Gaskets and Seals Market Size, Share, Trends, Industry Analysis Report

: By Material, By Sales Channel (Aftermarket and OEMs), By Product, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM1823

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

The gaskets and seals market size was valued at USD 69.88 billion in 2024, growing at a CAGR of 4.8% during 2025–2034. Key drivers of the market include rising automotive and industrial demand, strict emission regulations, growth in the oil & gas sector, and advances in sealing technologies.

Key Insights

- The OEMs segment is witnessing strong growth due to rising adoption in manufacturing and aerospace industries, along with increased demand from electric and hybrid vehicle production supported by clean energy regulations.

- Rubber remains the dominant material segment with around 25% market share in 2024, owing to its superior elasticity, chemical resistance, and thermal durability, making it ideal for diverse industrial applications.

- North America leads the market, driven by advanced automotive technologies, robust R&D investments, and the strong presence of leading gasket and seal manufacturers supporting rising vehicle production.

- Asia Pacific is projected to record the highest CAGR, fueled by rapid industrialization, government-backed manufacturing initiatives, and growing demand across automotive, electronics, and energy sectors.

Industry Dynamics

- Rising EV production and strict emission regulations are boosting demand for advanced, heat-resistant, and efficient gaskets across industries.

- Increasing deep-sea exploration and energy infrastructure expansion require durable seals to withstand high pressure, temperature, and corrosive environments.

- Adoption of smart technologies and automation in vehicles and oilfields fuels demand for precision sealing solutions that ensure operational reliability.

- Volatile raw material prices and stringent environmental regulations increase production costs and compliance burdens, limiting profitability and flexibility.

Market Statistics

2024 Market Size: USD 69.88 billion

2034 Projected Market Size: USD 109.45 billion

CAGR (2025–2034): 4.8%

North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Gaskets and seals are used for leakage or ingress prevention, as well as protection against environmental contaminants and vibrations. Rubber is a prominent material used for the manufacturing of the product. Nitrile is used in applications involving oils, fuels, and solvents, whereas Viton is more appropriate for chemicals.

Engine gaskets and seals offer internal leakage prevention of oil, fluids, coolants, and air while enabling maximum compression. Automotive seals and gaskets are manufactured using a wide range of materials such as rubber, plastic polymer, and stainless steel. The product also uses other materials such as multi-layered steel, copper, and composites for enhanced strength and flexibility.

The imposition of stringent industrial emission regulations has increased the demand for gaskets and seals from the industrial and manufacturing sectors. The increasing industrialization, rising demand for automobiles from emerging economies, and technological advancements have also accelerated the market growth.

Market Dynamics

Expansion of Automotive Industry

The rise in automotive production and sales, especially electric and hybrid cars, is driving the gaskets and seals market. According to the International Organization of Motor Vehicle Manufacturers, vehicle sales in 2024 were 82,061,217. These components are critical for preventing fluid and gas leaks in engines, transmissions, and other vehicle systems. Manufacturers are relying on advanced sealing technologies to improve reliability and reduce maintenance as consumers demand more fuel-efficient and high-performance vehicles. Additionally, the shift toward electric vehicles (EVs) introduces new needs for thermal management and battery protection, further increasing the importance of durable, heat-resistant gaskets and seals. This trend is especially strong in growing economies and countries pushing for cleaner transportation.

Growth of Oil & Gas Industry

The oil & gas industry relies heavily on gaskets and seals to maintain the integrity of pipelines, valves, and drilling equipment. According to the American Petroleum Institute, 11 million people are employed in the industry in the US alone. Gaskets and seals help contain high-pressure fluids and gases while preventing leaks in extreme environments. The demand for robust sealing solutions is rising with increasing exploration activities, including deep-sea drilling and shale gas extraction. The need for dependable and high-performance sealing components is growing as energy companies expand operations globally. Hence, the growth of the oil & gas industry is propelling the gaskets and seals market expansion.

Segment Analysis

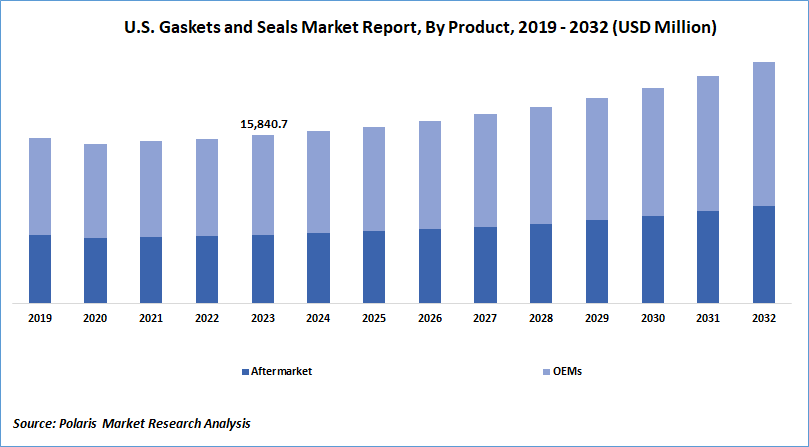

Market Assessment by Sales Channel

The gaskets and seals market segmentation, based on sales channel, includes OEMs and aftermarket. The OEMs segment in the market is anticipated to register a CAGR of 4.3% during the forecast period. A massive increase in the use of gaskets and seals from the manufacturing and aerospace industries has been registered, fueling the growth of the OEM segment. The rising penetration of electric and hybrid vehicles and the introduction of government regulations regarding the use of clean and renewable energy resources further accelerate the growth of the segment.

Market Evaluation by Material

The gaskets and seals market segmentation, based on material, includes metals, plastic, rubber, fiber, silicones, graphite, and other materials. The rubber segment held the largest share of around 25% in 2024 due to its capabilities, including tear rigidity, elasticity, and toughness. Furthermore, temperature resistance, electrical characteristics, and oil and chemical resistance are other qualities of rubber that are expected to fuel its demand during the forecast period.

Regional Analysis

By region, the study provides the gaskets and seals market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the market driven by the growing R&D investment coupled with the emerging automotive technologies and strong presence of gaskets and seals manufacturers including VICONE High Performance Rubber Inc.; ACS Industries, Inc.; Elastostar Rubber Corporation; Accro-Seal; Qualiform Rubber Molding; and ACE Rubber Products. Additionally, the demand for gaskets and seals is largely supported by the growing sales of automobiles and the rising production of both private and commercial vehicles. Over 13.4 million motor vehicles were produced in North America in fiscal 2020. Gaskets and seals are used in vehicles to combine various systems and withstand extreme temperatures and high pressure.

Asia Pacific is expected to record the highest CAGR during the forecast period, driven by rapid industrialization, rising infrastructure projects, and strong automotive and manufacturing sectors. Countries such as China, Japan, and South Korea lead the region with advanced technologies and large-scale production capabilities. Additionally, growing demand from the electronics, oil & gas, and aerospace industries supports market expansion. Government initiatives encouraging foreign investment and smart manufacturing are further boosting regional production. Industries are increasingly adopting high-performance sealing solutions with a focus on energy efficiency and environmental safety.

The demand for gaskets and seals is rapidly growing in India, due to its expanding automotive industry, industrial growth, and infrastructure development. The government’s “Make in India” initiative and focus on manufacturing self-reliance have encouraged both local and foreign companies to invest in production facilities. India’s growing power, chemical, and oil & gas sectors further drive the demand for reliable sealing solutions. The rising need for leak prevention, safety compliance, and operational efficiency across industries is increasing the adoption of advanced gaskets and seals in India.

Key Players and Competitive Analysis

The market opportunity is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the market by introducing innovative products to meet the demand of specific market sectors. The competitive trend is amplified by continuous progress in product offerings. A few major players in the market includes AB SKF, Boyd Corporation, Bruss Sealing System GmbH, Dana Holding Corporation, Datwyler, Flowserve Corporation, Freudenberg Sealing Technologies GmbH & Co. KG, Garlock Sealing Technologies LLC, Hutchinson SA, James Walker, Magnum Automotive Group LLC, Parker Hannifin Corporation, Smiths Group Plc, and Trelleborg Sealing Solutions AB.

AB SKF, established in 1907 and based in Gothenburg, Sweden, is a manufacturer of bearings, seals, lubrication systems, and related products. The company operates in approximately 130 countries. SKF’s manufacturing network includes around 100 production facilities worldwide, supported by more than 17,000 distributor locations. The company’s operations are divided mainly into two segments: Industrial and Automotive. The Industrial segment supplies products and services to a wide range of sectors, such as aerospace, agriculture, food and beverage, machine tools, marine, metals, mining, oil and gas, pulp and paper, railways, and wind energy. Products in this segment include rolling bearings, mounted bearings and housings, super-precision bearings, slewing bearings, plain bearings, magnetic bearings, industrial seals, lubrication systems, and condition monitoring equipment. The segment also provides services, including application engineering, asset management, condition-based maintenance, mechanical maintenance, remanufacturing, and training. The Automotive segment focuses on bearings, seals, and related components used in electric and conventional vehicles. It serves original equipment manufacturers (OEMs) and aftermarket customers with products for e-powertrain, wheel-end, driveline, engine, suspension, and steering applications. SKF’s operations cover Europe, the Middle East, Africa, the Americas, and Asia. The company supplies products through both direct sales and distributor networks, addressing markets in developed and developing regions.

Dana Holding Corporation, now operating as Dana Incorporated, is a company specializing in the design, engineering, manufacturing, and distribution of power conveyance and energy-management components for vehicles and industrial equipment. Established in 1904 and based in Maumee, Ohio, Dana supplies parts to a wide range of vehicle and engine manufacturers globally. The company maintains more than 100 facilities in around 30 countries. Dana’s product range includes axles, driveshafts, transmissions, electrodynamic components such as motors and inverters, thermal-management systems for batteries and electronics, and sealing products such as gaskets and cam cover modules. The company’s operations are divided into four main segments: Light Vehicle Drive Systems, which produces axles, driveshafts, and electric propulsion systems for passenger vehicles; Commercial Vehicle Drive and Motion Systems, providing driveline and motion components for trucks and buses; Off-Highway Drive and Motion Systems, serving agricultural, construction, mining, forestry, and material handling equipment; and Power Technologies, which manufactures sealing and thermal products for engines, transmissions, and fuel cells. Dana operates internationally, with manufacturing, engineering, and distribution facilities in North America, Europe, Asia Pacific, and South America.

List of Key Companies in Gaskets and Seals Market

- AB SKF

- Boyd Corporation

- Bruss Sealing System GmbH

- Dana Holding Corporation

- Datwyler

- Flowserve Corporation

- Freudenberg Sealing Technologies GmbH & Co. KG

- Garlock Sealing Technologies LLC

- Hutchinson SA

- James Walker

- Magnum Automotive Group LLC

- Parker Hannifin Corporation

- Smiths Group Plc

- Trelleborg Sealing Solutions AB

Gaskets and Seals Industry Developments

January 2025: Flowserve Corporation received a contract for supplying Dry Gas Seals and Dry Gas Seal Systems. The company revealed that the contract will support a major initiative of the Abu Dhabi National Oil Company.

In July 2024, FITOK Ruby Orifice Restriction Gaskets were launched to provide precise fluid flow control in harsh environments, featuring laser-drilled ruby orifices, superior corrosion resistance, and high thermal stability for semiconductor applications.

In April 2023, The Type SB2/SB2A USP seal was launched by John Crane to enhance sealing performance in abrasive slurry applications, offering extended repair intervals, reduced water and power usage, and improved sustainability.

Gaskets and Seals Market Segmentation

By Material Outlook (Revenue USD Billion, 2020–2034)

- Metals

- Plastic

- Rubber

- Fiber

- Graphite

- Other Materials

By Sales Channel Outlook (Revenue USD Billion, 2020–2034)

- Aftermarket

- OEMs

By Product Outlook (Revenue USD Billion, 2020–2034)

- Gasket

- Non-Metallic

- Semi-Metallic

- Metallic

- Seal

- Molded

- Vehicle Body

- Shaft

- Others

By End Use Outlook (Revenue USD Billion, 2020–2034)

- Aerospace

- Electronics

- Automotive

- Oil & Gas

- Industrial Manufacturing

- Food & Beverage

- Rail

- Marine

- Energy & Utilities

- Construction

- Pharmaceuticals

- Others

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Gaskets and Seals Market Report Scope

|

Report Attributes |

Details |

|

Market Size value in 2024 |

USD 69.89 billion |

|

Market Size value in 2025 |

USD 71.69 billion |

|

Revenue Forecast in 2034 |

USD 109.45 billion |

|

CAGR |

4.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 69.89 billion in 2024 and is projected to grow to USD 109.45 billion by 2034.

The global market is projected to register a CAGR of 4.8% during the forecast period.

North America held the largest share of the global market in 2024.

A few key players are AB SKF, Boyd Corporation, Bruss Sealing System GmbH, Dana Holding Corporation, Datwyler, Flowserve Corporation, Freudenberg Sealing Technologies GmbH & Co. KG, Garlock Sealing Technologies LLC, Hutchinson SA, James Walker, Magnum Automotive Group LLC, Parker Hannifin Corporation, Smiths Group Plc, and Trelleborg Sealing Solutions AB.

The rubber segment dominated the market in 2024, due to its capabilities, including tear rigidity, elasticity, and toughness.

The OEM segment is expected to witness significant growth during the forecast period, owing to the massive increase in the use of gaskets and seals from the manufacturing and aerospace industries.