Industrial Crystallizers Market Share, Size, Trends, Industry Analysis Report

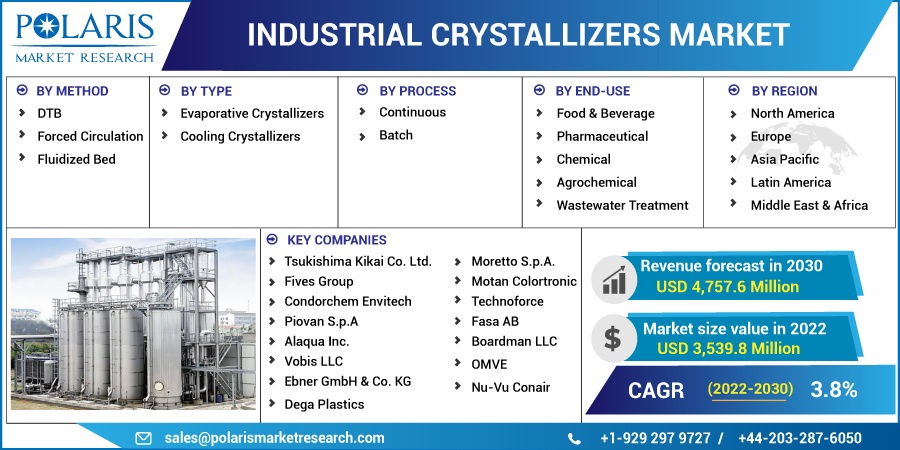

By Method (DTB, Forced Circulation and Fluidized Bed); By Type; By Process; By End-Use Industry; By Region; Segment Forecast, 2022-2030

- Published Date:Nov-2022

- Pages: 118

- Format: PDF

- Report ID: PM2872

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

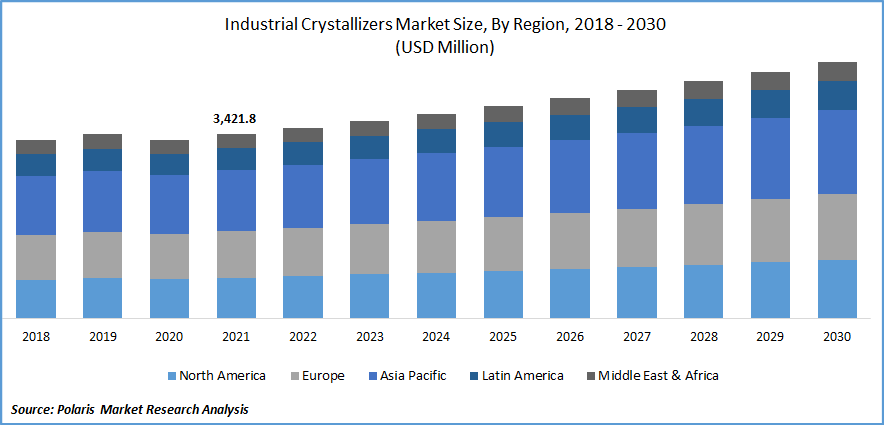

The global industrial crystallizers market was valued at USD 3,421.8 million in 2021 and is expected to grow at a CAGR of 3.8% during the forecast period.

The increasing applications of industrial crystallizers among key industries for refining minerals and process valuable crystals is expected to support industry growth. Moreover, key market players providing value-added services such as installation, retrofitting assemblies, starting the systems, and training staff personnel are some reasons expected to increase the uptake of these devices.

Know more about this report: Request for sample pages

Moreover, major market players focusing on the development of cost-effective systems and producing superior product quality is anticipated to supply the demand for high-grade industrial crystals and augment the growth of the market. For instance, in March 2022, Metso Outotec announced the launch of the Activated Carbon filter to recover and recycle valuable battery chemicals, enhancing crystallization. The company runs a Planet Positive portfolio program through which it ensures energy and water-efficient technologies for catering to the growing demand for advanced and sustainable metal processing technologies for batteries and other products.

Furthermore, novel crystallization processes under development, through collaborations among major market players and research organizations to catapult technological advancements in the field of drug discovery, is anticipated to increase the product demand. For instance, in August 2022, Eli Lilly and Company announced a partnership with Redwire Space Corporation to test and develop Pharmaceutical In space Laboratory Bio crystal Optimization Xperiment (PIL-BOX). The program aims to study crystal growth in space and help design better-optimized treatments for diseases such as diabetes and cardiovascular disorders. The increasing demand for drug discovery and investments by major market players to innovate new methods to crystallize molecules efficiently are anticipated to drive the market's growth.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of industrial crystallizers, with major manufacturers shutting down operations and logistical restrictions on the supply chain. Moreover, factors such as decreased availability of labor and health restrictions for limiting the risk of spreading the virus among personnel hampered the industry.

The decline in the market was also due to stalling of demand in the crystallization end-use industries, although drug development and pharmaceuticals were exceptions supporting the recovery of its demand. Additionally, shut down of the industrial sector directly affected the industrial crystallizer market during the affected period.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The growth in the pharmaceutical sector in conjunction with drug development is anticipated to drive the demand for ultra-pure crystals. This, along with increasing demand for crystallization in the chemical industry, is expected to foster the market's growth. For instance, according to an article published by the National Aeronautics and Space Administration in July 2022, protein crystallization accounted for more the 500 experiments conducted in space and has been one of the critical experiments on the International Space Station (ISS). The growing significance of larger space-grown protein crystals, which are larger and have fewer defects, are promoting key stakeholders to invest in research activities and further develop crystallizers based on the technology on the scale. This is a crucial market trend shaping the market and is expected to support the market's growth.

Moreover, increasing demand for chemical crystals as raw materials to conduct chemical reactions, along with the high number of crystallization applications in various fields of science, such as nanoparticle technology and flow chemistry, are further projected bolster product demand. The adoption of crystallization in food technology and the rising demand of food grade crystals to produce processed food is projected to increase the demand for industrial crystallizers.

Report Segmentation

The market is primarily segmented based on method, type, process, end-use industry and region.

|

By Method |

By Type |

By Process |

By End-Use Industry |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Forced circulation segment is expected to witness the fastest growth

The increasing demand for forced circulation crystallizers and higher adoption of forced circulation technologies such as draft tubes and submerged circulating crystallizers among industry stakeholders is projected to foster market growth. Moreover, the technology is better suited to the production requirements of continuous crystallization owing to which the demand for the product is increased. For instance, in August 2022, France Evaporation announced the commercial delivery of a Skid Evaporator to the Government of Tunisia as part of a contract across the Atlantic. The development establishes the company's market presence globally, supplying the increasing demand for crystallizer devices in the region.

The batch process accounted for the largest market share in 2021

The increasing demand for high-value chemicals in the chemical industry, and the rising need for flexible systems to manage complex chemical systems for producing these crystals, are expected to support the adoption of batch crystallizers. Moreover, innovative technologies integrated with batch crystallizing systems to improve control over product quality are also expected to grow the market segment. For instance, a research article published by Industrial & Engineering Chemistry Research in 2022 reported the development of machine learning models and predictive control-based machine learning for batch crystallization. The integration of artificial intelligence in batch crystallizer technology to cater to the rising demand for handling toxic chemicals to develop pure crystals is anticipated to support the segment's growth.

The pharmaceutical sector is expected to hold a significant revenue share.

Crystallization is an essential step in the development of drugs, and crystalline properties of drugs influence downstream industrial processing of drugs due to ease of production and storage. The rising need for crystalline active pharmaceutical ingredients, along with the growing volume of pharmaceutical drug production, is anticipated to drive the uptake of industrial crystallizers through the segment. For instance, according to a research article published by IntechOpen, in May 2022, an estimated 70% to 80% of all small-molecule, active pharmaceutical ingredients require a minimum of one crystallization step in their manufacturing processes. This is to facilitate processes, such as filtration, drying, dissolution testing, and formulation, along with consistent production of crystals in order to specific properties such as crystal size, shape, and polymorphism.

The demand in Asia Pacific is expected to witness significant growth.

Asia Pacific is one of the most significant markets for industrial crystallizers owing to the growing industrial infrastructure among pharmaceutical, chemical, and food & beverage industries. Moreover, the high demand for high-purity minerals and increasing applications of crystallizers in the refining of these minerals is anticipated to drive the growth of the region. Further, the increasing demand of crystallized and refined sugar commercially and among households is directly augmenting the uptake of industrial crystallizers to ramp up production. Thus the rising demand of sugar is augmenting the growth of the crystallizer market.

For instance, in October 2022, according to an article published by the International Sugar Organization, some of the top sugar producers, including India, China, Thailand, Pakistan, and Australia, accounted for 70% of global sugar production. Some of the key reasons for growing sugar demand are attributed to the growth of population, increasing per capita income, and the price of sugar, among other factors. The increasing demand of sugar, followed by rising interest of market players in catering to the spurring demand for refined sugar, is anticipated to drive the market's growth.

North America is anticipated to grow due to the increasing demand for crystallized lithium and the growing demand for batteries requiring pure lithium for developing high-energy-density batteries. Moreover, the rising awareness and sustainability initiative for recycling key minerals to reduce and reuse electronic waste is anticipated to drive the growth of the market in the region.

For instance, in April 2022, Li-cycle collaborated with Veolia Water technologies to develop a lithium recycling plant and capture the lithium equivalent of powering 225,000 electric vehicle batteries annually. The process is possible due to Veolia's proprietary HPD crystallization technology for optimizing the creation of nickel sulfate and cobalt sulfate from lithium-ion batteries.Key players include Tsukishima Kikai., Fives Group, Condorchem Envitech, Vobis LLC, Anssen Metallurgy, Ebner GmbH, Moretto, Motan Colortronic, Boardman, OMVE, and Shaanxi Aerospace.

Recent Developments

In March 2022, Saltworks announced commercial launch and delivery of SaltMaker MVR crystallizers along with SaltMaker ChilledCrys with a view of producing lithium and nickel for development of electric vehicle batteries. The device utilizes forced circulation mechanical vapour recompression to crystallize compounds which is a key benefit as offered by these systems in the industry. The launch strengthens the company’s market presence along with diversifying its product portfolio in the crystallizer market.

Furthermore, in April 2022, Technobis Crystallization introduced Crystal16 V3, integrated with the transmission technology with the extended analytical capabilities, along with a streamlined design reducing the resources and the time consumed during crystallization experiments & analysis.

Industrial Crystallizers Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 3,539.8 million |

|

Revenue forecast in 2030 |

USD 4,757.6 million |

|

CAGR |

3.8% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Method, By Type, By Process, By End-Use Industry and By Region. |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Tsukishima Kikai Co. Ltd., Fives Group, Condorchem Envitech, Piovan S.p.A, Alaqua Inc., Vobis LLC, Anssen Metallurgy Group Co. Ltd., Ebner GmbH & Co. KG, Moretto S.p.A., Motan Colortronic, Technoforce, Fasa AB, Boardman LLC, OMVE, Nu-Vu Conair, Dega Plastics, Shaanxi Aerospace Power Hi-Tech Co. Ltd. among others |