Industrial Robotics Market Size, Share, Trends, & Industry Analysis Report

By Type (Traditional, Collaborative), By Payload, By Component, By Application, By End-Use Industry, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 119

- Format: PDF

- Report ID: PM2743

- Base Year: 2024

- Historical Data: 2020-2023

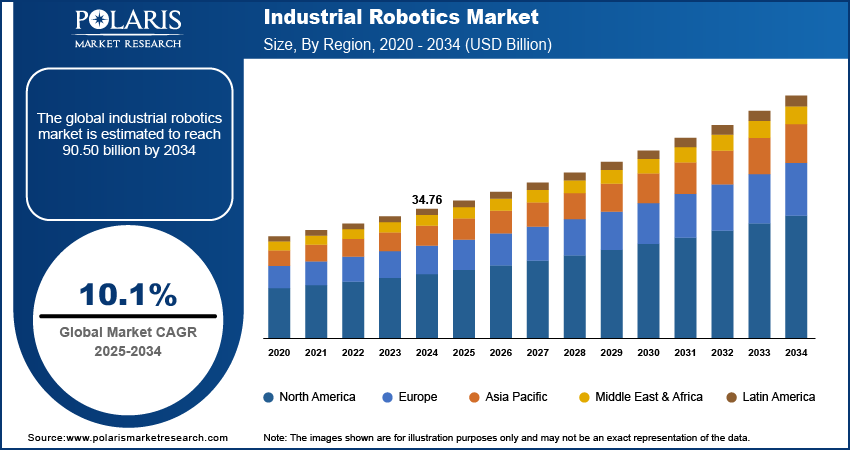

The industrial robotics market was valued at USD 34.76 billion in 2024 and is expected to grow at a CAGR of 10.1% during the forecast period. The factors attributed to the growing demand for industrial robotics are the shortage of skilled labor in manufacturing and the ever-increasing demand for cobots across several sectors.

Key Insights

- The collaborative industrial robots accounted for the largest share in 2024 due to its multiple advantages and related applications.

- The 16.0- 60.00 kg segment is expected to witness significant growth due to rising demand for automation in arc welding, spot welding, and painting.

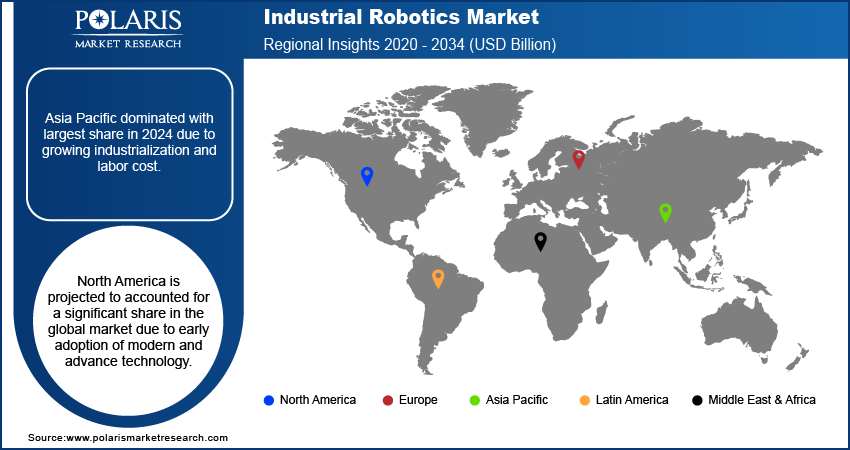

- Asia Pacific dominated with largest share in 2024 due to growing industrialization and labor cost.

- North America is projected to accounted for a significant share in the global market due to early adoption of modern and advance technology.

Industry Dynamics

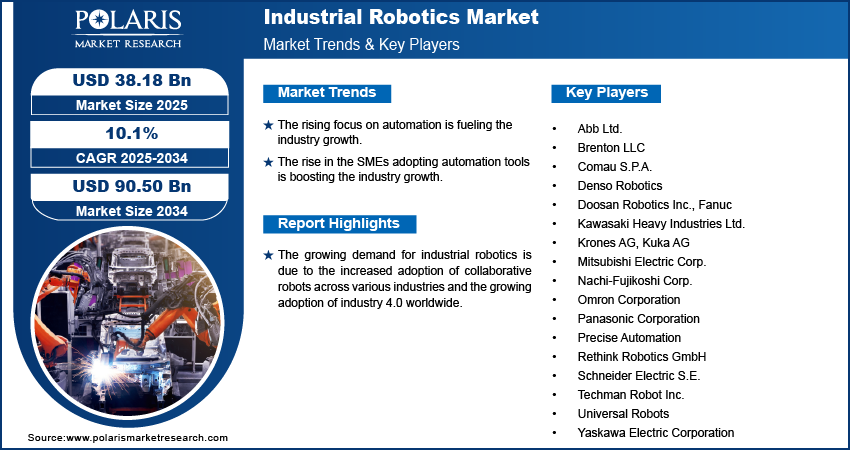

- The rising focus on automation is fueling the industry growth.

- The rise in the SMEs adopting automation tools is boosting the industry growth.

- Technological advancement is driving the growth.

- High initial investment and integration costs is limiting the adoption.

Market Statistics

- 2024 Market Size: USD 34.76 Billion

- 2034 Projected Market Size: USD 90.50 Billion

- CAGR (2025-2034): 10.1%

- Largest Market: Asia Pacific

To Understand More About this Research: Request a Free Sample Report

Impact of AI on Industry

- AI helps industrial robots to analyze data, learn from experience, and make real-time decisions which improve the manufacturing efficiency.

- AI-integrated vision systems enable robots to perform precise object recognition, quality inspection, and defect detection.

- AI helps to reduce downtime and maintenance cost by predicting failures before its happens.

The beneficial advantages of industrial robots, such as system flexibility, cost-effectiveness, advanced data analytics, reduced waste, and workplace safety, are anticipated to accelerate the market's growth. Additionally, the market is driven due to the increased utilization of industrial robots across several verticals, such as automotive, pharmaceutics, cosmetics, food & beverages, and others. Industrial robots facilitate high payload lifting during the manufacture of vehicles and machinery customization. The market potential will increase as smart factories become more prevalent. Factors including growing consumer goods demand elevated public awareness of industrial mishaps, and employee safety are all fostering the development of the market.

Moreover, in order to include AI and create advanced sensors, manufacturers are focusing on R&D efforts, which will accelerate the market's growth over the forecast timeline. Venture capitalists are willing to invest in startups that create, test, and manufacture robots due to market shifts.

On the other hand, companies are progressively returning to their normal levels of production and services. Industrial robot companies are anticipated to restart operating at full capacity, which is anticipated to aid in the market's recovery over the forecast period.

Industry Dynamics

Growth Drivers

The demand for industrial robots has increased due to the ongoing shift from manual to automated processes, the primary driver fueling the market's expansion. For industrial workflows to run smoothly, management, production, and control must be coordinated. Industrial robots are becoming more significant due to their ability to improve workflow accuracy and efficiency while facilitating operational procedures. Furthermore, there is an increasing need for industrial robots due to the rise of small enterprises, more automation investments, and stringent regulatory rules on handling hazardous materials and products. These robots also assist with lifting hefty weights while creating machines and automobiles. The introduction of smart factories increases the market's potential. Major firms are concentrating on mergers and acquisitions to increase their market position, thereby fueling the expansion.

Report Segmentation

The market is primarily segmented based on type, payload, component, application, end-use industry, and region.

|

By Type |

By Payload |

By Component |

By Application |

By End-Use Industry |

By Region |

|

|

|

|

|

|

Know more about this report: Request for sample pages

Collaborative industrial type accounted the largest market share in 2024

The collaborative type acquired the largest market share as these robots are designed to collaborate with people in a shared workspace. Collaborative robots are utilized in a wide range of applications, including packaging, pick-and-place, screw driving, assembly, lab testing, and quality inspection, as they can automate the work quickly. They can also usually be taught instead of programmed by an operator. Additionally, since collaborative robots can do repetitive tasks more quickly, they help enterprises increase manufacturing productivity while improving workplace safety. Due to its multiple advantages and related applications, the demand for collaborative robots is constantly increasing across various industrial verticals, including retail, healthcare, and automotive manufacturing. All these factors are responsible for the segment’s growth.

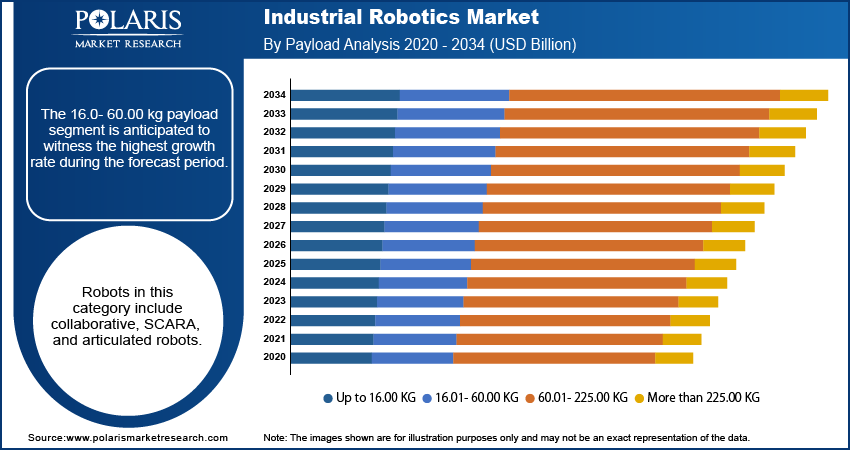

16.01-60.00 kg payload is expected to witness highest growth rate

The 16.0- 60.00 kg payload segment is anticipated to witness the highest growth rate during the forecast period. Robots in this category include collaborative, SCARA, and articulated robots. The 16.01–60.00 kg payload capacity robots are mainly adopted in the automotive industry for arc welding, spot welding, painting, and many others. The rapidly expanding demand for automation in the electrical and electronics industry, where SCARA robots are widely employed for assembly and handling applications, is responsible for the segment's rapid expansion in the up to 16.01-60.00 kg weight range. SCARA robots have a higher operating speed and optional cleanroom requirements.

Asia-Pacific dominated the regional market

Asia-Pacific dominated the regional market due to rising labor costs, which forced manufacturers to automate their manufacturing processes to maintain a cost advantage. Additionally, due to moderate emissions and safety regulations, and government initiatives for foreign direct investment (FDI), automation in the APAC region will accelerate the growth of the global industrial robotics market. Major players in Asia pacific are at the leading edge in installing industrial robots, which also impels regional growth. The growing automotive and manufacturing industries in China & India are accelerating the product demand in this region.

North America is projected to witness significant growth during the projection period. The region is one of the early adopters of advanced technologies and is home to several major players. North America also has significant investments in the manufacturing sector. Rising geopolitical tensions have prompted American manufacturers to bring production back to the region. At the same time, high labor costs make companies more reliant on robots rather than traditional factory workers. All these factors are driving the demand for industrial robotics in the region.

Competitive Insight

Some of the major players operating in the global market include Abb Ltd., Brenton LLC, Comau S.P.A., Denso Robotics, Doosan Robotics Inc., Fanuc, Kawasaki Heavy Industries Ltd., Krones AG, Kuka AG, Mitsubishi Electric Corp., Nachi-Fujikoshi Corp., Omron Corporation, Panasonic Corporation, Precise Automation, Rethink Robotics GmbH, Schneider Electric S.E., Techman Robot Inc., Universal Robots, and Yaskawa Electric Corporation.

Recent developments

- May 2024: Neura Robotics and OMRON formed a strategic partnership to integrate AI-enhanced cognitive robots into manufacturing processes, thereby increasing productivity and safety.

- May 2024: ABB unveiled two new models, the IRB 7720 and IRB 7710, in its modular big robot line. ABB stated that the new models provide up to 30% reduction in energy consumption.

- In March 2022, FANUC introduced the new CRX-5iA, CRX-20iA/L, and CRX-25iA collaborative robots. The newest CRX cobots are an addition to FANUC's line of CR and CRX cobots, which currently includes 11 cobot model variations to handle products from 4 kg to 35 kg.

- In February 2021, Kawasaki Heavy Industries, Ltd., completed a domestic automated polymerase chain reaction (PCR) test system installation in Japan that operates Kawasaki robots at Fujita Medical University in Aichi Prefecture.

Industrial Robotics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 34.76 billion |

| Market size value in 2025 | USD 38.18 billion |

|

Revenue forecast in 2034 |

USD 90.50 billion |

|

CAGR |

10.1% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Type, By Payload, By Component, By Application, By End-Use Industry, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Abb Ltd., Brenton LLC, Comau S.P.A., Denso Robotics, Doosan Robotics Inc., Fanuc, Kawasaki Heavy Industries Ltd., Krones AG, Kuka AG, Mitsubishi Electric Corp., Nachi-Fujikoshi Corp., Omron Corporation, Panasonic Corporation, Precise Automation, Rethink Robotics GmbH, Schneider Electric S.E., Techman Robot Inc., Universal Robots, and Yaskawa Electric Corporation. |

FAQ's

• The market size was valued at USD 34.76 Billion in 2024 and is projected to grow to USD 90.50 Billion by 2034.

• The market is projected to register a CAGR of 10.1% during the forecast period.

• A few of the key players in the market are Abb Ltd., Brenton LLC, Comau S.P.A., Denso Robotics, Doosan Robotics Inc., Fanuc, Kawasaki Heavy Industries Ltd., Krones AG, Kuka AG, Mitsubishi Electric Corp., Nachi-Fujikoshi Corp., Omron Corporation, Panasonic Corporation, Precise Automation, Rethink Robotics GmbH, Schneider Electric S.E., Techman Robot Inc., Universal Robots, and Yaskawa Electric Corporation.

• The collaborative industrial robots accounted for the largest market share in 2024.

• The 16.01-60.00 kg payload segment is expected to record significant growth.