Styrene Butadiene Rubber (SBR) Market Size, Share, Trends, Industry Analysis Report

: By Product [Oil Extended, Butyl Lithium, Type 4, Non-Oil Extended, Emulsion SBR (E-SBR), Solution SBR (S-SBR)], By Application, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 116

- Format: PDF

- Report ID: PM1496

- Base Year: 2024

- Historical Data: 2020-2023

Styrene Butadiene Rubber (SBR) Market

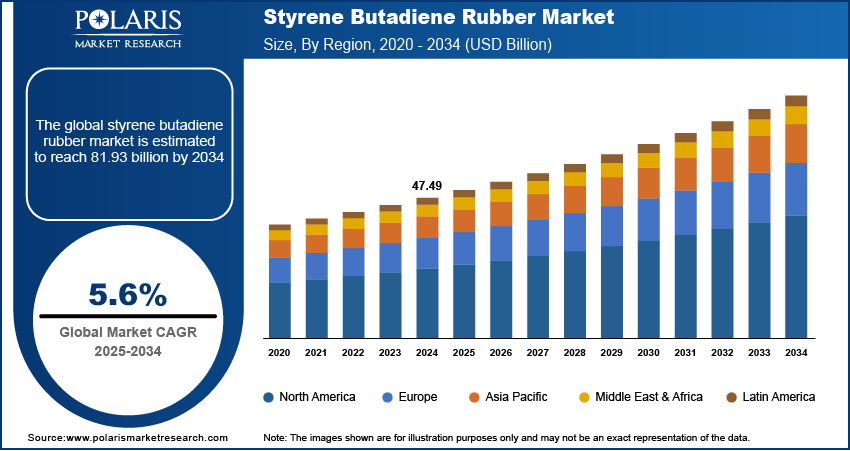

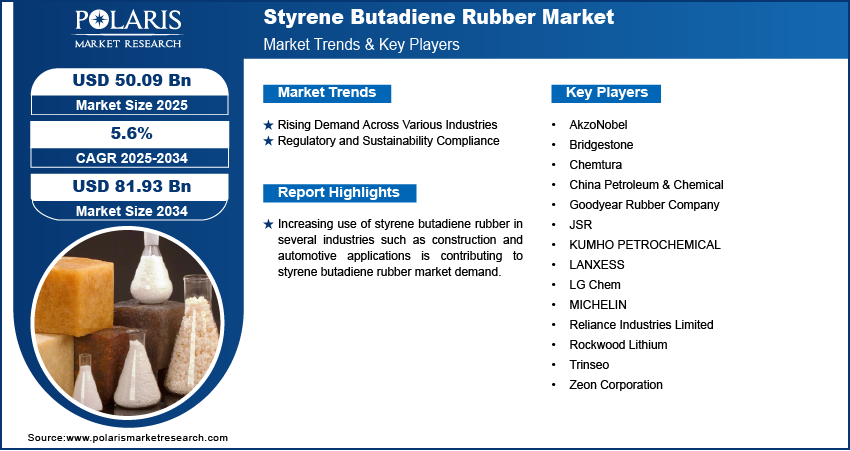

The global styrene butadiene rubber (SBR) market size was valued at USD 47.49 billion in 2024, exhibiting a CAGR of 5.6% from 2025 to 2034. The market is supported by strong automotive demand, growing use in applications such as construction and footwear, sustainability legislation, and the limited supply of natural rubber, which is driving a shift toward synthetic alternatives.

Key Insights

- In 2024, the E-SBR segment dominated the market, accounting for a 69.6% revenue share, due to its superior properties and lower production costs.

- In 2024, the automotive sector led the market, fueled by growth in car ownership and automobile production.

- North America led the global market in 2024, with a 44.3% revenue share, supported by its robust automotive market, infrastructure development, and increasing demand for vehicles and high-performance tires.

- Asia Pacific is projected to expand at the highest CAGR, supported by infrastructure growth, increasing consumer demand, and escalating regional investment in manufacturing.

Industry Dynamics

- The high demand for styrene-butadiene rubber in the automotive sector is a key driver of market growth.

- The shortage of natural rubber supply is increasing demand for affordable synthetic versions, such as SBR, which have similar properties and widen market opportunities.

- Environmental pressures and increased regulations are driving growth in the SBR market as sectors shift towards more environmentally friendly and sustainable materials.

- The market is constrained by volatile raw material costs and environmental issues surrounding production.

Market Statistics

2024 Market Size: USD 47.49 billion

2034 Projected Market Size: USD 81.93 billion

CAGR (2025-2034): 5.6%

North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

Styrene butadiene rubber (SBR) is made by copolymerizing styrene and butadiene to form long molecules, which are then cross-linked during vulcanization. The styrene-to-butadiene ratio can be adjusted to change the properties of the rubber. SBR is known for its abrasion resistance, aging stability, and durability. It also has good tear, crack, and electrical resistance.

The high consumption of styrene butadiene rubber in the automotive industry is driving the styrene butadiene rubber market growth. SBR is used in several automotive applications, including tires, belts, automotive hoses, seals, and vibration isolators. In addition, changing consumer lifestyles, along with increased spending on modern commodity products, drive the use of SBR in other applications such as footwear, extruded rubber products, industrial hoses, and other consumer goods. Moreover, regulations and standards promoting safety, performance, and sustainability are further driving the demand for SBR.

The global demand for vehicles, especially in emerging markets, fuels the need for high-performance tires, where SBR is a crucial component. The construction industry, particularly in residential and commercial buildings, utilizes SBR for sealants and waterproofing membranes. The limited supply of natural rubber further drives the demand for synthetic alternatives like SBR. SBR offers a cost-effective alternative to natural rubber while maintaining similar properties, creating several opportunities in the styrene butadiene rubber market.

Styrene Butadiene Rubber Market Dynamics

Rising Demand Across Various Industries

The styrene butadiene rubber market growth is driven by its widespread application across multiple industries. Beyond its primary use in tire manufacturing, SBR is extensively utilized in the production of hoses, footwear, adhesives, and conveyor belts. The rapidly expanding construction industry also relies on SBR for various components, including waterproofing membranes and sealants. In addition, SBR is used in the production of medical supplies such as gloves and tubing, as well as in the modification of asphalt pavers for improved road durability. This broad range of applications underscores the material’s versatility and continues to drive the global demand for SBR.

Regulatory and Sustainability Compliance

Environmental concerns and regulatory restrictions are other major factors driving the styrene butadiene rubber market development. Governments worldwide are implementing stricter emission standards and sustainability initiatives, prompting industries to adopt eco-friendly materials. In the automotive industry, SBR is widely used in low rolling resistance automotive tires, which enhance fuel efficiency and reduce carbon emissions, aligning with global sustainability goals. Additionally, manufacturers are exploring bio-based alternatives and advanced recycling methods to comply with regulatory requirements and reduce reliance on petroleum-based raw materials.

Styrene Butadiene Rubber Market Segment Insights

Styrene Butadiene Rubber Market Evaluation by Product Insights

Based on product, the styrene butadiene rubber market is segmented into oil extended, butyl lithium, type 4, non-oil extended, emulsion SBR (E-SBR), solution SBR (S-SBR), phenyl lithium, and others. The emulsion SBR (E-SBR) segment dominated the market with a 69.6% revenue share in 2024 due to its superior properties and lower production costs. E-SBR offers good abrasion resistance and aging stability, making it suitable for various applications, especially in the automotive industry, particularly in tire manufacturing. Large-scale emulsion SBR production benefits from economies of scale, leading to further cost reductions. Additionally, the manufacturing process for E-SBR is simpler and less expensive than that of S-SBR, making it a preferred choice for manufacturers seeking cost-effectiveness.

Styrene Butadiene Rubber Market Assessment by Application Insights

The styrene butadiene rubber market, based on application, is segmented into automotive, polymer modification, catalyst for chemical reactions, footwear, and adhesives. The automotive segment dominated the market in 2024, driven by rising car ownership and increased automobile production. The demand for high-performance tires has grown as more vehicles are produced and sold. SBR is widely used in tire production due to its durability, abrasion resistance, and ability to enhance grip and fuel efficiency. In addition, the shift towards fuel-efficient and long-lasting tires has made SBR a preferred material among manufacturers. Thus, the ongoing advancements in tire technology and rising demand for vehicles contribute to the segment’s leading market position.

-market-segment.webp)

Styrene Butadiene Rubber Market Regional Analysis

By region, the report provides the styrene butadiene rubber market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America dominated the global market with a 44.3% revenue share in 2024. The region's dominance can be attributed to its well-developed automotive industry, ongoing infrastructure expansion, and rising consumer demand for vehicles and high-performance tires. The growing adoption of electric vehicles, which require specialized tires and components, has further increased the need for high-quality SBR. In addition, large-scale infrastructure projects in the region drive demand for SBR in applications such as waterproofing, adhesives, and sealants. These factors collectively contribute to the region's leading position in the global market.

The Asia Pacific styrene butadiene rubber market is expected to register the highest CAGR during the forecast period. The region is experiencing significant growth in infrastructure projects, particularly in Southeast Asian countries, where SBR is widely used in various construction applications. The presence of a favorable regulatory environment and increased investment in SBR production capacities also drive the regional market growth. Additionally, the growing middle class and rising consumer spending in these countries are fueling demand for consumer goods such as footwear, which frequently uses SBR due to its comfortable and durable properties.

-market-region.webp)

Styrene Butadiene Rubber Market – Key Players and Competitive Insights

The styrene butadiene rubber market includes both global leaders and regional players. Leading market players are pursuing a variety of strategic activities to expand their footprint, including new product launches, acquisitions and mergers, contractual agreements, increased investments, and collaboration with other companies. Market participants are also investing heavily in R&D to broaden their product offerings, which will help the market grow even further.

Manufacturers of styrene butadiene rubber have adopted local manufacturing as a key business strategy to reduce operating costs, benefit customers, and expand the market sector. A few of the key market players are Rockwood Lithium, Chemtura, AkzoNobel, Bridgestone, MICHELIN, LANXESS, JSR, China Petroleum & Chemical, Reliance Industries Limited, LG Chem, Zeon Corporation, Trinseo, Goodyear Rubber Company, and KUMHO PETROCHEMICAL.

List of SBR Market Key Players

- AkzoNobel

- Bridgestone

- Chemtura

- China Petroleum & Chemical

- Goodyear Rubber Company

- JSR

- KUMHO PETROCHEMICAL

- LANXESS

- LG Chem

- MICHELIN

- Reliance Industries Limited

- Rockwood Lithium

- Trinseo

- Zeon Corporation

Styrene Butadiene Rubber Industry Developments

In December 2023, Synthos, a leading global synthetic rubber producer, signed a memorandum of understanding (MOU) with Kumho Tire, a well-known tire manufacturer in South Korea. According to Synthos, the partnership will focus on the development of sustainable tire raw materials.

In August 2023, Goodyear, a global leader in tire technology, partnered with German automaker Opel to develop an innovative custom tire for the Opel experimental concept vehicle. According to Goodyear, the collaboration highlights the dedication of both companies to improving the vehicle's aerodynamic performance, which will lead to high energy efficiency.

Styrene Butadiene Rubber Market Segmentation

By Product Outlook

- Oil Extended

- Butyl Lithium

- Type 4

- Non-Oil Extended

- Emulsion SBR (E-SBR)

- Solution SBR (S-SBR)

- Phenyl Lithium

- Others

By Application Outlook

- Automotive

- Polymer Modification

- Catalyst for Chemical Reactions

- Footwear

- Adhesives

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Styrene Butadiene Rubber Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 47.49 billion |

|

Market Size Value in 2025 |

USD 50.09 billion |

|

Revenue Forecast by 2034 |

USD 81.93 billion |

|

CAGR |

5.6% from 2025 to 2034 |

|

Base Year |

2020 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 47.49 billion in 2024 and is projected to grow to USD 81.93 billion by 2034

The market is projected to register a CAGR of 5.6% from 2025 to 2034.

North America accounted for the largest share of the global market in 2024.

Rockwood Lithium, Chemtura, AkzoNobel, Bridgestone, MICHELIN, LANXESS, JSR, China Petroleum & Chemical, Reliance Industries Limited, LG Chem, Zeon Corporation, Trinseo, Goodyear Rubber Company, and KUMHO PETROCHEMICAL are a few of the key market players.

The emulsion SBR (E-SBR) segment dominated the market in 2024.

The automotive segment held the largest share of the market in 2024.