Industrial Microwave Heating Equipment Market Size, Share, Trends, Industry Analysis Report

By Equipment (RF Solid State Amplifiers, Magnetron), By Power, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM1402

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

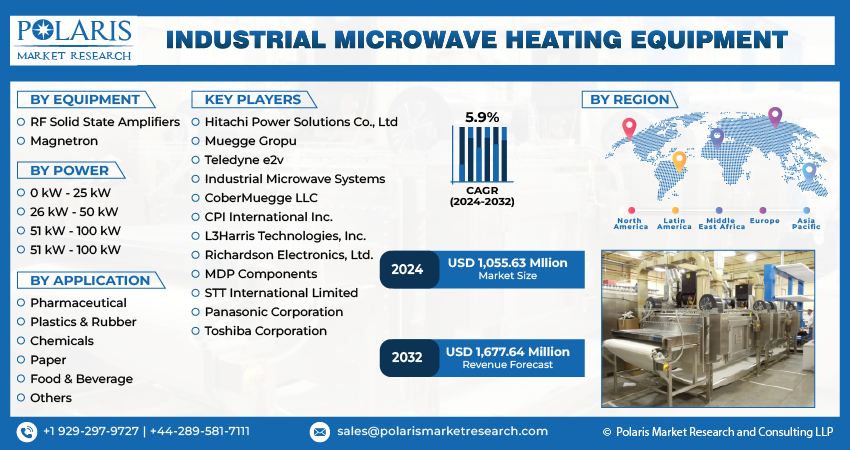

The global industrial microwave heating equipment market size was valued at USD 1.13 billion in 2024, growing at a CAGR of 6.1% from 2025 to 2034. Key factors driving demand for industrial microwave heating equipment are the growth of the global food & beverage industry and advent of RF solid state amplifiers.

Key Insights

- The RF solid state amplifiers segment is anticipated to register a CAGR of 8.3% during the forecast period, driven by advancements in device technology and increasing adoption over traditional RF and microwave solutions, which were primarily focused on wireless communication and navigation.

- In 2024, the pharmaceutical segment captured a 12.15% revenue share, fueled by growing demand for precise, rapid, and contamination-free processing methods to ensure the safety and quality of pharmaceutical products.

- Europe accounted for 30.45% of the global industrial microwave heating equipment market revenue share in 2024, supported by stringent environmental regulations and a strong push toward energy-efficient technologies across multiple industries.

- The North American market is projected to register a CAGR of 5.3% during the forecast period, driven by rapid technological advancements and a growing focus on automation in industrial operations.

- In the U.S., demand for industrial microwave heating equipment is increasing due to its advanced industrial infrastructure and a strong need for innovative and efficient thermal processing technologies.

Industry Dynamics

- Growth of the global food & beverage industry propels the demand for industrial microwave heating equipment.

- Advent of RF solid state amplifiers is driving the industrial microwave heating equipment market by improving accessibility and practicality.

- The advantages such as faster processing times, energy efficiency, and improved product quality compared to conventional heating methods are driving the adoption of industrial microwave heating equipment.

- High initial cost of equipment and installation limits adoption among small and medium-sized enterprises.

Market Statistics

- 2024 Market Size: USD 1.13 Billion

- 2034 Projected Market Size: USD 2.04 Billion

- CAGR (2025–2034): 6.1%

- Europe: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

AI Impact on Industrial Microwave Heating Equipment Market

- AI-integrated microwave heating systems reduce energy consumption by eliminating inefficient frequencies and optimizing heating cycles.

- During microwave heating, AI algorithms [especially Convolutional Neural Networks (CNNs)] help predict temperature profiles in materials.

- Companies invest in AI integration to gain a technological edge, comply with regulatory standards, and expand market share.

- Decentralized AI-enabled microwave systems help reduce labor and transportation costs. It offers competitive advantages over traditional heating systems as the AI systems improve precision and reduce operational expenses

The industrial microwave heating involves the use of microwave energy to heat, dry, or process materials in sectors such as food & beverage, pharmaceuticals, chemicals, and rubber. It offers various advantages such as faster processing times, energy efficiency, and improved product quality compared to conventional heating methods.

When compared to alternative heating methods, this technology allows for better system integration. Sensors can communicate back data on operational parameters such as temperature, which may subsequently be changed to improve streamlining. It further allows for the elimination of inefficient frequencies, leading to a boost in efficiency. All of these benefits have contributed to the market's quick rise in recent years.

The industrial microwave heating equipment industry is driven by a growing demand for commercial microwave heating equipment across the chemical and food industries. In particular, the widespread use of this equipment in the plastics sector to melt high plastics, dry foundry cores, as well as other substances is likely to boost the worldwide development.

Industrial microwave heating has become mainstream in almost all of its application areas. The process has garnered significant attention due to the volumetric heating effect it provides and the ability to achieve considerable process times as compared to other conventional processes. They are therefore being effectively deployed as a means to achieve high productivity and to decrease production costs and are being used on a large scale in various applications such as metallurgy, polymers, textiles, rubber, food, pharmaceuticals among others.

Drivers & Opportunities

Growth of global food & beverage industry: The food & beverage industry has witnessed tremendous growth in the past few years. According to the Eurostat, as of 2023, in Europe alone, the food and beverage industry employs 4.6 million people in 0.3 million food and beverage processing enterprises. This growth is driven by the rising preference for processed foods over unprocessed foods. The same is prompted by changing lifestyles that demand convenience, rising disposable income, and easy availability of products. Moreover, such processed food purchase now forms a top priority in the overall consumer spending. The industry is characterized by high volumes of production, expensive equipment, complex value chains, and strict adherence to quality regulations. Industrial microwave heating equipment complements all these parameters due to their characteristics and inherent advantages, and hence, they are finding widespread usage in the industry.

Industrial microwave heating equipment is finding widespread applications in the food & beverage industry and is used for microwave food drying, pasteurization, sterilization, tempering, heating, among others. The usage of microwave equipment ensures that all these processes are ensured with high efficiency, retention of original nutritional content, and in less cost. This scenario is further driving the penetration of these equipment in the food & beverage industry, fueling the growth.

Advent of RF solid state amplifiers: RF solid state amplifiers offer tremendous control over the heating process which has been unprecedented in the overall heating process. Moreover, the feedback of power as well as energy parameters in an ongoing process and the ability to adjust the same immediately to suit specific needs have proved highly advantageous in many application industries. These factors have resulted in the rapid adoption of RF solid state amplifiers in diverse applications ranging from laboratory processes, which require precise parameter control to continuous manufacturing processes such as food processing.

The major reason for this wide applicability is the ability of RF solid state amplifiers to provide real time data pertaining to the overall heating process. The equipment allows for monitoring at which frequency how much energy is reflected and allows the variation of frequency to achieve optimum energy reflection. Moreover, the frequencies can further be changed when there is a severe load change, a characteristic vital especially in the industrial sector, where load changes are common. RF solid state amplifiers have a lifespan of ten years or more; hence, they do not require frequent replacement, therefore guaranteeing no frequent shutdowns, driving their adoption.

Magnetron vs RF Solid State Technology

|

Features |

Microwave Heating Oven |

Solid State RF Energy Heating Oven |

|

Frequency Range of Operation |

300 MHz to 300 GHz |

3 KHz to 300 GHz |

|

Excitation Source |

Magnetron |

RF synthesizer and RF Power Amplifier |

|

Turn Table Requirement |

Needed in order to move the food around to heat it from all sides |

Not needed as heating in this method is homogeneous from all sides |

|

Heating Effect |

Heating is non-homogeneous, and hence, food gets cooked on the top layers and does not get cooked in the middle part. |

Heating is homogeneous, and hence, food gets cooked equally from all sides. |

Industrial Microwave Heating Systems Manufacturers and Innovations

There are several new technologies that have emerged as highly efficient way of using microwave heating across the application industries. The use of microwave heating technology is very crucial in several industries, including food & beverage, chemical, pharmaceuticals, and plastics & rubber. The technology is also being used for drying grains and wood in the agricultural and lumber industries, respectively.

|

Company Name |

Innovation |

|

Max Industrial Microwave |

To minimize the cost of microwave heating and drying in the food industry, the company uses only a small percentage of the energy required by other heating/drying systems per liter of water evaporated from the processed material, with reduced thermal processing time. The system is designed in a compact footprint as a form of “microwave tunnel,” so that material passing through the system can be continuously exposed to microwave radiation for heating and drying. The tunnel configuration results in predictable and uniform heating of the material with minimal thermal processing times. |

|

Cellencor |

The company developed an industrial microwave oven that is about 12 feet in length with a continuous conveyer belt running through the tunnel-like structure for material samples. The system applies microwave energy to the cavity from a high-power source, using a waveguide feed to transfer EM energy to the cavity via two or more high-power, rotating antennas to achieve even heating of material samples. |

|

Advanced Microwave Technologies |

Fruits and vegetables processed with the company’s systems have yielded increased shelf lives. The firm’s industrial systems are designed for fast and efficient heating of materials in a smooth production flow and with clear graphical user interface (GUI) for ease of programming and control. This GUI control system aids programming an industrial microwave system developed for food processing and pasteurization. |

Mineral processing is expected to be one of the novel applications of microwave technology, wherein microwave-assisted sorting and microwave-assisted comminution combined is likely to reduce the energy consumption during grinding. The process is an energy-intensive operation that accounts for 50–70% of the total energy consumption in the mining and cement industries, equivalent to about 5% of the global energy consumption. Microwave device technology is also expected to be used in cement production before calcination. The utilization of biomass waste for renewable energy has been one of the major issues across the globe to promote green energy initiatives. Pyrolysis is one of the popular techniques used to convert bio-waste to liquid, solid, and gaseous state. However, the complex nature of the materials leads to high heating requirements for use in other applications. As a result, the use of microwave heating is expected to witness growth in pyrolysis techniques to get the required temperature with optimum efficiency.

RF Solid State Heating Equipment Component Suppliers by Region

|

Company Name |

Role |

Region |

|

XP Power |

RF Amplifiers |

Asia Pacific |

|

ACORDE Technologies S.A. |

RF Amplifiers |

Europe |

|

Crescend Technologies |

RF Amplifiers |

North America |

|

Shenzhen Ronghua Technology Co., Ltd. |

RF Synthesizers |

Asia Pacific |

|

STMicroelectronics |

RF Synthesizers |

North America |

Magnetron Heating Equipment Component Suppliers by Region

|

Company Name |

Role |

Region |

|

Panasonic Corporation |

Magnetron |

Asia Pacific |

|

MUEGGE GmbH |

Magnetron |

Europe |

|

L3 Technologies, Inc. |

Magnetron |

North America |

|

STT International Limited |

Magnetron |

North America |

Segmental Insights

Equipment Analysis

Based on equipment, the segmentation includes RF solid state amplifiers and magnetron. The RF solid state amplifiers segment is projected to register a CAGR of 8.3% during the forecast period, driven by the recent adoption and advancement in the device technology of RF solid-state amplifiers over the traditional RF and microwave applications that focus on wireless communication or navigation. Additionally, the rising advantages of RF solid state solutions over magnetrons is driving the demand. RF solid state amplifiers provide better control and precision over energy direction, thus resulting in its even distribution. Therefore, this ability to achieve optimal control of temperature is benefiting the segment growth. Moreover, collaborative efforts taken by various stakeholders in application industries have benefitted the rate of adoption of the equipment. These efforts of standardization are anticipated to have favorable consequences such as reduction in overall design complexity, reduction in costs, and ease of application integration. All such factors have resulted in the segment witnessing the highest growth rate over the forecast period.

The magnetron segment is expected to witness a significant share during the forecast period due to the challenges associated with the designing and manufacturing of the RF solid state amplifiers. The extensive design, expertise, development time, and investment of the RF solid-state amplifier are benefiting the growth of the magnetron segment. Additionally, some of the RF solid-state power amplifier products possess some complex integration requirements, and suppliers often don’t offer knowledgeable engineering support for end-users without dedicated RF expertise. Moreover, the advantages of magnetron, including high quality, high performance, compactness, light in weight, and high efficiency, drive its growth. Furthermore, the development of novel products by industry participants and customized solutions offered by them to suit diverse needs are further driving the segment growth.

Power Analysis

In terms of power, the segmentation includes 0 kW–25 kW, 26 kW–50 kW, 51 kW–100 kW, and more than 100 kW. The 26 kW–50 kW held 32.83% of the revenue share in 2024, due to its balance between energy efficiency and performance. These systems are ideal for mid-scale operations that require consistent and uniform heating without high power consumption. Additionally, the increasing need for cost-effective and energy-efficient heating solutions in industries like food processing, textiles, and materials treatment is further driving the growth. Moreover, the demand for mid-range microwave heating systems is expected to grow in the coming years as more businesses aim to reduce carbon footprints and lower operational costs, thereby fueling the segment growth.

Application Analysis

In terms of application, the segmentation includes pharmaceuticals, plastics & rubber, chemicals, paper, food & beverage, and others. The pharmaceuticals segment held a significant revenue share of 12.15% in 2024, driven by the rising demand for precise, contamination-free, and rapid processing methods to ensure drug quality and safety. Microwave heating offers non-contact, uniform heating, which is especially beneficial in maintaining the integrity of heat-sensitive pharmaceutical compounds. Pharmaceutical companies are turning to microwave technology to meet quality standards while improving efficiency with stricter regulations and the need for faster production cycles in drug manufacturing. This growing need for controlled and reliable thermal processing is boosting growth in this segment.

Regional Analysis

The Europe industrial microwave heating equipment market accounted for 30.45% of global revenue share in 2024, driven by strong environmental regulations and the push for energy-efficient technologies across various industries. European manufacturers are increasingly adopting microwave heating solutions to reduce energy consumption and carbon emissions, especially in sectors such as food processing, chemicals, and pharmaceuticals. The region's focus on sustainability and innovation supports the integration of advanced heating systems in industrial processes. Moreover, government incentives for green technologies and increasing investments in automation are encouraging companies to modernize their operations, further boosting demand for industrial heating equipment throughout the region.

Germany Industrial Microwave Heating Equipment Market Insights

Germany held 25.93% of the revenue share in Europe industry in 2024, driven by the country’s strong engineering base and its focus on precision manufacturing, which aligns well with microwave heating’s advantages in accuracy and efficiency. The growing automotive, pharmaceutical, and chemical sectors in Germany require advanced thermal processing solutions, making microwave heating an attractive choice. Additionally, government support for clean and energy-efficient industrial practices encourages companies to shift from conventional heating methods to modern alternatives like microwave systems, thereby driving the growth.

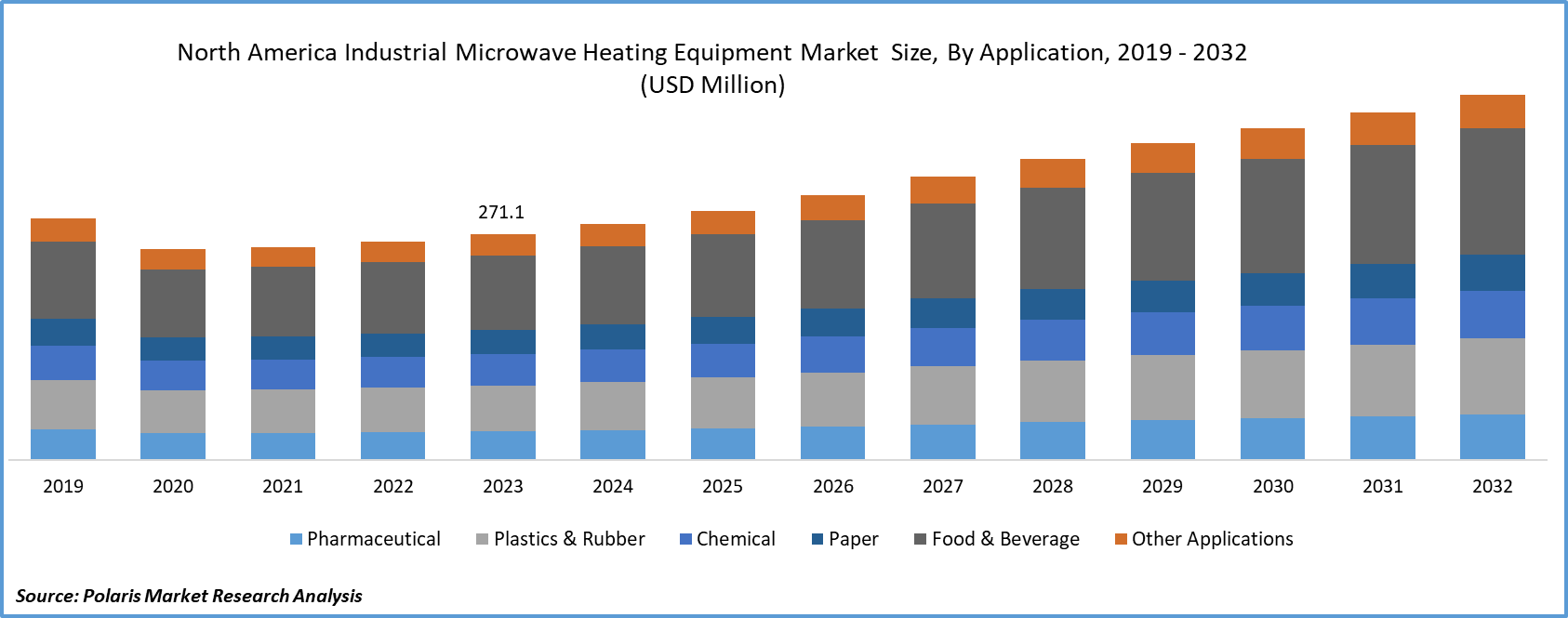

North America Industrial Microwave Heating Equipment Market Trends

The market in North America is expected to register a CAGR of 5.3% during the forecast period, fueled by technological advancements and increasing demand for automation in industrial processes. Industries are seeking faster, cleaner, and more energy-efficient heating methods, making microwave heating a preferred solution. Additionally, the growing focus on reducing operational costs while improving production efficiency across sectors such as food & beverage, plastics, and pharmaceuticals is further driving the growth. Moreover, increased research and development efforts, along with favorable government policies promoting energy-efficient technologies, are accelerating the adoption of microwave heating systems in the region.

U.S. Industrial Microwave Heating Equipment Market Overview

The demand for industrial microwave equipment is rising in the U.S. due to its advanced industrial infrastructure and high demand for innovative thermal processing solutions. The strong presence of pharmaceutical and food processing industries that require fast, precise, and hygienic heating methods is fueling the growth. The push for energy conservation and the need to reduce carbon emissions are further influencing industries to adopt microwave heating systems over traditional methods. Moreover, the U.S. government’s support for advanced manufacturing and energy-efficient technologies further promotes the adoption of industrial microwave solutions across various sectors, thereby boosting the growth.

Asia Pacific Industrial Microwave Heating Equipment Market Outlook

The industry in Asia Pacific is projected to register a CAGR of 6.7% from 2025 to 2034, driven by expanding industrialization and increasing demand for energy-efficient technologies. Countries across the region are investing in manufacturing, food processing, pharmaceuticals, and chemicals. Additionally, the rising focus on improving production efficiency and reducing energy consumption to stay competitive globally further fuels the growth. Moreover, the growing awareness of sustainable practices and government initiatives promoting clean technologies is encouraging industries to adopt advanced heating methods. The region’s large-scale production facilities and rising automation trends are further fueling demand.

Key Players & Competitive Analysis

The competitive landscape is characterized by the presence of both established global players and niche technology providers. Key companies such as Hitachi Power Solutions, Teledyne e2v, Panasonic Corporation, and Toshiba Corporation lead the market with extensive product portfolios, global reach, and strong R&D capabilities. Specialized firms such as Muegge Group, CoberMuegge LLC, and Industrial Microwave Systems contribute through innovation in solid-state RF technologies and customized heating solutions. CPI International and L3Harris Technologies enhance market competitiveness with their advanced RF and microwave systems. Meanwhile, Richardson Electronics, MDP Components, and STT International focus on components and support services. Strategic activities such as partnerships, acquisitions, and technological innovations are prevalent, aiming to meet the growing demand from industries such as food processing, pharmaceuticals, and chemicals. High industry rivalry, moderate buyer and supplier power, and a steady influx of technological advancements define the market’s dynamic nature.

Key Players

- CoberMuegge LLC

- CPI International Inc

- Hitachi Power Solutions Co., Ltd

- Industrial Microwave Systems

- L3Harris Technologies, Inc.

- MDP Components

- Muegge Group

- Panasonic Corporation

- Richardson Electronics, Ltd.

- STT International Limited

- Teledyne e2v

- Toshiba Corporation

Industrial Microwave Heating Equipment Industry Developments

In November 2023, Richardson Electronics expanded its microwave product range through a partnership with Junkosha Cable Assemblies. Drawing on Junkosha's extensive experience in the RF market, their advanced cables and interconnects for the 5G industry excel in handling higher frequencies and demonstrate efficient performance in environments characterized by high flexure and temperature variations.

In July 2023, Teledyne e2v announced that it is broadening its footprint in Asia Pacific by expanding a new office in Hong Kong. This office will offer comprehensive support, including sales, technical assistance, and operational services, to customers across the region with an extensive technology portfolio covering various domains, such as industrial machine vision, space imaging, microwave devices for radar and radiotherapy, as well as high-performance semiconductors.

Industrial Microwave Heating Equipment Market Segmentation

By Equipment Outlook (Revenue, USD Billion, 2021–2034)

- RF Solid State Amplifiers

- Magnetron

By Power Outlook (Revenue, USD Billion, 2021–2034)

- 0 kW–25 kW

- 26 kW–50 kW

- 51 kW–100 kW

- More than 100 kW

By Application Outlook (Revenue, USD Billion, 2021–2034)

- Pharmaceutical

- Plastics & Rubber

- Chemicals

- Paper

- Food & Beverage

- Others

By Regional Outlook (Revenue, USD Billion, 2021–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Industrial Microwave Heating Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.13 Billion |

|

Market Size in 2025 |

USD 1.20 Billion |

|

Revenue Forecast by 2034 |

USD 2.04 Billion |

|

CAGR |

6.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.13 billion in 2024 and is projected to grow to USD 2.04 billion by 2034.

The global market is projected to register a CAGR of 6.1% during the forecast period.

Europe dominated the market in 2024.

A few of the key players in the market are Hitachi Power Solutions Co., Ltd; Muegge Group; Teledyne e2v; Industrial Microwave Systems; CoberMuegge LLC; CPI International Inc; L3Harris Technologies, Inc.; Richardson Electronics, Ltd.; MDP Components; STT International Limited; Panasonic Corporation; and Toshiba Corporation.

The RF solid state amplifier segment dominated the market revenue share in 2024.

The pharmaceutical segment is projected to witness the fastest growth during the forecast period.