Industrial Microbiology Testing Services Market Share, Size, Trends, Industry Analysis Report

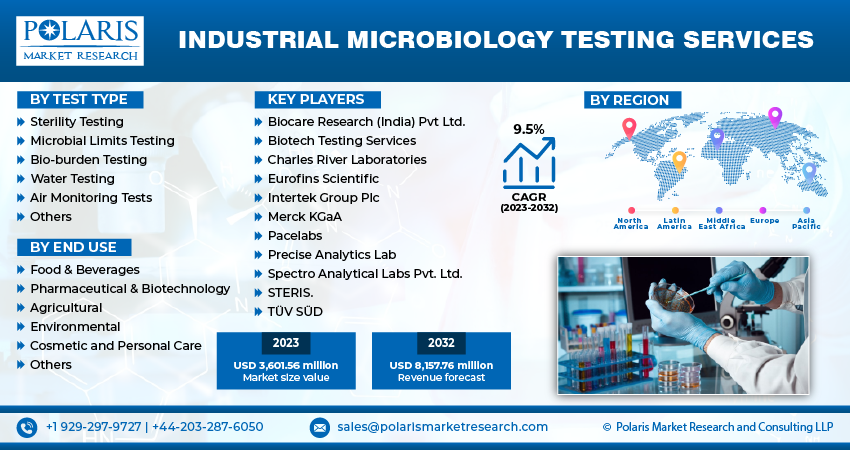

By Test Type (Sterility Testing, Microbial Limits Testing), By End-use (Agricultural, Food & Beverages), By Region, And Segment Forecasts, 2023 - 2032

- Published Date:Nov-2023

- Pages: 119

- Format: PDF

- Report ID: PM3913

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

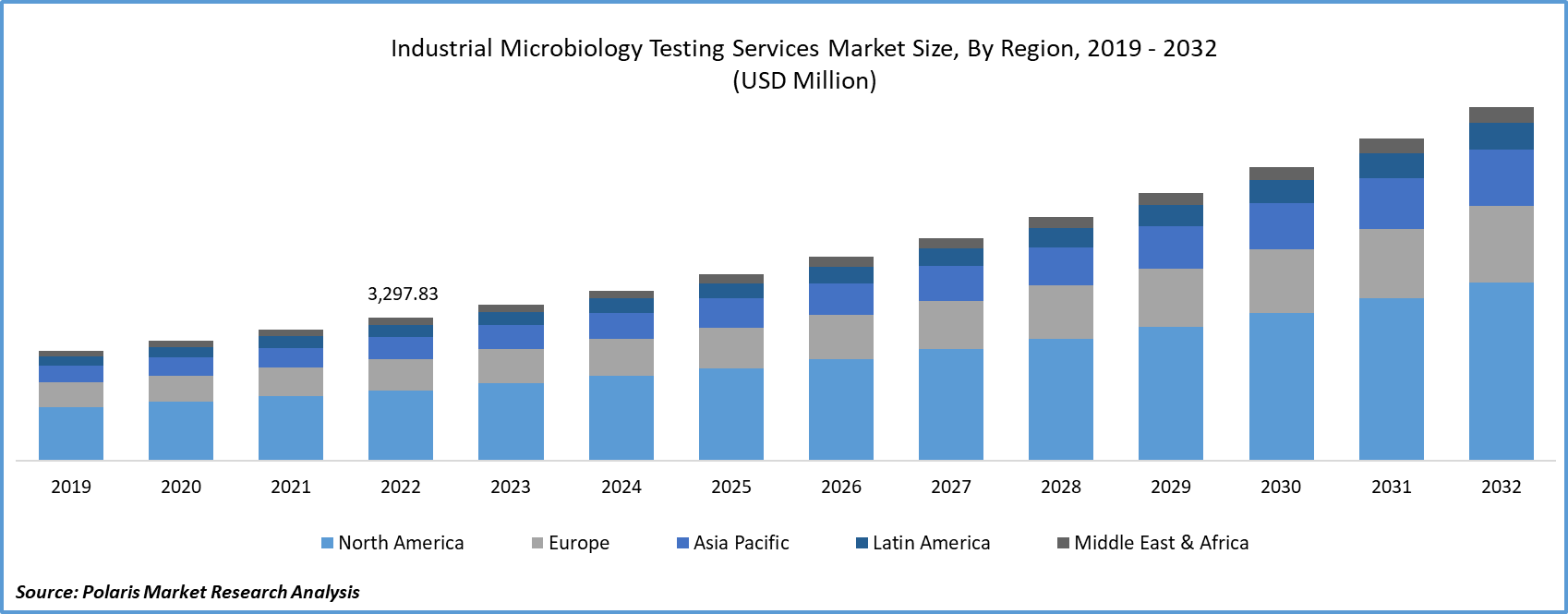

The global industrial microbiology testing services market size and share was valued at USD 3,297.83 million in 2022 and is expected to grow at a CAGR of 9.5% during the forecast period.

Increasing number of strategic partnerships, the expansion of healthcare facilities and laboratories, the availability of cost-effective clinical microbiology testing products, and a rise in per capita healthcare expenditures. For instance, the National Institute of Standards and Technology (NIST) introduced the Rapid Microbial Testing Methods (RMTM) Consortium. This consortium aims to address the need for standards and regulations that enhance confidence in the utilization of rapid tests for detecting microbial contamination in products related to advanced therapy and regenerative medicine.

Microbiology testing includes recognition of the iteration of microbial freight in food and its associated industries or medical devices. The industrial microbiology testing services market demand is on the rise as testing is primarily important for several industries involving healthcare, food and beverage, pharmaceuticals, and many more. One of the normal types of microbiological testing includes sterility testing. This testing guarantees that no thriving bacteria or their endospores are prevalent in the product or environment. It is crucial in pharmaceutical and food refining to guarantee the security and effectiveness of sterile products.

The leading objective of manufacturing units is to generate superior, dependable commodities or food products for the consumer market. However, tragedies and negligence sometimes cause health ultimatums to consumers, causing industries to encounter recollected products from the market and even grand executions against assembling firms, causing enormous economic deprivation.

To Understand More About this Research: Request a Free Sample Report

The market is poised to present even more promising opportunities for market participants in the foreseeable future. This optimistic outlook can be attributed to a confluence of factors that are expected to shape the industry's trajectory. One significant driver is the augmented funding derived from collaborative efforts between public and private sectors aimed at supporting targeted research initiatives. This collaborative approach not only bolsters the advancement of cutting-edge testing methodologies but also fosters innovation and the development of comprehensive solutions.

Moreover, the global demographic landscape is undergoing a significant transformation characterized by a growing elderly population. With age often comes susceptibility to various health challenges, making accurate and timely microbial testing an imperative aspect of healthcare management. This demographic shift has created a surge in demand for high-quality healthcare solutions, consequently driving the need for advanced industrial microbiology testing services that can contribute to enhanced patient care and safety.

The market report provides a thorough analysis of the industrial microbiology testing services market, covering all the major aspects stakeholders need to know. It sheds light on the key developments and trends that are anticipated to drive the industrial microbiology testing services market demand over the forecast period. Besides, it maps the qualitative impact of various key factors on market segments and geographies. Furthermore, it examines the key steps taken by industry participants to strengthen their presence in the industry.

For Specific Research Requirements: Request for Customized Report

The COVID-19 pandemic has acted as a catalyst for business growth. A notable instance is the collaborative effort in April 2021 by researchers from Universitat Pompeu Fabra, Universitat de Barcelona, and Hospital Clinic, who presented an evaluation of the microbiological diagnostic approach for COVID-19. Similarly, the American Society for Microbiology established a verification process aimed at aiding laboratories in effectively verifying commercial molecular assays for COVID-19. This dynamic has propelled the expansion of the market. Industries, especially pharmaceutical and food & beverage production sectors, are increasingly focused on minimizing the risk of product contamination due to its serious implications and stringent regulatory frameworks.

Industry Dynamics

Key Market Growth Drivers

Rising Adoption of Advanced Industrial Microbiology Methods

The industrial microbiology testing services market is being driven by the swift proliferation of infectious diseases worldwide, encompassing the novel coronavirus and its evolving strains. Additionally, there is a heightened adoption of advanced industrial microbiology methods in the production of pharmaceuticals and food & beverages. Furthermore, growing public apprehensions regarding the effectiveness and safety of pharmaceutical and food products contribute to industrial microbiology testing services market growth. The progress in molecular biology and genetic technologies has profoundly influenced microbiological applications, leading to the development of innovative diagnostic techniques.

Consequently, the market is anticipated to expand in the forthcoming years due to the rigorous testing prerequisites set by regulatory authorities to ensure product integrity and quality control. Furthermore, the rising adoption of these testing methodologies within the food & beverage industry is expected to fuel growth over the projected timeframe. Anticipated drivers include a heightened emphasis on industrial safety, food safety, and hygiene, leading to an increase in demand in the upcoming years.

Report Segmentation

The market is primarily segmented based on test type, end-use, and region.

|

By Test Type |

By End Use |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Test Type Analysis

Sterility Testing Segment Accounted for the Largest Market Share in 2022

The sterility testing segment accounted for the largest market share. This segment's dominance is due to heightened research and development activities in the life sciences sector and an increase in the introduction of new medications to the market. Additionally, the global demand for products that undergo sterilization processes is on the rise, driven by concerns over product safety. Manufacturing processes involving intricate biological and structural attributes can sometimes lead to safety issues, which further underscores the significance of sterility testing in driving market expansion throughout the forecast period.

The microbial testing segment will grow at a steady pace. Multiple factors influence this significant growth. First, the escalating occurrence of chronic and infectious diseases has heightened the importance of microbiological testing to ensure the safety and efficacy of pharmaceutical products. Second, the increasing demand for packaged food and beverage items has emphasized the necessity of rigorous microbiological limit testing to guarantee consumer health and product integrity. As a result, the heightened demand for these testing services in both the pharmaceutical and food industries is expected to be a key driver behind the overall market's expansion over the forecast period.

By End-Use Analysis

Pharmaceutical Segment Held the Largest Share in 2022

The pharmaceutical segment dominated the market. Within the pharmaceutical and biotechnology sectors, the preservation of quality throughout the manufacturing process is of paramount importance. To ensure these stringent quality standards are met, various methods are employed. One such critical approach is the implementation of environmental monitoring procedures. These procedures play a pivotal role in assessing the quality and sterility of the controlled manufacturing environment, thereby contributing to the overall integrity of the products produced.

The food & beverage segment will grow at a rapid pace. This growth is propelled by factors such as the increasing incidence of foodborne illnesses, heightened consumer awareness concerning food safety, the enforcement of stringent food safety regulations, and a rising consumer preference for convenient and packaged food products. For instance, in the U.S., the CDC estimates that annually, 48 million individuals fall ill, 128,000 require medical treatment, and 3,000 fatalities occur due to foodborne infections. As a response to these concerns, the demand for robust microbial testing services in the food and beverage industry is expected to surge, driven by the imperative need to ensure the safety and quality of consumable products.

Regional Insights

North America Region Dominated the Global Market in 2022

North America held the largest share. The strong presence of key players across industries like pharmaceuticals, biotechnology, and the food and beverage sector drives the region's growth. The region's leadership is underscored by its role as a hub for major companies and a proactive stance in fostering industrial testing advancements. A notable example is the acquisition of Perfectus Biomed Group by the NAMSA in October 2022. This strategic move aims to enhance specialized microbiological services and simultaneously establish a global reach through a network of 20 laboratory locations, signaling a commitment to expanding and elevating microbiological testing capabilities on a broader scale.

APAC will grow at a steady pace. The region's continuous improvement in healthcare infrastructure, coupled with its burgeoning economic landscape, creates a conducive environment for the adoption of industrial microbiology testing services. Government initiatives aimed at raising awareness further propel this growth while favorable regulatory frameworks streamline the integration of such services. Notably, the increasing demand for high-quality healthcare solutions within the region adds to the positive trajectory of the industry, making APAC a promising market for industrial microbiology testing.

Key Market Players & Competitive Insights

The consistent and widespread demand for industrial microbiology testing services across various applications has opened a multitude of market opportunities for leading players to seize. Major companies to develop innovative testing solutions, expand their service offerings, and establish themselves as trusted partners in ensuring product quality, regulatory adherence, and consumer safety. These opportunities enable market leaders to cater to diverse sectors while contributing to the overall growth and advancement of the industrial microbiology testing industry.

Some of the major companies operating in the global market include:

- Biocare Research (India) Pvt Ltd.

- Biotech Testing Services

- Charles River Laboratories

- Eurofins Scientific

- Intertek Group Plc

- Merck KGaA

- Pacelabs

- Precise Analytics Lab

- Spectro Analytical Labs Pvt. Ltd.

- STERIS.

- TÜV SÜD

Recent Developments

- In June 2023, Eurofins Microbiology Laboratories, has received approval from the Colorado Department of Public Health & Environment (CDPHE) to conduct microbial testing for industrial hemp and hemp-derived products, thereby ensuring adherence to compliance standards.

- In October 2019, Alcami Corp. introduced its rapid sterility solution. Utilizing advanced microbiological diagnostic technologies, this service expedites the delivery of test results to customers.

Industrial Microbiology Testing Services: Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 3,601.56 million |

|

Revenue Forecast in 2032 |

USD 8,157.76 million |

|

CAGR |

9.5% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments Covered |

By Test Type, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Delve into the intricacies of industrial microbiology testing services in 2023 through the meticulously compiled market share, size, and revenue growth rate statistics by Polaris Market Research Industry Reports. Uncover a comprehensive analysis that not only projects market trends up to 2032 but also provides valuable insights into the historical landscape. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.