubber Products.

List of Key Players

- Bohra Rubber Pvt. Ltd.

- Continental AG

- Federal-Mogul Corporation

- Freudenberg and Co. Kg

- Hutchinson SA

- NOK Corporation

- Steele Rubber Products

- Sumitomo Riko Co. Ltd.

- Toyoda Gosei Co. Ltd.

- Trelleborg AB

Rubber Molding Industry Developments

In April 2024, Continental announced the acquisition of Slovakian mold production specialist EMT Púchov s.r.o., a key player in the production of specialty tires for commercial vehicles. According to Continental, the acquisition completes its portfolio for mold making technology.

In January 2024, Moldex3D partnered with SIMPATEC, M.R. Mold and Engineering, and Shin-Etsu Silicones of America to address the challenges of Liquid Silicone Rubber (LSR) molding. This collaborative research, based on Shin-Etsu's optical LSR grade, focuses on mold, injection, and cure faults.

Rubber Molding Market Segmentation

By Molding Type Outlook

- Transfer Molding

- Injection Molding

- Compression Molding

- Others

By Material Outlook

- Styrene-Butadiene Rubber (SBR)

- Ethylene Propylene Diene Monomer (EPDM)

- Natural Rubber (NR)

- Others

By End-User Outlook

- Healthcare

- Automotive

- Sporting Goods

- Industrial

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Rubber Molding Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 39.14 billion |

|

Market Size Value in 2025 |

USD 40.94 billion |

|

Revenue Forecast by 2034 |

USD 62.32 billion |

|

CAGR |

4.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The rubber molding market was valued at USD 39.14 billion in 2024 and is projected to grow to USD 62.32 billion by 2034.

• The market is expected to register a CAGR of 4.8% from 2025 to 2034.

• Asia Pacific held the largest market share in 2024.

• Freudenberg and Co. Kg, Continental AG, Sumitomo Riko Co. Ltd., NOK Corporation, Federal-Mogul Corporation, Hutchinson SA, Toyoda Gosei Co., Ltd., Trelleborg AB, Bohra Rubber Pvt. Ltd and Steele Rubber Products are a few of the key players in the market.

• The ethylene propylene diene monomer (EPDM) segment dominated the market in 2024.

• The injection molding segment led the market in 2024.